The global oils and fats trade proved very demanding throughout 2017. This was attributed partially to political, social and economic uncertainties. Free trade as understood and practised over the decades was twisted by new political demands in the China-US trade negotiations, as well as the European Parliament’s vote proposing an earlier exit date for palm biofuels in the RED II mandates.

Such sparring between trading nations does not augur well for the global economy and more specifically for palm oil producing nations. The tremors in the case of the latter are often felt in the very heart of smallholders. Their livelihood is impacted by decisions taken by the high and mighty, who never come face to face with the very communities compromised by their lopsided decisions.

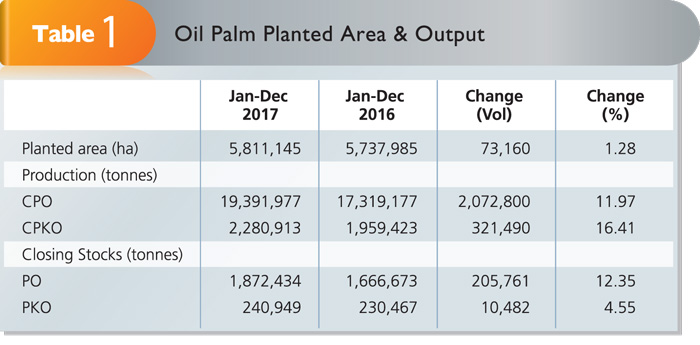

In spite of these increasingly challenging scenarios, Malaysian palm oil mostly tracked positive results in 2017, thanks to the discipline, commitment and teamwork of all stakeholders. This was assisted by fair weather conditions. The overall Malaysian oil palm planted acreage was recorded at 5.8 million ha in 2017, a 1.3% growth of 73,160 ha compared to 5.7 million ha in 2016 (Table 1).

Source: MPOB – data as at Feb 28, 2018; subject to revision

Crude palm oil production jumped by 2.1 million tonnes (11.9%) compared to 2016. Weather conditions improved throughout the year, especially in the second half, and this more than made up for the production shortfalls of 2016. Production of crude palm kernel oil (2.3 million tonnes) increased by 321,490 tonnes (by 16.4%) compared to almost 2 million tonnes in 2016.

Compared to 2016, palm oil production recovered in 2017, resulting in higher monthly ending stocks. December 2017 recorded a higher year-ending stock of 1.9 million tonnes compared to 1.7 million tonnes the previous year.

For palm kernel oil, the stock levels were recorded lower in the first quarter of 2017, but gradually rose in the following months. The year-ending stock was recorded marginally higher at 240,949 tonnes against 230,467 tonnes a year earlier.

In 2017, prices were higher, influenced by the slower recovery of palm oil production, the weaker Ringgit and stronger demand by major consuming countries. The annual average FOB CPO price increased by US$16.67 (2.5%) to US$678.67 per tonne against US$662 in 2016. This was also reflected in the higher export earnings of palm-based products at RM74.75 billion.

Market performance

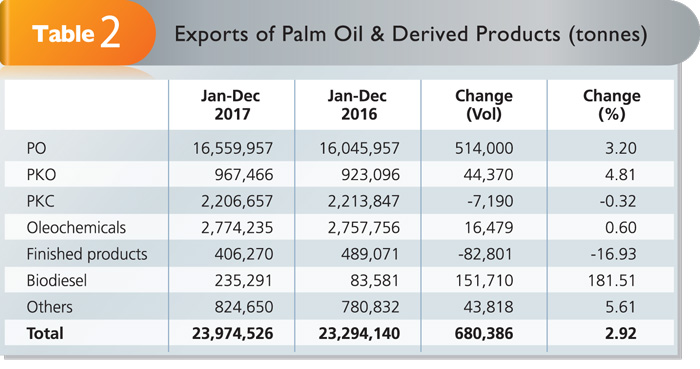

2017 saw higher exports of palm oil and its derived products. Total exports were at 23.9 million tonnes (Table 2), an increase of 680,386 tonnes (2.9%). With the exception of palm kernel cake and finished products, all other palm products registered increases in export volume. Palm biodiesel exports increased by an impressive 151,710 tonnes (181.5%), facilitated by an anti-dumping litigation against palm biodiesel ex-Indonesia.

Source: MPOB – data as at Feb 28, 2018; subject to revision

Exports of finished products in 2017 fell by 82,801 tonnes, mainly due to the drop in soap chips imported by the Philippines, followed by the drop in shortenings, vegetable fats and vegetable ghee demand from several consuming regions.

Soap chip imports by the Philippines dropped due to higher availability of coconut oil in the domestic market that grew 7% in 2017; this narrowed the price gap between locally-produced soap noodles and imported soap noodles made from palm oil.

