Performance in first half of 2022

August, 2022 in Issue 2 - 2022, Markets

Indian vegetable oil demand remained intact over the first half of 2022, with imports rising by 2% year-on-year (y-o-y). High landed prices of palm oil and narrow spreads with soft oils led to a shift in demand towards soft oils. This reduced the palm oil share of vegetable oil imports to 54% against 63% y-o-y, while imports in 1H 2022 declined by 12% compared to the same period in 2021.

With supply disruptions in the countries of origin, the market share of major exporters also fell in 1H 2022. The Indonesian palm oil share dropped to 32% from 44% in 1H 2021. The Russia-Ukraine war led to a 4% y-o-y decline in sunflower oil imports largely from Ukraine, as importers switched to supplies from Russia and Argentina; about 80% of India’s annual imports have traditionally been from Ukraine.

A recent price drop discounted palm oil to soft oils by US$250-500/tonne, while increasing palm oil import parity to more than US$100/tonne. This will raise the palm oil import share.

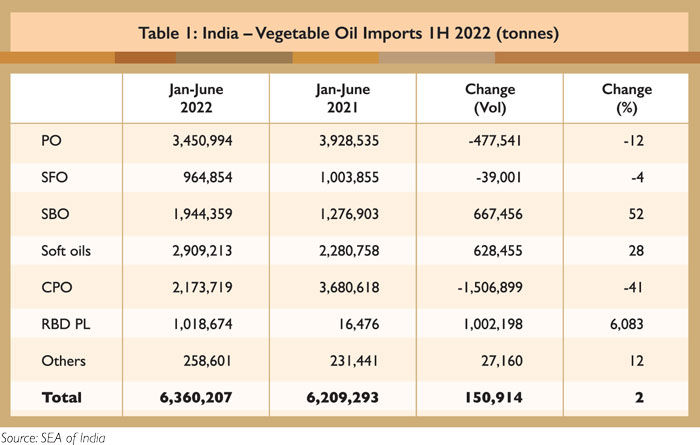

India’s vegetable oil imports for 1H 2022 increased to 6.4 million tonnes (by 2%), against 6.2 million tonnes in 1H 2021. Imports during the first quarter of 2022 were higher by 16% over the comparative period, but the volume fell by 10% during the second quarter due to high prices attributed to the Russia-Ukraine war and other global factors.

Import disparity and narrow spreads with competing oils reduced palm oil demand in 1H 2022, as imports fell by 477,541 tonnes (12%) to 3.5 million tonnes (Table 1). In terms of volume, however, it remained the most traded commodity. The import of soft oils went up by 628,455 tonnes (28%) to 2.9 million tonnes, driven by higher soybean oil imports. The share of soft oils in the import basket stood at 46%, compared to 37% in 1H 2021.

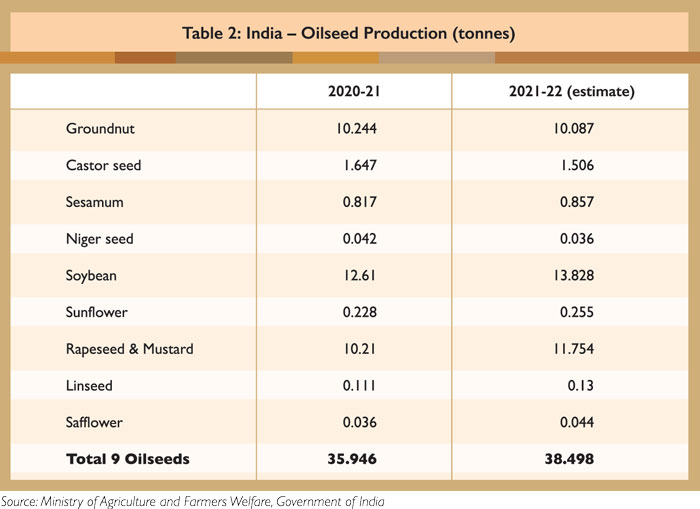

Domestic oilseed production in 2021-22 is pegged to rise by 7% to 38.5 million tonnes against 35.9 million tonnes in 2020-21. This is due to good price realisation for the output, encouraging farmers to plant more oilseeds in preference to competing crops. Total vegetable oil production in 2021-22 is estimated to rise by 5% to 10.3 million tonnes against 9.8 million tonnes in the previous year.

