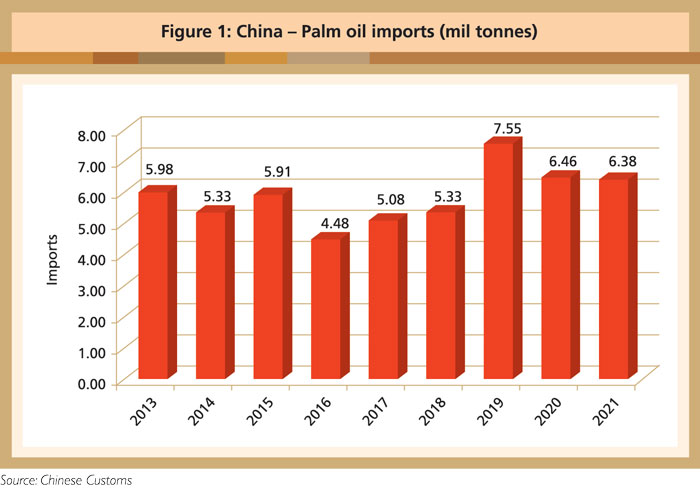

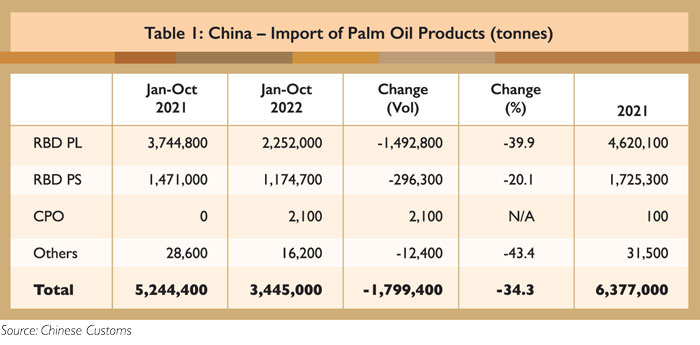

China’s palm oil imports recorded a drop from January to October 2022. The volume shrank by 1.8 million tonnes compared to the same period in 2021, although the deficit is expected to slightly narrow by 100,000 tonnes by end December.

Both RBD palm olein (PL) and RBD palm stearin (PS) recorded a significant decline in volume (Table 1). The import of RBD PS up to October 2022 was lower by 296,300 tonnes (20.1%) over the comparative period. However, if the intake of hydrogenated vegetable oils (HVO) is taken into account, the import of RBD PS – a feedstock for oleochemical production – has not dropped by too much.

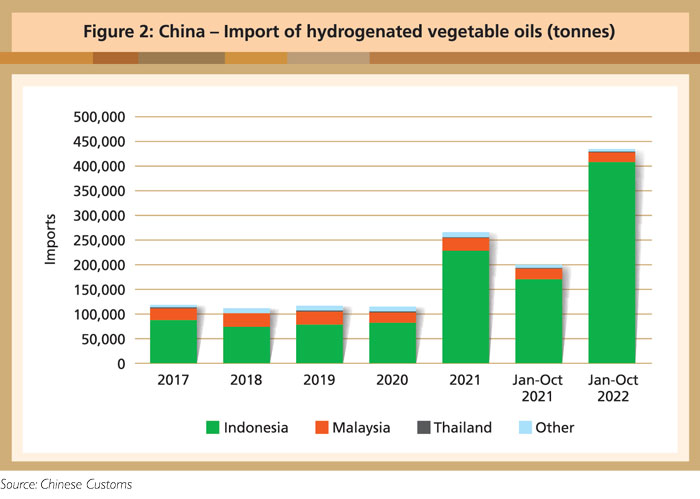

According to Chinese Customs, the import of HVO rose tremendously in 2021 and remained significant in 2022. In 2021, HVO imports more than doubled that in the previous year (264,900 tonnes vs 114,900 tonnes); up to October 2022, imports jumped by 234,600 tonnes against the 200,000 tonnes recorded from January to October 2021.

