With a land area of almost 240,000 square km, Romania is the biggest country in the Balkans. It has become very much an industrial country since 2007, when the country joined the European Union (EU).

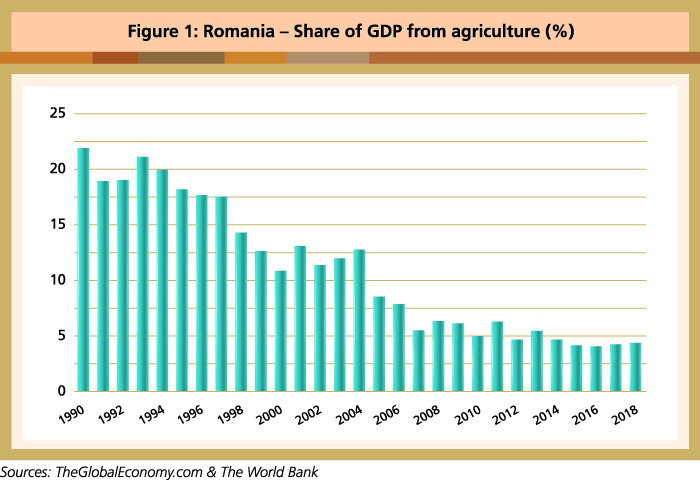

Of its agricultural land capacity of close to 15 million ha, only 10 million ha have been used as arable land. Agriculture contributed about 20% to the GDP in the 1990s (Figure 1), but this fell to 12.6% in 2004 and then to 4.3% in 2019. According to the Romanian Country Economic Memorandum (2020), income per capita increased from 26% of the EU-28 average in 2000 to 63% in 2017.

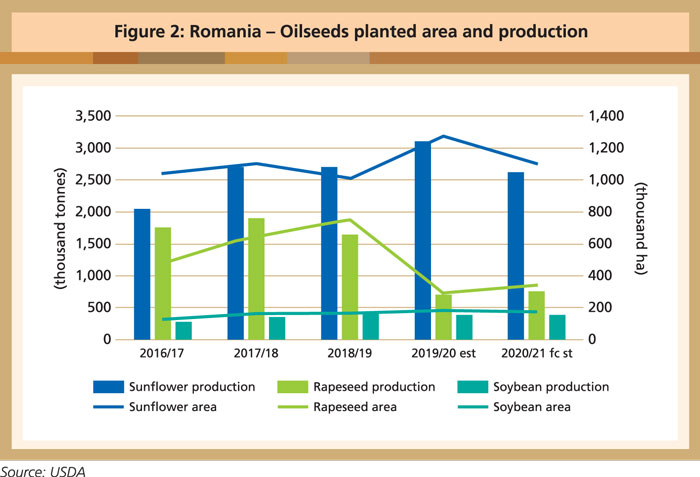

The planting of oilseeds utilises about 25% of the cultivated area, with sunflower accounting for the largest share, followed by rapeseed and soybean (Figure 2). Based on USDA data, the oilseed acreage is forecast to be lower by 7% this year due to a decline in sunflower planting. Year-on-year total oilseed production is forecast to fall by 10.7%.

Romania is the EU’s largest producer of sunflower seed, with the volume expanding by 26% in 2019/20. However, production is projected to contract by 13% in 2020/21 due to the lower profit margin and crop rotation. Exports are therefore expected to fall by 20%. Most of the sunflower seed will go to EU markets, with only about 15% bound for other destinations.

It is estimated that 400,000 ha were planted with rapeseed in the autumn of 2019 during exceedingly dry conditions. Of this, only about 340,000 ha remain under rapeseed, with the other 60,000 ha being diverted to spring crops. Drought over the winter and spring, as well as a damaging mid-March frost this year, could lead to a 7% decline in yield compared to 2019. Despite the lower planted area, rapeseed production is forecast at 750,000 tonnes, a 9.3% increase year-on-year.

