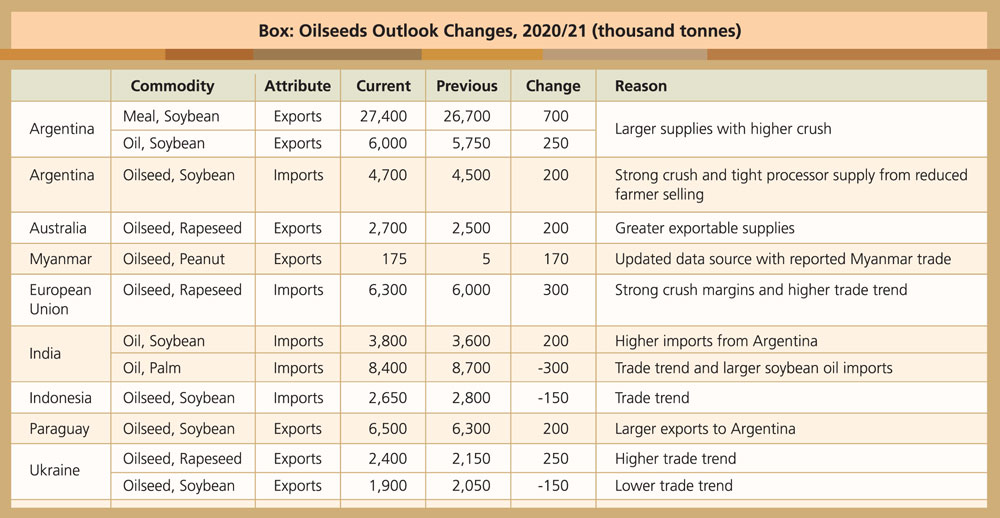

Global oilseeds production for 2020/21 is forecast at 596 million tonnes, 750,000 tonnes above February. Higher Brazil soybean production, coupled with greater Australia and European Union (EU) rapeseed production, have more than offset lower palm kernel, cottonseed and sunflower seed production forecasts.

Global oilseed exports, at 195 million tonnes, are up 820,000 tonnes primarily on higher Australia and Ukraine rapeseed exports. Oilseed crush is raised 1.2 million tonnes to 514 million tonnes. The larger Brazil and Argentina soybean crush and EU rapeseed crush more than offset lower China soybean crush. Global oilseed stocks are up 760,000 tonnes mostly on higher Brazil and China soybean stocks, more than offsetting lower Argentina soybean stocks.

Protein meal production is up 1.2 million tonnes and ending stocks are up 910,000 tonnes. Protein meal exports are raised 890,000 tonnes due to a 1 million tonne increase in Argentina soybean meal shipments partially offset by other changes.

Global vegetable oil production is down 200,000 tonnes despite higher crush as lower palm oil production more than offsets higher rapeseed oil and soybean oil production. Vegetable oil exports are up 350,000 tonnes on higher Argentina soybean oil and Black Sea sunflower oil. Ending stocks are up 520,000 tonnes primarily due to higher India palm oil carryout. The projected US season-average farm price for soybean is unchanged at $11.15 per bushel.

Argentina – soybean scenario

With declining demand for biodiesel, Argentina’s exports of soybean oil have been rising despite lower crush. Local year April 2020 to March 2021 soybean oil exports are estimated at 5.9 million tonnes, 800,000 tonnes above the previous year, and come despite a 4 million tonne decrease in soybean crush and a 600,000 tonne decline in soybean oil output.

Biodiesel exports, produced primarily from soybean oil, have declined from nearly 1.8 million tonnes in 2017/18 to an estimated 400,000 tonnes in 2020/21. Relatively low global energy prices, barriers to imports and, recently, higher vegetable oil prices, all play a role in reducing biodiesel export prospects. This has freed up an estimated 750,000 tonnes of soybean oil for the food market and for exports.

