When China’s Minister of Foreign Affairs, H.E. Wang Yi, paid an official visit to Malaysia in July 2022, he gave the assurance that his country would buy more palm oil. It was welcome news, given the significant drop in China’s imports over the first half (1H) of 2022.

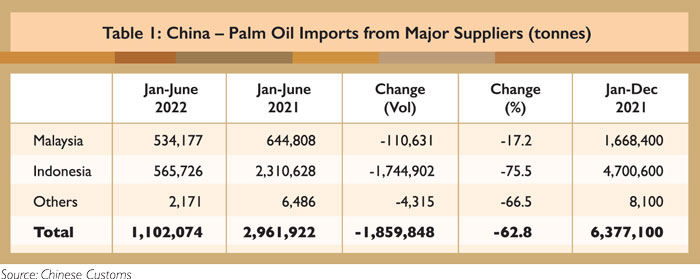

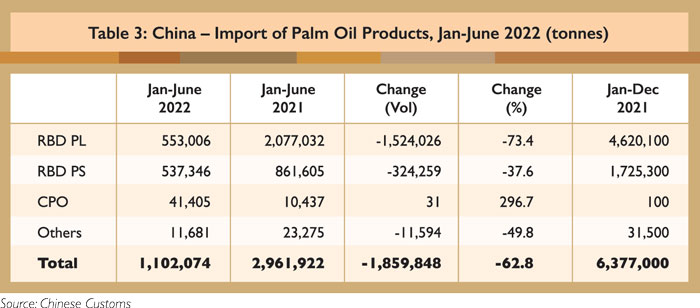

The volume dipped by a drastic 62.8% year-on-year to a record low of 1.1 million tonnes (Table 1). This was a level not seen since China acceded to the World Trade Organisation in 2002, when the import quota was enlarged from 1.4 million tonnes to 2.4 million tonnes, and the tariff rate quota system was phased out in 2006. The cut affected Malaysia and Indonesia, with the latter recording a 75.5% drop in its exports to China.

Soybean oil and rapeseed oil imports were also poor, being slashed by 80.5% and 63.4% respectively. Soybean and rapeseed imports fell by 48.9% and 5.4% respectively. The combined reduction of both commodities – in terms of oil and oilseeds – amounted to a loss equivalent to 2.2 million tonnes of vegetable oil, compared to the same period in 2021. In total, China’s imports of the three major vegetable oils (in oil and oilseed forms) dropped by 4.1 million tonnes, equivalent to 10% of the total oils and fats consumed in 2021.

The shortage was partially offset by the utilisation of inventories – total stocks of the three vegetable oils declined from 1.6 million tonnes at the end of December 2021 to 1.3 million tonnes at the end of June 2022. However, the exhaustion of such a small volume of the stocks meant that demand remained disappointing from January to June.

This was proven by the increase in vegetable oil stocks kept in the form of oilseeds, namely soybean. By the end of June, the stock level of soybean went up by 2.6 million tonnes, equivalent to 500,000 tonnes of oil. About 100,000 tonnes of the rapeseed stock was used; however, the 42,000 tonnes of oil derived through crushing were insignificant against the supply shortage created by the drop in imports.

Impact of price hikes

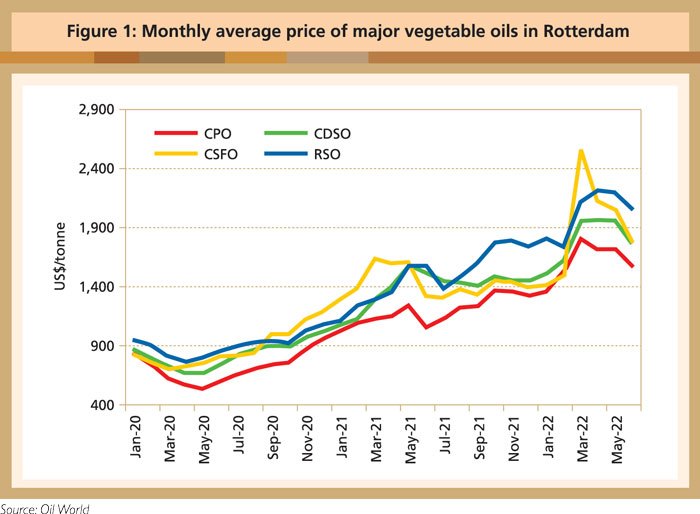

The main reason for the decline in Chinese consumption was the higher price of vegetable oils after the start of the Russia-Ukraine war in early February, and uncertainties in Indonesia’s palm oil export policy, including the ban imposed in late April. As supplies of sunflower oil and palm oil were disrupted, the price of other vegetable oils rose to record levels. The average CPO delivered price in Malaysia was RM6,873/tonne in May, a 35.6% jump from the RM5,070/tonne in December 2021. This was on top of the 40% surge in CPO price in 2021, partly due to the lower-than-expected growth in global vegetable oil output.

