The second edition of MPOC’s Palm Oil Internet Seminar from Oct 18-24 was based on the theme ‘Determining Price Direction Amidst Market Uncertainties’. Among the topics covered by a panel of experts were CPO price forecasts; the global oil and fats supply outlook in 2021; palm oil supply and demand; the edible oils market in China and India; and opportunities for palm oil in Asia. A summary of three presentations follows.

‘Opportunities for Palm Products in Japan’s Renewable Energy Sector’

Hiroaki Goto

General Manager, EREX Singapore Limited

Following the Fukushima nuclear power plant disaster in 2011, biomass has been increasingly used as a fuel source in Japan’s power plants. Palm kernel shell (PKS) is the preferred biomass, due to its narrow price gap with coal.

Japan has exponentially increased PKS imports since 2012, when biomass-generated electricity became eligible for the feed-in-tariff programme. Imports rose by 94% to record 3.3 million tonnes in 2020, up from 1.7 million tonnes in 2018. Indonesia is the main supplier of PKS, holding a market share of 73%. This was equivalent to 2.4 million tonnes in 2020.

Due to a significant increase in tax and levy by the Indonesian government, the price of PKS went up in 2020. This had a significant impact on the earnings of most of Japan’s power plants. Several buyers have since switched to Malaysian PKS or to wood pellets. Also due to the high price of PKS, plans for new power plants were cancelled or operations were postponed.

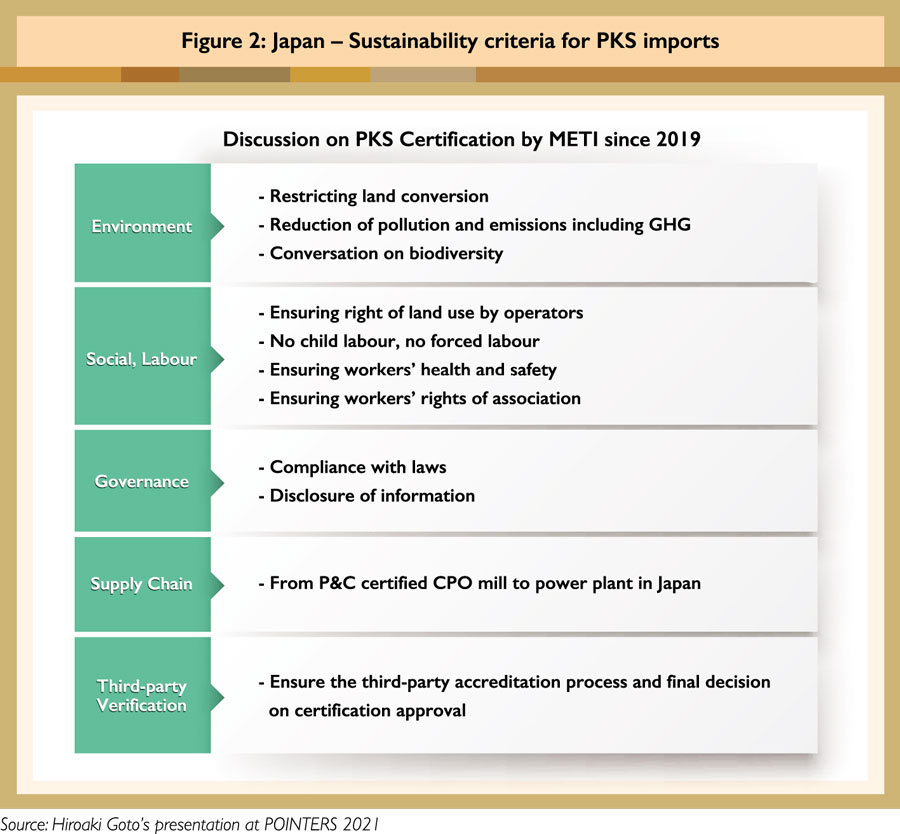

Japan’s Ministry of Economy, Trade and Industry has been discussing issues of the sustainability of PKS since 2019. Figure 2 illustrates the sustainability criteria that must be met for PKS to be imported. Only imports with the RSPO 2013/2018 certification and Roundtable on Sustainable Biomaterials certification have been accepted to date. The Japanese government is currently exploring acceptance of other certification standards, such as the Malaysian Sustainable Palm Oil (MSPO) and Indonesian Sustainable Palm Oil schemes.

‘Opportunities for Certified Sustainable Malaysian Palm Oil in the Asian Market’

Mohammad Hafezh

CEO, Malaysian Palm Oil Certification Council (MPOCC)

The region’s trade plays a key role in boosting demand for sustainably produced palm oil. Malaysia is committed to ensuring that its palm oil industry adopts sustainable practices and offers fair market access to every industry player, from mega-plantation companies to smallholders. Under the MPOCC’s purview, efforts have been put in place to develop and implement sustainable palm oil production through the MSPO certification scheme. As at 2021, almost 90% compliance has been achieved. The focus is being expanded towards stepping up market acceptance, to demonstrate commitment to sustainable development and climate action.

‘MSPO Trace’ was launched in 2019 to enable end-users to trace the origin of the palm oil used in products, and to ensure transparency in sustainability management. As there is stronger commitment to sustainable sourcing by importing countries and companies, MSPO certification will provide a competitive edge in the uptake of certified sustainable palm oil.

In Japan, MSPO certification was recognised as proof of sustainability for the Olympics 2020 and Summer Paralympics. South Korea, which is in transition to a low-carbon economy, has set an ambitious target to reduce its greenhouse gas emissions by 37% by 2023, from the business-as-usual emission level. India and China, the two largest importers of palm oil, are moving towards sustainable palm oil trade with their own standards, such as the Indian Palm Oil Sustainability Framework.

At the same time, rapid economic growth and higher disposable income have led to changes in food consumption patterns in Vietnam and the Philippines; this has contributed to higher palm oil imports by the two countries.

‘Growth of Palm Oil Demand in the ASEAN Region in 2022 and Beyond’

Dr Julian McGill

Head of South East Asia, LMC International

ASEAN is one of the world’s most dynamic economic regions, with its member-states having experienced substantial GDP growth in recent years. Food consumption habits have changed with the availability of higher disposable income, as well as the rapid rate of urbanisation.

Consumption of vegetable oils has gone up in the region, particularly with the popularity of fast foods, snacks and processed foods. However, several countries, such as Cambodia and Laos, still have low levels of income; this translates to low vegetable oil calorie disappearance.

Palm oil dominates the consumption of oils and fats in the region (Figure 5), especially in Malaysia, Indonesia and Thailand, which are also major producers of the commodity.

Thailand and Vietnam have crushing facilities for soybean. As such, soybean oil is the main competitor of palm oil in these countries. Myanmar is the only country in the region that produces peanut oil. However, output is insufficient to meet the country’s oils and fats requirements.

Although the Philippines is the world’s largest coconut oil producer, palm oil dominates the share of oils and fats consumption in the country. Since 2005, coconut oil has been replaced by palm oil due to the wide price gap between both oils. Although the price gap between coconut oil and palm olein has narrowed to below US$100 since 2018, the volume of palm oil imports has remained consistent. This is attributed to consumer preference.

For the Philippines, coconut oil has become an export commodity due to its high market price compared to other edible oils. Additionally, the cyclical typhoon phenomenon disrupts the country’s supply of coconut oil; this has helped maintain the stability of palm oil imports.

The volume of palm oil imports by ASEAN member-states is expected to go up steadily due to the region’s growing population, increase in middle-class consumers and outstanding growth of the tourism sector.

Rina Mariati Gustam

& Nuradibah Mohd Razali

MPOC