The outbreak of the coronavirus pandemic (Covid-19) at the beginning of 2020 had pushed China’s first-quarter GDP into its first decline in decades, contracting 6.8% year-on-year. However, the economy recovered from the second quarter, ending the year with a 2.3% year-on-year growth.

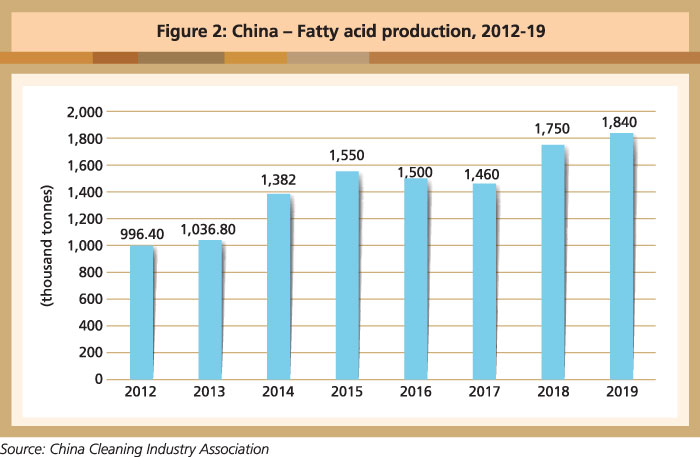

This bodes well for China’s oleochemicals industry which was affected by supply chain disruptions, price fluctuations of raw materials and lower profitability in 2020. The output of major oleochemicals – fatty acid, fatty alcohol, fatty amine and glycerin – amounted to 2.5 million tonnes in 2019. Fatty acid accounted for 72.7% of the total production volume in 2020, followed by fatty alcohol (11.6%), glycerin (10.2%) and fatty amine (5.6%).

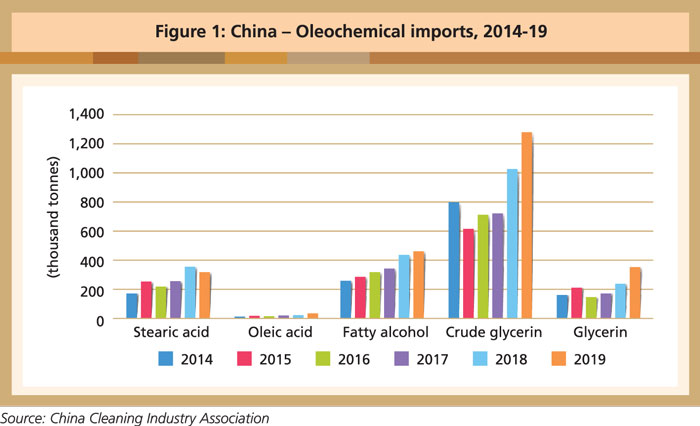

To meet rising demand, China imported 454,600 tonnes of fatty alcohol, 354,080 tonnes of fatty acid and 352,200 tonnes of glycerin in 2019. Favourable tax treatment for oleochemicals from ASEAN countries also encouraged imports (Figure 1).

Fatty acid production recorded 1.8 million tonnes in 2019 (Figure 2), to which stearic acid contributed about 1 million tonnes with 276,500 tonnes of soap noodles and 300,000 tonnes of oleic acid being produced. China imported 319,000 tonnes of stearic acid in 2019, with Indonesia (260,000 tonnes) and Malaysia (57,000 tonnes) being the major suppliers. Oleic acid imports rose to 35,000 tonnes, or by 45%, to meet demand at a time when domestic production was flat.

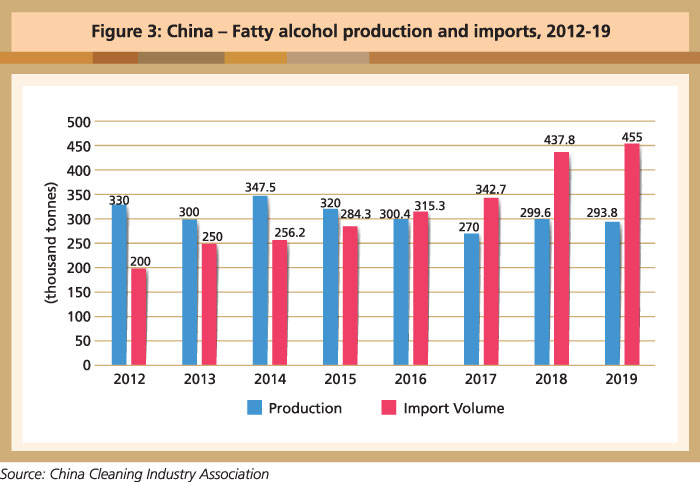

Fatty alcohol production was led by six domestic suppliers. However, capacity fell from 685,000 tonnes in 2015 to 655,000 tonnes in 2019. Output fell to 293,800 tonnes (by 1.9%) in 2019, from 299,600 tonnes in 2018. Against this scenario, demand went up steadily from 520,000 tonnes in 2015 to 650,000 tonnes in 2019.