Oils and fats market

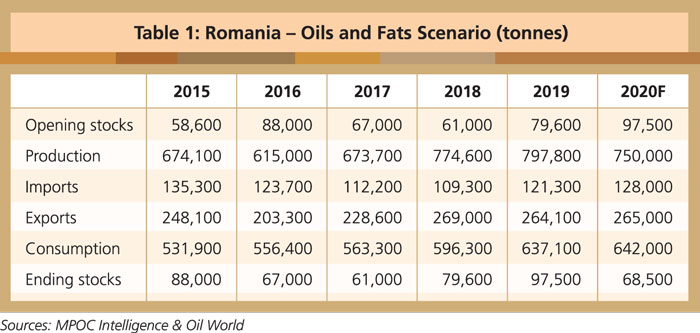

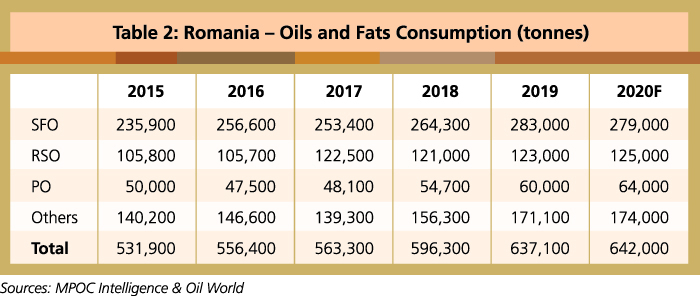

Romania is self-sufficient in terms of oils and fats production, and is even a net exporter. Annually it produces more than 700,000 tonnes of oils and fats, of which sunflower oil makes up 500,000 tonnes or 65% of total production. About 90% is exported to countries within the EU. Domestic consumption is recorded at 650,000 tonnes, mainly comprising sunflower and rapeseed oils at a combined 400,000 tonnes or 62% of the total.

The domestic market is pressed by low margins. Large players such as Prutul, Bunge, Ulerom, Ultex and Expur have invested in, or announced plans to invest, in biodiesel production as they expect the market to expand. The most significant players are Bunge, Argus, Cargill and Agricover.

Bunge has a share of about 36% in the edible oils market and operates two factories, Interoil Oradea and Unirea Iasi. Argus is the second-biggest player, holding about 20% of the market. Cargill, which has acquired Topway’s oil business including the Bunica brand, is currently ranked third but aims to take top spot in the industry.

Palm oil imports

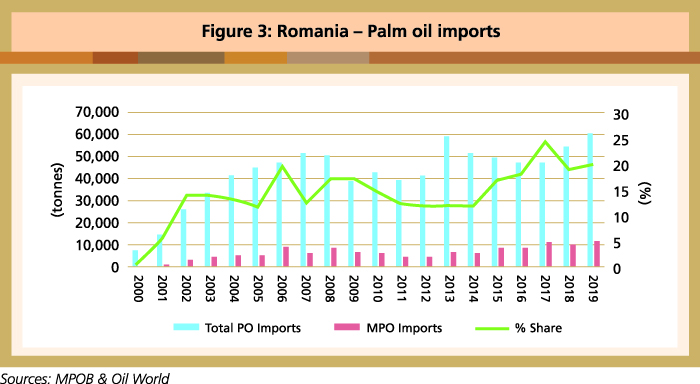

Romania imports more than 110,000 tonnes of oils and fats annually. Palm oil is the main product at close to 60,000 tonnes, or slightly more than 50% of total imports. It is also the third-most consumed vegetable oil behind sunflower oil and rapeseed oil. About 80% of the palm oil imports arrive via the Netherlands. Malaysia’s market-share stood at about 20% in 2019 (Figure 3).

Industrial users are the largest consumers of palm oil. Sectors like food manufacturing, chemicals, cosmetics and pharmaceuticals are all important in Romania’s economy and are potential customers for palm oil. Some large manufacturers already use palm oil in their production processes, as do restaurants and bread producers, among others in the food industry.

