Pakistan’s oleochemicals market is estimated at 164,640 tonnes per annum, consisting of 95,000 tonnes of local production (or 55% of the market share) and 74,640 tonnes of imports (45%) in 2018-19. The market is growing at about 10.5% per annum, aided by capacity enhancement and technological upgrading in the industry. Expansion of consumer sectors like soap, cosmetics, toothpaste, pharmaceuticals, specialty chemicals, food and paint has helped build demand for oleochemicals.

Oleochemicals can be segregated into six groups – fatty acids, esters of fatty acids, fatty alcohols, fatty amines, glycerols and soap noodles. These categories collectively contain more than 30 products in Pakistan (Table 1).

Soap noodles are the top local product, recording 65,435 tonnes a year or 40% of the market share. The soap industry relies chiefly on this raw ingredient, used mainly in making toilet soap. Of the domestic output of soap noodles, some 5,000 tonnes are exported, mainly to Afghanistan.

Palm acid oil (PAO), DFA/PFAD and Mixture of Palm Fatty Acids hold the largest share of the market (Figure 1). These are basic raw materials for common laundry soap (brown Nerol type); the soap sector is the sole consumer sector for these products. PKFAD has a mere 1% share of the market. It is used by the soap industry in combination with the other three products in laundry soap production.

DFA/PFAD is supplied via domestic production, as well as imports. The soap industry depends on imports of PAO and Mixture of Palm Fatty Acids. Current local production of DFA is limited, thereby providing opportunities for imports from Malaysia.

The market share of glycerols/glycerin is about 10%. This is a multipurpose raw material with applications in pharmaceuticals, specialty chemicals, food, soap, cosmetics, tobacco, paint and textile processing. The production of refined glycerin is a threat to imports. However, the high quality (purity, clearness and consistency) of glycerin from Malaysia and Indonesia makes imports the preferred choice for the quality-conscious pharmaceutical and food industries.

Annual availability of stearic acid is estimated at about 10,000 tonnes, making up 6% of the market. It is used in pharmaceuticals, specialty chemicals, cosmetics, aromatics, calcium carbonate grinding and polymers. Stearic acid imports are rising for use in the pharmaceutical and food sectors, to meet specific end-product requirements.

Lauric acid has an estimated volume of 6,540 tonnes, or about 4% of the market-share. The product is fully imported for use in specialty chemicals, soap and cosmetics.

Mixed scenario

The focus of local production is on basic oleochemicals like soap noodles (70,000 tonnes), DFA (10,000 tonnes), refined glycerin (8,000 tonnes) and stearic acid (7,000 tonnes). Production of other value-added fatty acids, esters, alcohols and amines is non-existent.

Over a dozen companies are engaged in the production of oleochemicals in Pakistan. They import RBD palm stearin and RBD palm kernel oil, mainly from Indonesia and Malaysia, to be processed into soap noodles and glycerin.

In line with the growing volume of imported RBD palm stearin and RBD palm kernel oil, oleochemicals production has averaged 13% per annum over the last five years – from about 60,000 tonnes in 2014-15 to 95,000 tonnes in 2018-19. There are indications that the output will rise by an annual average of 15% for the next three years, to register 145,000 tonnes by 2021-22.

Improved local output of some oleochemicals has affected imports. For example, soap noodles imports have been reduced to 435 tonnes (Table 2). Growth in glycerin imports has been almost zero for the last five years.

Pakistan imports about 75,000 tonnes of oleochemicals a year. PAO is the top product with a 39% share, while Mixture of Fatty Acids makes up 16%. Refined glycerin and PFAD hold 11% each, with lauric acid at 9% and stearic acid at 4%.

Malaysia dominates as the single largest supplier of oleochemicals with a 60% share of imports (Figure 2). The key products are soap noodles (100% share), fatty alcohols (73%), fatty acids (63%), fatty acid esters (43%) and glycerols (33%).

Indonesia holds a 20% share of imports, contributing only in two groups – glycerol (48% share), and fatty acids (18%). Other suppliers are from Thailand, Saudi Arabia, the Philippines, Sri Lanka and the UAE.

Historical data hints at an average import growth rate of 8% per annum over the last five years – from 54,000 tonnes in 2014-15 to 74,640 tonnes in 2018-19. But this is expected to slow to 6% annually over the next three years, to 89,000 tonnes by 2021-22. One reason lies in the improved domestic production of oleochemicals, in particular DFA, stearic acid, glycerin and soap noodles. Another factor is that the government is discouraging imports by increasing tariffs, valuation ruling, documentation and controls on under-invoicing.

