Supply, demand and price projections

December, 2020 in Issue 4 - 2020, Cover Story

The crude palm oil (CPO) price rally since June 2020 has been driven by supply disruptions in key edible oils, as well as in palm oil producing regions. With demand outpacing supply, the Bursa Malaysia Derivatives Exchange’s third-month benchmark price passed RM3,000 to trade at RM3,064 per tonne by mid-October. This was 38% higher from a year ago. On Nov 13, it hit its highest level, reaching RM3,490 per tonne.

Palm oil output from Indonesia and Malaysia was adversely affected by drought and reduced fertiliser application in 2019. This was compounded by labour shortage and movement restrictions due to the Covid-19 pandemic in 2020. Indonesia and Malaysia produce about 85% of the global palm oil supply. The lower-than-expected supply of other edible oils, particularly sunflower and rapeseed oils, had induced the sharp rise in vegetable oil prices, which then had a spillover effect onto CPO prices.

Although the Covid-related partial lockdowns imposed in many countries had curbed demand for edible oils, the reduction in palm oil exports was short-lived. By the second quarter of 2020, key importing countries had started to re-stock. Also, reduced availability of used cooking oil and animal fats due to the pandemic has led some biodiesel producers to switch their feedstocks to vegetable oils, which also boosted global demand for palm oil.

At the Virtual Palm and Lauric Oils Price Outlook Conference & Exhibition in October, most analysts concurred that CPO prices would likely trade above RM2,500-3,000 per tonne for the rest of the year. This is due to tight palm oil stocks, concerns over the La Niña impact on edible oil supplies, and labour constraints in Malaysia which will impact fresh fruit bunch (FFB) yields in the coming months.

The Council of Palm Oil Producing Countries (CPOPC) is of the view that palm oil prices are likely to stay high in the first half of 2021, amid lower soybean crushing in Argentina and rising sunflower oil prices. Another key factor to watch is the weather pattern and the severity of La Niña going forward. Ongoing La Niña heavy rainfall has started to disrupt output in Southeast Asian palm oil producing countries. This will subdue global supply until the first quarter of 2021. Towards the second half of 2021, adequate rainfall and better crop management incentivised by the current high palm prices will significantly boost production.

Oil World recently forecast that vegetable oil prices in 2021 should trade higher due to improved demand and a tighter supply of soft oils such as soybean and sunflower oils. It indicated that soybean oil would lead the way. The rally in sunflower oil due to a lower crop harvest has also made soybean oil and palm oil attractive to price-sensitive buyers. China’s edible oils re-stocking policy is expected to continue in the months ahead with fund buying. Combined with Argentina’s soybean crushing problems, this could further boost palm oil prices.

Market outlook

Covid-19 pandemic

This is unlikely to have any severe impact on vegetable oil demand, including palm oil. This is because edible oils are a daily necessity, as a kitchen staple, cleaning agent or renewable fuel, in many people’s lives throughout the world.

In fact, the rising demand for oleochemical products has sustained demand for edible oils, including palm oil. Oleochemical derivatives such as glycerine, fatty acids and methyl ester, are the raw material for sanitisers, detergents and soaps which are experiencing rising demand due to better hygiene awareness and government-mandated health protocols.

Since the start of the pandemic, there has been a shift from business-to-business channels to business-to-consumer consumption habits with many households cooking and eating at home. The benefit of this change is that consumers will be changing their vegetable oils more regularly, as companies are selling smaller packs to consumers in the light of lower demand from restaurants.

