Market Updates – Issue 1, 2018

By gofb-adm on Thursday, April 26th, 2018 in Issue 1 - 2018, Market Briefs No Comments

By gofb-adm on Thursday, April 26th, 2018 in Issue 1 - 2018, Market Briefs No Comments

Summary

Envoy: China will not ban Malaysian palm oil

China will not impose a ban on Malaysian palm oil and palm-based products, said H.E. Bai Tian, who is China’s Ambassador to Malaysia.

Instead, China will import more primary products such as palm oil and rubber-based products from Malaysia in the future.

“We will not set any limit on the import of Malaysian palm oil and related products. There will be no glass ceiling for the imports,” he said after paying a courtesy call on Plantation Industries and Commodities Minister Datuk Seri Mah Siew Keong in Putrajaya.

Malaysia exported palm oil and palm-based products worth RM8.5 billion to China from January to November 2017, compared to RM7.8 billion over the same period in 2016 – this reflects an increase of 9.8%.

Bai said China would encourage more of its business community to invest in primary industries, especially biomass, in Malaysia.

On China’s biodiesel market, he said diesel and biodiesel B5 consumption in 2016 stood at about 165 million tonnes and 8.3 million tonnes, respectively, while its biodiesel production in 2015 was 300,000 tonnes.

“This means, we need to import 8 million tonnes of biodiesel. I think this is good news for palm biodiesel producers. We hope Malaysia will take up this golden opportunity,” he said.

Meanwhile, Mah said China is the second-biggest buyer of Malaysian palm oil and palm-based products after the EU for its biofuel needs.

“China has overtaken India to become the Number Two export destination for Malaysian palm oil and palm-based products. We expect China to become the biggest importer of our commodity in two years’ time,” he said.

Mah further said the Ministry, through the Malaysian Palm Oil Board, is conducting a study with China’s Tsinghua University on biodiesel B5.

To counter the EU’s intended palm oil ban in biofuels, Mah said Malaysia is pursuing the growth potential in markets like Iran, Vietnam, the Philippines, Japan and the Middle East.

On rubber and rubber products, Mah said China has overtaken the US and the EU to become Malaysia’s top export destination.

He said Malaysia exported rubber and rubber products worth RM7.5 billion to China from January to November 2017, an increase of 76% compared to RM4.2 billion over the same period in 2016.

Source: Bernama, Feb 3, 2018

Another stiff hike in India’s import duty on palm oil

India has raised import tax on crude and refined palm oil to the highest level in more than a decade, the government said in a statement, as the world’s biggest edible oil importer tried to support local farmers.

The duty increase would lift oilseed prices and encourage domestic supply for crushing, helping to cap edible oil imports in the 2017/18 marketing year that started on Nov 1, dealers said.

India raised import tax on crude palm oil to 44% from 30% and on refined palm oil to 54% from 40%, a government order said.

India relies on imports for 70% of its edible oil consumption, up from 44% in 2001/02.

The fourth increase in import tax in less than six months would push up domestic edible oil prices and support prices of local oilseeds like soybean and rapeseed, said BV Mehta, executive director of the Solvent Extractors’ Association, a Mumbai-based trade body.

“Supplies from the new season rapeseed crop have just started. Now farmers will get remunerative prices due to the duty hike,” Mehta said.

India primarily imports palm oil from Indonesia and Malaysia and soybean oil from Argentina and Brazil. It also buys small volumes of sunflower oil from Ukraine and canola oil from Canada.

The duty hike will narrow the difference between palm oil and soft oils like soybean oil and sunflower oil, making it lucrative for refiners to increase purchases of soybean oil and sunflower oil in the coming months, said a Mumbai-based dealer with a global trading firm.

“Palm oil’s share is likely to fall substantially unless India raises import tax on soybean oil and sunflower oil,” the dealer said.

Source: Reuters, March 2, 2018

Traceability required for sale of CPO futures in Malaysia

Sellers of crude palm oil futures who want to be involved in physical deliveries must now provide traceability details up to the palm oil mill’s location, according to a document posted on the Bursa Malaysia Derivatives website.

Crude palm oil sellers should submit traceability documents to port tank installations approved by Bursa Malaysia Derivatives.

The traceability document requires the name of the parent company, mill address and coordinates, and quantity of crude palm oil received. The requirement took effect from Feb 26.

Source: Reuters, Feb 26, 2018

Leading analyst predicts higher Malaysian palm oil prices

Malaysian palm oil prices are expected to trade at RM2,500 to RM2,700 per tonne as production falls from March and stock levels decline between January and July.

Leading vegetable oils analyst Dorab Mistry said this would mean a recovery for benchmark palm oil prices that have slumped more than 10% since early November 2017 on rising Malaysian stockpiles. Inventory levels in Malaysia rose to their highest in more than two years in December 2017, hitting 2.7 million tonnes.