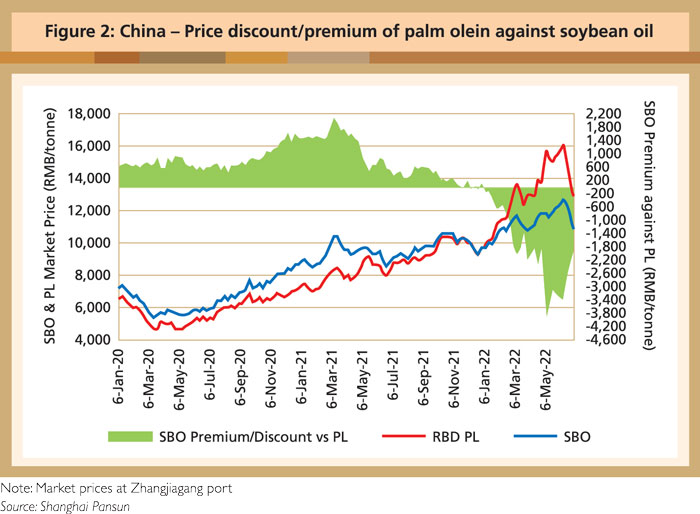

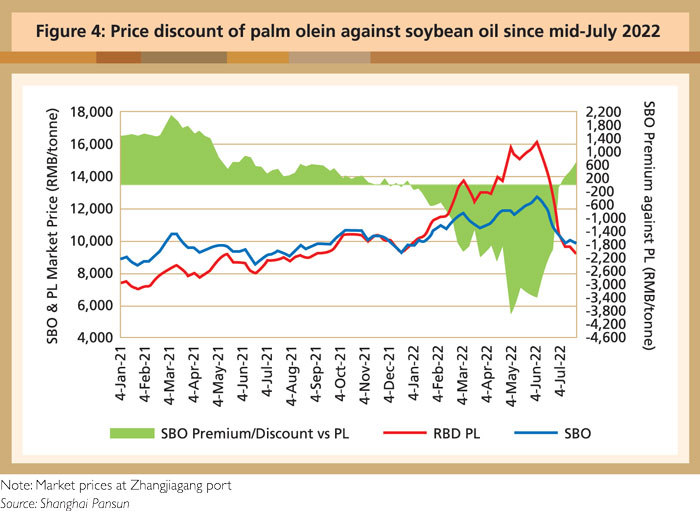

Demand for palm oil in China was affected by its price competitiveness against soybean oil (Figure 2). The price discount of RBD palm olein (PL) against soybean oil (SBO) started falling in October 2021, and became premium to SBO from January 2022, with a record high at RMB3,900/tonnes in early May.

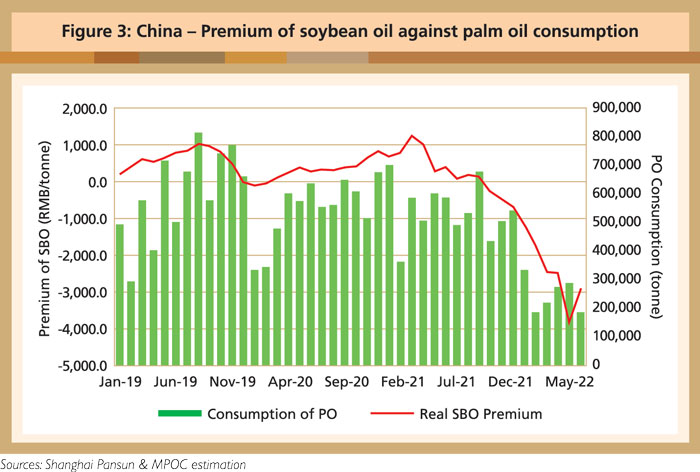

The premium made RBD PL unattractive to many food manufacturers, especially those who could easily substitute it with SBO. It was deduced from data that monthly demand for palm oil dropped from 540,000 tonnes in December 2021 to an average of 247,700 tonnes/month in 1H 2022 (Figure 3). This was a far cry from the average consumption of 542,800 tonnes/month in 2021.

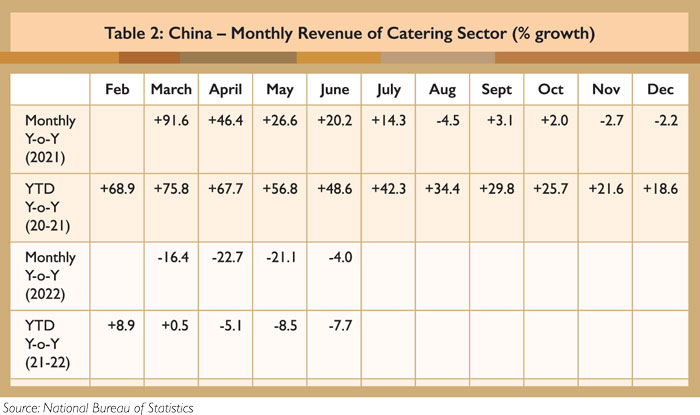

A slowdown in demand from the catering and oleochemical sectors was another factor behind the drop in PO imports. The catering sector’s revenue growth fell by 7.7% in 1H 2022, due to a sudden rise in Covid-19 cases. This led to the movement restriction orders being re-imposed in some cities, and suspension of dine-in activities at restaurants.