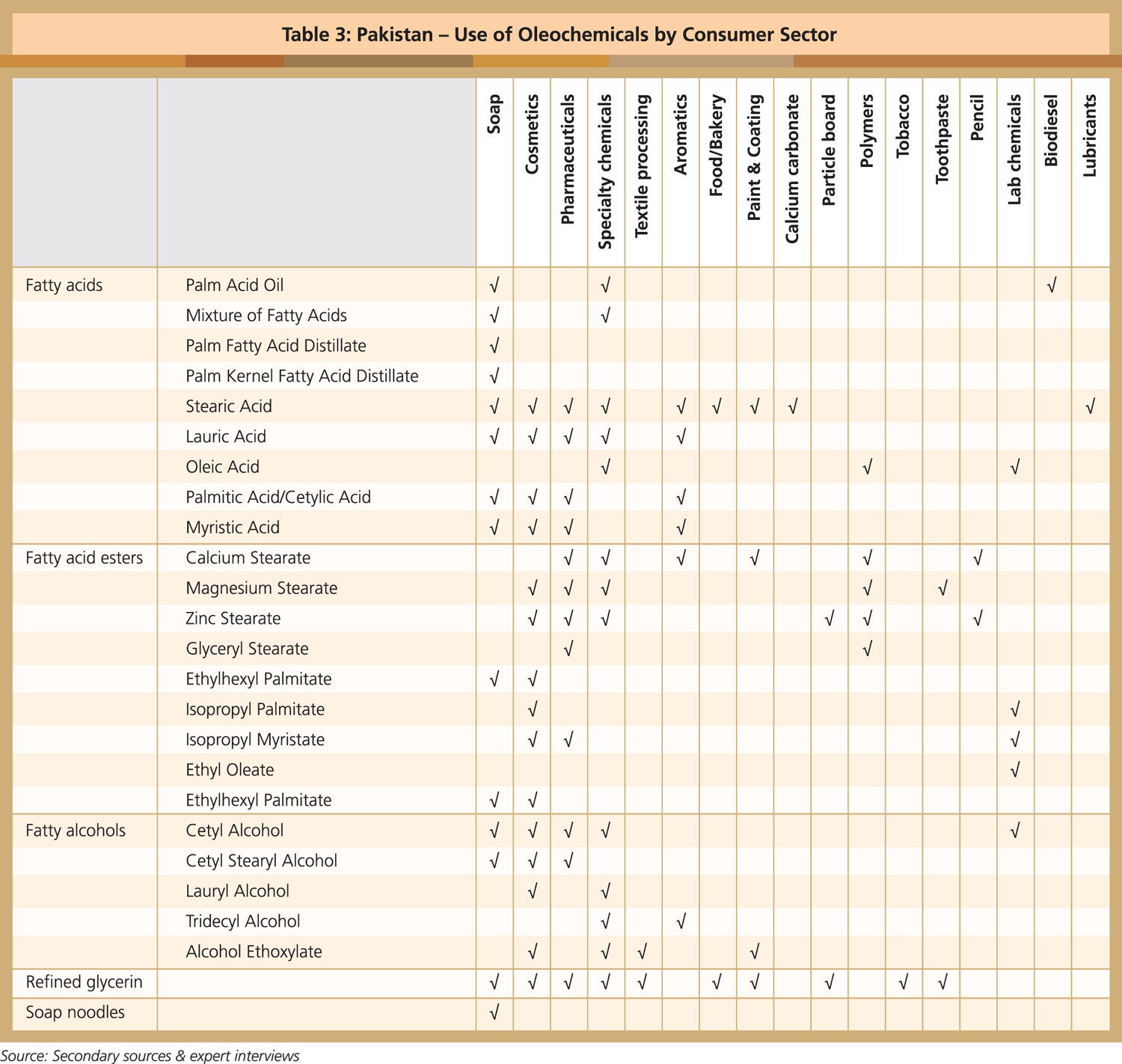

Oleochemicals are used in more than 20 consumer sectors in Pakistan (Table 3).

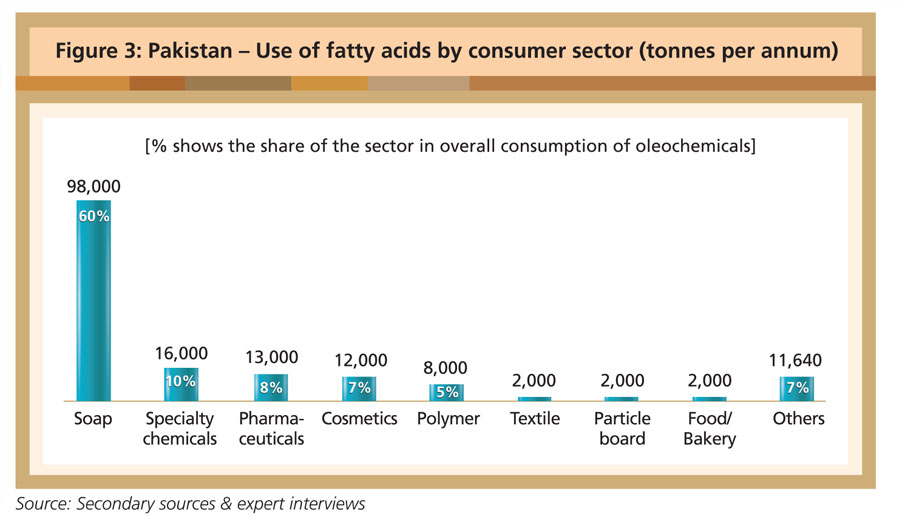

Of the user sectors, the soap industry dominates with a 60% share (Figure 3), while specialty chemicals, pharmaceuticals, cosmetics and polymer hold a share of 10%, 8%, 7% and 5% respectively.

Pakistan’s oleochemicals consumption is projected to register consistent growth over the next few years. The incremental market will be captured mainly by local manufacturers.

However, imports of advanced oleochemicals – by sectors like cosmetics, pharmaceuticals and textiles – will increase gradually. These products include refined glycerin, PFAD, PAO, lauric acid, stearic acid, alcohol ethoxylate, zinc stearate and PKFAD. By building on its comparative and competitive advantages, Malaysia is well-positioned to gain from the trade opportunities ahead.

MPOC Pakistan