Palm oil imports

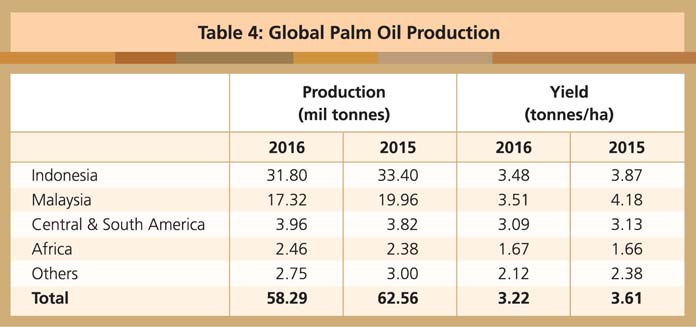

CPO from Indonesia and Malaysia accounts for 84% of global supply. However, this fell significantly by about 8% last year (Table 4), due to the impact of the El Nino phenomenon which started in early 2015 and lasted about 15 months. It affected the production of fresh fruit bunches, as well as the oil yield. The decline in the combined CPO output of both countries last year was estimated at 4.2 million tonnes. This limited the availability of CPO and processed palm products for export, as the two countries ship at least 70% of their production to more than 150 countries.

Source: Oil World

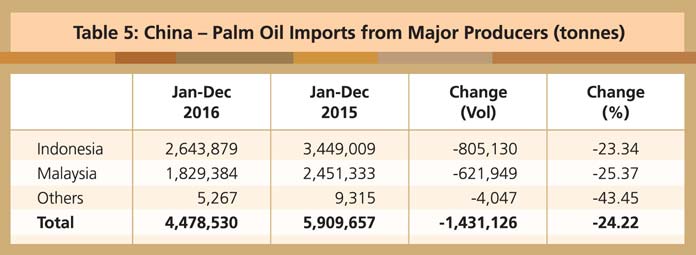

China’s palm oil imports from Indonesia and Malaysia fell by 23.3% and 25.4% respectively, compared to 2015 (Table 5). The rate of decline was higher than the drop in CPO output of both countries. An explanation for this can be found in China’s import duty structure for palm-based products.

Source: General Administration of Customs, China

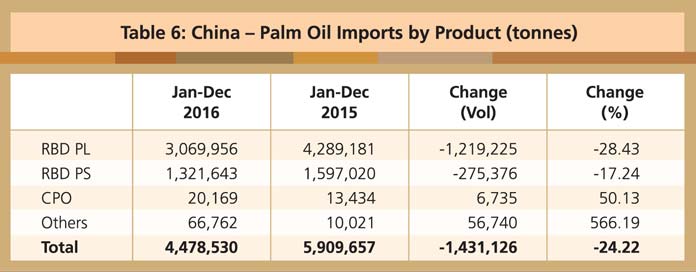

China mainly imports RBD palm olein and RBD palm stearin (Table 6) to meet industrial demand. The decision is greatly influenced by the import duty structure. Duty is set at 9% for all palm-based products, except RBD palm stearin (8% for melting point below 50°C, and 2% for melting point from 50-55°C). There is also a difference in the value added tax – 13% for RBD palm olein, RBD palm stearin and CPO; and 17% for other palm-based products. As such, it is more economical for China to import RBD palm olein and RBD palm stearin.

Source: General Administration of Customs, China

Competition and price sensitivity also play a role in the choices made. RBD palm olein is used in the food processing and catering sectors; in winter, however, it has to be fractionated to a lower melting point to be used in pure or blended form with other soft oils.