... behind Malaysian Palm Oil industry's resilience in 2020

July, 2021 in Issue 2 - 2021, Markets

Within a gloomy global scenario marked by extensive lockdowns, movement restrictions and social distancing to curb the Covid-19 pandemic, economic growth and routine business dynamics have been severely constrained since January 2020. Every industry has struggled to find new ways to cope with sudden demands thrown up by a much-changed market place and consumer preferences.

It was no different for the Malaysian Palm Oil industry, although it eventually posted a creditable performance in 2020. This was partly due to a recovery of prices, as the global economy adapted to challenges posed by the pandemic. Demand for palm oil picked up, and the price rose to close at RM3,600/tonne at the end of the year.

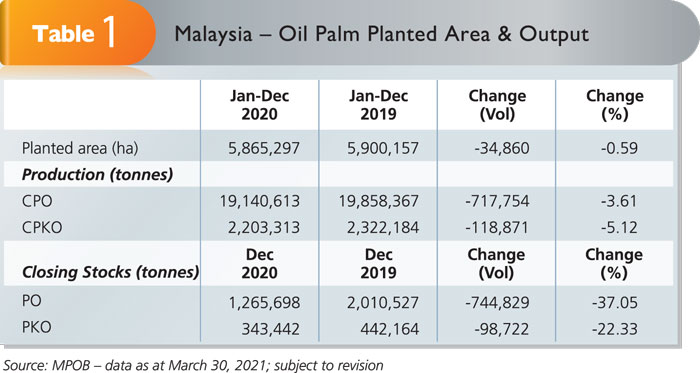

It was not all plain sailing, though. Malaysian CPO production dropped by 717,754 tonnes (3.6%) to 19.1 million tonnes (Table 1). A shortage of workers affected harvesting of fresh fruit bunches, leading to lower processing. Another factor was that the oil extraction rate fell to 19.9% (by 1.4%) from 20.2% in 2019.

The oil palm planted area fell by 34,860 ha (0.6%). Replanting in some areas was delayed because of the low palm oil price, especially at the beginning of the year. The year-end palm oil stock level dropped by 744,829 tonnes (37.1%) to stand at 1.3 million tonnes. PKO year-end stocks declined by 98,722 tonnes (22.3%) to 343,442 tonnes due to lower production and higher domestic consumption.

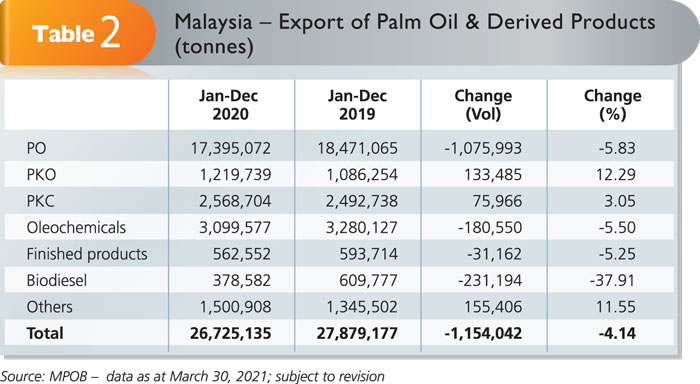

Overall exports of palm oil products fell by 1.2 million tonnes (4.1%) to 26.7 million tonnes (Table 2). However, PKO sales improved by 133,485 tonnes (12.3%) year- on-year.

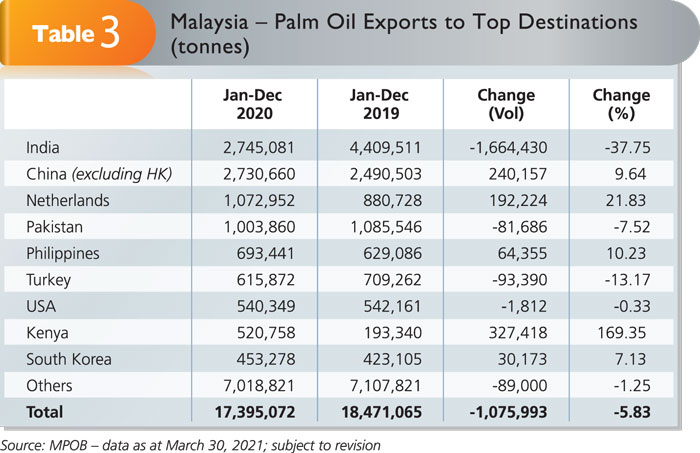

India remained the leading importer of Malaysian Palm Oil for the seventh year in a row, with 2.7 million tonnes (Table 3). However, its volume was lower by 1.7 million tonnes (37.8%) due to competition, as well as the narrowing spread between the price of soybean oil and palm oil domestically.

India’s imports from Malaysia slowed from January to April 2020 because of geo-political tensions. In addition, domestic business operations were shut down by a national lockdown and movement restrictions linked to the control of Covid-19. Demand for palm oil fell in the hotel, restaurant and café (HORECA) sectors, which are typically substantial users.

