India: Vegetable Oils Scenario

By gofb-adm on Saturday, August 20th, 2022 in Issue 2 - 2022, Markets No Comments

By gofb-adm on Saturday, August 20th, 2022 in Issue 2 - 2022, Markets No Comments

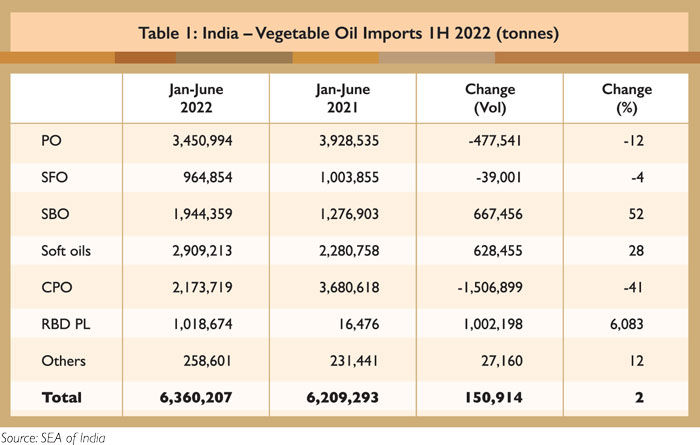

Indian vegetable oil demand remained intact over the first half of 2022, with imports rising by 2% year-on-year (y-o-y). High landed prices of palm oil and narrow spreads with soft oils led to a shift in demand towards soft oils. This reduced the palm oil share of vegetable oil imports to 54% against 63% y-o-y, while imports in 1H 2022 declined by 12% compared to the same period in 2021.

With supply disruptions in the countries of origin, the market share of major exporters also fell in 1H 2022. The Indonesian palm oil share dropped to 32% from 44% in 1H 2021. The Russia-Ukraine war led to a 4% y-o-y decline in sunflower oil imports largely from Ukraine, as importers switched to supplies from Russia and Argentina; about 80% of India’s annual imports have traditionally been from Ukraine.

A recent price drop discounted palm oil to soft oils by US$250-500/tonne, while increasing palm oil import parity to more than US$100/tonne. This will raise the palm oil import share.

India’s vegetable oil imports for 1H 2022 increased to 6.4 million tonnes (by 2%), against 6.2 million tonnes in 1H 2021. Imports during the first quarter of 2022 were higher by 16% over the comparative period, but the volume fell by 10% during the second quarter due to high prices attributed to the Russia-Ukraine war and other global factors.

Import disparity and narrow spreads with competing oils reduced palm oil demand in 1H 2022, as imports fell by 477,541 tonnes (12%) to 3.5 million tonnes (Table 1). In terms of volume, however, it remained the most traded commodity. The import of soft oils went up by 628,455 tonnes (28%) to 2.9 million tonnes, driven by higher soybean oil imports. The share of soft oils in the import basket stood at 46%, compared to 37% in 1H 2021.

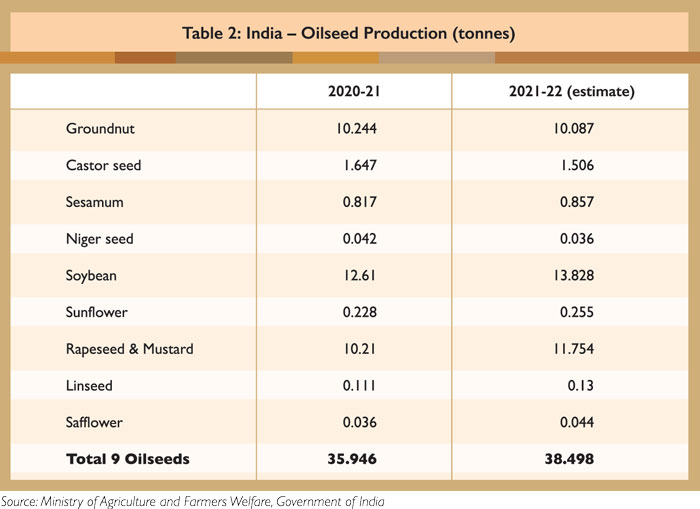

Domestic oilseed production in 2021-22 is pegged to rise by 7% to 38.5 million tonnes against 35.9 million tonnes in 2020-21. This is due to good price realisation for the output, encouraging farmers to plant more oilseeds in preference to competing crops. Total vegetable oil production in 2021-22 is estimated to rise by 5% to 10.3 million tonnes against 9.8 million tonnes in the previous year.

Import duties

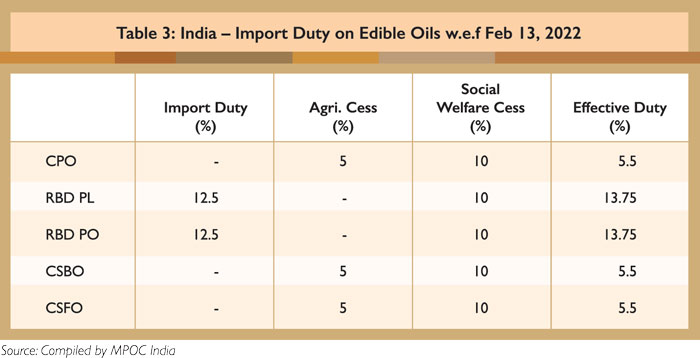

India had levied high import duty on edible oil imports in order to protect domestic oilseed producers. However, the Covid-19 pandemic caused global supply chain disruptions, while other macro-economic factors contributed to hiking up vegetable oil prices to exorbitant levels. This forced the government to reduce the import duty.

