Five reasons for optimism

February, 2017 in Biofuels, Issue 1 - 2017

To meet the USDA’s forecast, ethanol producers must use 100.1 million bushels of corn per week; 109.2 million bushels were used during the week of Dec 9, 2016. If the current trend continues, the USDA will have to raise its ethanol demand forecast for the 2016/17 crop year.

Under the EPA’s final RVOs, the implied conventional mandate for corn ethanol is now at the statutory maximum of 15 billion gallons. This is because the agency did not use its general waiver authority to avoid breaching the blend wall. Total motor gasoline consumption is projected to be 144 billion gallons based on the US Energy Information Administration’s (EIA’s) October Short-Term Energy Outlook. In the proposed rule, the EPA assumed the use of 14.4 billion gallons of ethanol and the conventional category’s remaining 400 million gallons to be made up of non-advanced renewable fuels.

In the final rule, however, the EPA states it is assuming an increase in motor fuel use in 2017, but the mandated volume is still likely to exceed the 10% blend wall. Ethanol production over the mandated volume will go into stocks and exports. WPI is projecting that 2017 ethanol production will reach 15.5-15.75 billion gallons, which would represent 5.3-5.6 billion bushels of corn use.

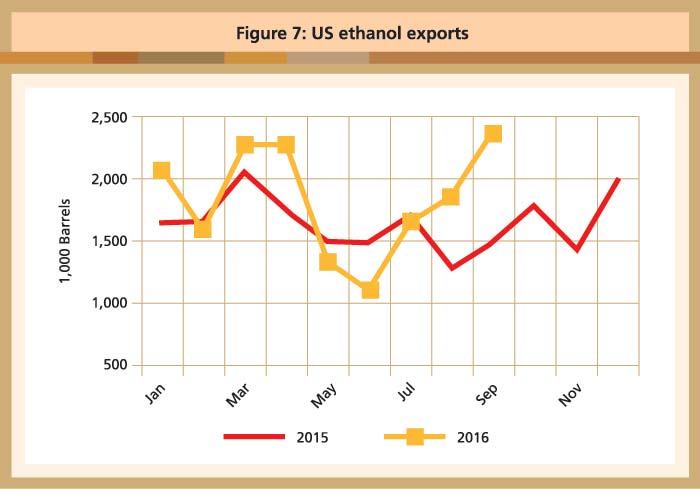

Ethanol prices have been more expensive than gasoline blendstock for much of the year. That has limited discretionary blending, but exports are picking up the slack (Figure 7). They accounted for more than 830 million gallons last year and are trending 13% higher through September.

Source: EPA, WPI

The primary reaction to the EPA’s announcement of a higher ethanol volume has been in the RINs market where prices spiked nearly 15%. In addition to being a compliance mechanism under the RFS, RINs are the implicit subsidy to produce ethanol and thus part of the value of each gallon of biofuel to which they are attached.

According to the EIA: ‘[RINs provide] … an economic incentive to use renewable fuels. If RIN prices increase, blenders are encouraged to blend greater volumes of biofuels, based on their abilities to sell both the blended fuel and the separated RIN.’

Under the RFS, the effective cost incurred by obligated parties is the cost of ethanol-net-of-RINs. This is derived from the ethanol mills’ ability, as described by the EIA, to blend the fuel and separate the RIN. Thus, as RIN prices rise, the net marginal cost of blending ethanol at a fixed price is actually reduced for obligated parties.

Ethanol margins should remain strong for the foreseeable future. Corn supplies are certainly plentiful with US ending stocks projected to exceed 2.4 billion bushels. Crude oil prices are near their highs for the year, but will be dependent on the success or failure of an OPEC agreement to limit production going forward.

Dave Juday, Mike Kruger & Matt Herrington

Ag Review Dec 2016

World Perspectives, Inc