Falling local production and rising demand led to a surge in imports (Figure 3). In 2019, China’s fatty alcohol imports stood at 455,000 tonnes, or 17,200 tonnes (3.9%) more than in 2018 (Figure 3). Indonesia (70%), Malaysia (25%), Thailand (4%), the Philippines and India were the main suppliers.

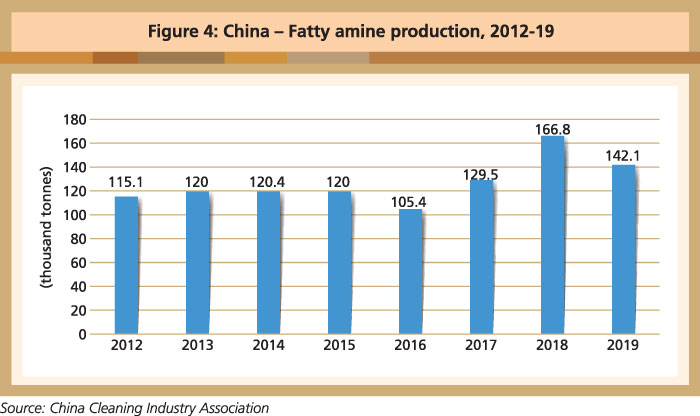

The China Cleaning Industry Association (CCIA) reported that 142,100 tonnes of fatty amine were produced in 2019 (Figure 4). Of this, primary fatty amine accounted for 49,400 tonnes (34.8%).

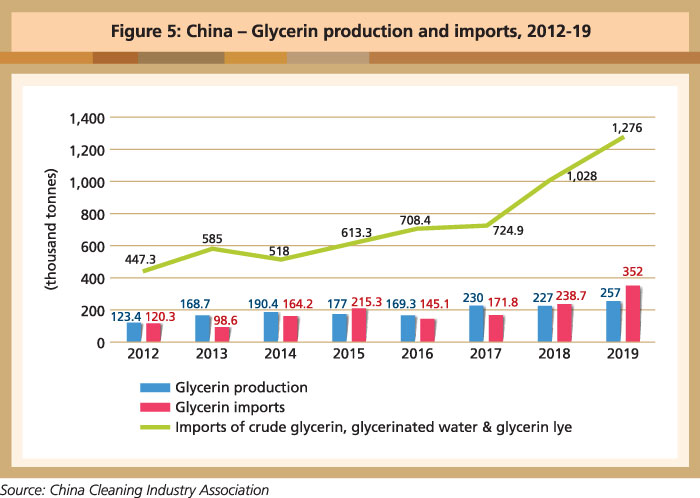

Domestic glycerin output for industrial and medical use and for special oils and fats registered 257,300 tonnes in 2019 (Figure 5), up by 13.6% against 2018. Imports reached 352,200 tonnes in 2019, or higher by 47.5%. Crude glycerin, glycerinated water and glycerin lye imports amounted to 1.3 million tonnes, up by 24% over the same period. Crude glycerin from Indonesia, Brazil, Argentina and Malaysia made up 74% of this.

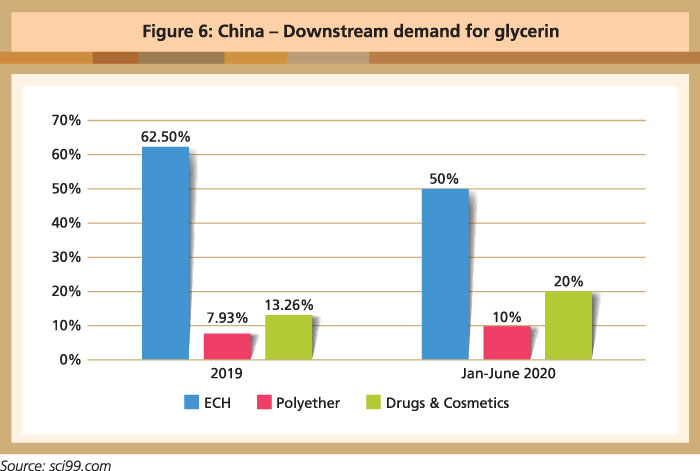

Three downstream sectors – Epichlorohydrin (ECH, at 62.5%), polyether (7.9%) and drugs and cosmetics (13.3%) – absorbed more than 80% of the glycerin volume in 2019. In the first six months of 2020, these sectors respectively accounted for 50%, 10% and 20% of glycerin demand (Figure 6).

