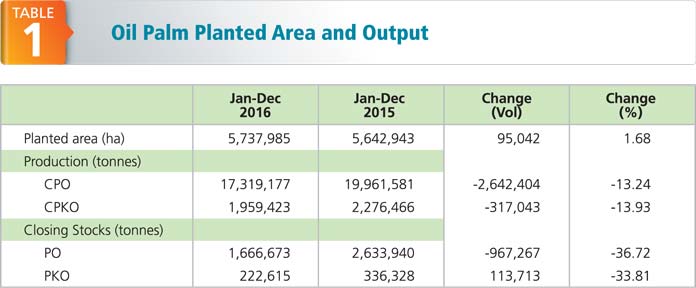

Malaysia’s oil palm acreage grew to 5.7 million ha in 2016, marginally up by 1.7% compared to 5.6 million ha a year earlier (Table 1). Severe drought induced by the El Nino phenomenon in the second and third quarter of the year severely impacted palm oil production.

Source: MPOB – data as at February 28, 2017; subject to revision

As a result, crude palm oil (CPO) production was down by more than 2.6 million tonnes (13.2%) compared to 2015. Weather conditions improved in the second half of the year, but did not help make up the production losses sustained in earlier months. Crude palm kernel oil production was not spared either by the impact of El Nino, with output falling by 317,043 tonnes (13.9%).

Although there was some recovery in palm oil production over the last four months of the year, most plantations reported tree stress. This reduced overall output despite the increase in planted area. Palm oil ending stocks were recorded at 1.7 million tonnes compared to 2.6 million tonnes in 2015, down by 36.7%. Palm kernel oil stocks fell to 222,615 tonnes (by 33.8%) against 336,328 tonnes a year earlier.

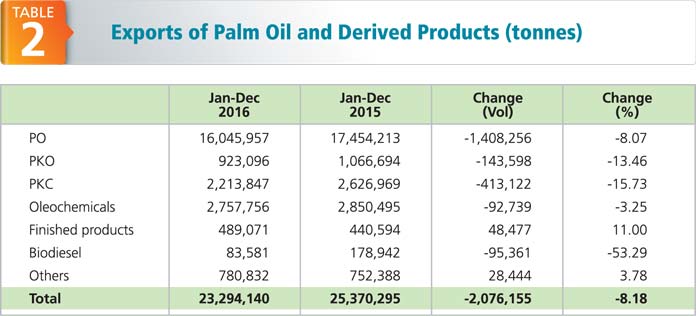

The production shortfall led to slightly lower exports of palm oil and derived products. At 23.3 million tonnes (Table 2), this was a drop of 2.1 million tonnes (8.2%). Reduced volumes were registered in exports of almost all categories of palm-based products. Palm oil fell by 1.4 million tonnes (8.1%); palm kernel oil by 143,598 tonnes (13.5%); palm kernel cake by 413,122 tonnes (15.7%); and biodiesel by 95,361 tonnes (53.3%).

Source: MPOB – data as at February 28, 2017; subject to revision

However, the export volume of finished products rose by 48,477 tonnes (11%), while other products accounted for an additional 28,444 tonnes (3.8%) during the year.

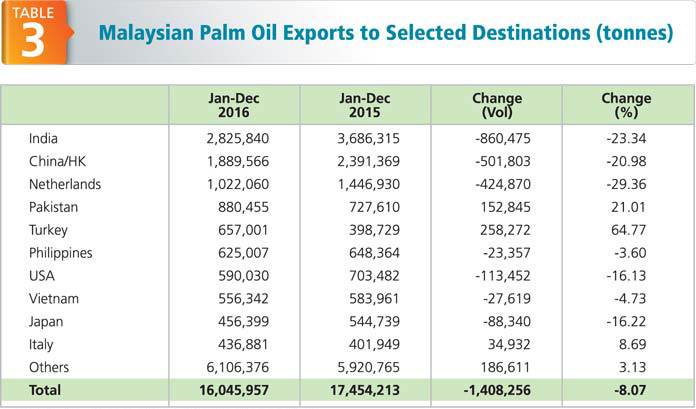

Demand for Malaysian palm oil continued to be driven by strong consumption in India, China, EU-28, USA and ASEAN member-states (Table 3). The top 10 importing countries and regions took up 9.9 million tonnes, or 62% of the 16 million tonnes exported. A significant increase in Malaysian palm oil imports was seen in Turkey, Pakistan and Italy.

Source: MPOB – data as at February 28, 2017; subject to revision

India remained the biggest importer even though it absorbed 860,475 tonnes (23.3%) less than in 2015. Its intake of 2.8 million tonnes made up 17.6% of Malaysia’s palm oil exports. China/HK’s imports of 1.9 million tonnes, while still substantial, represented a drop in demand of 501,803 tonnes (21%). This was due to higher domestic crushing that produced an estimated 90 million tonnes of rapeseed oil, against 70 million tonnes the previous year.