As a case in point, the import duty on CPO was as high as 44% in 2019. By the end of 2021, the effective import duty on CPO had come down to 8.25%, and on other crude oils to 13.75%. In 1H 2022, the import duty on CPO was further reduced, although there was no change for the other vegetable oils.

In order to support domestic processors and to control cooking oil prices, the government reduced the agri-cess on CPO to 5% with effect from Feb 13, 2022, bringing the effective import duty down to 5.5% from 8.25% (Table 3).

To control rising inflation, the government has allowed duty-free imports of crude soybean oil and crude sunflower oil – capped at 2 million tonnes for each – for the next two financial years with effect from May 25, 2022; this will facilitate the import of soybean oil at a lower price.

The Directorate-General of Foreign Trade (DGFT) was directed to allocate the tariff rate quota (TRQ) based on the refining capacity of applicants, as well as sales over the last three financial years. The objective is to extend the facility to actual processors of vegetable oil, not to traders.

The DGFT and Ministry of Consumer Affairs, Food and Public Distribution recently released the allotment under the TRQ, with a cap of 200 KMT per refiner. However, the Solvent Extractors Association of India has since requested a review, citing anomalies which would prevent the TRQ benefits from being transferred to consumers.

Many leading soybean and sunflower oil refiners who produce up to 1,000 KMT have been allocated only 200 KMT under the TRQ. This would compel them to import the quantity above 200 KMT at full duty. Smaller players, meanwhile, could take advantage of the higher duty-free import quota without passing on the full benefits to consumers.

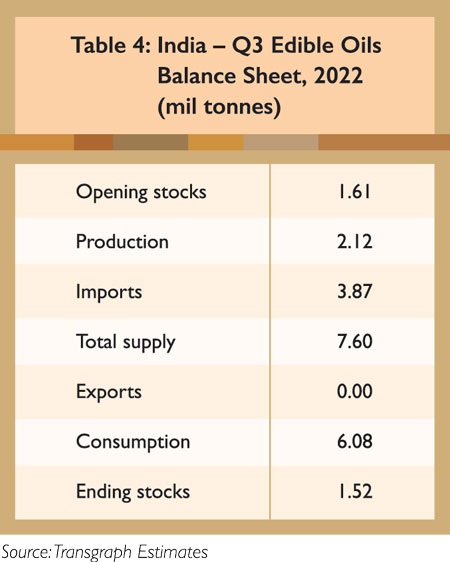

Domestic edible oil production in the third quarter of 2022 is projected at 2.1 million tonnes (Table 4), with imports estimated at 3.9 million tonnes (monthly average of about 1.3 million tonnes) in anticipation of escalated demand for festivals. Existing stocks stand at 1.6 million tonnes. Consumption is estimated at 6.1 million tonnes, compared to 5.7 million tonnes in the second quarter of the year.

MPOC India

By gofb-adm on Saturday, August 20th, 2022 in Issue 2 - 2022, Markets No Comments

On Nov 17, 2021, the European Commission (EC) published its draft proposal for a regulation on the import and export of commodities and products associated with deforestation and forest degradation (Draft Regulation), as well as a number of accompanying documents.

The rules are expected to cover six commodities – cattle, cocoa, coffee, palm oil, soybean and wood. Annex 1 lists specific products – namely those that contain, have been fed with, or have been made using the commodities – to which the regulation will also apply.

The Draft Regulation will prohibit the import of the six commodities and their export from the EU market ‘unless they are deforestation-free and have been produced in accordance with the relevant legislation of the country of production’.

On June 28, 2022, the Council of the EU adopted its position regarding the Draft Regulation. The European Parliament’s Committee on Environment, Public Health and Food Safety (ENVI Committee) had presented a Draft Report on April 20, introducing Compromise Amendments to the Draft Regulation. On July 12, the ENVI Committee adopted the Draft Report with 60 votes in favour, 2 against and 13 abstentions.

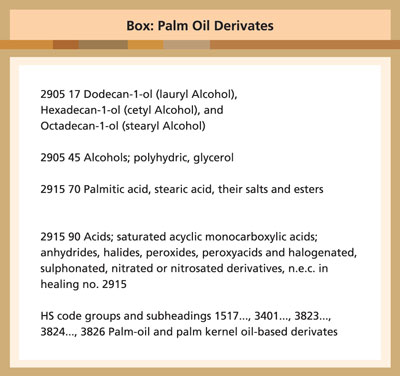

The Compromise Amendments will expand the scope of commodities covered by the Draft Regulation, adding swine, sheep and goats; poultry; palm-oil based derivates (see Box); maize; rubber; and other products, including charcoal and printed paper products, to the list.

Significant proposals

The ENVI Committee’s Draft Report further proposes a change to the meaning of the concept of ‘deforestation’, with four new definitions: ‘ecosystem conversion’, ‘agricultural use’, ‘other wooded land’ and ‘natural ecosystem’. The intention is to ensure that the Draft Regulation will cover not only land classified as ‘forest’, but also other land and ecosystems that are not classified as ‘forest’.

Currently, the definition of ‘deforestation’ in the Draft Regulation states that it ‘means the conversion of forest to agricultural use, whether human-induced or not’. This definition has been criticised by various organisations for being vague and not covering other ecosystems.

Therefore, the ENVI Committee proposes to define ‘deforestation’ as the ‘conversion, whether human-induced or not, of forests or other wooded land to agricultural use or to plantation forest’ (emphasis added).

