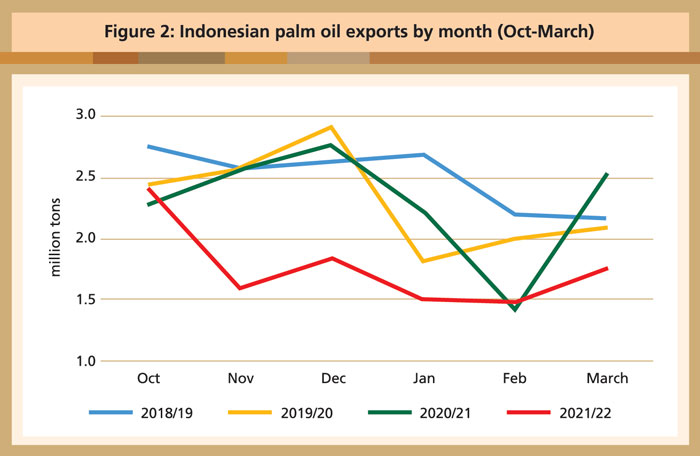

In marketing year 2021/22 (October to September), Indonesian palm oil exports were lower by 3 million tons [as at May 2022], down to a 12-year low of 25 million tons. The forecast is reduced on Indonesia’s slow export pace through the first six months of MY 2021/22 and various palm oil export policies in effect since November 2021. Although the government of Indonesia implemented a palm oil export ban on April 28, 2022, industry sources expect it to be short-lived and therefore have a limited impact on trade.

Cumulative shipments from October 2021 to March 2022 declined over 30% compared to the same period in MY 2020/21. Exports plunged after export taxes increased in November 2021. This reduced pace is expected to continue into May as Indonesia continues its restrictive export policies.

A stronger export pace is anticipated for the remainder of the marketing year. The current slow pace of exports is leading to a build-up of supplies that will need to be cleared from storage facilities to accommodate future production.

Market features

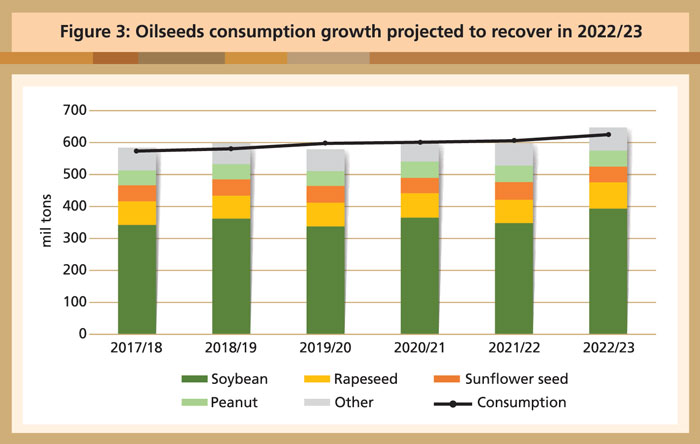

Global oilseed production is forecast to grow 8% in 2022/23, primarily on growth in soybean output in South America and the US, as well as rapeseed production in Canada and the European Union (EU), more than offsetting loses of sunflower seed output in Ukraine and Russia.

Global oilseed production is projected to reach 647 million tons, with soybean production forecast to rise 45 million tons to nearly 395 million, up 13%.

Global oilseed consumption is forecast to rise 3% in 2022/23, driven by higher China soybean demand as a result of a recovery from a decline seen in the last marketing year. Soybean crush and consumption are projected to account for most of the growth in global oilseed use. Sunflower seed consumption is projected down 3%, while rapeseed consumption is up 7%.

Global oilseed trade is forecast higher mostly on higher soybean demand from China. Trade in soybean, rapeseed, sunflower seed and peanuts is expected to rise, while cotton seed exports are forecast lower.

Global ending stocks are projected to rise on growing soybean production and stocks in South America and the US.