“Palm oil looks oversold and demand is at record levels,” Mistry said at an edible oils conference in Karachi, Pakistan.

“We must expect measures from the Malaysian government to assist small growers and to support prices. Stocks have peaked and will gradually decline from now until July.”

Mistry said his price outlook is based on an assumption of Brent crude oil prices at US$60-75 a barrel.

Palm oil production typically rises during the fourth quarter of each year before declining through the middle of the following year. Analysts, however, expect to see slower seasonal tapering this year, as output trends have been affected by the El Nino event of 2015.

Mistry, the director of Indian consumer goods company Godrej International, pegged Malaysia’s 2018 palm oil output at 21 million tonnes, while Indonesia’s was forecast at 38 million tonnes. Together, these countries account for nearly 90% of global palm oil production.

The Malaysian Palm Oil Board reported an output of 19.9 million tonnes last year, while the Indonesia Palm Oil Association estimated its production at 36.5 million tonnes.

“Overall in oil year 2017-2018 [ending September 2018], palm oil production will be up at least 4.5 million tonnes [globally],” said Mistry.

Based on rainfall patterns and weather forecasts, production is expected to surge from September, he said.

The crude palm oil price would rise to US$750 per tonne CIF Rotterdam by mid-year, while the RBD palm olein price would touch US$720 a tonne on a free-on-board basis, he added.

Source: Reuters, Jan 22, 2018

India’s branded edible oils sales cross Rs 1.3 trillion mark

Health-conscious Indians are driving the sale of branded edible oils, ditching ‘loose oil’ sold by neighbourhood grocery stores.

According to market research firm Euromonitor International, the edible oils category in India grew 25.6% to cross the Rs 1.3 trillion mark last year – the first time any packaged food category has done so. Dairy products were second, achieving Rs 1.2 trillion or 16.5% more than in 2016.

Edible oils formed over 30% of the Rs 4.3 trillion packaged foods market in India, compared to the 8.8% share held by rice, pasta and noodles.

“Growth is primarily coming from new consumers who are shifting from loose to packaged oils,” said Atul Chaturvedi, chief executive officer of Adani Wilmar Ltd, which refines and produces edible oils.

Deoki Muchhal, managing director of Cargill’s food business in India, said: “Packaged oil sales are growing at 2.5 times the rate of overall edible oils consumption in India.

“Increasing awareness of safe products, the food law administration restricting loose product sales and the crackdown by the government on unfair trade practices have aided this growth.”

According to Euromonitor, the rice, pasta and noodles category will grow faster than others until 2022 with a 12% cumulative average growth rate, followed by breakfast cereals (10.6%). Edible oils are expected to maintain a healthy rate of 9%.

Source: Business Standard, Feb 7, 2018

India’s cooking oil imports on the rise

In the wake of unsatisfactory oilseed production in the harvesting year 2017-18, India is expected to import 15 million tonnes of cooking oil. This is likely to push up the annual bill for edible oils imports to about Rs 650 billion.

The latest survey by the Soybean Processors Association estimates that Indian soybean production will register 8.4 million tonnes, or 24% less compared to 10.9 million tonnes previously. Soybean contributes nearly a third of domestic oilseeds output.

India is the world’s largest importer of edible oils, buying nearly 70% of the volume required to keep pace with consumer demand for cooking oil.

Local farmers having been planting less soybean each year to avoid losses arising from low prices. Last year, industry players and farmers requested the government to impose higher import duty on edible oils in order to safeguard their interests. As a result, the import duty was raised to the highest level in more than 10 years.

Source: Financial Express, Feb 13, 2018

Turning oil palm waste into biogas in Thailand

Thai palm oil producer Agriculture of Basin Co Ltd (ABC) and Japan’s Osaka Gas Co Ltd are engaged in a joint project to refine biogas – generated from agriculture process residues – for use as fuel in vehicles that run on natural gas.

ABC has installed a facility to refine biogas, as well as a natural gas station, at its palm oil factory in southern Thailand. Organic matter in the factory’s wastewater first goes through the process of digestion to generate biogas. This is then refined into biomethane – a renewable natural gas – after removing carbon dioxide (CO2) and other impurities.

The hybrid biogas refining system, developed by Osaka Gas, is based on an original combination – CO2 separation membrane with Pressure Swing Adsorption, a technology that selectively adsorbs and removes CO2. The system, which can extract 99% of the methane contained in biogas, is among the most efficient of its kind, according to Osaka Gas.

A year-long pilot project was launched last November to focus on verification of a long-term stable operation, as well as methods to minimise the cost of producing methane gas and determine the effectiveness of the output as a vehicle fuel.