The definition of ‘other wooded land’ means ‘land not classified as forest, spanning more than 0.5 ha, with trees higher than 5 metres and a canopy cover of 5-10%, or trees able to reach these thresholds in situ, or with a combined cover of shrubs, bushes and trees above 10%, excluding land that is predominantly under agricultural or urban use’.

Such definitions are particularly relevant as the ENVI Committee also proposes to include the assessment of forest conversion as part of the criteria to classify countries in ‘low’, ‘standard’, or ‘high-risk’ categories. If adopted in the final text, the definitions will have an impact on the classification of countries, as one criterion will be the ‘rate of deforestation, forest degradation and forest conversion’.

With respect to due diligence and enforcement, the ENVI Committee’s Draft Report notes that ‘while no country or commodity will be banned, companies placing products on the EU market would be obliged to exercise due diligence to evaluate risks in their supply chain’.

Importantly, the due diligence requirements will be derived from the ‘country benchmarking system’. In other words, obligations for operators and authorities in EU member-states will vary depending on the classification given to each country.

Notably, operators from ‘low-risk’ countries will have less onerous due diligence obligations, compared to those in ‘high-risk’ countries. The latter would have to provide, inter alia, a risk assessment to establish whether the relevant commodities and products are non-compliant with the requirements of the proposed regulation.

Under the EC’s Draft Regulation, such due diligence obligations only relate to deforestation and forest degradation or the production of products in accordance with ‘relevant legislation of the country of production’.

However, the ENVI Committee’s Draft Report proposes to amend the definition of ‘non-compliant’ to include the notion that a product must be also produced in accordance with ‘relevant laws and standards, including the rights of indigenous people, tenure rights of local communities, and the right to free, prior and informed consent, and which were not covered by an accurate due diligence statement’.

For example, traders and operators would need to provide information that the production of palm oil and derived products does not cause deforestation and forest degradation, and that it also complies with laws and standards regarding indigenous peoples’ rights.

Unless operators are able to prove that these products come from deforestation-free areas when originating in countries labelled as ‘standard’ or ‘high-risk’, the products look poised to be banned from the EU market.

Implications for palm oil

The Draft Report proposes to include specific palm oil and palm kernel oil-based derivatives within the scope of the Draft Regulation. These include ‘palmitic acid, stearic acid, their salts and esters’, which are used in food production.

While this could provide some clarity on the palm oil products to be covered, it is worth noting that there is no similar amendment regarding soybean derivatives, for example. Once again, a different approach towards palm oil can be observed. This appears to be discretionary and discriminatory in nature.

It would be in Malaysia’s interests to call upon the EC to classify countries according to transparent, science-based and objective criteria, with datasets gathered and verified with respect to all the commodities covered by the Draft Regulation.

This process of classification must also recognise Malaysia’s efforts and commitments towards the environment and sustainable production of palm oil and of all other commodities, whether or not they fall within the scope of the Draft Regulation.

Additionally, it should be emphasised that under the Malaysian Sustainable Palm Oil certification scheme, mandatory rules already confirm product compliance with a number of social and environmental standards. These should be counter-checked with the social and environmental elements referenced in the Draft Regulation.

The European Parliament is scheduled to vote on its Draft Report in September 2022. When it is adopted by the plenary, it will become the European Parliament’s position for the inter-institutional ‘trilogue’ negotiations with the Council and the EC, scheduled to begin after the summer recess.

The three institutions must agree on the text of the Draft Regulation, which will then have to be approved by the European Parliament’s plenary and by the Council. The EC will publish the measure in the EU’s Official Journal for adoption and implementation.

MPOC Brussels

By gofb-adm on Saturday, August 20th, 2022 in Issue 2 - 2022, Markets No Comments

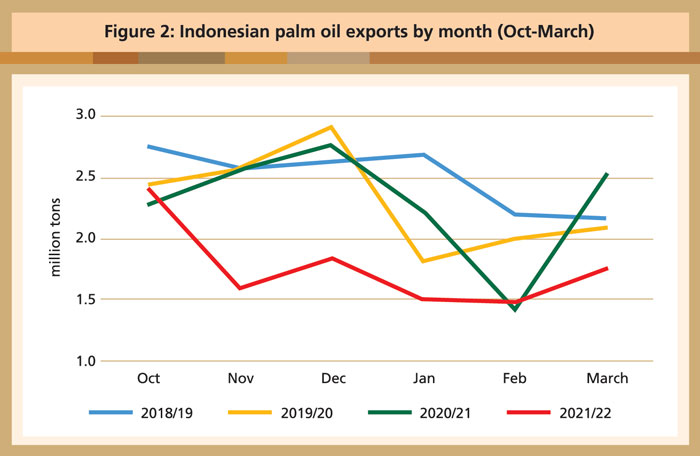

In marketing year 2021/22 (October to September), Indonesian palm oil exports were lower by 3 million tons [as at May 2022], down to a 12-year low of 25 million tons. The forecast is reduced on Indonesia’s slow export pace through the first six months of MY 2021/22 and various palm oil export policies in effect since November 2021. Although the government of Indonesia implemented a palm oil export ban on April 28, 2022, industry sources expect it to be short-lived and therefore have a limited impact on trade.

Cumulative shipments from October 2021 to March 2022 declined over 30% compared to the same period in MY 2020/21. Exports plunged after export taxes increased in November 2021. This reduced pace is expected to continue into May as Indonesia continues its restrictive export policies.