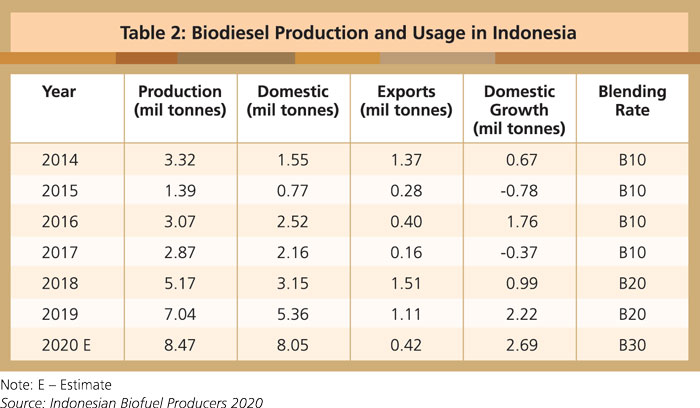

Biodiesel mandate

The Indonesian B30 mandate will help absorb the increase in palm oil supply in 2021. The wide gap between biodiesel and diesel prices has led to the accelerated drawdown of the Indonesian CPO fund. The earlier concerns about Indonesian biodiesel usage that might contract in 2020 will not happen, as the B30 biodiesel mandate will be fully implemented until the end of 2020.

However, the spread of palm oil to gas oil and low diesel price translates into expensive biodiesel mandates. As such, any revision or abandonment of biodiesel mandates would exert downward pressure on prices. In this context, it is crucial for both main producing countries to implement the biodiesel mandate, which is B30 for Indonesia and B20 for Malaysia. The use of palm oil biodiesel in the European Union could slow down if the supply of used cooking oil returns to the market with more economic activities opening up in 2021.

La Niña

The price outlook for 2021 will depend on the development of La Niña and its impact on the soybean complex in South America. Should there be a severe La Niña event, there will be lower soybean production. This, combined with a limited supply of sunflower and rapeseed oils from the Black Sea region, will result in higher vegetable oil prices in the first half of 2021. In this scenario, CPO prices will also benefit.

It is also noted that soybean crop replanting in Brazil and Argentina has been delayed due to the current dry weather conditions. If this persists, soybean yields in the coming season will be impacted. If the La Niña conditions advance into April 2021, this may also hurt soybean plantings in the US.

Oil palm replanting

The CPOPC sees structural changes in the global palm oil supply from 2021 due to a slowdown in new oil palm plantings throughout Indonesia and Malaysia since 2015. With the ageing tree profile across both countries, the replanting programme will also temporarily limit palm oil supply in the short to medium term.

As agricultural land becomes limited, oil palm replanting will be key to boosting palm oil yield across Indonesia and Malaysia. It is important to replant so as to sustain supply in the long run. Replanting is especially important for smallholders because their trees respectively account for 42% and 40% of Indonesian and Malaysian oil palm plantations.

Production outlook

There are three key drivers to the palm oil supply and growth prospects in 2021 – area expansion; oil palm tree age and yield; and weather.

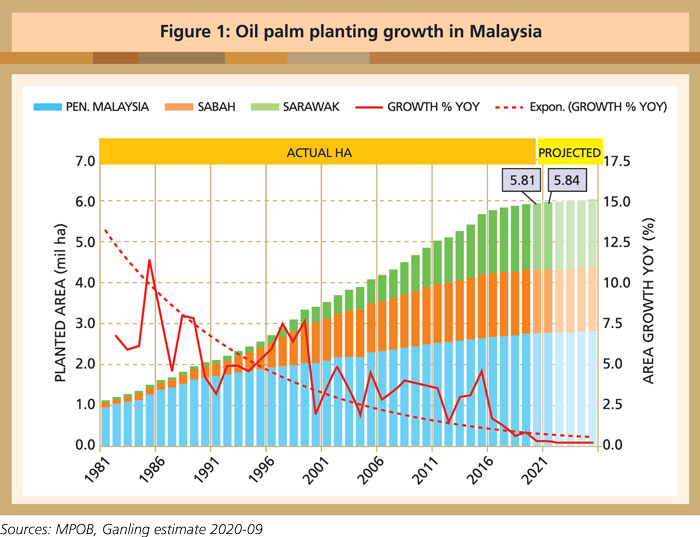

A recent Rabobank Group report highlighted that the slowdown in new plantings is due to a moratorium by the Indonesian and Malaysian governments on agricultural expansion and low commodity prices. Malaysia has capped its oil palm planted area at 6.5 million ha. To date, Indonesia has limited agricultural land availability and approved concession areas of up to 4 million ha. This structural change will impact the global palm oil supply from 2021. The replanting of 500,000 ha of oil palm by Indonesian smallholders, by the end of 2022, should sustain palm oil supply for the world.

