Look elsewhere for drivers of deforestation

December, 2019 in Issue 4 - 2019, Comment

The production and use of biofuels have received much attention around the world, particularly in the US, Brazil and across Europe. Developing countries in Asia are similarly turning to biofuels to reduce dependence on costly fossil fuel imports and to address climate change. The use of palm oil biofuels could be a major consideration for policy makers in search of alternatives.

In the EU, however, a major obstacle lies in the Delegated Act of the Renewable Energy Directive II. It singles out palm oil as ‘unsustainable’ due to its ‘high risk of causing deforestation’ based on indirect land use change.

In effect, the EU has decided unilaterally that biofuels produced from palm oil cannot be counted towards meeting green fuel targets. The Delegated Act was passed on June 10, 2019, in the European Parliament. It caps palm oil use for biofuels at 2019 levels until 2023, and will then phase out its use by 2030. This will affect about 2.5 million tonnes of palm oil biofuels, or 33% of the EU’s annual palm oil imports.

In addition to referring a complaint to the World Trade Organisation, palm oil producing countries will have to drive up demand for the commodity. Leaders Indonesia and Malaysia have stepped up to the plate with plans to raise their respective biofuel mandates – this will see them become larger consumers of palm oil in their own right.

Higher domestic consumption would also stabilise the price of palm oil, bolster sustainable growth of the industry and maintain jobs toward socio-economic security within each country.

The Malaysian Biofuel Industry Act 2007 came into force on Aug 1, 2008, to ensure the orderly development of the industry. The national biodiesel programme started with the B5 blend in 2011, increasing the bio-content to B7 by the end of 2014. The B10 mix was made mandatory for the transportation sector from Feb 1, 2019, while the B7 blend was implemented in the industrial sector with effect from July 1, 2019. This will help increase domestic palm oil consumption to 760,000 tonnes annually.

In tabling the Federal Budget speech in the Parliament on Oct 11, 2019, Finance Minister, the Hon. Lim Guan Eng, proposed implementing the B20 biodiesel programme in the transport sector by end 2020. This is expected to boost local palm oil demand by 500,000 tonnes per annum.

Indonesia is projected to become the fifth-most populous nation by 2050 with 321 million people, compared to 271 million currently. Oil World estimates that Indonesian consumption of palm oil stood at 12 million tonnes last year. It is estimated that the volume will exceed 14 million tonnes when palm oil is diverted to the biofuels sector.

Indonesian President Joko Widodo announced on Aug 12, 2019, that there are plans to increase the palm oil biofuels blend from B20 to B30 from January 2020, and to B50 by the end of that year. Domestic palm oil consumption for biofuels could then rise to 8.4 million tonnes and 13.9 million tonnes in 2020 and 2021 respectively, according to a CIMB analyst.

Indonesia has had to act swiftly for another reason. The EU has announced that countervailing duties of between 8% and 18% will be imposed on Indonesian palm oil biofuels. This is in response to a complaint by the European Biodiesel Board that the palm oil biofuel producers benefit from ‘unfair’ subsidies. Indonesia is challenging the decision.

Further opportunities are expected for the palm oil sector as and when Brexit comes to pass. The UK is a net importer of agricultural products. The OECD-FAO Agricultural Outlook 2019 projects a substantial impact on the UK due to Brexit, as more than 70% of its agricultural imports have come from the EU and 62% of its agricultural exports have been to the EU.

With higher trade barriers anticipated after Brexit, the UK will need new trade partners. Malaysia’s palm oil producers would do well to explore any openings that arise.

‘Misguided policy’

Malaysia’s Prime Minister, the Hon. Tun Dr Mahathir Mohamad, has referred to the Delegated Act as a misguided policy designed to protect the agricultural industries of a few EU member-states. In an opinion piece for Bloomberg on Aug 19, 2019, he noted that beef production – for example in Latin America – represents the world’s biggest cause of deforestation.

