For the confectionery sector

September, 2019 in Issue 3 -2019, Markets

Russia’s main consumer of specialty fats is the confectionery industry. The sector ranks fourth in terms of food production domestically after baked goods, dairy products and fish. Since 2000, it has contributed more than 17 billion rubles to the budget annually. It also accounts for 10% of jobs across the food industry and 8% of basic production assets.

The federation ranks fourth in the global production of confectionery, after the US, Germany and the UK. Domestic consumption of confectionery products stands at about 3.5 kg per year per capita. Every year, citizens consume about 770,000 tonnes of flour confectionery products, 500,000 tonnes of caramel and 325,000 tonnes of chocolate.

Currently, about 1,500 specialised and other food enterprises produce confectionery in Russia. More than a third of the total annual capacity of 3 million tonnes is concentrated at the 25 largest enterprises. The largest share of the market is occupied by flour confectionery products (55%), chocolates (32%) and the sugar group (13%).

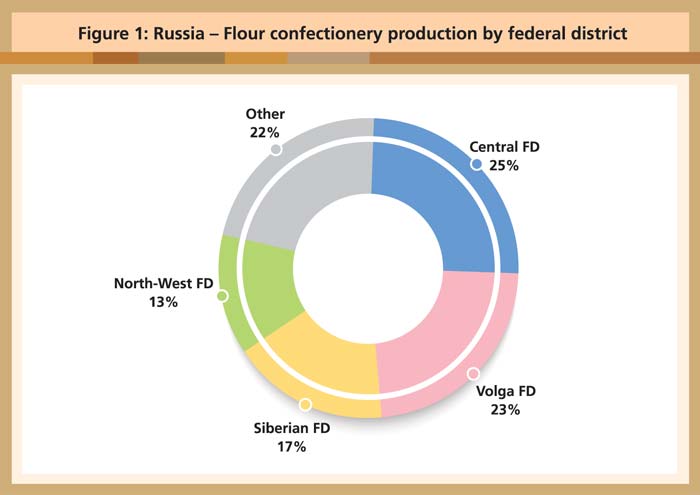

The industry leaders are Concern Babayevsky, OJSC Moscow Confectionery Factory Krasny Octyabr and the Confectionery Factory Rot Front. Foreign manufacturers like Craft Foods, Nestle, Mars and Cadbury contribute slightly more than 12% of the volume produced. The Central Federal District (FD), Volga FD, Siberian FD and North-West FD lead in the output of flour confectionery products (Figure 1).

Source: Federal State Statistic Service

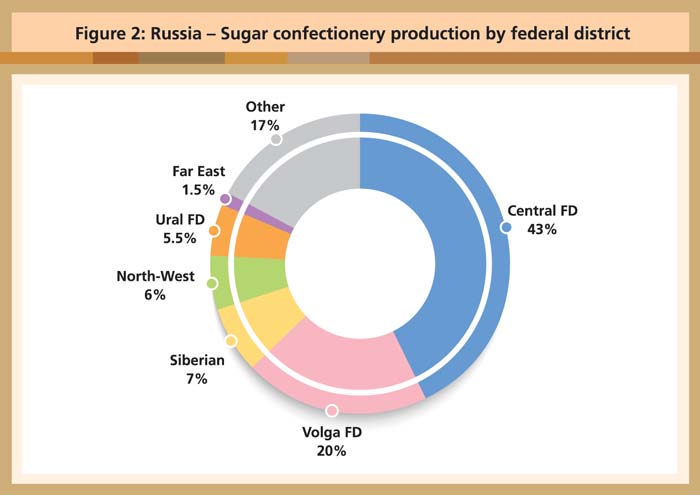

Sugar confectionery products are mainly represented by caramel, lollipops and chocolate. The market is dominated by domestic producers. The share of imports is a little over 20%. The market for domestic chocolate products is saturated and highly competitive, with the average annual growth in production standing at about 5%. The Central FD is the leading producer of sugar confectionery products, accounting for 43% of the domestic volume (Figure 2).

Source: Federal State Statistic Service

Use of specialty fats

Russia is a big producer of specialty fats for the food industry. Although the volume of imports is relatively small, there is potential for higher intake of some specialty fats for the confectionery industry. Two groups of imports – HS 1516 and HS 1517 – are commonly used in this sector.

HS 151620, which represents 99% by value of the HS 1516 group in Russia, comprises vegetable fats and oils and their fractions, partly or wholly hydrogenated, inter-esterified, re-esterified or elaidinised, whether or not refined, but not further prepared.