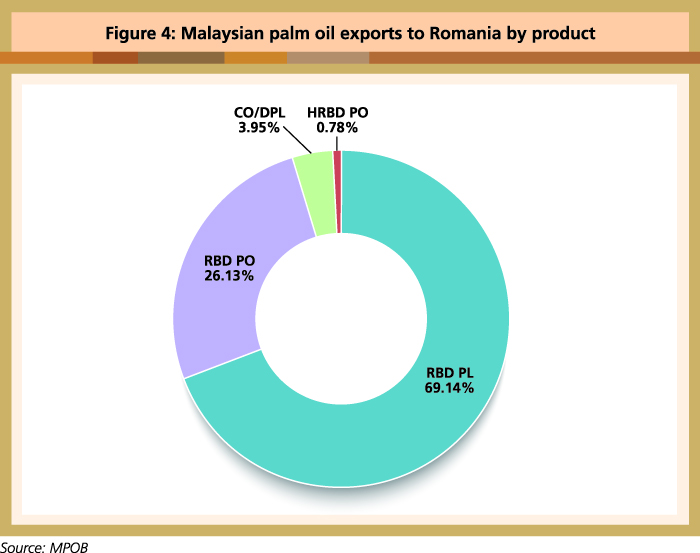

Almost all of the palm oil is consumed and there are no carryover stocks. With limited storage facilities within the country, users tend to purchase only what is needed. In 2019, Malaysia exported 12,104 tonnes of palm oil valued at RM37.1 million. RBD palm olein was the main product, for use in the prepared food industry (Figure 4).

In view of possible lower crushing of edible oilseeds, it is likely that Romania will import up to 300,000 tonnes of vegetable oils this year. Since the common EU foreign policy now applies for Romania, there are opportunities for Malaysian exporters who could consider exporting direct, rather than via a third country.

Storage capacity

Practically every farmer in Romania sells the oilseed crop at harvest time, as they lack adequate storage facilities. Even when storage is available, they cannot sufficiently control the self-heating phenomenon that affects oilseeds. Commercial storage capacity is limited and the prices are high. This is attributed to the quality of services provided and the regional monopoly that operators exert over competitors.

Oil factories also have limited storage facilities, and so they cap operations to a month at a time. Under long-term contracts, the operators get the silos – or send representatives to silos – to purchase sunflower seeds at harvest time. They pay for the seeds in the shortest time possible.

Port facilities and logistics

The Port of Constanta, located on the western coast of the Black Sea, is Romania’s main port. It occupies more than 3,900 ha and contains 156 berths, of which 140 are operational with a handling capacity of 100 million tonnes per year.

The facilities are comparable to those offered by most European and international ports, accommodating tankers with a capacity of up to 165,000 dwt and bulk carriers of up to 220,000 dwt. Several projects are underway to build facilities for cargo handling and to improve the transport connections between Constanta Port and its hinterland. These projects are mainly located at the southern end of the port.

Import procedures

As a member-state of the EU, Romania applies the standard procedures to the process of importing food-based products. The country’s food laws and regulations are also harmonised with EU legislation. Specific agencies are responsible for clearing shipments, depending on the category of products.

In respect of food and agricultural products, the agencies include the Ministry of Agriculture and Rural Development; Ministry of Environment; National Sanitary Veterinary and Food Safety Authority; Ministry of Health; and the National Authority for Consumer Protection.

Romania adopts the EU-level customs regime through Regulation 2013/952 of the European Parliament. Import duties are determined by the tariff classification of goods and by the Customs value. Other taxes applicable to agricultural and food products are the value added tax (VAT) and excises. Romania applies a reduced VAT rate of 9% to food products and agricultural inputs such as fertilisers and pesticides, and a standard VAT rate of 19% to other items.

Izham Hassan,

Manager,

Marketing & Market Development, MPOC