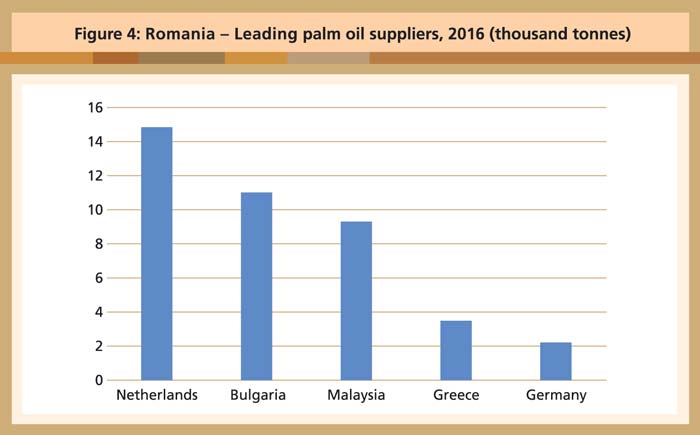

In 2016, Malaysia sold 9,300 tonnes of palm oil to Romania (Figure 4). Interestingly, Bulgaria supplied 11,000 tonnes.

Source: Oil World Annual 2017

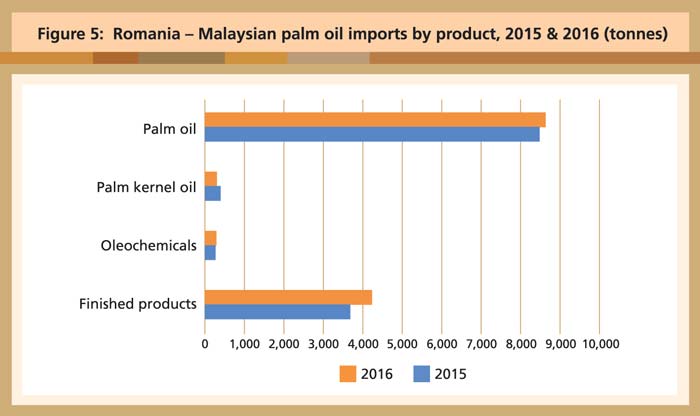

Malaysian Palm Oil Board statistics show a slight increase in the export volume of palm-based products, except palm kernel oil (Figure 5).

Source: MPOB

In 2016, biodiesel exports were not registered after having recorded almost 3,000 tonnes in 2013. Perhaps this was an indication of higher domestic production. The global agribusiness and food company Bunge Limited has sites in the cities of Buzau and Lehliu; it claims to be ‘the principal trader in the local market and a leader in bottled oil and biodiesel’.

Given its relatively sizeable population, impressive growth rates for a few years now, and increased foreign direct investment into vegetable oil infrastructure, it appears that the volume of Romania’s palm oil imports has not lived up to the market potential.

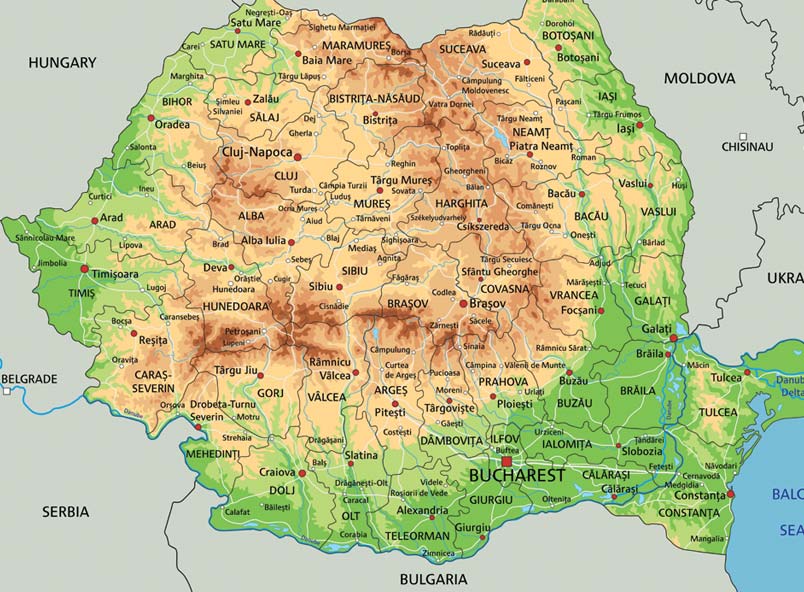

Romania is uniquely positioned as a gateway to Eastern Europe. It is a redistribution hub for markets to the west via Constanta, the biggest port on the Black Sea, as well as the navigable Danube River.

The movement of goods through Constanta is growing by about 8% annually. In addition, Rotterdam, the largest edible oil processing and redistribution hub in Europe, is an important partner city of Constanta. All this bodes well for palm oil sellers intending to venture into Romania.

MPOC Brussels

Pages : 1 2