A stronger export pace is anticipated for the remainder of the marketing year. The current slow pace of exports is leading to a build-up of supplies that will need to be cleared from storage facilities to accommodate future production.

Market features

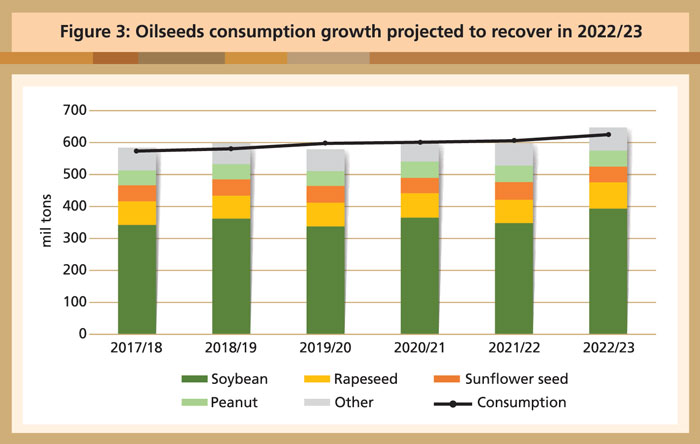

Global oilseed production is forecast to grow 8% in 2022/23, primarily on growth in soybean output in South America and the US, as well as rapeseed production in Canada and the European Union (EU), more than offsetting loses of sunflower seed output in Ukraine and Russia.

Global oilseed production is projected to reach 647 million tons, with soybean production forecast to rise 45 million tons to nearly 395 million, up 13%.

Global oilseed consumption is forecast to rise 3% in 2022/23, driven by higher China soybean demand as a result of a recovery from a decline seen in the last marketing year. Soybean crush and consumption are projected to account for most of the growth in global oilseed use. Sunflower seed consumption is projected down 3%, while rapeseed consumption is up 7%.

Global oilseed trade is forecast higher mostly on higher soybean demand from China. Trade in soybean, rapeseed, sunflower seed and peanuts is expected to rise, while cotton seed exports are forecast lower.

Global ending stocks are projected to rise on growing soybean production and stocks in South America and the US.

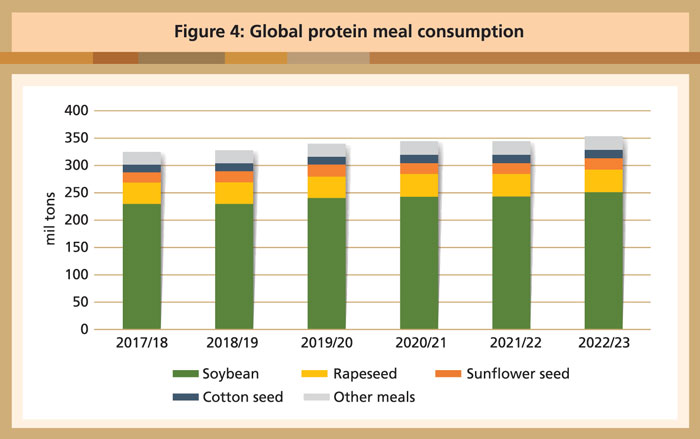

Global oilseed meal production is forecast to grow in 2022/23, led by soybean and rapeseed meal. Global consumption is expected to climb, mostly on robust demand from China. Trade in protein meal is expected to grow with higher soybean meal and rapeseed meal imports.

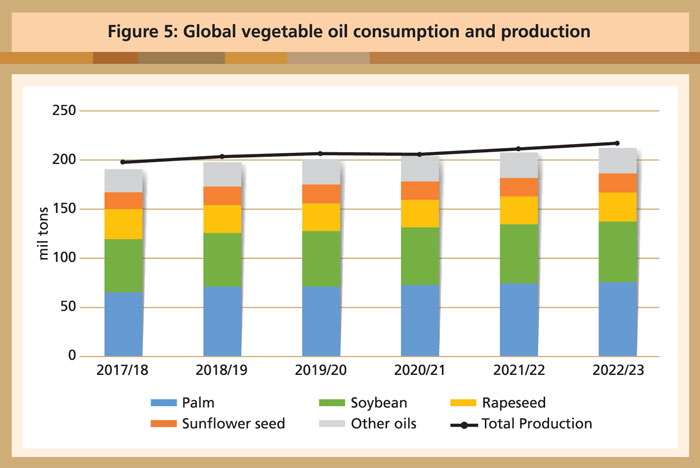

Global vegetable oil production is expected to grow by 3%, with major gains for soybean, rapeseed and palm oil, more than offsetting losses for sunflower seed and olive oil. Global consumption is forecast to expand by nearly 4.6 million tons (2%), primarily driven by palm and soybean oil growth in China.

Global vegetable oil trade will strengthen in 2022/23, owing to strong recovery in palm oil and rapeseed oil import growth. Global vegetable oil ending stocks are projected to grow by 4% to over 28 million tons.

2022/23 commodities outlook

Soybean

Global soybean production in 2022/23 is forecast at a record 394.7 million tons, up 13% from 2021/22. Likewise, soybean production in Brazil and the US is forecast at a record, continuing the trend of higher-concentrated production in exporting countries. If realised, year-over-year soybean production will expand by the largest amount in over a decade, predominantly on higher yields in South America following this year’s drought.