Increased exports of other palm products were led by palm kernel shell and palm fibre to Japan, going up from 431,154 tonnes to 478,422 tonnes; and to China, from 213,216 tonnes to 217,777 tonnes, for use in their energy sector.

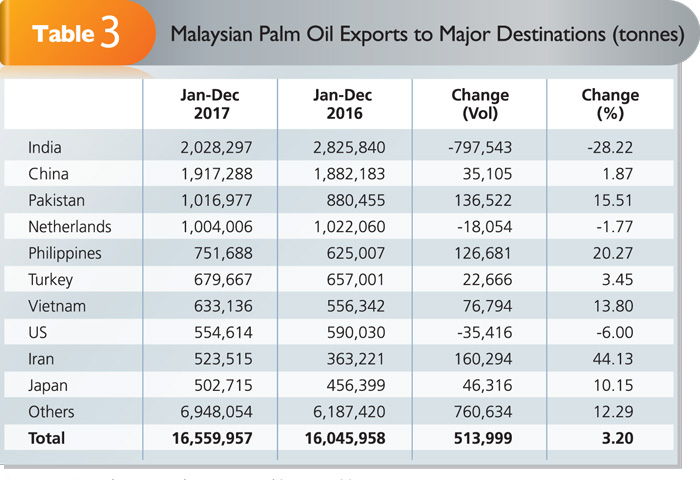

Overall, Malaysia exported 16.6 million tonnes of palm oil, an increase of 513,999 tonnes (3.2%) compared to 2016 (Table 3). The top 10 importing countries purchased 9.6 million tonnes or 58% of Malaysian palm oil. Demand for Malaysian palm oil continued to be driven by strong consumption especially in countries like India, China, Pakistan, the Netherlands and the Philippines.

Source: MPOB – data as at Feb 28, 2018; subject to revision

India retained its position for the second year running as the biggest importer of Malaysian palm oil, even though it imported 797,543 tonnes (28.2%) less compared to 2016. The uptake of more than 2 million tonnes represented 12.3% of Malaysian palm oil exports. Competitive prices of crude palm oil and processed palm oil from Indonesia impeded further inroads by Malaysian palm oil in India.

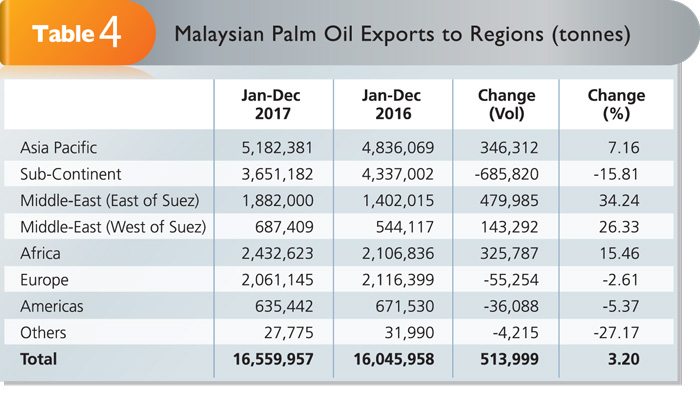

Some regions registered consistent growth for Malaysian palm oil and derived products. Overall, uptake of Malaysian palm oil showed an increase of 3.2% (513,999 tonnes), highlighted by a 7.2% increase in the Asia Pacific, 34.2% in the East of Suez, 26.3% in the West of Suez and 15.5% in Africa (Table 4).

Source: MPOB – data as at Feb 28, 2018; subject to revision

MPOC continues to ensure that Malaysian palm oil retains a favourable global market position through its various programmes and activities that have also contributed to the improved export performance.

Our key Palm Oil Trade Fair and Seminar was instrumental in again creating much needed awareness among the trade; this was successfully completed in Iran and Ghana. In the US, another MPOC-branded programme held was the Global Oils and Fats Forum. These events were supplemented through a targeted outreach programme called Techno-Economic and Marketing of Palm Oil in Uzbekistan, Pakistan, the Philippines, Egypt, South Korea and China.

A number of official delegations led by the Minister of Plantation Industries and Commodities to key importing nations or regions (Vietnam, the Philippines, EU-28, Japan, Iran and India) assisted in enhancing exports of Malaysian palm oil.

