The global economy slowed down in 2019, with the International Monetary Fund downgrading growth to 3% from 3.8% in 2018. Weak growth was driven by a sharp deterioration in manufacturing and trade activities, with higher tariffs and prolonged uncertainty over trade policy damaging investment sentiment and demand for capital goods.

In addition, the automobile industry contracted due to a variety of factors, such as disruptions from new emissions standards in the Euro area and China. The overall trade volume growth in the first half of 2019 fell to 1%, the lowest since 2012.

The European Parliament’s vote that adopted the Delegated Act – which mandates an earlier exclusion date for palm biofuels under RED II – was initially expected to have a negative impact on palm oil consumption. However, the converse occurred, as European consumption increased by 3.8% compared to 2018. This was driven mainly by the competitive price of palm oil over the first three-quarters of 2019. Almost two-thirds of the palm oil in Europe is used for energy – 53% of imports goes into biodiesel for vehicles, while 12% is used for generating electricity and for heating.

The Malaysian palm oil sector was able to curtail the impact of economic volatility through the discipline, commitment and teamwork of stakeholders. The oil palm planted area was recorded at 5.9 million ha in 2019 (Table 1). Without erratic weather patterns to affect productivity, crude palm oil (CPO) production rose by 341,826 tonnes (1.8%) compared to 2018. Production of crude palm kernel oil saw an increase of 22,199 tonnes (by about 1%).

Although CPO production expanded during the year, the stock level in December declined significantly by 1.2 million tonnes, compared to 2018. This was primarily because of higher exports of palm oil and its products, fueled by the comparatively low price of palm oil, which had traded below RM2,000 per tonne between March and September. This widened the price discount with competing oils, such as soybean oil, sunflower oil and rapeseed oil, in the global market. The year-end stock level of palm kernel oil was slightly higher at 442,164 tonnes (up by 1.9%), compared to 2018.

Malaysia’s exports of palm oil products increased by just over 3 million tonnes (12.1%) to register 27.9 million tonnes in 2019. With the exception of finished products, all other categories showed an increase in the export volume (Table 2).

Total palm oil exports were recorded at 18.5 million tonnes (Table 3) and valued at RM41.6 billion. In terms of volume, this was close to 2 million tonnes (12%) higher compared to 2018; in terms of value, it was RM605 million or 1.4% more. The relatively smaller increase in value in 2019 was attributed to the low average price of palm oil in the second and third quarters of the year.

Export revenue

The trend of lower palm oil prices from June 2018 carried through into 2019. From March through October, the price hovered between RM1,900 and RM2,100 per tonne.

The annual average local delivered CPO price decreased by RM154 (6.9%) to RM2,079 per tonne in 2019 (Table 5), but it did not dampen the Malaysian palm oil industry. The price spread with soybean oil widened over this period, leading to higher demand for palm oil. This was reflected in Malaysian palm oil exports rising by about 12%.

Improved demand for palm oil and competing oils stabilised the price of oils and fats worldwide. Low stock levels of Malaysian CPO helped strengthen the palm oil price, which inched higher from November to exceed RM2,500 per tonne. This pushed the average price to a respectable RM2,079 per tonne.

In 2019, Malaysia’s revenue from exports of palm oil products decreased by 2.6% to RM63.7 billion (Table 6). The larger volume of exports was offset by the lower price of palm oil, especially in the first half of the year. This was also true of all major vegetable oils worldwide – the price of soybean oil, for example, dropped by about 28%.

Export earnings from crude and processed palm oil went up by RM605 million (1.5%); biodiesel by RM165 million (11.5%) and other palm oil products by RM315 million (43.6%).

The proceeds were lower from palm kernel oil (by 12.9%), palm kernel cake (7.4%), oleochemicals (13.8%) and finished products (7.1%). However, some optimism returned when prices started to climb in the fourth quarter of the year.

Global trade in oils and fats

The world oils and fats trade was generally able to weather the economic challenges because of the rising popularity of edible oil as an essential part of the food and nutrition cycle. A surge in disposable income, coupled with increased consumption of processed food globally, were other contributing factors.

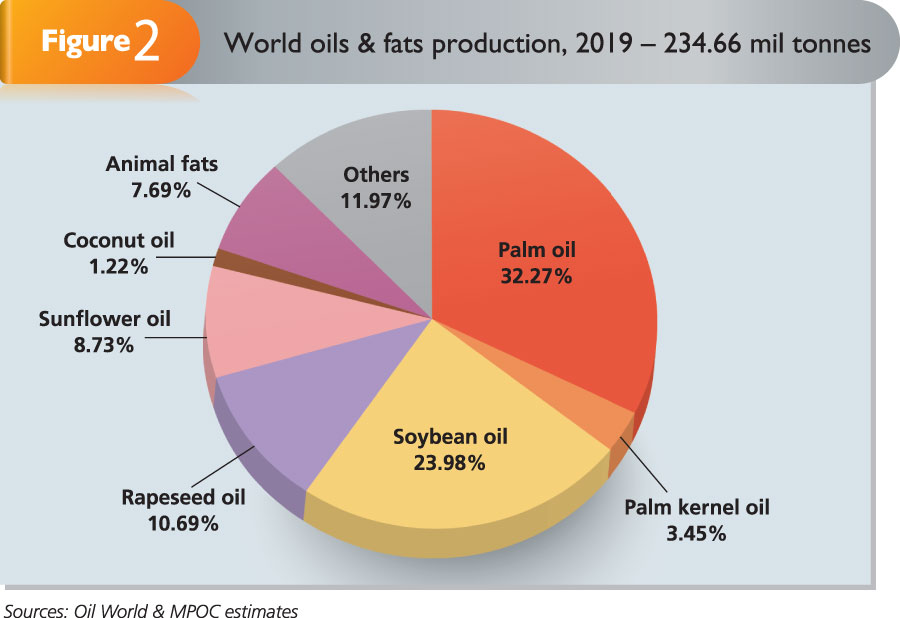

Global production of oils and fats stood at 234.7 million tonnes in 2019, a marginal increase of 1.3 million tonnes (by 0.6%) compared to 2018. Interestingly, oils and fats consumption of 237.1 million tonnes over the year exceeded production by 2.5 million tonnes. However, the high carryover stocks from 2018 cushioned the impact of this.

The combined output of palm oil and palm kernel oil accounted for 83.8 million tonnes, or 35.7%, of the total oils and fats volume (Figure 2). Soybean oil contributed 56.3 million tonnes (almost 24%), while rapeseed oil registered 25.1 million tonnes (10.7%).

Of the 95.3 million tonnes of oils and fats traded worldwide, palm oil and palm kernel oil jointly made up 57.5 million tonnes – or 60.3% of the total volume (Figure 3).

Malaysia remained a major player in the oils and fats export market. Its palm oil exports of 18.5 million tonnes represented 34.2% of the global palm oil trade (Figure 4).

MPOC