Brazil, Argentina and Paraguay account for more than 85% of production gains on both expanded planted area and higher yields. Soybean planted acres in Brazil are expected to grow for the 17th consecutive year, as high prices and a favourable exchange rate enhance producer returns despite high fertiliser prices. Plantings in the US are currently forecast to be a record as some farmers displace corn plantings due to high input costs.

Driven by expanding production, global soybean supplies will likely reach record levels. Export demand will continue to be led by China, which is projected to account for more than 50% of global trade growth while rebounding from this year’s slowing imports.

Export growth is forecast to outpace crush in the top three exporter countries in 2022/23 for the first time in three years on larger supplies and demand from China. Ample supplies are expected in exporter countries in 2022/23 and are responsible for the stronger growth in disappearance. Soybean stocks in the top three exporter countries on Sept 30, 2023 are expected to rise by 30% versus the previous year but remain well below the five-year average. China ending stocks are expected to grow much more modestly but remain at record levels.

Global soybean meal consumption is projected to rise 3% in 2022/23, a recovery from the slight downtick forecast for this year. China is expected to account for half of global consumption growth after a year of weaker soybean meal consumption. Exports are set to rise in line with consumption on a rebound in South America crush following improved soybean production prospects and higher US supplies.

Argentina’s share of global trade is projected to fall in 2022/23, while Paraguay, China and the US are forecast to see the largest growth in exports. Meal exports from Brazil and the US are forecast well above the five-year average as production gains are forecast to outpace domestic demand growth.

Soybean oil consumption is projected to rise 2%, mostly on the strength of China food use demand and higher US renewable diesel production. Global exports are forecast to rise 4% in 2022/23 with total global volume projected at a record 12.7 million tons.

Export growth is likely to be driven by South America on production gains outpacing domestic consumption growth and reduced competition from the US due to high domestic industrial usage. Remaining export growth is likely to come from European countries to offset reduced sunflower seed oil trade in the region due to the conflict in Ukraine.

Highlights

US soybean exports are projected to rise 1.6 million tons to 59.9 million tons on larger supplies and expected reduced export competition from Brazil at the start of the US harvest.Soybean supplies in 2022/23 are up on both higher carry-in and a larger crop, driven primarily by increased plantings. Soybean crush is forecast to rise at a slower pace than the previous year. Soybean meal exports are forecast to be a record, but strong domestic demand for soybean oil for renewable biodiesel will tighten exportable supplies and boost prices.

Argentina soybean production is projected to rise to 51 million tons on better weather and increased plantings. Trade is expected to recover from the current year with exports, mostly to China, at 4.7 million tons and imports, primarily from Paraguay, at 4.8 million. Strong demand for products and larger supplies will boost crush; however, increased competition from Paraguay, Brazil and the US will dampen meal and oil export growth. Soybean meal exports are forecast to rebound to 28.5 million tons, and soybean oil is projected to rise to 5.9 million tons.

Brazil soybean production is forecast to rise 24 million tons to 149 million tons on expected higher yields due to more favourable weather coupled with expanded planting in 2022/23.This will be the 17th straight year of expanded soybean plantings driven by strong export demand and excellent grower returns. Exports are projected to rise to 88.5 million tons, 5.8 million tons above the 2021/22 forecast. Crush is forecast to rise 1.3 million tons driven by strong crush margins and growing domestic meal and oil demand, leaving exports of soybean meal marginally higher and oil flat.

Rapeseed

Global rapeseed supplies in 2022/23 are projected to rise 10% to a record 100.5 million tons as production in Canada recovers from last year’s devastating drought. Both global harvested area and production are projected to be records. Reduced carryover, the smallest in nearly 20 years, will necessitate some stock-building in the coming year and provide a measure of price support.

Exports are projected to rise significantly above this year’s current forecast but will fall short of the 2020/21 record volume as stock building and strong crush recovery in Canada restrict exportable supplies. Global rapeseed crush is forecast to reach a record 75.1 million tons.

Global rapeseed meal production is forecast up 7% to a record in 2022/23. Canada leads the way in production growth as seed supplies rebound. Larger seed supplies in the EU and China, driven by larger production and seed imports, will facilitate crush and meal production growth in the coming year. Global rapeseed meal trade is projected to rise nearly 1 million tons as importers push purchases to near 2020/21 levels. Much of this is driven by increased exports from Canada. Higher meal production and increased trade will support record global consumption.

Record global crush will also push rapeseed oil production to a record 30.7 million tons in 2022/23. The same dynamics driving rapeseed meal trade and consumption are also in play in the oil market. Global rapeseed oil supplies are expected to remain tight with rising consumption and tight supplies of other oils. Consumption is projected to rise 1 million tons, reaching a record 30.2 million tons. Food oil use accounts for most of the growth with industrial use, primarily in biofuels, expected to grow slowly. Global rapeseed oil stocks will improve over this year’s low but will likely remain well below the 10-year average stock level.

