Post-Pandemic Recovery in the US

By gofb-adm on Wednesday, September 21st, 2022 in Issue 3 - 2022, Markets No Comments

By gofb-adm on Wednesday, September 21st, 2022 in Issue 3 - 2022, Markets No Comments

Like other nations, the US has been moving forward with its recovery process from the chaos created by the Covid-19 pandemic, which damaged global supply chains and wrecked the economy.

The initial stage of the pandemic in 2020/21 had put a slight dent in oils and fats demand and supply, mainly due to disruptions in logistics and lower consumption. The preventive measures put in place by the US federal and state governments, including travel restrictions, social distancing and stay-at-home orders, affected demand from the food and the hotel, restaurant and café segment.

However, the US government and the industry were quick to put in place remedial initiatives to address issues related to supply chain and logistical support, vital in the recovery efforts to improve oils and fats demand and consumption. The Senate also approved a stimulus package designed to jump-start the economy.

The US is one of the world’s largest markets for vegetable oils. It accounted for approximately 80% of the volumetric share in the North American vegetable oils market in 2021. The US dominates the regional market, owing to its high consumption and export of oils. The increase in demand for vegetable oils from the food service and food processing industries, coupled with demand growth in the convenience foods market segment, helped maintain steady growth in the oils and fats market. Based on the vegetable oils report, oils and fats are projected to record a compound annual growth rate of 4.9% from 2021 to 2027.

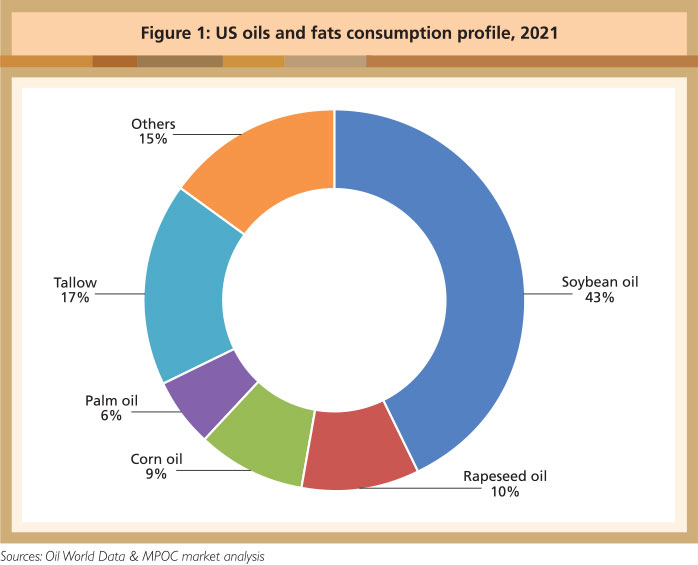

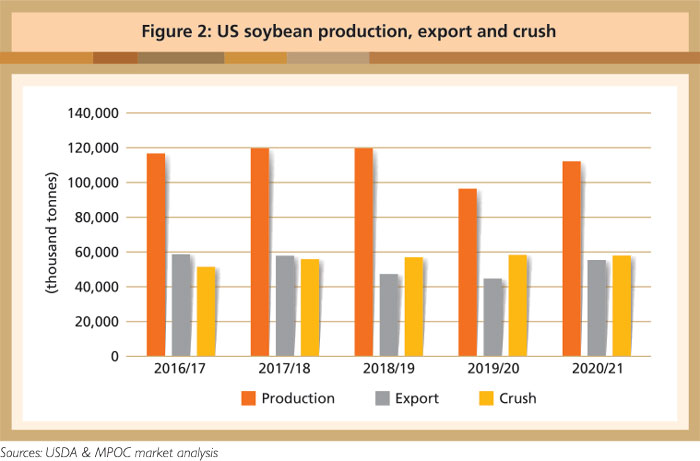

The US is also the largest producer of oils and fats in North America. Oil World data indicates that it produced 21.7 million tonnes of oils and fats in 2021. According to the US Department of Agriculture, soybean oil is by far the most widely produced and consumed edible oil domestically, mainly used for fast-food frying, addition to packaged foods, and feed for livestock.

In 2021, soybean oil constituted 52.6% of total oils and fats production, or about 11.3 million tonnes. Over the past three years, domestic consumption of soybean oil has been increasing, mainly due to the availability of a large supply and competitive pricing. Based on industry estimates, about 85% of soybean oil production is used domestically, with the remaining 15% being exported.

