Supply-demand landscape

Rapeseed oil

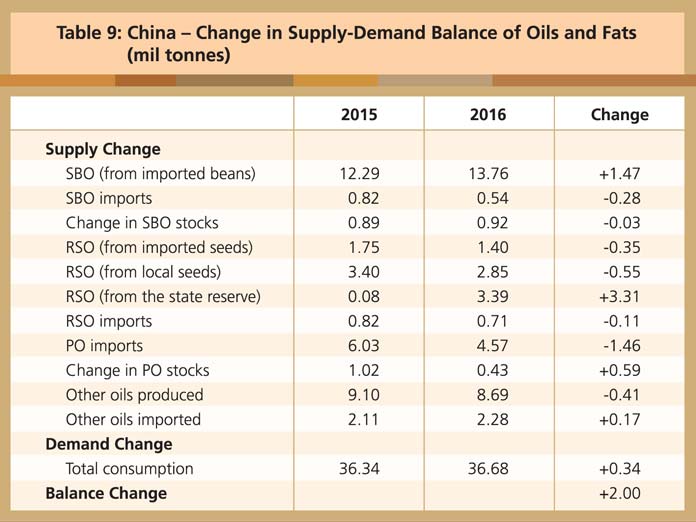

From analysis of available data, there appears to be a huge carryover stock of rapeseed oil – estimated at 2 million tonnes – into this year (Table 9). The government continued to release the state reserve of rapeseed oil through a weekly auction of 100,000 tonnes until March 15. About 889,540 tonnes have been auctioned to date this year, while an estimated 1.4 million tonnes remain in reserve.

Source: Oil World, MPOC estimates

The government suspended the auction because of the build-up of rapeseed oil stocks in the market. This put pressure on the selling price, especially when the auction price fell in February. Buyers of earlier batches have had difficulty selling their stocks because they had paid a higher price last December and in January this year.

According to official data, about 1.8 million tonnes of the rapeseed oil auctioned since last October had been collected from the designated tanks. However, only some 800,000 tonnes had been utilised as at the end of March. So, about 1 million tonnes remain in the bidders’ storage tanks.

Based on the policy of the National Grain Trade Centre, successful bidders are required to collect the oil within 60 days. This means that the volume auctioned since Feb 15 this year – 397,134 tonnes – had yet to be released into the market at the time of writing. The price will come under further pressure when the volume is fully offloaded into the market by mid-May.

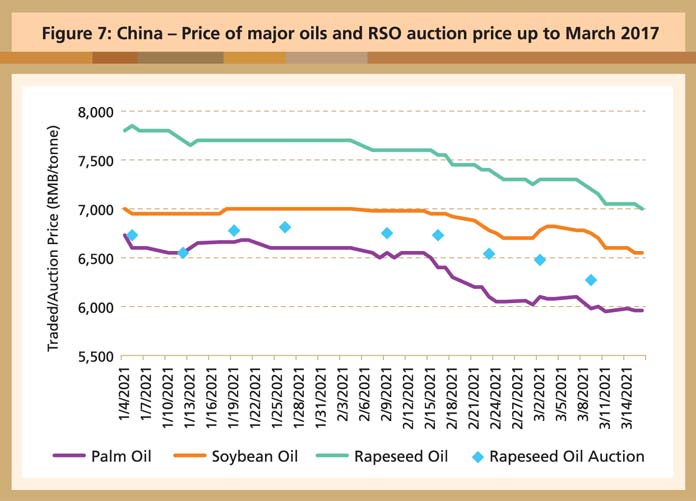

However, this may not necessarily prevent importers or traders from importing oils. For instance, the auction price from January to March this year was higher than the market price of RBD palm olein. When the cost of refining the auctioned rapeseed oil is taken into account, RBD palm olein will be more competitively priced.

Source: CNGOIC, National Grain Trade Centre

At the same time, the auctioned rapeseed oil will compete with imported rapeseed and rapeseed oil. Domestic rapeseed production is forecast to be lower by 931,000 tonnes this year, which is equivalent to a reduction of about 460,000 tonnes of rapeseed oil.

Another reason why RBD palm olein will not face competition is that the state reserve consists of Grade 4 rapeseed oil, which is mainly used as cooking oil in rural or suburban areas in the central region of China. Refining it to Grade 1 – for use as bottled cooking oil – would cost about RMB300-400/tonne. Complicating the situation is that the quality of the Grade 4 oil is below par or adulterated with cottonseed oil. It therefore cannot be used for applications that RBD palm olein fulfils.

However, the cheaper auctioned rapeseed oil could still create difficulties in the domestic market by putting pressure first on the soybean oil price, and then that of RBD palm olein. If the price discount of RBD palm olein against soybean oil does not stay at an attractive level – given that it varies throughout the year due to weather conditions – consumption of RBD palm olein will be flat this year compared to last year.