According to Ganling Malaysia, the ongoing declining palm oil yield is due to ageing trees across Indonesia (24%) and Malaysia (30%). Any catch-up in replanting will temporarily limit the supply growth in the short to medium term. In Indonesia, replanting at an average of 1% per annum will take about 1.5 million tonnes out of the supply chain, while in Malaysia, the replanting rate average at 1.8% per annum is expected to withdraw about 1.1 million tonnes. The total withdrawal will be about 2.6 million tonnes out of the potential supply chain in 2021.

The La Niña weather pattern, which induces higher rainfall throughout tropical Indonesia and Malaysia, should boost fruit yield and CPO output in 2021. However, higher rainfall could also lead to flooding, which could hurt output and support prices.

The Meteorological, Climatological and Geophysical Agency of Indonesia has forecast a low-to-moderate intensity La Niña in the last three months of 2020. The agency expects about 55% of Indonesia to receive higher rainfall than average. Generally, Southeast Asia, South Africa, India and Australia receive above-normal rainfall due to La Niña, while Argentina, Europe, Brazil and the southern US experience drier weather. The US National Oceanic and Atmospheric Administration has also stated that there is a 75% chance that La Niña will stay for the entire winter, into early 2021.

La Niña is likely to result in a drier climate in the Eastern Pacific and South America, a major area for soybean production. Soybean yields could drop in Argentina and Brazil due to drought-like conditions, which will then support soybean oil prices. Since palm oil and soybean oil are the two most consumed vegetable oils globally, their prices are positively correlated due to easy substitution.

Due to the movement control measures amid the Covid-19 pandemic, Malaysia has banned foreign workers from entering the country. Since foreign labour accounts for 75% of Malaysia’s oil palm plantation workforce, the shortage of workers will lead to palm oil production setbacks in crop losses. A prolonged labour shortage is expected to trigger a larger-than-expected drop in CPO output this year and in 2021.

Indonesia has also enforced large-scale social distancing measures to curb Covid-19. While plantations have imposed strict hygiene measures and restricted workers’ movement, supply disruption is expected to be limited as palm oil producers have no plans to halt operations.

Demand outlook

In 2021, palm oil imports by key destinations are expected to improve slightly from 2020, with the exception of Europe, according to Refinitiv Agriculture Research, Singapore. Economic activities in key palm oil destinations are recovering more swiftly than anticipated, thanks to the resumption of business activities and financial stimuli. Palm oil demand from India and China is expected to grow in 2021.

India’s palm oil imports are expected to spike by 4.8% to 8.7 million tonnes, boosted by a gradual recovery in demand, as well as low inventories. There will be re-stocking and higher demand from bulk buyers in the hotel/restaurant/café sectors after slower demand during the Covid-19 lockdowns. While there has been a surge in palm oil exports to India, domestic crop cultivation, especially soybean, appears to have risen too. Therefore, if there are very good harvests of the rapeseed, groundnut and soybean crops in 2021, India could curtail its palm oil purchases.

China’s demand for palm oil is anticipated to edge up by 3% to 6.9 million tonnes in 2021. The market has seen strong demand for palm oil in anticipation of the Chinese New Year celebrations that typically fall in January or February, as well as due to re-stocking.

EU palm oil imports will likely decline by 8.6% to 6.4 million tonnes, partly due to its policies. Palm oil biodiesel (considered as ‘high risk’ for indirect land-use change under the EU’s Renewable Energy Directive II) usage will be gradually reduced from 2023 until 2030.