High oleic soybean oil

The US soybean industry is in full swing to expand the development and production of high oleic soybean to recapture lost market share in the food sector, and to venture into new market segments.

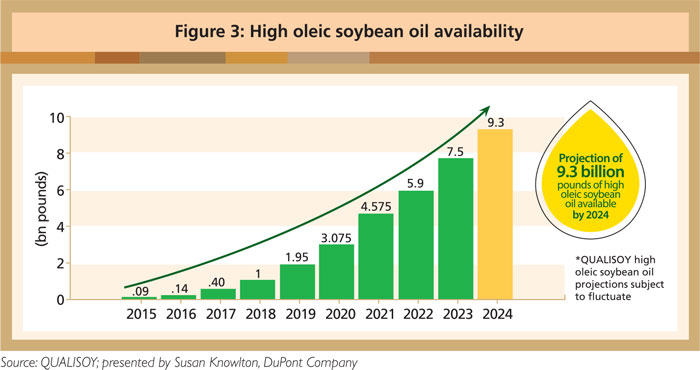

The American Soybean Association describes high oleic soybean as a GMO crop that delivers oil with lower saturated fat than conventional soybean oil and contributes no trans fats to products. It offers an extended product shelf life and features an improved fat profile. The high oleic soybean initiative was launched commercially in 2012. To accelerate productivity, the United Soybean Board (USB) has set a target of 18 million acres of high oleic soybean to be grown by 2023. On average, American soybean farmers grow approximately 80 million acres of soybean annually.

The US Food and Drug Administration’s decision to impose a trans fats labelling requirement in 2006 had a huge negative impact on the demand for hydrogenated soybean oil. A December 2019 article published by the USB stated that, to comply with the labelling requirement, US food manufacturers started using high oleic canola oil and palm oil as a replacement for partially hydrogenated soybean oil in baking and frying fats. This led to a doubling of imports of palm oil between 2005 and 2012.

The mandatory trans fats labelling law triggered a change in the edible oils market. The soybean industry started looking at ways of addressing critical losses in market share. This pushed the industry to invest heavily in research and development into soybean varieties that provide functional and nutritional benefits.

The USB indicated that the current momentum in the production of high oleic soybean oil is progressing as planned. According to a market projection by QUALISOY, an independent, third-party collaboration that promotes the development of soybean traits, about 9.3 billion pounds of high oleic soybean oil will be available by 2024 (Figure 3).

Palm oil market prospects

Despite its large domestic output, the US has remained a net importer of oils and fats for decades; in 2021, imports amounted to 5.2 million tonnes. The US is the largest importer of palm oil in the Americas region. According to the earliest recorded data published by the research group IndexMundi, palm oil has been available in the US since 1965. Palm oil imports have increased steadily over the years, recording a huge leap in volume between 2002 and 2008.

Over the last decade, consumption of edible oils and fats, including palm oil, has undergone considerable change in the US. Factors such as consumer awareness of oils and fats nutrition and health attributes, dietary guidelines, and legislation in the form of nutrition labelling of saturated and trans fats have helped shape the demand and consumption patterns.

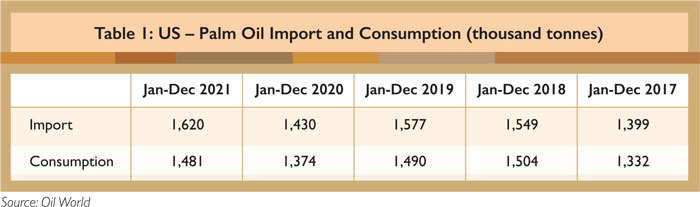

In 2021, US palm oil consumption amounted to 1.5 million tonnes (Table 1), or about 6% of total oils and fats consumption. Imports constituted about 32% of total oils and fats. Recent data published by Research and Market showed that, in 2021, the palm oil market in the US is valued at about US$11.9 billion.

The analysis by Research and Market also projected that future growth in the palm oil market will be driven by demand for certified sustainable palm oil, against a backdrop of concern over wildlife conservation, environmental and deforestation issues.