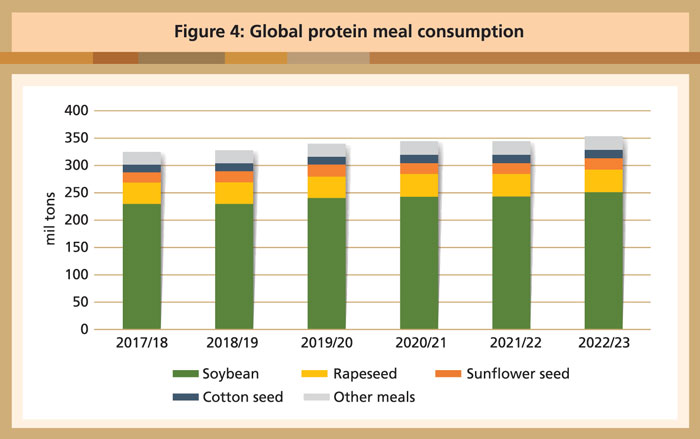

Global oilseed meal production is forecast to grow in 2022/23, led by soybean and rapeseed meal. Global consumption is expected to climb, mostly on robust demand from China. Trade in protein meal is expected to grow with higher soybean meal and rapeseed meal imports.

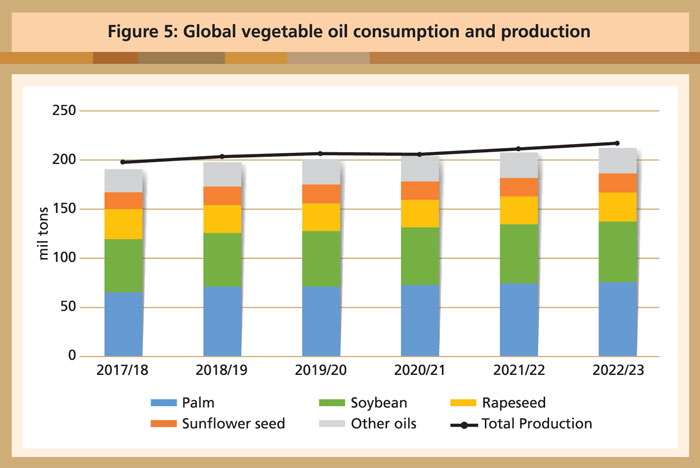

Global vegetable oil production is expected to grow by 3%, with major gains for soybean, rapeseed and palm oil, more than offsetting losses for sunflower seed and olive oil. Global consumption is forecast to expand by nearly 4.6 million tons (2%), primarily driven by palm and soybean oil growth in China.

Global vegetable oil trade will strengthen in 2022/23, owing to strong recovery in palm oil and rapeseed oil import growth. Global vegetable oil ending stocks are projected to grow by 4% to over 28 million tons.

2022/23 commodities outlook

Soybean

Global soybean production in 2022/23 is forecast at a record 394.7 million tons, up 13% from 2021/22. Likewise, soybean production in Brazil and the US is forecast at a record, continuing the trend of higher-concentrated production in exporting countries. If realised, year-over-year soybean production will expand by the largest amount in over a decade, predominantly on higher yields in South America following this year’s drought.

Brazil, Argentina and Paraguay account for more than 85% of production gains on both expanded planted area and higher yields. Soybean planted acres in Brazil are expected to grow for the 17th consecutive year, as high prices and a favourable exchange rate enhance producer returns despite high fertiliser prices. Plantings in the US are currently forecast to be a record as some farmers displace corn plantings due to high input costs.

Driven by expanding production, global soybean supplies will likely reach record levels. Export demand will continue to be led by China, which is projected to account for more than 50% of global trade growth while rebounding from this year’s slowing imports.

Export growth is forecast to outpace crush in the top three exporter countries in 2022/23 for the first time in three years on larger supplies and demand from China. Ample supplies are expected in exporter countries in 2022/23 and are responsible for the stronger growth in disappearance. Soybean stocks in the top three exporter countries on Sept 30, 2023 are expected to rise by 30% versus the previous year but remain well below the five-year average. China ending stocks are expected to grow much more modestly but remain at record levels.