Fern, a Dutch NGO for forestry issues, had signaled this in a 2018 Policy Brief entitled ‘Agricultural commodity consumption in the EU’. It said beef production is the main driver of deforestation. In seven countries with high deforestation in 2011, conversion to cattle pasture was responsible for nearly 60% of forest loss linked to agriculture in terms of land area, mainly in Brazil. The forest lost to ranching was double that of the combined deforestation associated with soybean, palm oil and timber.

According to The Economist, the Amazon basin contains 40% of the world’s tropical forests and accounts for 10-15% of global biodiversity. Brazil alone had lost nearly a billion trees due to deforestation between August 2017 and July 2018 (7,900 sq km of Amazon forest).

Brazil is also the world’s biggest beef exporter and largest soybean producer. The USDA projects that Brazil will harvest 124 million tonnes of soybean in 2019/20, while its soybean acreage is expected to increase to 37 million ha. It is estimated that 80% of soybean meal is used for animal feed worldwide.

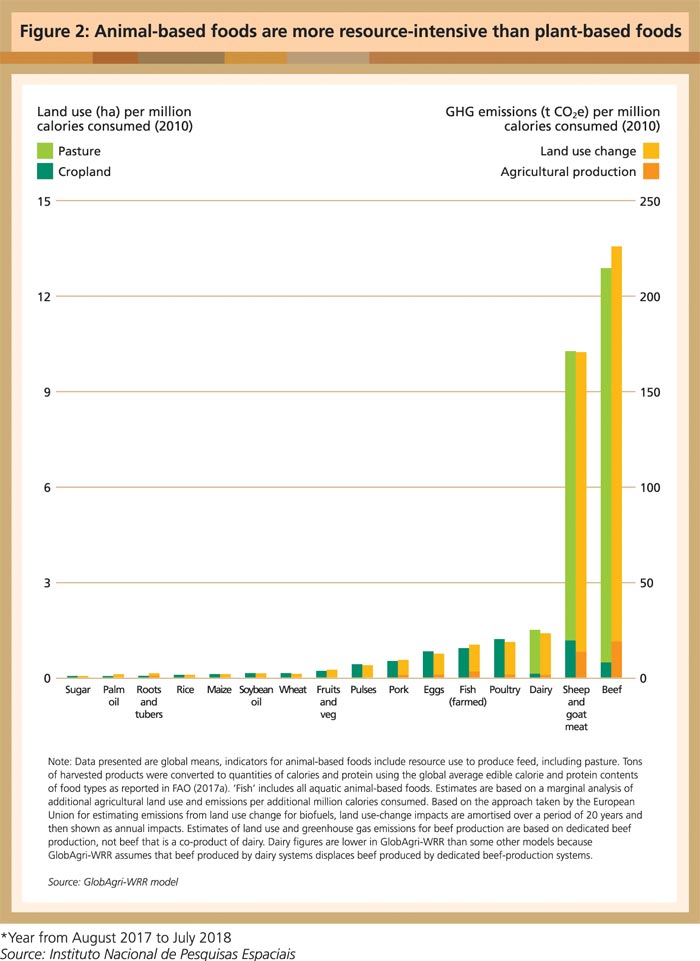

The World Resources Report 2018 projects consumption of animal-based foods to rise 68% between 2010 and 2050, with an 88% increase in consumption of ruminant meat (from cattle, sheep and goats). For every food calorie generated, animal-based foods – and ruminant meats in particular – require many times more feed and land inputs, and emit far more greenhouse gases, than plant-based foods.

What this should show critics of palm oil is that they should remove the blinkers. The current disasters linked to deforestation and greenhouse gas emissions lie in other quarters that operate unhindered and untroubled by the impact on the climate.

It is time that due recognition is given to the palm oil industry, which has progressed furthest in the agricultural world in providing both affordable and sustainably produced food and fuel. If this is not a convincing argument for widening the use of palm oil, then what is?

Belvinder Sron

Deputy CEO, MPOC