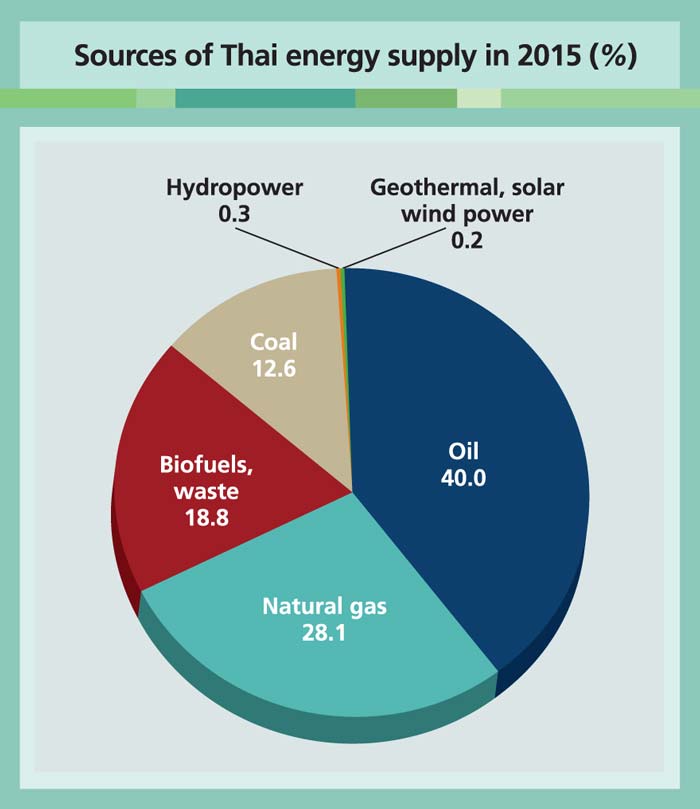

Source: International Energy Agency

Note: Electricity trade not included

Once approved as meeting Thailand’s quality standards for vehicle fuel, ABC will use the refined methane gas to run its own natural gas-powered vehicles. Based on the outcome of pilot testing, ABC will develop further transportation initiatives to effectively utilise the renewable natural gas.

The project is supported by the Thai government, which has provided over 40% of the 35 million baht (US$1.1 million) that ABC has spent building the natural gas station.

With concerns growing about the depletion of domestic natural gas reserves – the principal source of electricity in Thailand – the government is keen to develop new sources of energy.

It is therefore looking to biogas to help raise the share of renewable energy sources in the country’s overall final energy consumption to 30% by 2036.

The clean energy campaign is also driven by growing concerns about the heavy dependence on imported energy. Thailand uses imports for over 40% of its energy needs, according to the International Energy Agency.

The government views biomethane as an important energy source that can help the country wean itself off its reliance on imports, a top official at the Ministry of Energy said.

Since agriculture is one of Thailand’s most prominent industries, there is an abundance of biomass resources. These include oil palm residue; the remnants of sugarcane crushed to extract juice; and food factory wastewater. The use of natural gas vehicles is also becoming more prevalent in Thailand.

Sources: Business Wire, Nov 26, 2017; NVG Global News, Dec 3, 2017; Nikkei Asian Review, Jan 5, 2018

Malaysia enhances use of oil palm trunks, rubber trees

Malaysia is making better use of wood from oil palm trunks and rubber trees, given the versatility and durability of this raw material.

The move away from hardwood timber is also in line with efforts to conserve the country’s natural forests, said Malaysian Timber Industry Board (MTIB) director-general Datuk Dr Jalaluddin Harun.

Timber industry players are looking at using raw materials from rubber trees and oil palm trunks to produce veneer, plywood and panels, he said.

“We have relatively huge rubber and oil palm plantations. Currently, 80% of our furniture exports [are made of] rubber wood. The future of the plantation sector is secure,” he said.

Malaysia has close to 1.1 million ha of rubber estates to sustain demand for timber downstream businesses.

“We also have 5.7 million ha of oil palm plantations. These estates undergo replanting after 25 years. We have about 80,000 ha to 100,000 ha of oil palm plantations available for harvesting and replanting annually,” he said.

Currently, five factories produce veneer plywood and soft-timber made from oil palm trunks.

Jalaluddin said the National Forestry Department is also active in replanting trees: “In that sense, we are managing the situation sustainably for the future. For example, we plant Acacia mangium. We have more than 300,000 ha in Sabah, Sarawak and Peninsular Malaysia.”

Malaysia is the world’s eighth-largest exporter of wooden furniture. Japan is its biggest market for timber exports, followed by the US, European Union, India and Australia.

The MTIB also encourages the import of raw materials from North America, Europe, Africa and Latin America to add value to the furniture-making chain. Finished products are then exported at a premium price.

Logs are processing into furniture parts and building components like flooring, wall panels and mouldings, said an industry player.