Global soybean meal consumption is projected to rise 3% in 2022/23, a recovery from the slight downtick forecast for this year. China is expected to account for half of global consumption growth after a year of weaker soybean meal consumption. Exports are set to rise in line with consumption on a rebound in South America crush following improved soybean production prospects and higher US supplies.

Argentina’s share of global trade is projected to fall in 2022/23, while Paraguay, China and the US are forecast to see the largest growth in exports. Meal exports from Brazil and the US are forecast well above the five-year average as production gains are forecast to outpace domestic demand growth.

Soybean oil consumption is projected to rise 2%, mostly on the strength of China food use demand and higher US renewable diesel production. Global exports are forecast to rise 4% in 2022/23 with total global volume projected at a record 12.7 million tons.

Export growth is likely to be driven by South America on production gains outpacing domestic consumption growth and reduced competition from the US due to high domestic industrial usage. Remaining export growth is likely to come from European countries to offset reduced sunflower seed oil trade in the region due to the conflict in Ukraine.

Highlights

US soybean exports are projected to rise 1.6 million tons to 59.9 million tons on larger supplies and expected reduced export competition from Brazil at the start of the US harvest.Soybean supplies in 2022/23 are up on both higher carry-in and a larger crop, driven primarily by increased plantings. Soybean crush is forecast to rise at a slower pace than the previous year. Soybean meal exports are forecast to be a record, but strong domestic demand for soybean oil for renewable biodiesel will tighten exportable supplies and boost prices.

Argentina soybean production is projected to rise to 51 million tons on better weather and increased plantings. Trade is expected to recover from the current year with exports, mostly to China, at 4.7 million tons and imports, primarily from Paraguay, at 4.8 million. Strong demand for products and larger supplies will boost crush; however, increased competition from Paraguay, Brazil and the US will dampen meal and oil export growth. Soybean meal exports are forecast to rebound to 28.5 million tons, and soybean oil is projected to rise to 5.9 million tons.

Brazil soybean production is forecast to rise 24 million tons to 149 million tons on expected higher yields due to more favourable weather coupled with expanded planting in 2022/23.This will be the 17th straight year of expanded soybean plantings driven by strong export demand and excellent grower returns. Exports are projected to rise to 88.5 million tons, 5.8 million tons above the 2021/22 forecast. Crush is forecast to rise 1.3 million tons driven by strong crush margins and growing domestic meal and oil demand, leaving exports of soybean meal marginally higher and oil flat.

Rapeseed

Global rapeseed supplies in 2022/23 are projected to rise 10% to a record 100.5 million tons as production in Canada recovers from last year’s devastating drought. Both global harvested area and production are projected to be records. Reduced carryover, the smallest in nearly 20 years, will necessitate some stock-building in the coming year and provide a measure of price support.

Exports are projected to rise significantly above this year’s current forecast but will fall short of the 2020/21 record volume as stock building and strong crush recovery in Canada restrict exportable supplies. Global rapeseed crush is forecast to reach a record 75.1 million tons.

Global rapeseed meal production is forecast up 7% to a record in 2022/23. Canada leads the way in production growth as seed supplies rebound. Larger seed supplies in the EU and China, driven by larger production and seed imports, will facilitate crush and meal production growth in the coming year. Global rapeseed meal trade is projected to rise nearly 1 million tons as importers push purchases to near 2020/21 levels. Much of this is driven by increased exports from Canada. Higher meal production and increased trade will support record global consumption.

Record global crush will also push rapeseed oil production to a record 30.7 million tons in 2022/23. The same dynamics driving rapeseed meal trade and consumption are also in play in the oil market. Global rapeseed oil supplies are expected to remain tight with rising consumption and tight supplies of other oils. Consumption is projected to rise 1 million tons, reaching a record 30.2 million tons. Food oil use accounts for most of the growth with industrial use, primarily in biofuels, expected to grow slowly. Global rapeseed oil stocks will improve over this year’s low but will likely remain well below the 10-year average stock level.

