Ethanol sector

While ethanol production dropped slightly at the end of March, it stayed above the 1 million barrels/day mark as the US Energy Information Administration (EIA) reported that the daily average for the last week of the month was 1.019 million barrels. That is the lowest total in 19 weeks and down 25,000 barrels/day from the previous week.

However, it is also the 23rd straight week that production has exceeded 1 million barrels/day. In addition, the volume was 4.5% higher than the same week a year ago and has helped push up stocks to the highest level on record since the EIA started tracking ethanol data in June 2010.

Such a drop in weekly production is not unusual as production follows a typical seasonal pattern, heading lower into March and April as plants start maintenance and the supply chain moves toward summer blends. Through March 31, ethanol production is on pace to reach about 15.7 billion gallons.

The RVO for this year is 15 billion gallons, which is at the statutory cap for conventional ethanol under the EISA. Thus, exports will be critical to move the additional ethanol being produced. Data for the month of January showed that exports were surprisingly up from December and reached the fifth-highest monthly total on record.

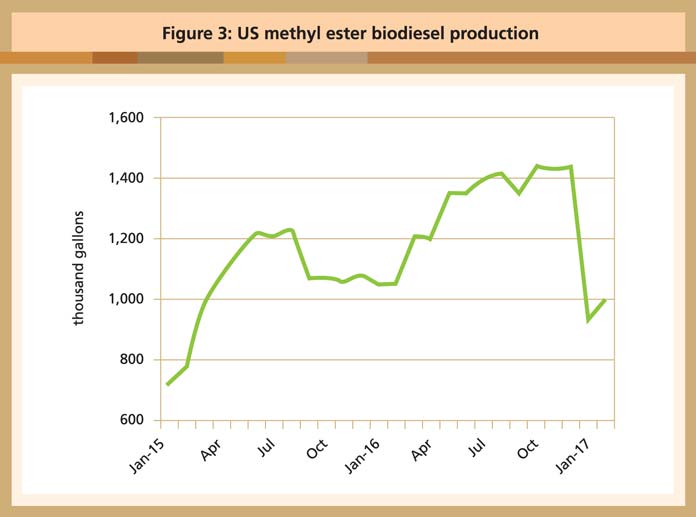

Source: EIA, WPI

However, shipments to China have stopped due to new tariffs imposed late last year; thus, the robust pace of production, coupled with slower exports, added about 131,000 barrels to ethanol stocks as at the week ending April 14, 2017.

In Brazil, the ethanol sector is pressing for a new import tariff of 16%, and there is widespread agreement that it is very likely to be enacted. Reportedly, that has helped boost US export sales for shipments between now and June. Last year the US exported about 1.1 billion gallons of ethanol with Brazil accounting for 267 million gallons or about 25% of that volume.

Domestically, the market looks good for the rest of the year. According to the EIA’s April Short-Term Energy Outlook (STEO), fuel ethanol blending is projected to increase to 960,000 barrels/day, approximately 20,000 barrels/day higher than last year, and will make up 10.1% of total motor gasoline consumption.

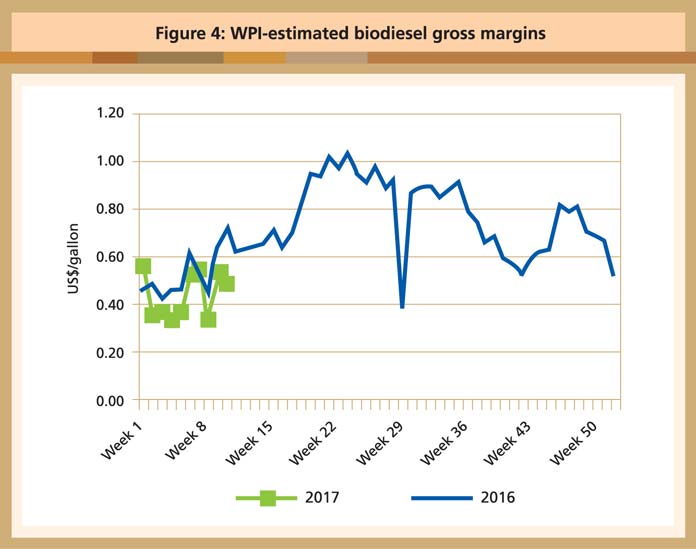

Note: Returns are per gallon for soybean oil methly ester.

Source: EIA, WPI

The EIA’s forecast for ethanol blending for the high-mileage, summer driving season is 963,000 barrels/day, up 1.7% from the 2016 season average of 947,000 barrels/day. The increases are due to greater highway travel despite overall motor gasoline prices being forecast at 10% higher than last year.

Over the first 15 weeks of the year, ethanol prices FOB Iowa plants are up 7% on average, while corn prices are down 1.7%. Natural gas prices are 8.4% lower, which is helping to offset a 28% decrease in DDGS prices. In total, this year’s average ethanol plant gross margin is very similar to last year’s and is following the same pattern.