HS 151790 represents 94% by value of the HS 1517 group in Russia. This comprises margarine, other edible mixtures or preparations of animal or vegetable fats or oils and edible fractions of different fats or oils (excluding fats, oils and their fractions, partly or wholly hydrogenated, inter-esterified, re-esterified or elaidinised, whether or not refined, but not further prepared, and mixtures of olive oils and their fractions).

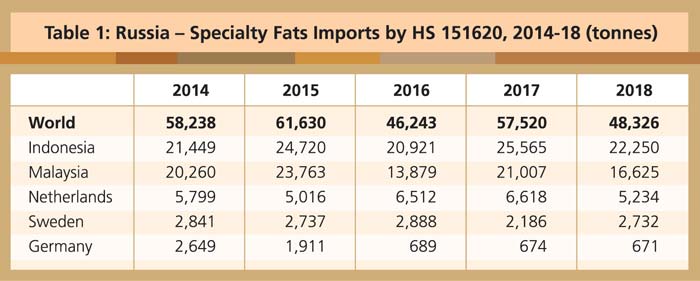

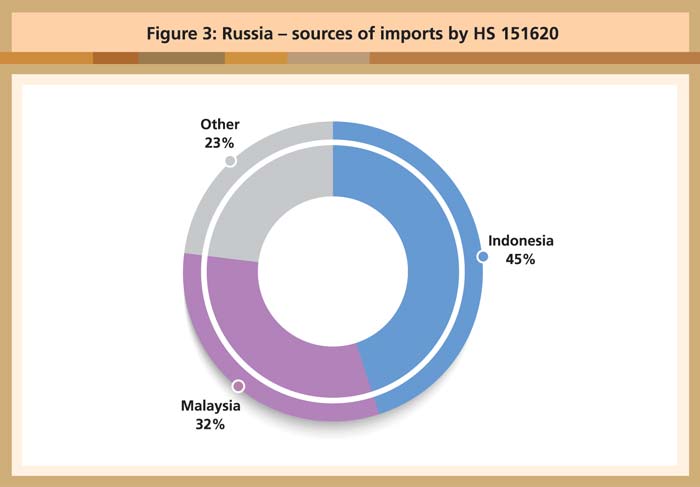

Russian imports by HS 151620 – 48,326 tonnes in 2018 (Table 1) – represent 2.6% of the global trade in these products, with the federation ranked 11th in the world. Its imports by HS 151790 – 49,103 tonnes in 2018 – represent 1.7% of the global trade in these products and it is ranked 13th worldwide. The market value of the two groups was US$171 million in 2018.

Source: Federal Customs Service of Russia

Supplies from Indonesia and Malaysia respectively make up 45% and 32% of the market share for Russian imports by HS 151620 (Figure 3). Other major sources of origin are the Netherlands, Sweden and Germany.

Source: Federal Customs Service of Russia

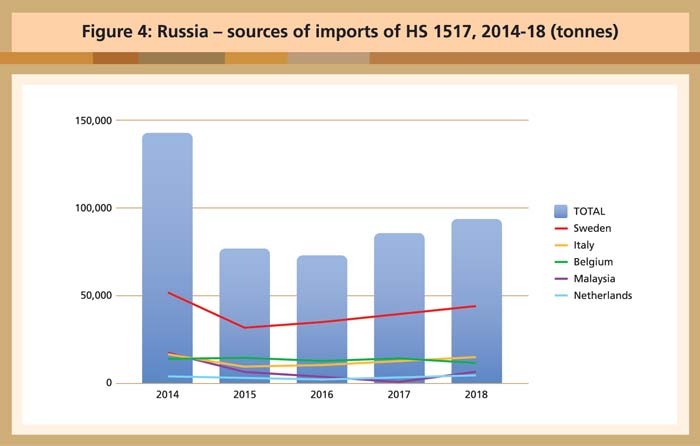

Russia’s imports of specialty fats by HS 1517 are mainly from EU member-states. Sweden is the leading supplier, holding 46.8% the market share (Figure 4), followed by Italy (16%). Malaysia is ranked fourth (7%).

Source: Federal Customs Service of Russia

Malaysia is a leading exporter of affordable specialty fats by both groups. In 2018, it exported over 2.1 million tonnes of specialty fats by HS 151620 worldwide, and was one of the top five suppliers by HS 1517. Given this, there is much scope for Malaysia to compete for a larger share of the Russian confectionery market, recognised as one of the fastest growing in the world.

MPOC Moscow