Demand for soybean oil exports remains strong. Exportable supplies in Brazil and the US are down in response to growing diversion of supplies to the fuel markets. Prices for competing oils have risen faster than those for soybean oil, while palm oil supplies remain tight on lower production growth.

Argentine soybean producers have been reluctant sellers this year. Despite the rise in global prices, high inflation, export taxes and a strong peso have discouraged producers from selling additional supplies of soybean beyond the amount needed to meet expenses. Additionally, while soybean prices have risen on strong China demand and growing demand for crush in Brazil and the US, global import demand for soybean meal has lagged in comparison due to its relatively small discount to soybean.

Given Argentina’s role as the largest soybean meal exporter, without strong demand for soybean meal exports, boosting soybean oil supplies by expanding crush is difficult. Consequently, with most of the reduction in biodiesel exports already in place and amidst difficulties in raising crush, additional expansion in Argentina’s soybean oil exports may be difficult to achieve in the coming year (April 2021 to March 2022).

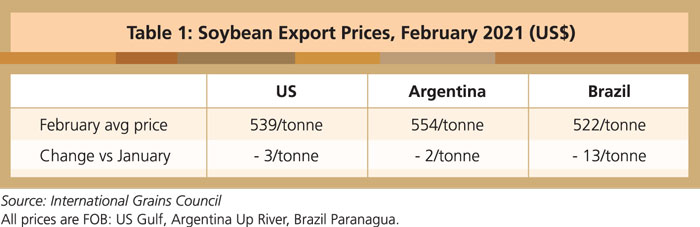

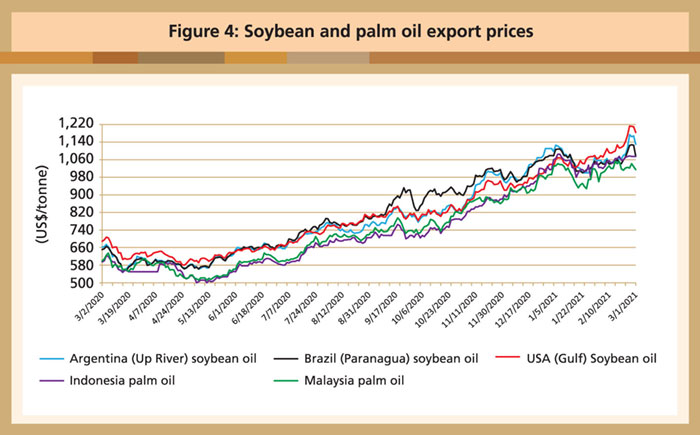

Soybean export prices

Export prices for the three largest soybean exporters were given a slight reprieve as average prices declined in February on expectations of seasonally large new-crop exportable supplies in Brazil and Argentina. Prices in the US and Argentina remained relatively flat while Brazil fell slightly as expectations of a large crop were mostly offset by slow harvest progress (Table 1).

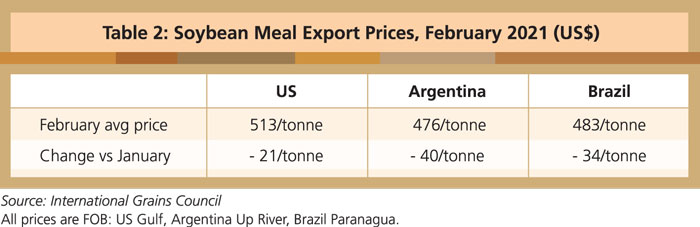

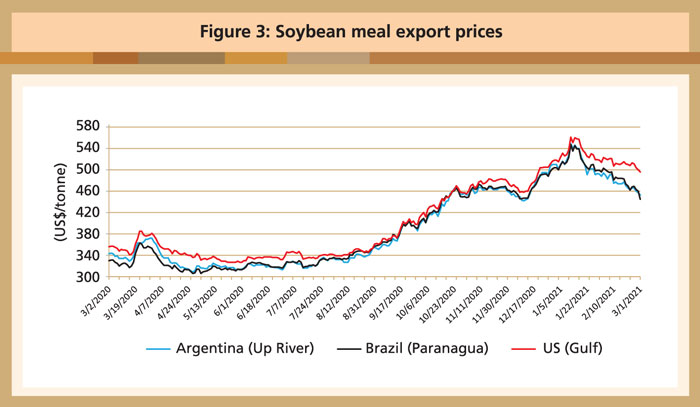

Meal prices declined throughout February reflecting the seasonal ramp-up in crush and availability of new-crop supplies with the onset of the soybean harvest in Brazil and Argentina coupled with softer demand for soybean meal (Table 2).