Sunflower seed

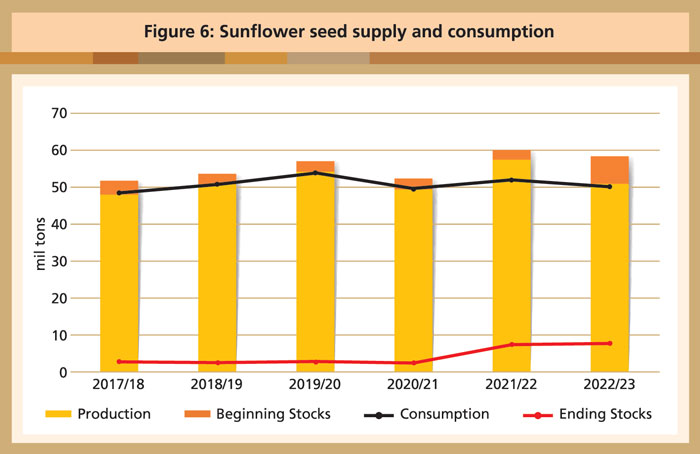

Global sunflower seed production in 2022/23 is forecast at 50.7 million tons, 12% lower than last year’s record crop. The largest declines are expected in Ukraine, Russia and Moldova, driven by smaller harvested area. Production growth is projected for Argentina, the US, Serbia, Turkey and the EU; however, total gains will not offset total losses.

Global sunflower seed consumption in 2022/23 is forecast to decline only 3% to 50.1 million tons as record carry-in stocks are likely to keep crush demand strong. Sunflower seed trade is projected higher with export growth at 44%, driven by Ukraine, Russia, Kazakhstan and Argentina. Imports are forecast to increase for the EU, China, Turkey and Uzbekistan.

Global sunflower seed meal trade is forecast to decline 1%, with lower exports from Ukraine and Russia more than offsetting larger shipments from the EU and Argentina. Meal imports are projected to decline in the EU and China.

Global sunflower seed oil demand is forecast at 18.1 million tons, almost unchanged from the previous marketing year. Strong demand for sunflower seed oil is projected to drive trade higher with imports growing 2% to 9.1 million tons. The higher import demand is mostly driven by the EU and Iran, followed by ongoing strong demand in China, India and Turkey. With declining crush by major producers coupled with growing global oil demand, sunflower seed oil stocks are projected to fall 16% to a two-year low at 2 million tons.

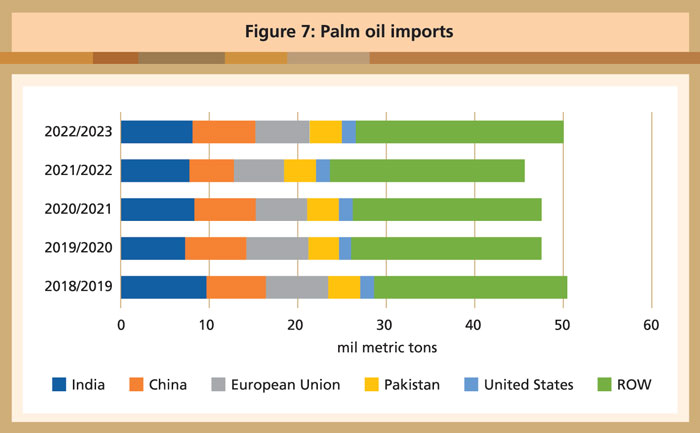

Palm oil

Global palm oil production in 2022/23 is forecast to rise as favourable weather patterns return to Southeast Asia. Additionally, Malaysia is expected to resolve labour shortages caused by the Covid-19 pandemic. Palm oil remains the largest vegetable oil consumed for food and industrial use. Rising output and increased demand boost global palm oil trade. Higher demand is expected in major markets including the EU, China and India as well other countries. Ending stocks are up as production outpaces consumption.

Highlights

Source: US Department of Agriculture

Foreign Agricultural Service, May 2022

These excerpts are from a report which is available at: https://apps.fas.usda.gov/psdonline/circulars/oilseeds.pdf

By gofb-adm on Saturday, August 20th, 2022 in Issue 2 - 2022, Sustainability No Comments

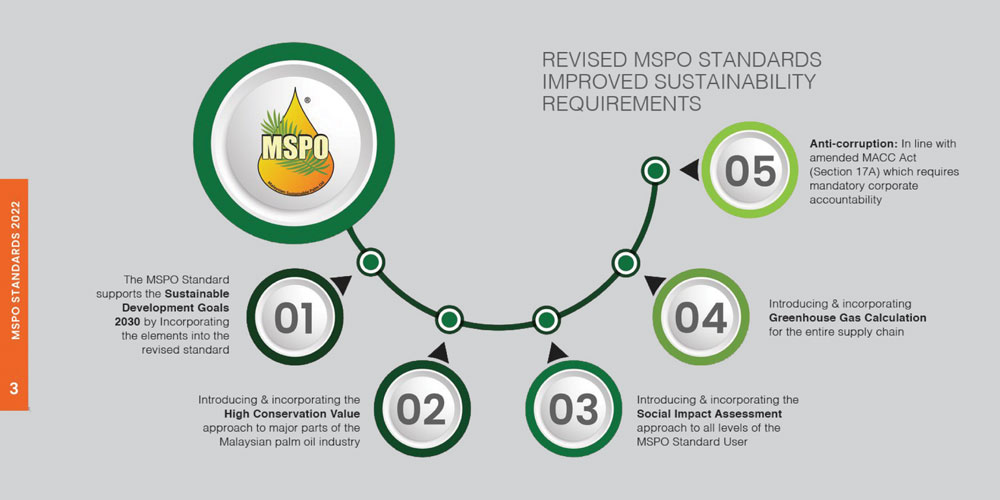

Compared to its predecessor, the MS 2530:2022 standard was developed with a very different industry baseline knowledge on sustainable oil palm management practices. In 2013, sustainable certification of oil palm was only implemented by large industry players.

Based on groundwork established by the MS 2530:2013 standard, revised Malaysian Sustainable Palm Oil (MSPO) standards were launched in March 2022 with more awareness about sustainable practices and the capacity to implement them, which was not previously present.