In relation to the oleochemicals sector, China imported 11.5 million tonnes of edible oils and 1.2 million tonnes of oils for industrial non-food use in 2019. According to the China National Grain & Oils Information Centre, vegetable oil consumption is expected to decline by 810,000 tonnes in 2019/20 for the first time in recent years, due to the impact of Covid-19.

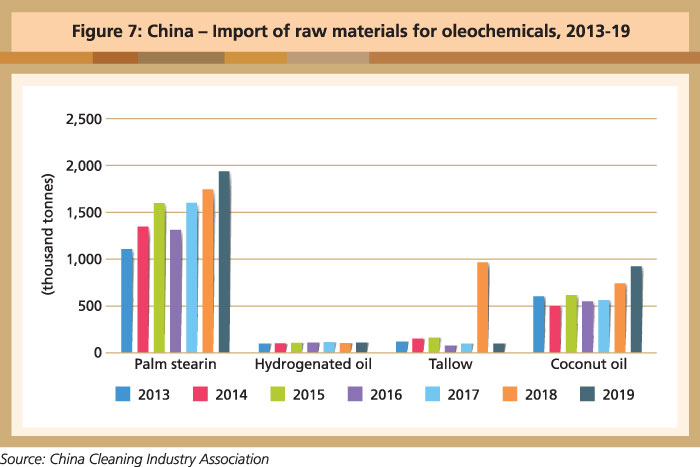

Demand is projected to fall by 180,000 tonnes for direct edible oils, and by 630,000 tonnes for non-food industry use. Imports of palm stearin, palm kernel oil and coconut oil experienced growth in 2019, compared to 2018 (Figure 7). Palm kernel oil saw the largest increase of 24.9% among the raw materials for oleochemicals, due to stable output in Indonesia and Malaysia.

Price trends

Stearic acid

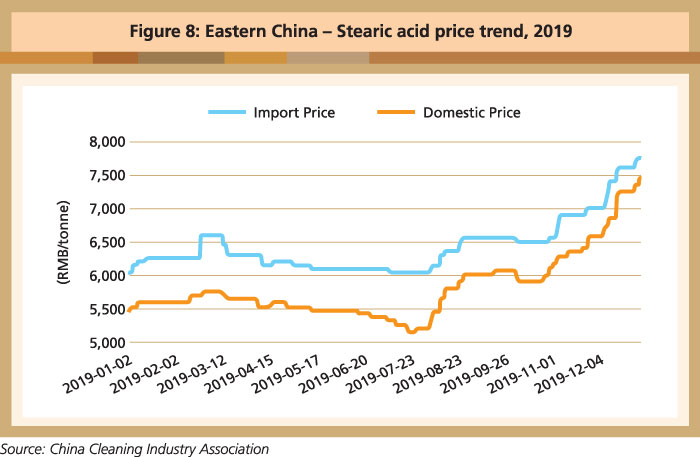

In eastern China, the price of imported stearic acid peaked at RMB7,750/tonne over the course of 2019. The highest price for domestic first-grade stearic acid price was RMB7,500/tonne (Figure 8).

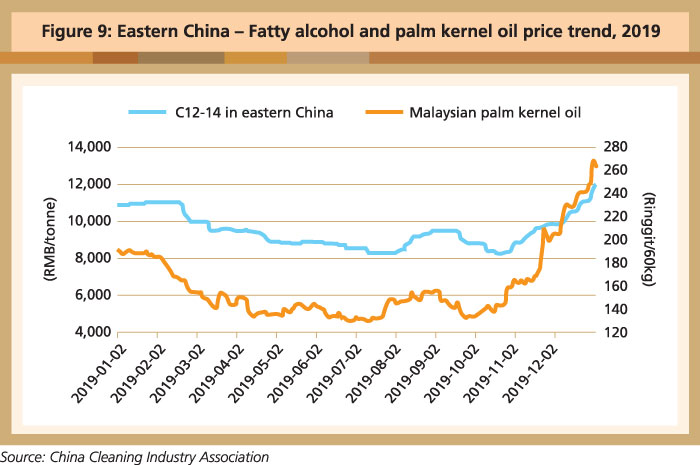

Fatty alcohol

The C12-14 fatty alcohol price trend mirrored that of its raw material – palm kernel oil – in 2019 (Figure 9). The fatty alcohol price fell from March and bottomed out at RMB8,200/tonne in July. Subsequently, the traditional peak season for detergent and cosmetics production supported the price from August. It went up to RMB12,000/tonne in eastern China by the end of 2019.

