Palm oil

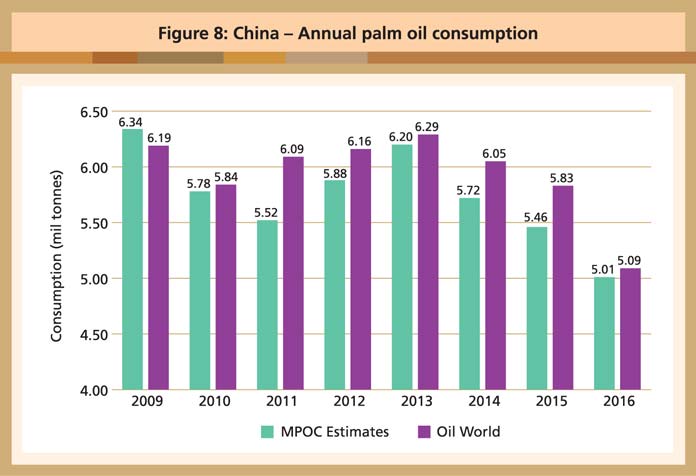

Despite a significant reduction in China’s palm oil imports by 1.4 million tonnes last year, consumption only dropped 450,000 tonnes and was pegged at about 5 million tonnes based on MPOC estimates. Part of the demand was met by utilising stocks held in the country. In the years when there was no disruption in global supply, the minimum consumption in China was 5.5 million tonnes (Figure 8).

Source: Oil World, Chinese Customs, Shanghai Pansun, MPOC estimates

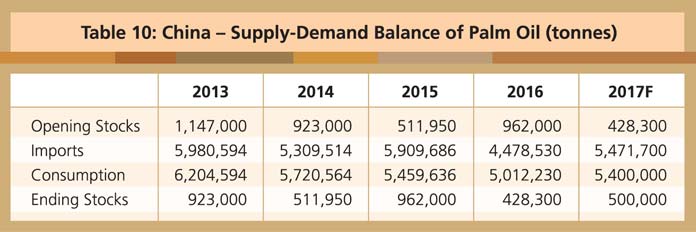

Since the palm oil stock level in China is relatively low (less than, or close to, the one-month buffer stock required to ensure that supply is not disrupted), demand will be largely satisfied through imports of at least 5.5 million tonnes this year – up by 993,170 tonnes compared to last year (Table 10). About 1.6 million tonnes will be utilised by the oleochemicals industry and the rest by the food sector.

Source: Chinese Customs, Shanghai Pansun, MPOC estimates

Soybean oil

The supply-demand balance of soybean oil is reliant on the animal feed sector, which expects to generate better demand this year. The volume of soybean imports will therefore also expand, as will soybean oil supply.

The China National Grain and Oils Information Centre has predicted that 2016/17 soybean imports will grow by about 3.3 million tonnes, or by 3.9%, compared to 2015/16. Soybean oil supply is expected to rise by 318,600 tonnes (at an extraction rate of 18%), which is about equivalent to China’s additional oils and fats needs this year.

Desmond Ng

MPOC China