Global scenario

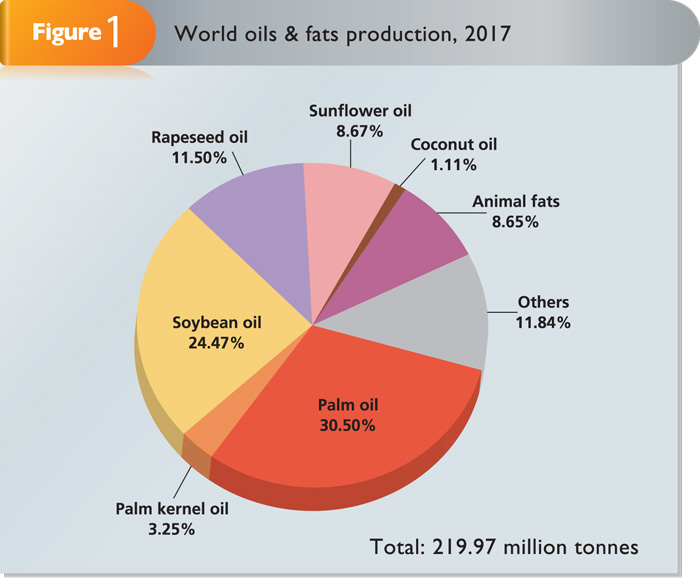

The 2017 world production of oils and fats stood at about 219.9 million tonnes, an impressive increase of 14.3 million tonnes from 2016 (Figure 1). Palm oil and palm kernel oil jointly accounted for 74.3 million tonnes, which made up 33.8% of total oils and fats production. Soybean oil output contributed 51.5 million tonnes (24.5%) and rapeseed oil registered 24.9 million tonnes (11.5%).

Source: Oil World & MPOC estimates

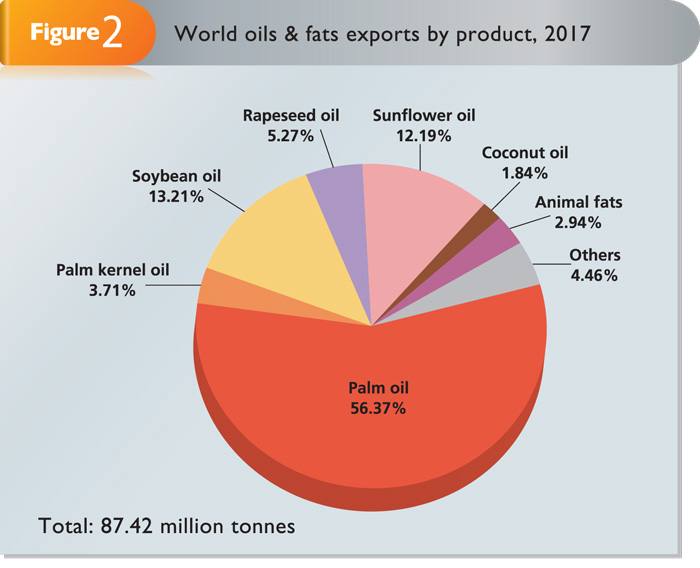

Of the 87.4 million tonnes of oils and fats traded worldwide in 2017, palm oil and palm kernel oil together accounted for 60.1% (Figure 2). Malaysia retained its position as a major player in the oils and fats export market. Its palm oil exports of 16.6 million tonnes represented 33.6% of the global palm oil trade.

Source: Oil World & MPOC estimates

The IMF forecasts that China’s GDP will continue to grow this year at 6.5%, while its population will grow by 0.5% or 6.3 million to 1.4 billion. In line with this, MPOC’s supply and demand model predicts that China’s domestic oils and fats disappearance will increase to approximately 37.6 million tonnes. Palm oil import demand is projected at about 5.1 million tonnes on account of high palm oil stocks at the end of the year and projected improved soybean crushing.

In India, population growth will continue to drive oils and fats consumption. Its 2018 oils and fats production is forecast to increase to 9.9 million tonnes, which is only 4.1% more than in 2017. The country will continue to be dependent upon imports to fill the supply and demand gap. MPOC anticipates India’s palm oil imports to stand at 10 million tonnes this year.

For EU-28, MPOC estimates that oils and fats imports will increase slightly to 12.3 million tonnes. Overall, palm oil imports are projected at 7.6 million tonnes and Malaysia’s share is estimated at over 2 million tonnes.

The Middle East region should feature as a net importer of oils and fats as domestic production caters to less than 40% of projected consumption. Countries such as Saudi Arabia, Egypt, Turkey and Iran will continue to spur demand. MPOC estimates imports of Malaysian palm oil by Turkey and Iran at 1 million tonnes on account of the favourable FTA with Turkey and removal of the palm oil import quota in Iran.

Africa, with its population of more than 900 million, will present significant opportunities for palm oil. The region is deficient in its production of domestic oils and fats and will continue to depend upon palm oil imports to satisfy its consumption needs.

MPOC estimates total oils and fats imports by the Sub-Saharan region this year to record 5.7 million tonnes, of which palm oil will account for nearly 5.1 million tonnes.

The Asia Pacific region is expected to record healthy growth demand for Malaysian palm oil, to potentially reach 3.4 million tonnes. The Philippines, Vietnam and Japan are anticipated to feature as strong markets for Malaysian palm oil and its products.

MPOC