China’s imports of Malaysian Palm Oil rose by 240,157 tonnes (9.6%) to satisfy the demand for vegetable oils. There was a shortfall because domestic soybean crushing activities were reduced. In addition, palm oil stocks were depleted early in the year, necessitating an increase in imports.

The Netherlands, Pakistan and the Philippines were the other significant importers of Malaysian Palm Oil for the year.

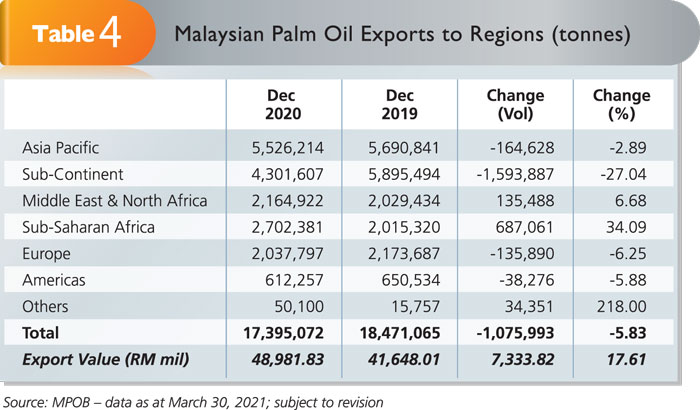

Crude and processed Malaysian Palm Oil exports made up 17.4 million tonnes and were valued at close to RM49 billion (Table 4). Although the export volume fell by about 1.1 million tonnes (5.8%), the value increased by RM7.3 billion (17.6%) due to price recovery in the second- and third-quarter of the year.

Price movements

The trend of lower palm oil prices from June 2019 carried through into 2020, but staged a mini-recovery in February. However, the pandemic and collapse of crude oil prices pulled down the palm oil price from RM2,986/tonne in January to RM2,050/tonne in May. It then strengthened to between RM2,400 and RM3,600 per tonne from June through December

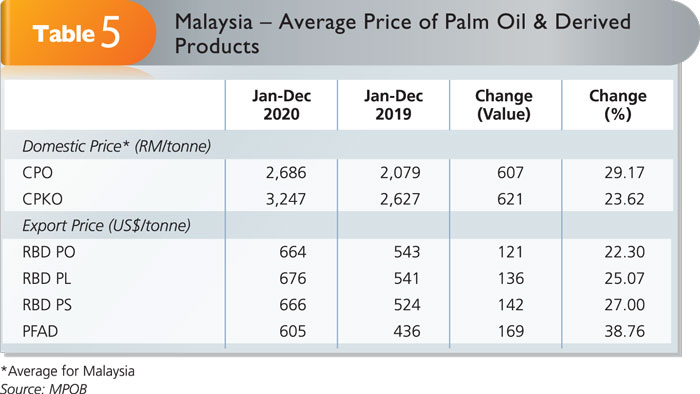

The annual average local delivered CPO price increased by RM607 (29.2%) to RM2,686/tonne (Table 5), because of a production shortfall and low monthly domestic stocks. Prices of competing vegetable oils also rose over this period due to concerns over supply shortages. For example, the soybean oil price rose by about 34%.

As demand switched to palm oil, its price was pushed up as well. The highest average monthly traded Malaysian CPO price was seen in December at RM3,620.50/tonne, while the lowest was in May at RM2,050/tonne.

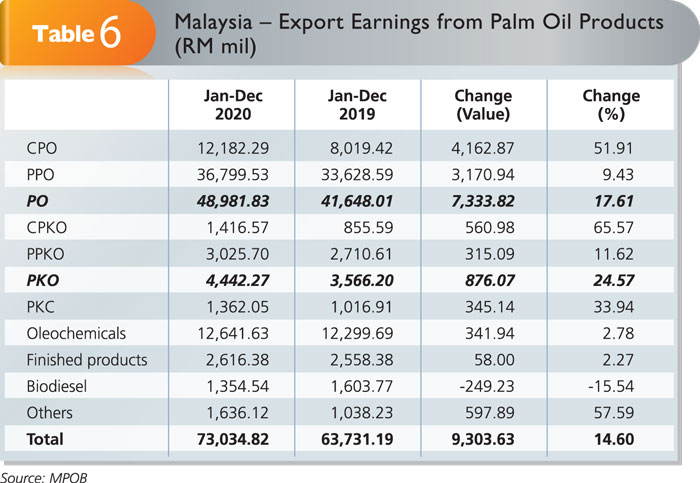

Earnings from exports of Malaysian Palm Oil products went up by RM9.3 billion (14.6%) to exceed RM73 billion in 2020, even though the volume was smaller (Table 6). This was attributed to a steady rise in the palm oil price, in particular during the second half of the year.