Oil prices continued their nearly 12-month climb through February but gains were partially offset by softening prices in the last few days of the month. Palm oil prices continued to rally to near 9-year highs in February tracking strong rival oil prices and tight stocks (Table 3).

US soybean exports

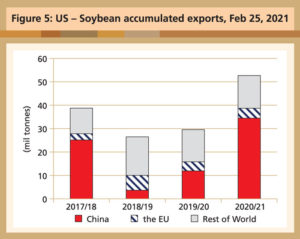

As of Feb 25, 2021, cumulative global US soybean shipments reached 52.7 million tonnes, with China accounting for 65% (34.5 million tonnes). This pace for exports to China is nearly triple from the same period in 2019/20.

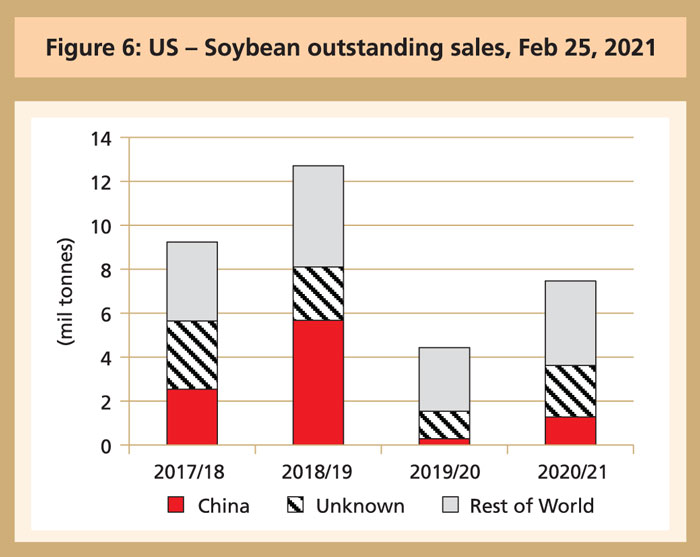

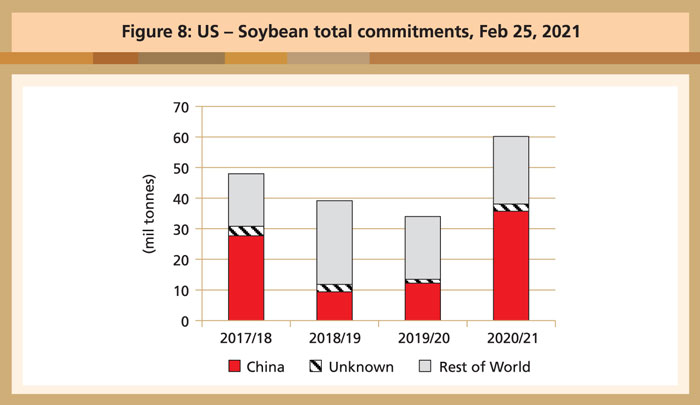

Outstanding sales to all destinations reached 7.5 million tonnes, up nearly 70% from last year. These are led by outstanding sales to China of just over 1 million tonnes, more than triple last year. Due to growth in sales and exports to China, total export sales commitments reached a record 60 million tonnes, up 70% (26 million tonnes) from last year.

Foreign Agricultural Service

US Department of Agriculture

The full report, posted in March, is available at: https://apps.fas.usda.gov/psdonline/circulars/oilseeds.pdf