With a population of 211 million, Brazil is the largest country in South America and the largest economy in Latin America. Brazil is a leading oilseeds producer globally and one of the world’s largest producers of soybean oil. Strong international demand for its agricultural exports has been supported by the devaluation of the Real. This has also discouraged dollar-denominated imports and, in turn, stimulated demand for domestic agricultural products.

In 2019, Brazil’s production of oils and fats amounted to 11.4 million tonnes. Soybean oil made up 77% of this. Most of the oils and fats are consumed locally. According to Oil World, consumption of oils and fats in 2019 amounted to 10.9 million tonnes. Despite an economic slowdown as a result of the widespread effects of the Covid-19 pandemic, Brazil’s agricultural sector thrives, having entered new markets and set export records in recent months.

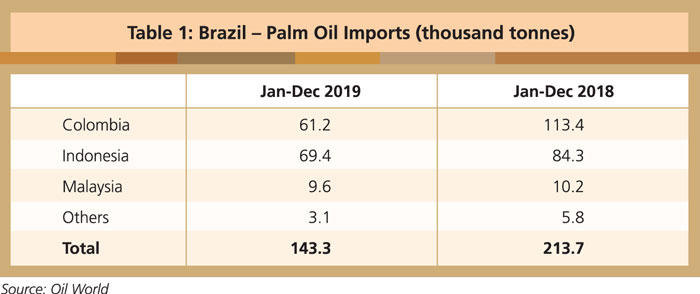

Brazil is a net importer of palm oil. National production of palm oil is insufficient to fulfill domestic consumption which reached 620,000 tonnes last year. In 2019, Brazil imported 143,000 tonnes of palm oil, mainly from Colombia and Indonesia (Table 1). Last year, Brazil was Malaysia’s sixth-largest export destination in the Americas region. Malaysia’s palm oil exports to Brazil consists mainly of RBD palm oil and RBD palm olein.

Palm oil is considered an economical alternative to other edible oils such as soybean oil and sunflower oil. Higher acceptance among food processors is expected to boost palm oil demand growth in Brazil.

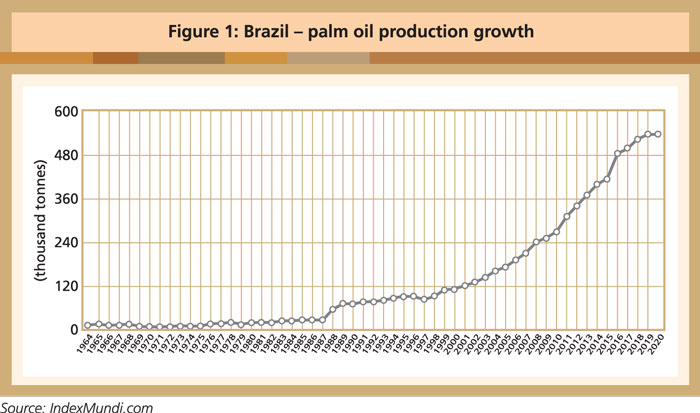

Over the last five years, palm oil production has grown marginally in Brazil. According to Oil World data, it amounted to about 470,000 tonnes in 2019, or roughly 4% of total oils and fats production. However, IndexMundi, a data portal that gathers facts and statistics from multiple sources, projected a higher production volume of palm oil in Brazil (Figure 1).

Brazil’s goals

The country began focusing aggressively on oil palm expansion initiatives in 2004. With 31 million ha of degraded land, Brazil is thought to be on track in achieving its objective of establishing itself as a major producer of palm oil. According to a report by Abrapalma, the body which represents palm oil producers in Brazil, the land area dedicated to oil palm doubled between 2004 and 2010. This is projected to double again between now and 2025.

Palm oil production is mostly limited to the Amazonian state of Pará, which offers an ideal climate throughout the year, as well as lower land prices. Despite industry growth of over 200% since its inception, oil palm cultivation only covered about 219,000 ha by 2014, or less than 1% of the more than 31 million ha of cleared land that is considered to be potentially available for this purpose.

One main reason for the slow expansion appears to be the inability of the plantations to produce palm oil at a competitive price. Brazil’s lack of an adequate transportation infrastructure is another setback.

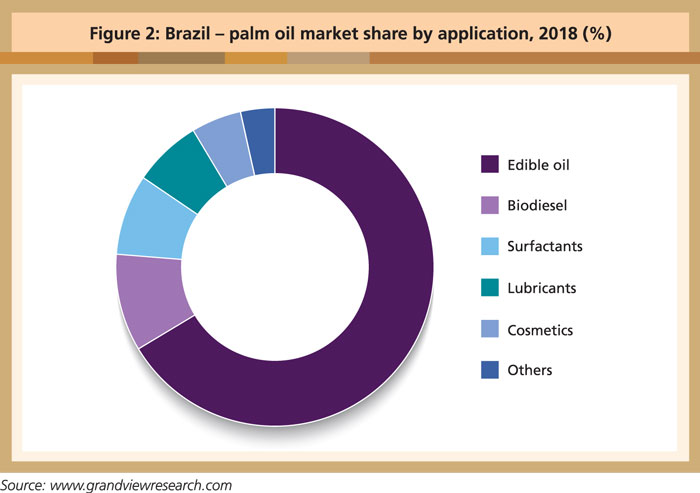

A recent report by the business intelligence firm Expert Market Research indicates that Brazil’s palm oil market was valued at US$938.4 million in 2019; it is projected to grow at a CAGR of 14.3% during the forecast period of 2020-25. The palm oil market size is expected to reach US$2.2 billion by 2025. The edible oils market segment accounted for the largest share of revenue, and is expected to continue its dominance in the coming years.

A significant increase in palm oil consumption – owing to the lower price and rising awareness of its health benefits – is expected to drive market growth. The food industry is a huge and fast-growing segment in Brazil. Its growth trend alone is expected to trigger demand for edible oils, including palm oil.

A report by Grand View Research highlights that CPO dominated Brazil’s palm oil market with a share of 56.5% in 2018 (Figure 2). The rising demand is closely associated with the demand growth from the food and beverage, personal car, cosmetics, detergent and biodiesel sectors.

Brazil’s palm oil industry is poised to continue its expansion. With strong government support, coupled with demand growth from the food and non-food sectors, Brazil is moving toward self-sufficiency within the next few years.

Zainuddin Hassan

MPOC USA