The MS 2530:2022 standard retains the four main parts, but is further divided into eight separate parts. This is to cater to differences in capacity and scale of the implementers of the MSPO.

Scope of the MS 2530:2022 standard

MS 2530-1:2022 – MSPO Part 1: General Principles

Part 1 lists the general principles of the standard. It provides the framework for the other parts and includes terms and definitions used throughout the standard. Part 1 does not contain requirements used to assess conformity.

MS 2530-2-1:2022 – MSPO Part 2-1: General Principles for Independent Smallholders (less than 40.46 ha)

Part 2-1 contains requirements used to assess conformity for independent smallholders against the MSPO. Independent smallholders are categorised as individual farmers who own or lease less than 40.46 ha (100 acres) of an oil palm smallholding and manage the smallholding themselves.

MS 2530-2-2:2022 – MSPO Part 2-2: General Principles for Organised Smallholders (less than 40.46 ha)

Part 2-2 contains requirements used to assess conformity for organised smallholders against the MSPO. This refers to individual farmers who own or lease less than 40.46 ha of an oil palm smallholding, and the holdings are managed by government agencies such as FELDA, RISDA, FELCRA, SALCRA and SLDB.

MS 2530-3-1:2022 – MSPO Part 3-1: General Principles for Oil Palm Plantations (40.46 ha to 500 ha)

Part 3-1 contains requirements used to assess conformity against the MSPO for small oil palm estates between 40.46 ha and 500 ha.

MS 2530-3-2:2022 – MSPO Part 3-2: General Principles for Oil Palm Plantations (more than 500 ha)

Part 3-2 contains requirements used to assess conformity against the MSPO for large oil palm estates/plantations with areas of more than 500 ha.

MS 2530-4-1:2022 – MSPO Part 4-1: General Principles for Palm Oil Mills including Supply Chain Requirements

Part 4-1 contains requirements used to assess conformity for palm oil mills against the MSPO. This standard contains requirements for sustainable management, as well as supply chain requirements.

MS 2530-4-2:2022 – MSPO Part 4-2: General Principles for Palm Oil Processing Facilities including Supply Chain Requirements

Part 4-2 contains requirements used to assess conformity for palm oil processing facilities – such as for crude palm oil and palm kernel – against the MSPO. This standard contains requirements for supply chain requirements, as well as introduces requirements for sustainable management practices.

MS 2530-4-3:2022 – MSPO Part 4-3: General Principles for Dealers including Supply Chain Requirements

Part 4-3 contains requirements used to assess conformity for fresh fruit bunch dealers and palm oil traders against the MSPO. The category includes all types of dealers under MPOB licensing, including exporters and importers that purchase and sell oil palm products without changing the chemical properties of the materials. This standard contains requirements for sustainable management, as well as supply chain requirements.

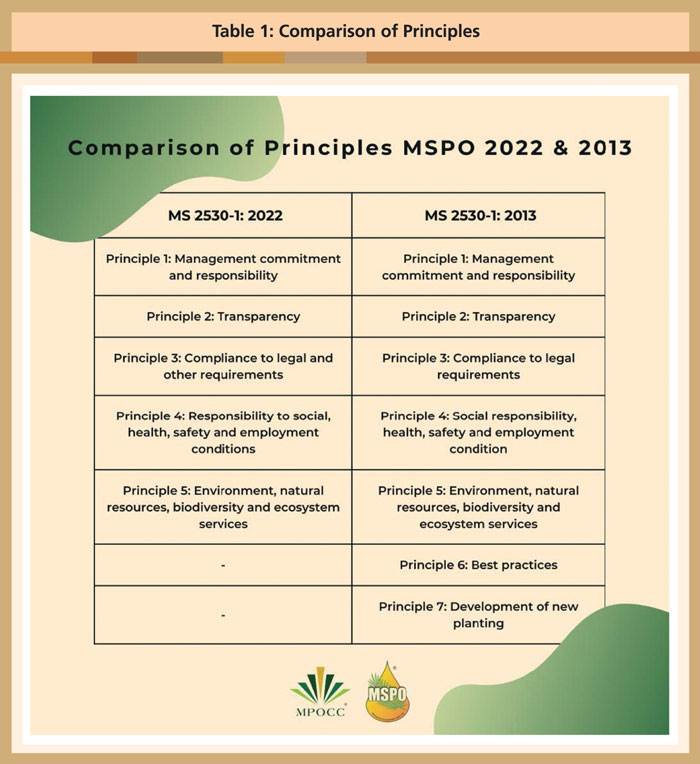

The new framework for MSPO Standards has only five principles compared to the previous version of seven principles (Table 1). This was decided by the Technical Committee on MSPO to further streamline the requirements to be consistent with the overall flow.

Principles 1-5 are very similar between the MS 2530:2013 and the MS 2530:2022 standards. Principle 6 of MSPO 2013 has been amalgamated into Principles 1, 2, 4 and 5. The requirements for new plantings have been strengthened and incorporated mainly into Principle 1, with supporting requirements appearing in Principle 4 and Principle 5.

Cheah Chi Ern

Systems Management Manager

Malaysian Palm Oil Certification Council

By gofb-adm on Saturday, August 20th, 2022 in Issue 2 - 2022, Sustainability No Comments

The MS 2530:2013 series of standards under the Malaysian Sustainable Palm Oil (MSPO) scheme has driven sustainability initiatives since implementation began in 2013. This has contributed to the transformation of the Malaysian industry in producing sustainable palm oil. The amount of human and financial investment in industry development has been massive, especially in ensuring continuous compliance by users of the standard. The impact has been extensive on both business standards and national policies on the commodity.

