Rapeseed oil

The domestic supply-demand balance of vegetable oils, as well as their prices, were disrupted substantially last year when the government auctioned close to 3.4 million tonnes of the state reserve of rapeseed oil. An estimated 6.2 million tonnes were available as at the end of 2015, having been purchased annually and stored since 2009 to protect the interests of rapeseed farmers. Prior to last year, only a small quantity had been auctioned and released into the market.

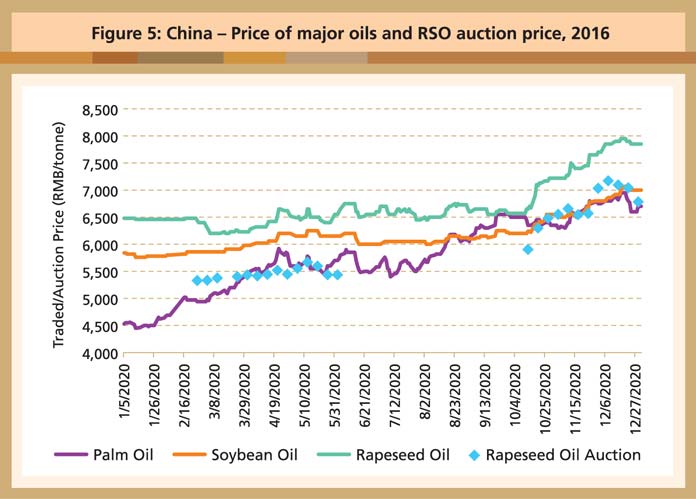

Since the quality of some of the oil had deteriorated over the years, the auction base-price was far lower than the market price of rapeseed oil – and even soybean oil – so that it could be sold at a competitive price after refining (Figure 5).

Source: CNGOIC, National Grain Trade Centre

Many traders took advantage of the competitive auction price, which was lower than, or on par with, that of RBD palm olein over the first half of last year. This eroded the import share of RBD palm olein, especially in the blended cooking oil segment. Soybean oil and rapeseed oil imports were similarly affected.

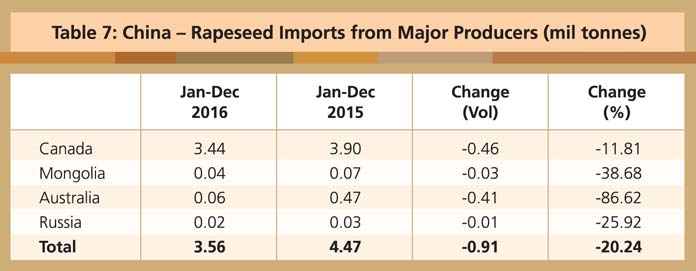

The impact spread to rapeseed imports, which decreased for the second consecutive year (Table 7) although this was also due to two other factors. China had intended to impose a requirement from April 1 to reduce impurity in imported rapeseed, from 2% to 1%. Implementation was postponed to Sept 1, and then suspended after a meeting with Canada’s leaders. It, however, deterred importers and traders from placing orders. Import activities were further affected by the smaller rapeseed output worldwide.

Source: General Administration of Customs, China