Sunflower seed

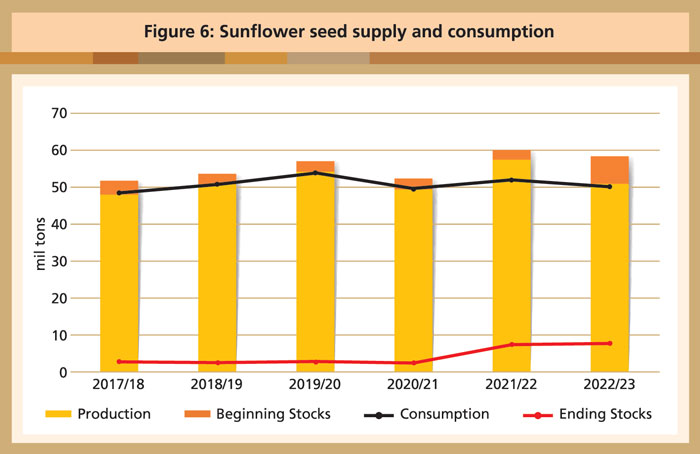

Global sunflower seed production in 2022/23 is forecast at 50.7 million tons, 12% lower than last year’s record crop. The largest declines are expected in Ukraine, Russia and Moldova, driven by smaller harvested area. Production growth is projected for Argentina, the US, Serbia, Turkey and the EU; however, total gains will not offset total losses.

Global sunflower seed consumption in 2022/23 is forecast to decline only 3% to 50.1 million tons as record carry-in stocks are likely to keep crush demand strong. Sunflower seed trade is projected higher with export growth at 44%, driven by Ukraine, Russia, Kazakhstan and Argentina. Imports are forecast to increase for the EU, China, Turkey and Uzbekistan.

Global sunflower seed meal trade is forecast to decline 1%, with lower exports from Ukraine and Russia more than offsetting larger shipments from the EU and Argentina. Meal imports are projected to decline in the EU and China.

Global sunflower seed oil demand is forecast at 18.1 million tons, almost unchanged from the previous marketing year. Strong demand for sunflower seed oil is projected to drive trade higher with imports growing 2% to 9.1 million tons. The higher import demand is mostly driven by the EU and Iran, followed by ongoing strong demand in China, India and Turkey. With declining crush by major producers coupled with growing global oil demand, sunflower seed oil stocks are projected to fall 16% to a two-year low at 2 million tons.

Palm oil

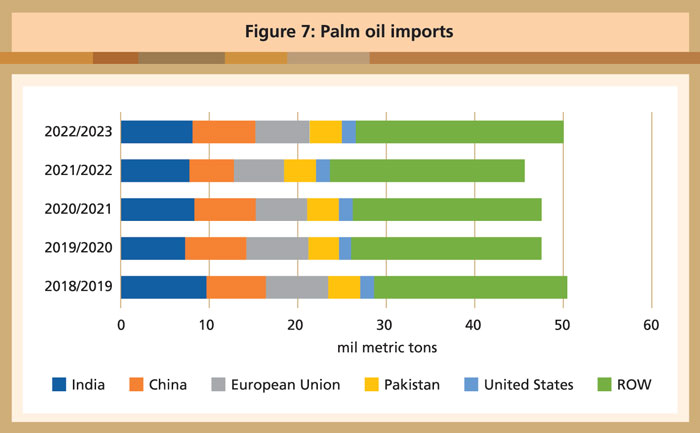

Global palm oil production in 2022/23 is forecast to rise as favourable weather patterns return to Southeast Asia. Additionally, Malaysia is expected to resolve labour shortages caused by the Covid-19 pandemic. Palm oil remains the largest vegetable oil consumed for food and industrial use. Rising output and increased demand boost global palm oil trade. Higher demand is expected in major markets including the EU, China and India as well other countries. Ending stocks are up as production outpaces consumption.

Highlights

Source: US Department of Agriculture

Foreign Agricultural Service, May 2022

These excerpts are from a report which is available at: https://apps.fas.usda.gov/psdonline/circulars/oilseeds.pdf