Fatty amine

The price of fatty amine trended downwards in 2019. Dodecyl tertiary amine and tetradecyl amine stood at RMB19,000/tonne at the beginning of 2019, falling by 24% to RMB14,500/tonne at the end of July. Over the next four months, the price stabilised at RMB14,000/tonne, and then went up to RMB15,000/tonne by the end of 2019.

The average price of dodecyl tertiary amine and tetradecyl amine was RMB15,300/tonne in 2019, down by 26.4% against 2018 – it was the largest decline in recent years. The price of fatty primary amine was about RMB14,000/tonne for the first seven months. It fell to RMB13,500/tonne in August and rebounded to RMB14,650/tonne at the end of 2019.

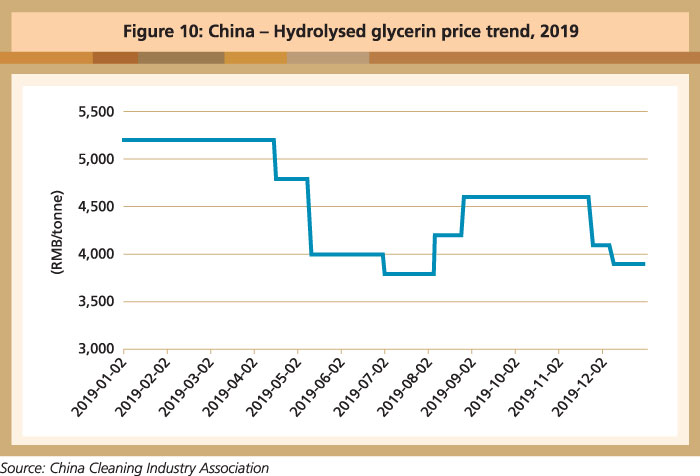

Glycerin

Crude glycerin and refined glycerin are the two main products in this category. Crude glycerin, as a by-product of fatty acid, contributes an annual output of 300,000 tonnes in China. The supply of refined glycerin is almost entirely dependent on imports, and is refined from crude glycerin.

The price of refined glycerin registered RMB3,400/tonne in eastern China by the end of 2019, down by 15% from the beginning of the year. The price fell to its lowest at RMB2,900/tonne from the end of June and into the middle of July. The highest price of RMB4,150/tonne was recorded in January and February.

The price of 99.5% hydrolysed glycerin decreased 26% from RMB5,200/tonne at the beginning of 2019 to RMB3,900/tonne at the end of the year (Figure 10).

Outlook for China’s oleochemicals industry

Covid-19 lockdowns have generally had a serious impact on the global economy. While China has reported a better- than-expected performance since the second quarter of 2020, some uncertainties remain in its oleochemicals industry. Development of the sector will depend on both the internal and external environment, encompassing policy implementation, downstream demand, imports and effective control of the pandemic.

The implementation of biodiesel mandates in Southeast Asia and South America will have an impact on China’s glycerin output. The price of palm oil will influence the progress of biodiesel programmes in Southeast Asia, as well as the import and export of glycerin products. The palm oil market itself will be affected by the weather and any natural disasters.

China has raised its imports of refined glycerin, mainly from South America, despite oversupply in the domestic market. Imports increased by 29% to 177,080 tonnes over the first five months of 2020, compared to 136,930 tonnes in 2019. This has squeezed the domestic refined glycerin market and put pressure on the overall glycerin price.

The ECH, daily chemical and paint sectors are major downstream consumers of glycerin in China. The newly-enlarged capacity in domestic glycerin production will largely be absorbed by the ECH sector, thanks to its good profit margin and because it is environment-friendly. The annual production capacity of ECH will stay at 600,000 tonnes.

There is increasing demand for alcohol-based hand sanitisers to control the spread of Covid-19, thereby enhancing demand for glycerin as well. Meanwhile, glycerin consumption in the paint sector is likely to decline due to reduced construction of buildings during the pandemic.

The fatty alcohol sector will be affected by the macro-economic situation, palm oil market and downstream demand, but there is room for optimism with the return to economic growth in China.

Fatty alcohol use is split between higher alcohols, medium alcohols and lower alcohols. Demand for higher alcohols is limited as it is mainly applied in textiles, creams and lotions, all of which have taken a big hit from the pandemic. There is weak demand for lower alcohols as well. However, the downstream sectors of medium alcohols are the cleaning industry and tertiary amine sector, which contribute significantly to controlling the spread of Covid-19.

Desmond Ng

Regional Manager

MPOC China