Crude and processed palm oil exports alone brought in close to RM49 billion (up by 17.6%), compared to RM41.6 billion in 2019. Revenue from CPKO and PPKO exports was higher by RM876 million (24.6%). An increase of RM341.9 million (2.8%) was recorded from exports of oleochemicals, while sales of other palm oil products saw earnings rise by RM597.9 million (57.6%). Only biodiesel exports returned a lower revenue of RM249.2 million – a drop of 15.5% due to a 231,195-tonne reduction (by 37.1%) in volume.

Global oils and fats trade

The difficulties posed by Covid-19, as well as demand disruptions, did not greatly affect the need for edible oils during the year. Soft oils assumed greater importance in households, because the HORECA sectors were closed under Covid-19 restrictions. Economic recovery in the second half of the year, coupled with increased global consumption of processed food, helped sustain the demand for edible oils.

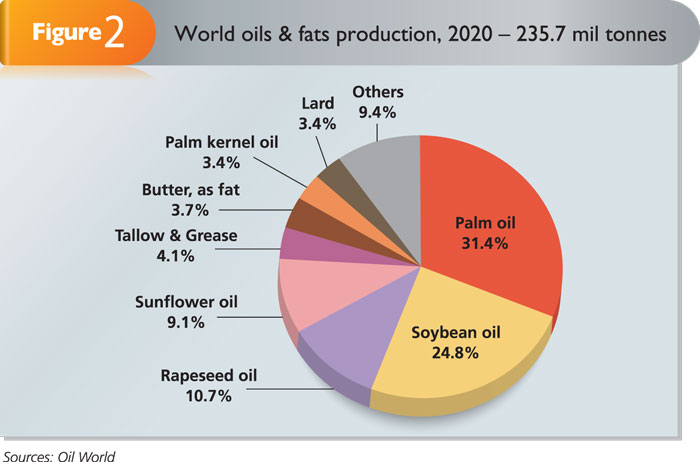

Global production of oils and fats stood at just over 235.7 million tonnes, a marginal decrease of 0.8 million tonnes (0.01%) compared to 2019. Oils and fats consumption registered 236.7 million tonnes against 238.2 million tonnes previously, or 1.5 million tonnes (0.01%) lower year-on-year.

Palm oil and palm kernel oil jointly accounted for 81.9 million tonnes or 34.8% of the world’s oils and fats output (Figure 2). Soybean oil registered 58.4 million tonnes (24.8%), while rapeseed oil recorded 25.3 million tonnes (10.7%).

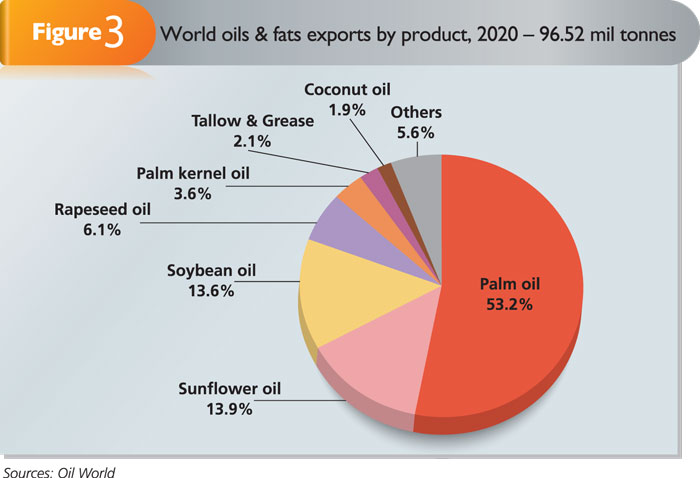

Of the 96.5 million tonnes of oils and fats traded globally, palm oil and palm kernel oil together made up 54.2 million tonnes or 56.8% (Figure 3).

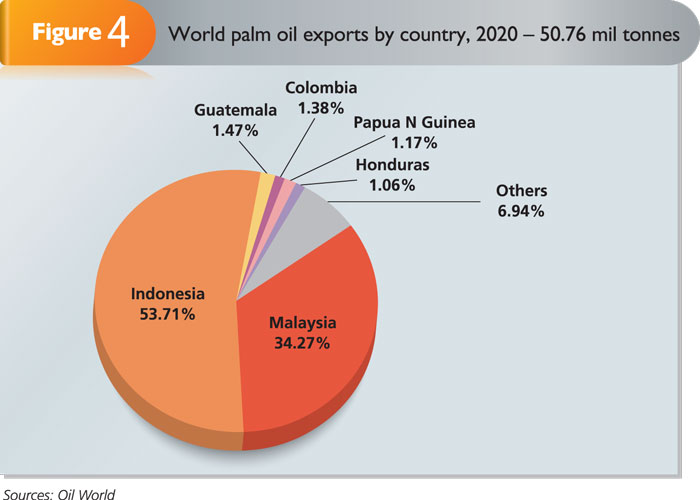

Malaysia’s exports of 17.4 million tonnes of palm oil represented 34.3% of the 50.8 million tonnes supplied by all producers (Figure 4).

MPOC