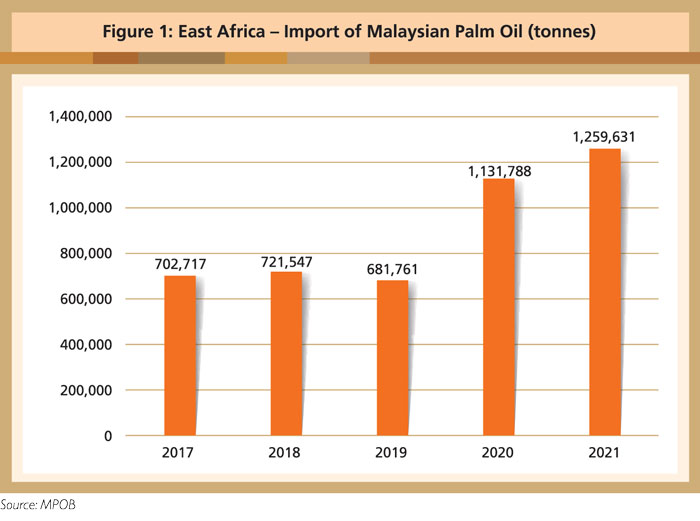

Sub-Saharan Africa, with a population of about 1.2 billion, is a net importer of palm oil, although several countries in the region are themselves producers. Demand for Malaysian Palm Oil (MPO) has been particularly strong in east Africa, which absorbed 1.3 million tonnes in 2021 – an increase of 11% compared to 2020 (Figure 1). Palm oil is mainly used in Fast-Moving Consumer Goods applications, such as cooking oil, baking fats and food products.

Key markets in region

Kenya is a net importer of oils and fats. Palm oil accounts for more than 90% of the oils and fats it consumes. In 2021, it absorbed 780,000 tonnes of palm oil, of which 670,000 tonnes were from Malaysia.

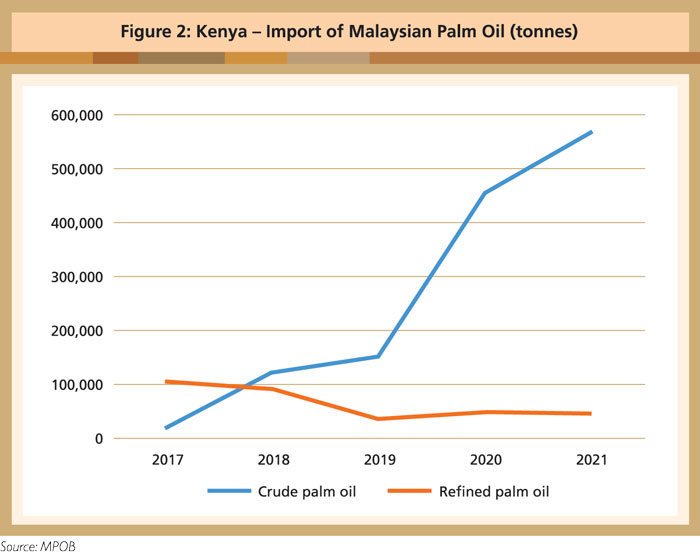

CPO has replaced RBD palm oil as the main MPO product since 2018 (Figure 2). Imports of RBD palm oil have declined due to Kenya’s enforcement of a requirement for mandatory fortification of vegetable fats and oils with Vitamin A. In addition, demand for CPO has been boosted by the zero import tariff. Mombasa port remains a major re-exporting hub for palm oil, especially to landlocked countries such as Rwanda, Burundi, Uganda and the Democratic Republic of Congo.

Tanzania is another major regional market for MPO. In 2021, it imported 204,085 tonnes, which made up about 43% of its palm oil import volume. On July 1, 2022, Tanzania lifted its high 25% import tariff on CPO. This had been imposed in 2018, when there was zero import tariff in most east African countries. It had led to unattractive prices and loss of markets in neighbouring countries, as Tanzania is also a re-export hub. With the lifting of the import tariff, palm oil trade is expected to pick up.

New infrastructure projects

Improved roads, ports and logistical services have aided the movement of goods in this region. Over the past decade, international investors – particularly from China, the US and France – have entered the African market. Countries like Kenya, Uganda, Nigeria and South Africa are growing into economic powerhouses.

In recent years, east Africa has prioritised the improvement of cross-border and transport infrastructure. The EAC Secretariat completed 1,700km of road projects from 2012-20 to link Kenya, Tanzania, Uganda, Rwanda and Burundi.

A mega project –Tripartite Transport and Transit Facilitation Programme Eastern and Southern Africa – is due to be completed by 2030. The countries in these regions will then have harmonised road transport policies, laws and regulations, and better road infrastructure.

China, which has been Africa’s biggest economic partner since 2000, is operating its Belt and Road Initiative here as well. The focus is on the development of roads, railways and ports across multiple African nations.

The port of Mombasa, one of the busiest in the region, has been going through phases of major reconstruction to accommodate vessels with a bigger capacity. Other ports along the northern corridor have been undergoing a revamp as well.

DP World Kigali in Rwanda is the first inland dry port in east Africa that has access to the port of Mombasa in Kenya and port of Dar es Salaam in Tanzania. It secures two main trade gateways to the sea, and has an annual handling capacity of 350,000 tons of cargo and 50,000 TEUs. It also connects Rwanda via road to neighbouring landlocked countries such as Uganda, the Democratic Republic of Congo and Burundi.

DP World Kigali has reduced the cost of logistics services, including long-haul transportation. It offers efficient operations, automation, an Inland Container Terminal and warehousing facilities. It has also served as a one-stop centre to connect all logistics players since operations began in 2018.

In 2021, DP World Maputo launched its first dedicated logistical train services between Maputo in Mozambique and Harare in Zimbabwe. The service is expected to reduce transit times for goods delivery between the two countries.

All these improvements have also helped ease the movement of MPO in the region.

MPOC Sub-Saharan Africa