From the 1960s, Malaysia’s oil palm plantations commenced planting with higher-yielding Tenera palms which yielded up to 30% more palm oil per planted ha. At the same time, a new domestic industry sprang up – production of palm oil mill machinery.

By 1974, a further advance had emerged by licensing in-house palm oil refining, fractionating and bleaching. In the 1980s, technology had been developed to transform palm oil mill liquid waste from a costly effluent to a profitable feedstock to generate electrical energy. Production research took a further leap forward by the multiplication of selected palms through clonal technology in the 1990s.

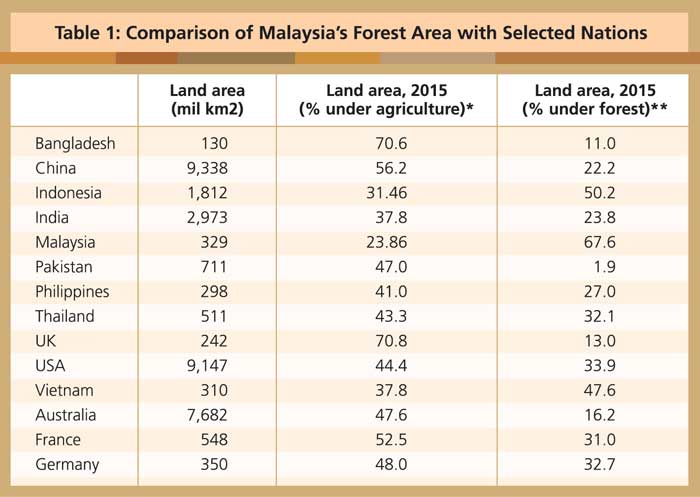

Source:

* https://data.world bank.org/indicator/AG.LND.AGRI.ZS,2015

** https://world bank.org/indicator/AG/LND.FRST.ZS,2015

Forest cover

Indonesia, as at 2017, has maintained 50.2% of its land area under forest cover. Malaysia appears to have maintained 67.6% natural forest cover (World Bank data, 2015). Currently, 17.6% of Malaysia’s landmass, or 5.7 million ha, remains undeveloped – less than the existing oil palm planted area of 5.8 million ha (MPOB, Dec 31, 2017).

A Malaysian national policy to preserve 50% (16.4 million ha) of natural forest cover would allow licensing of 11.4 million ha (35% of the landmass) for oil palm plantations, while preserving status quo with Indonesia in relation to Malaysia’s 1992 Earth Summit pledge of 50% forest cover. Malaysia’s all-important plantation economy has consistently emphasised its commitment to reducing carbon emissions and maintaining biodiversity.

The developed world (with some notable exceptions) records about a third of its land area devoted to forestry; the developing world in Southeast Asia records up to half of its land area devoted to forestry. The exception is Malaysia where, in 2015, 67.6% of its land area was shown to be under forest. Have Malaysian land-use policies been targeted by foreign NGOs financed or subsidised by nations which prop up domestic production of oilseeds?

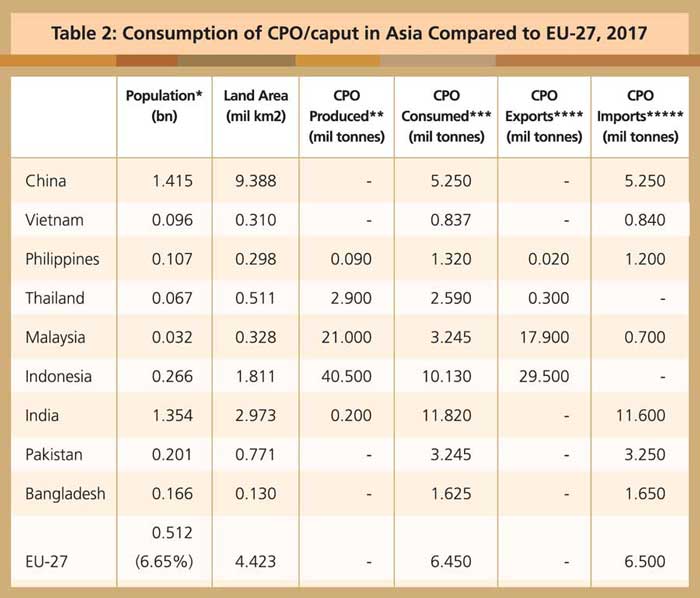

CPO consumption

Halting the 1981-2018 ‘oil palm fever’ has refocused national priorities from plantation investment to maximising the fresh fruit bunch (FFB) and crude palm oil (CPO) production per planted ha, with strong emphasis on product quality and marketing. It marks the end of a 37-year bull run which has seen palm oil increase from 7.8% of worldwide supplies of edible oils in 1980 to 35% in 2017.

CPO consumption/caput/annum was 101kg/caput in Malaysia, 38kg/caput in Indonesia and 13kg/caput in EU-27 in 2017 (Table 2). These figures contrast sharply with the average annual consumption (7.2kg/CPO/caput for the rest of Southeast Asia).

Source:

* www.worldometeters.info/world-population/population-by-country, 2017

** www.indexmundi.com/agriculture/?commodity=palmoil&graph=production, 2017

*** www.indexmundi.com/agriculture/?commodity=palmoil&graph=consumption, 2017

**** www.indexmundi.com/agriculture/?commodity=palmoil&graph=exports, 2017

***** www.indexmundi.com/agriculture/?commodity=palmoil&graph=imports, 2017

Pages : 1 2