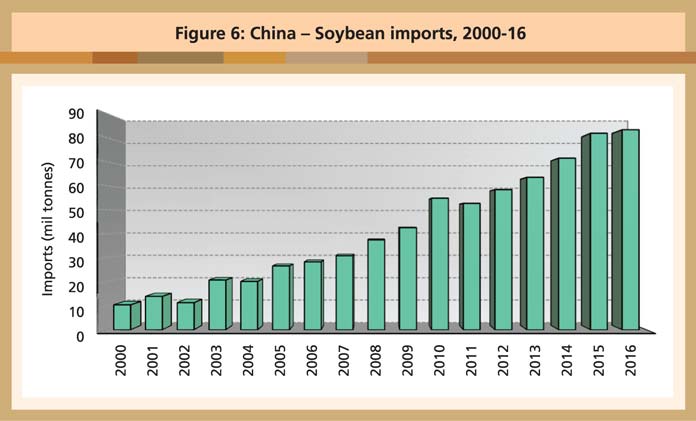

Soybean imports

Since the 1990s, China has imported bigger amounts of soybean (Figure 6) for crushing to produce meal for animal feed, with oil being a by-product. From 2003-16, the volume grew at an average rate of 11.3%, accounting for more than 90% of all imported oilseeds.

Source: Oil World

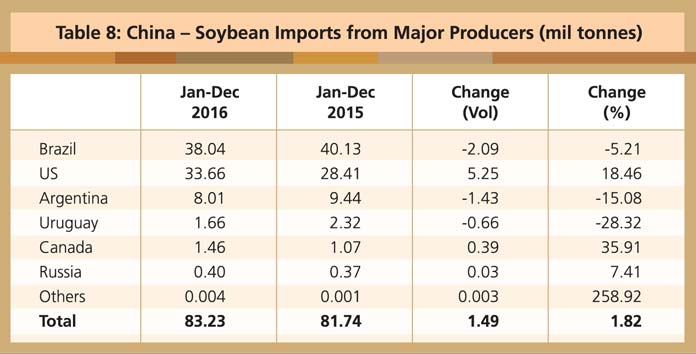

Last year, a reduction in South American soybean supply and the depreciation of the Renminbi increased the cost of – and discouraged interest in – importing soybean from Brazil, Argentina and Uruguay (Table 8). The price of US soybean rose by 25% – from RMB2,850/tonne to RMB3,550/tonne – over the year. Nonetheless, domestic crushing remained strong at 77.6 million tonnes, against 70.1 million tonnes in 2015.

Source: General Administration of Customs, China