This was closely related to the change in Indonesia’s export duty structure on palm-based products in 2021. It favours the export of downstream palm-based products through very competitive prices, including hydrogenated palm stearin (HPS).

At the same time, the import of HPS in China is exempted from import duty under the ASEAN-China FTA, in contrast with the 2% imposed on RBD PS. Some importers and fatty acid producers in China therefore switched from RBD PS to HPS, to enable the local industry to lower the cost of production and compete with imported fatty acids.

China’s HPS imports amounted to 320,000 tonnes from January to October 2022, up by 235,000 tonnes against the same period of 2021. This means that demand for RBD PS or HPS as feedstock for fatty acid plants only dropped by an estimated 61,300 tonnes up to October 2022.

Imports of palm kernel oil in the January to October period declined by 114,300 tonnes (23.8%) over the comparative period. Although coconut oil imports increased by 50,000 tonnes, the net import of lauric oils was lower by 64,300 tonnes (10.4%). Unlike RBD PS, which is mainly used in oleochemicals production in China, 50% of the lauric oils are used in the food sector as specialty fats; the balance is used primarily in fatty alcohol production.

Performance of products

Stearic acid

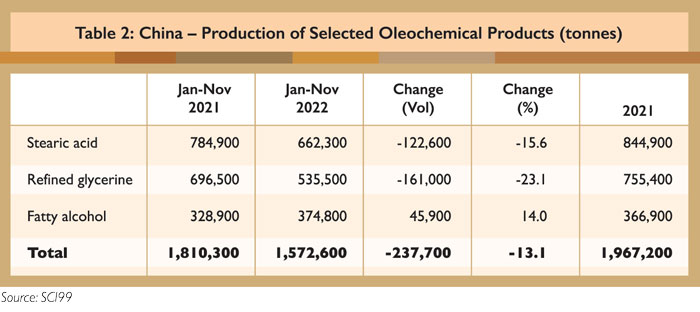

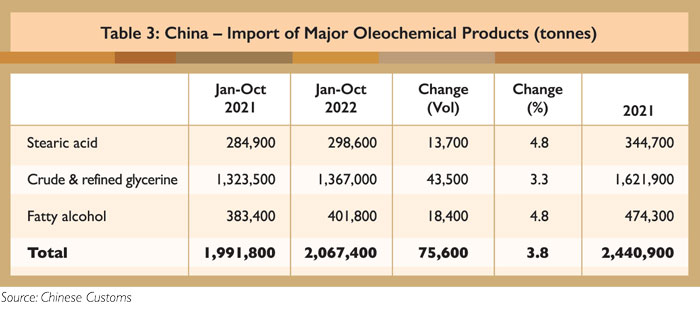

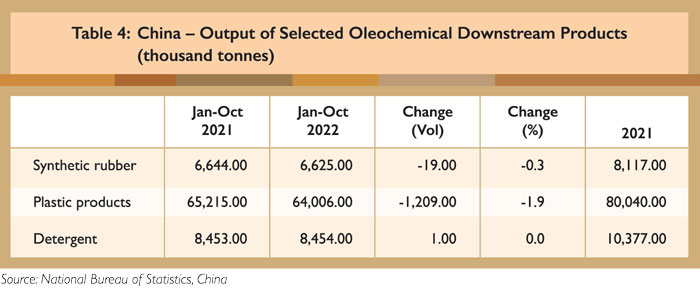

Overall supply of stearic acids in China declined in 2022, due to a drop in local production. The production data (Table 2) and import statistics (Table 3) show that demand for this product was stagnant or lower compared to 2021. It also explains why imports of RBD PS and HPS have dropped up to October 2022. Lower demand for stearic acid in 2022 was mainly due to the decline in the production of synthetic rubbers and plastic products; stearic acid is one of the key raw materials in this sector (Table 4).