The catering sector accounts for an estimated 20% of the palm oil consumed in China, equivalent to 1.4 million tonnes used in 2021. Within this volume, it is estimated that 800,000 tonnes were imported in 1H 2021 due to the favourable price discount of PL against SBO.

The 7.7% drop in the catering sector’s revenue in 1H 2022 may be taken to mean that demand for vegetable oil in this sector also declined by 7.7%. However, there is a need to consider that the average price discount of PL against SBO in 1H 2021 was RMB1,279/tonne/month, compared to a price premium of RMB1,881/tonne/month in 1H 2022. This change would have further deterred the use of PL. In other words, the loss of price competitiveness and poor revenue in 1H 2022 were estimated to have wiped out almost all the 800,000 tonnes of PL used by this sector in 2021.

A slightly poorer performance was also seen in the oleochemicals sector, where the total output of major products (stearic acid, glycerine and fatty alcohols) dropped by almost 20% in 1H 2022, compared to 2021. This led to lower demand for RBD palm stearin (PS) which is the main feedstock.

PS imports dropped by 37.6% in 1H 2022 (Table 3). This was partially offset by the import of hydrogenated vegetable oil (mainly comprising cheaper hydrogenated PS), to meet demand of about 80,000 tonnes. In spite of this, demand for PS or oleochemical feedstock fell by 240,000 tonnes (27.9%) against 2021.

The high price and premium of PL also affected demand in the food manufacturing sector. However, use by the instant noodle sector remained stable or even rose, because PL and PO are not easily substituted due to their functional advantages.

Stronger demand ahead

The price of palm oil has retreated since mid-June. With a sharper drop of PL price compared to SBO, a price discount reappeared in mid-July. At end July, the discount had widened to RMB650/tonne (Figure 4). This will now make PL more attractive than SBO, especially to medium-pack cooking oil packers. Also, during summer, PL does not need fractionation for its use; this will reduce costs and raise the volume of PL included in cooking oil.

The overall price of vegetable oil has gone down by as much as 44% in the domestic market from its peak. Most SME food manufacturers would want to recover profits when consumer demand strengthens in the second half of 2022.

On the economic front, China is poised to achieve higher growth in 2H 2022, with annual GDP growth being estimated at about 6%. Only 2.5% GDP growth was recorded in 1H; therefore, the economy is expected to grow by 8-9% in 2H, boosting demand for consumer goods. There is also hope for revival of the catering sector, since the government has experience in handling Covid-19 outbreaks and minimising their impact on economic activities.

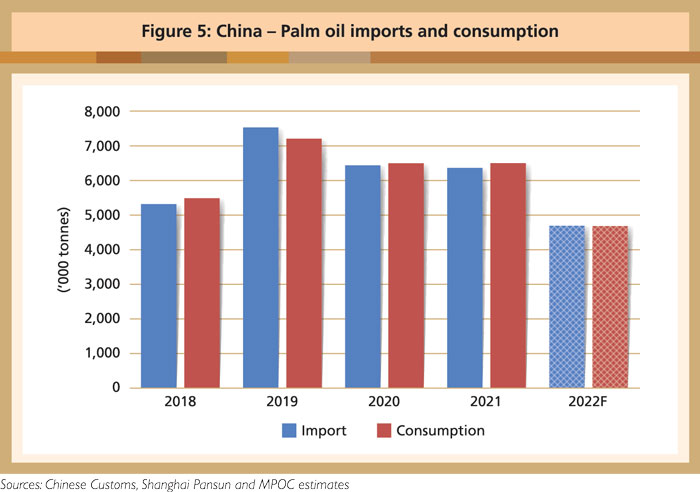

Demand for palm oil will improve, as PL is currently priced competitively against SBO. In addition, China will need to replenish stocks. Demand for PO in 2H 2022 is therefore projected at 3.2 million tonnes, on par with 2021.

With the stock level expected to return to 600,000 tonnes, traders and importers would need to import an additional 400,000 tonnes on top of the projected demand. Hence, PO imports in 2H 2022 are forecast at 3.6 million tonnes, far higher than 1.1 mil tonnes in 1H 2022 and 200,000 tonnes more than in H2 2021.

Desmond Ng

MPOC China