Moreover, the EU has set new food safety standards on 3-MCPDE and GE, contaminants found in refined oil products, potentially affecting palm oil demand in the food sector. As the Covid-19 pandemic leads to widespread restaurant closures and lower biodiesel use, overall consumption of palm oil is expected to be reduced in Europe.

Refinitiv also reports that Indonesia and Malaysia have continued to support the B30 and B20 biodiesel programmes respectively, despite subdued biodiesel consumption during the pandemic resulting from social distancing measures and movement control orders, as well as the high CPO premium over gas oil.

The price spread between palm oil and gas oil has been widening since the last quarter of 2019 to the peak of US$400 per tonne level. But in September 2020, it stabilised at around US$370, the highest since April 2016.

Due to the CPO premium over gas oil, the Indonesian government has allocated 2.78 trillion Rupiah to support the B30 programme for 2020.

Malaysia’s B20 mandate was restarted in Sarawak on Sept 1, 2020. It will be implemented in Sabah and Peninsular Malaysia in January and June 2021 respectively. Biodiesel mandates are anticipated to absorb around 10 million tonnes of CPO from both palm oil producing countries in 2021. This will support domestic consumption and reduce palm oil inventories.

It is projected that the palm oil market will likely trend up in the near-term in tandem with soybean prices, which is mainly supported by higher demand for soybean from China; lower global soybean stock estimates by the US Department of Agriculture; and unfavourable weather in the US Midwest and South America (namely Argentina and Brazil). One example would be Brazil’s current drought, which has delayed soybean plantings, thereby supporting soybean prices. La Niña could also limit the soybean oil yield potential.

Price and supply outlook

As at November 2020, palm oil futures on Bursa Malaysia Derivatives Market were trading above RM3,000 per tonne. If this continues for the rest of the year, palm oil prices will probably average around RM2,600-2,650, a return to the more optimistic prices of 2017.

Based on tighter supply-demand dynamics and low palm oil stocks, the CPOPC sees the momentum continuing until higher production resumes in the second half of 2021. The wider CPO price discount to other vegetable oils is also supportive of global palm oil demand. Droughts in the Black Sea region are also limiting sunflower and rapeseed production. This will result in elevated vegetable oil prices well into the first half of 2021. At the same time, the developing La Niña may cause some disruptions to soybean production in South America. If the dry weather persists, there will be more severe soybean oil disruptions in Brazil and Argentina.

Current edible oil stockpiles in China and India are also tight, keeping edible oil imports healthy. The price surge in the last quarter of 2020 reflects the rapidly recovering demand from India and China, the world’s two biggest palm oil consumers after they went through nationwide lockdowns and temporary halts on economic activities due to Covid-19. The rise in competing edible oil prices is also positive. It could encourage consumers to switch to palm oil as a cheaper alternative.

Many analysts agree that palm oil supply will improve in the second half of 2021 due to the effect of higher rainfall, which should be beneficial for FFB yields. Both Ganling Malaysia and Rabobank foresee that good weather conditions in Indonesia and Malaysia will raise global palm oil supply by 3.1 million tonnes in 2021.

There are also concerns that the current zero export tax for CPO in Malaysia may not be extended beyond Dec 31, 2020. This could negatively impact CPO exports to India, while Indonesia could raise its CPO export levy to support its B30 mandate.

On the whole, the palm oil outlook in 2021 looks favourable compared with the average prices of 2019 and 2020. However, this will depend on the development of La Niña on the soybean complex in South America and Indonesia’s B30 biodiesel mandate. The full implementation of the B30 mandate in Indonesia and the B20 mandate in Malaysia is crucial to sustain domestic consumption and absorb the anticipated palm oil supply growth. A deficit situation in global vegetable oils will lend support to CPO prices in 2021.

Council of Palm Oil Producing Countries

Jakarta, Indonesia

This is a slightly edited version of the report published in December 2020.