As the auxiliary raw material in both PVC and synthetic rubbers, stearic acid accounted for 1% of the raw materials used. The falling output of both downstream products means that demand for stearic acid had declined by about 12,000 tonnes up to October 2022. In addition, lower output of stearic acid was affected by high RBD PS prices in the first half of 2022; this led to smaller imports of RBD PS and HPS, as well as less interest in stearic acid production.

China’s property sector, which accounts for a quarter of the economic growth, struggled with defaults and stalled projects in 2022. This affected demand for synthetic rubbers and plastic products (mainly PVC), as these are two of the main construction materials used.

China’s National Bureau of Statistics states that the total new built-up area in the property sector declined drastically by 630 million sq m or 37.8% from January to October 2022 against the same period in 2021 (Figure 3). The drop was sharper than the annual decline recorded in 2021 (11.4%), and also marked a fall in building activity for the third consecutive year.

The reasons can be attributed to a slowdown in economic growth, and to the government’s move to restrict excessive borrowing by developers. The clampdown resulted in a drop in property sales and prices, and the suspension of housing construction.

However, with the rollout of what market analysts have described as the “most comprehensive” support measures by the Chinese government in mid-November, the property sector is expected to recover in 2023. This will lead to higher demand for building materials, including synthetic rubbers and plastic products. Hence, demand may improve for stearic acid and its raw materials (RBD PS & HPS) in 2023.

Fatty alcohol

Total supply of fatty alcohol increased up to October 2022, with output and imports up 14% and 4.8% respectively compared to 2021. The increase was primarily attributed to the stringent Covid-19 preventive measures put in place in China, with many cities having been either simultaneously or consecutively locked down since March. This triggered a surge in demand for sanitisers and detergent products for regular cleaning of compounds affected by residents or visitors who are Covid-positive.

According to China’s National Bureau of Statistics, the production of detergent was on par with 2021, up to October 2022 (Table 4), performing better than the demand from sectors related to stearic acid downstream products. Stronger demand for fatty alcohol also indicates that demand for lauric oils (PKO and CNO) in the food sector was lower in 2022 than 2021, compared to the non-food oleochemicals sector.

Glycerine

The slowdown in stearic acid output also meant a drop in the supply of glycerine, which is a by-product of the hydrolysis process. Refined glycerine can also be produced from refining crude glycerine imported mainly from Brazil, Indonesia and Malaysia. According to market information, the output of refined glycerine dropped by 161,000 tonnes (23.1%) from January-November, compared to the same period in 2021.

Although imports of glycerine (crude and refined) increased by 43,500 tonnes, this was not enough to offset the decline in output and signified that demand for glycerine was rather slow. A main reason for the decline in glycerine production was the sharp increase in the price of raw materials (RBD PS & HPS).

The decline in epichlorohydrin production was another reason for the slowdown in glycerine consumption in 2022. Epichlorohydrin accounted for 67% of the downstream applications of glycerine in China.

Epichlorohydrin is the raw material used in producing derivatives of chemical compounds to manufacture surfactants, plasticisers, emulsifiers and stabilisers; some of these are used for the production of detergent, plastic and synthetic rubbers. The drop in output of plastic products and synthetic rubbers – even as detergent production remained on par with 2021 – explains the lower demand for epichlorohydrin and, hence, the demand for glycerine in 2022.

Recovery in 2023

With China’s recent relaxation of Covid-19 preventive measures, economic activities are expected to recover progressively. Support for the property market is also expected to drive demand for stearic acid, glycerine and fatty alcohol. This will inevitably support feedstock such as RBD PS and HPS to satisfy production needs.

The expectation is for higher output and imports of oleochemicals, and imports of RBD PS and HPS; this will support the growth of palm oil consumption in China in 2023 from the second quarter. It is anticipated that Covid-19 infections could rise after preventive measures are lifted, and that this will temporarily affect operations in the manufacturing and service sectors. Once herd immunity is achieved, economic activities be will reignited fully, and lead to better demand for palm oil products.

Desmond Ng

MPOC China