Import duties

India had levied high import duty on edible oil imports in order to protect domestic oilseed producers. However, the Covid-19 pandemic caused global supply chain disruptions, while other macro-economic factors contributed to hiking up vegetable oil prices to exorbitant levels. This forced the government to reduce the import duty.

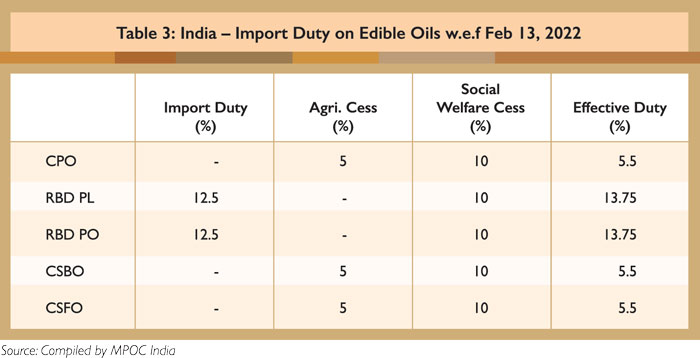

As a case in point, the import duty on CPO was as high as 44% in 2019. By the end of 2021, the effective import duty on CPO had come down to 8.25%, and on other crude oils to 13.75%. In 1H 2022, the import duty on CPO was further reduced, although there was no change for the other vegetable oils.

In order to support domestic processors and to control cooking oil prices, the government reduced the agri-cess on CPO to 5% with effect from Feb 13, 2022, bringing the effective import duty down to 5.5% from 8.25% (Table 3).

To control rising inflation, the government has allowed duty-free imports of crude soybean oil and crude sunflower oil – capped at 2 million tonnes for each – for the next two financial years with effect from May 25, 2022; this will facilitate the import of soybean oil at a lower price.

The Directorate-General of Foreign Trade (DGFT) was directed to allocate the tariff rate quota (TRQ) based on the refining capacity of applicants, as well as sales over the last three financial years. The objective is to extend the facility to actual processors of vegetable oil, not to traders.

The DGFT and Ministry of Consumer Affairs, Food and Public Distribution recently released the allotment under the TRQ, with a cap of 200 KMT per refiner. However, the Solvent Extractors Association of India has since requested a review, citing anomalies which would prevent the TRQ benefits from being transferred to consumers.

Many leading soybean and sunflower oil refiners who produce up to 1,000 KMT have been allocated only 200 KMT under the TRQ. This would compel them to import the quantity above 200 KMT at full duty. Smaller players, meanwhile, could take advantage of the higher duty-free import quota without passing on the full benefits to consumers.

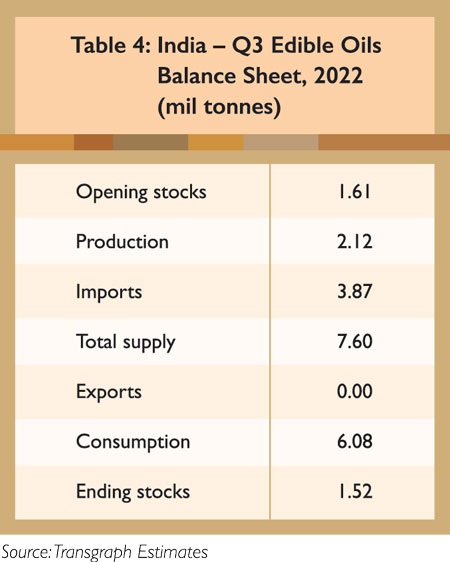

Domestic edible oil production in the third quarter of 2022 is projected at 2.1 million tonnes (Table 4), with imports estimated at 3.9 million tonnes (monthly average of about 1.3 million tonnes) in anticipation of escalated demand for festivals. Existing stocks stand at 1.6 million tonnes. Consumption is estimated at 6.1 million tonnes, compared to 5.7 million tonnes in the second quarter of the year.

MPOC India