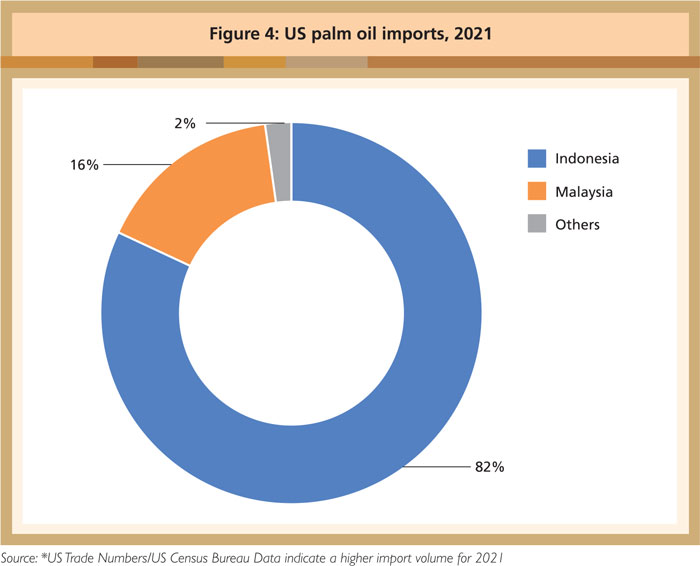

For many years, Indonesia and Malaysia have been the main suppliers of palm oil to the US – despite availability from South and Central America – mainly due to price competitiveness, product quality and sustainability.

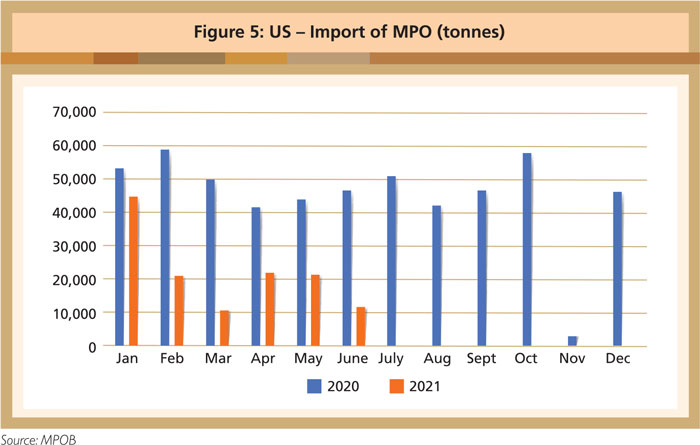

Malaysia dominated the US palm oil market for many years before Indonesia emerged as the front runner. Malaysian Palm Oil (MPO) imports by the US have been affected by the decision of the US Customs and Border Protection to issue a Withhold Release Order at the end of 2020 against two major palm oil producers and exporters, over the alleged use of forced labour. Despite the setbacks, the US remains the biggest destination for MPO in the Americas region, making up about 80% of the regional import volume or 334,663 tonnes in 2021.

According to a WorldCity analysis of the latest data published by the US Census Bureau, the value of palm oil imports rose 79.6% from US$635.78 million to US$1.14 billion for the first six months of 2022 compared to the first half of 2021. The five leading suppliers were Indonesia, Malaysia, Singapore, Mexico and Colombia. The leading gateways were the Port of New Orleans, Louisiana (45%); Port of Savanna, Georgia (26%); Port of Stockton, California (9.4%); Port of Newark, New Jersey (5.3%); and Port of Richmond, California (4.2%).

US Census Bureau data revealed that in 1H 2022, palm oil imports amounted to 805,000 tonnes. Indonesia supplied 88% of the volume or about 708,400 tonnes, while Malaysia’s market share was 9.6% or 77,280 tonnes. Demand is projected to remain good, supported by strong purchasing power and a growing population. Two other key factors will also contribute to this.

Firstly, demand growth is foreseen for palm shortening in the Asian catering and restaurant businesses due to higher consumer interest. The industry includes both quick-service and full-service restaurants, bakeries and pastry shops. Interest in such cuisines is also being propelled by growth in the Asian American population. This is one of the fastest-growing groups in the US – a report published by the Pew Research Centre in 2017 put the figure at about 20 million, an increase of 72% since 2000.

The second contributing factor is related to the growing use of vegetable oils, such as palm oil, in non-food uses; this is expected to stimulate demand for palm oleochemicals. The focus will be on beauty and personal care products. Growing consumer demand for, and awareness of, sustainable and biodegradable products may improve the market for palm products in the cosmetics industry. A market report published by Grand View Research cited a shift in demographics of the young US consumer market, which spends a considerable amount of money on skincare and other personal care items.

MPOC Washington DC