However, the Malaysian Palm Oil Certification Council (MPOCC) understands the need to further address market destination requirements, business and consumer needs, as well as the trajectory of certified sustainable palm oil. The MSPO 2022 version (MS 2530:2022 series of standards) – derived through a credible consultative process – will address all those concerns. The revisions have been based on international practices and are in accordance with the Standard Setting Process of the Department of Standards Malaysia (Standards Malaysia).

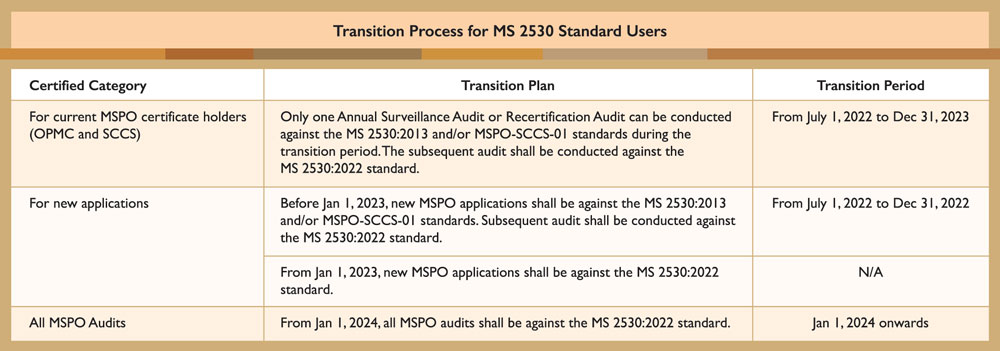

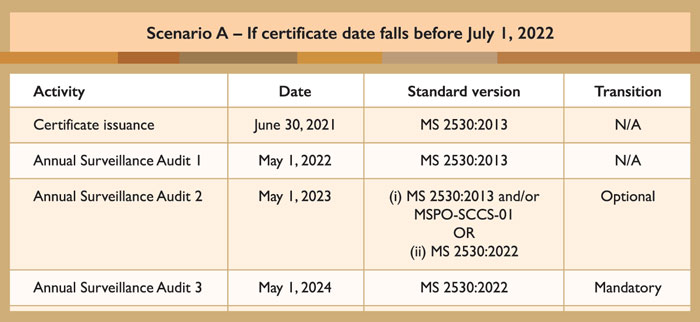

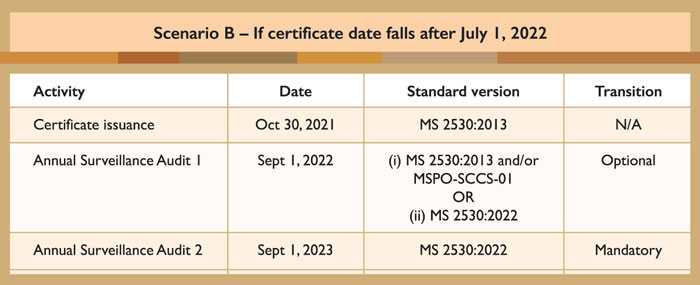

The MS 2530:2022 standard series were launched on March 22, 2022, following approval by the Ministry of International Trade and Industry on Jan 27, 2022. It will replace the MS 2530:2013 series and the Supply Chain Certification Standard (MSPO-SCCS-01).

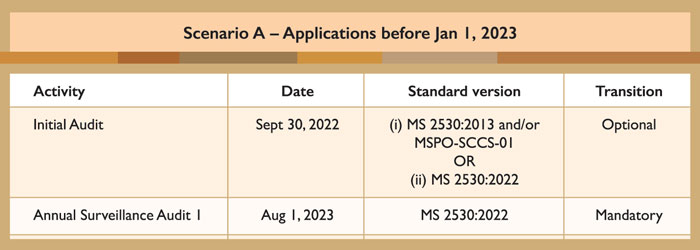

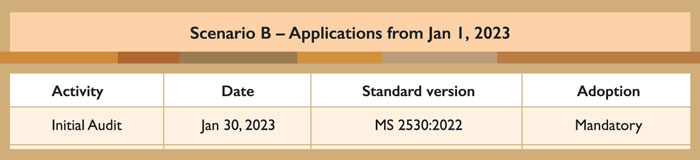

A systematic approach is now required to enable smooth implementation, taking into account new actors within the palm oil value chain, and additional needs in meeting environment, social and governance issues. For this, a feasible transition roadmap has been established. The English Language version will be applied over 18 months from July 1, 2022 to Dec 31, 2023. All audits from Jan 1, 2024 will be carried out against the MS 2530:2022 standard.

Accredited Certification Bodies

All accredited certification bodies (ACBs) are required to adhere to the following:

Note: Only CBs accredited to that particular scope can conduct audits for these parts.

Certificate holders and new applications

Current certificate holders

New Applications

Malaysian Palm Oil Certification Council

By gofb-adm on Saturday, August 20th, 2022 in Issue 2 - 2022, Cover Story No Comments

When China’s Minister of Foreign Affairs, H.E. Wang Yi, paid an official visit to Malaysia in July 2022, he gave the assurance that his country would buy more palm oil. It was welcome news, given the significant drop in China’s imports over the first half (1H) of 2022.

Read more »