Affin Hwang Capital plantation analyst Nadia Aquidah said timber is in scarce supply globally due to reduced availability of natural forest logs.

“There is no problem in selling our logs [while] the demand for plywood remains stable,” she added.

Within this scenario, oil palm smallholders have been urged to make better use of oil palm trunks whenever they carry out replanting.

Plantation Industries and Commodities Minister Datuk Seri Mah Siew Keong said the sale of oil palm trunks would generate additional income for the small farmers.

About 18 million mature oil palm trunks are produced every year during replanting exercises in Malaysia, with 136 oil palm trunks being extracted from every hectare planted, he noted.

Sources: New Straits Times, Dec 9, 2017; Bernama, Dec 19, 2017

Record volume of soybean imports by India

High domestic soybean prices coupled with a smaller crop in 2017 are causing processors in India to import a record volume of soybean this year. Reports indicate that they have contracted to import up to 100,000 tonnes since December 2017, with the 2017/18 total likely reaching 200,000 tonnes.

The shipments are said to be primarily sourced from Ethiopia and Benin – likely re-exports – because those countries have preferential access to the Indian market. India’s most-favoured nation tariff rate is 30%, and it does not allow the importation of genetically-modified (GM) soybean.

Over the last five crop years, the average soybean yield in India has been about 0.8 tonnes/ha. The crop is almost exclusively grown under dryland conditions and subject to the vagaries of rainfall during the monsoon season.

Many farmers do not want to grow soybean because of the low yield and despite the government’s guaranteed high minimum price. With some forecasters now predicting below-average rainfall during the upcoming monsoon season, it appears that 2018 may not be a good year for Indian soybean production.

Indian soybean meal demand is rising at about 10% annually due to its rapidly growing poultry and aquaculture sectors, and there is no foreseeable way that domestic soybean production is going to keep up.

Source: Ag Perspective, March 13, 2018

China to import 100 million tonnes of soybean in 2017/18?

JY Chow, a food and agriculture analyst with Japan’s Mizuho Bank, has predicted that China will import 100 million tonnes of soybean in 2017/18. He based this forecast on a rapidly growing swine sector that is requiring more soybean meal.

Muyuan Foods Co Ltd, China’s second-largest swine producer, recently indicated that the company plans to boost the number of hogs it will produce and slaughter to 12 million, up from 7 million in 2017.

An increase in China’s soybean imports may also be partly driven by expectations that it will export more meal in 2017/18. One trader has told Reuters that he estimates the country will export 2 million tonnes, almost double the volume in 2016/17.

The increases are anticipated because the drought in Argentina will likely reduce the amount of soybean meal that it exports. Another trader told Reuters he expects China will export more meal this year to Japan, Vietnam, Thailand and Indonesia, among other countries.

China imported 93.5 million tonnes in MY 2016/17, and the USDA is forecasting 97 million tonnes in 2017/18. The total increased by an average 6.9 million tonnes over the previous five years; therefore, achieving 100 million tonnes is certainly a possibility.

China’s growing demand for soybean makes it very unlikely that the country will retaliate against US soybean exports, as some have suggested. Even if it took all the soybean exported by Brazil, Argentina, Paraguay and Uruguay, China would still need to import about 25 million tonnes from the US.

In addition, the US would simply export to the other nations that could no longer source from those origins. Retaliation against US soybean would also be disproportionate since the volume exported to China in 2016/17 was valued at over $14.5 billion versus US imports of Chinese steel and aluminum worth slightly less than $1.7 billion.

Source: Ag Perspective, March 13, 2018

By gofb-adm on Monday, January 15th, 2018 in Issue 4 - 2017, Market Briefs No Comments

Summary

Indonesian biodiesel consumption to drop in H2 2017?

Dono Boestami, chief executive at the government agency Indonesia Estate Crop Fund, expects a slowdown in domestic biodiesel consumption in the last six months of 2017 due to “some technical difficulties”.

In the first six months, domestic biodiesel consumption reached 1.7 million kilolitres. However, this is expected to fall to 0.9 million kilolitres in the second half of the year, resulting in an estimated total of 2.5 million kilolitres in 2017. In the near future, Boestami wants to boost the consumption volume to 3.5 million kilolitres per year.

Through government sponsored programmes, local authorities encourage the production (and consumption) of biodiesel. Considering that Indonesia – which is Southeast Asia’s largest economy –is also the world’s biggest palm oil producer, it can produce palm biodiesel in a relatively cheap way.

Moreover, biodiesel consumption eases Indonesia’s rising reliance on imports of crude oil-based fuel and curbs the country’s greenhouse gas emissions. In the B20 biofuels programme that was launched in 2016, the government set a minimum 20% blend of bio-content in diesel fuel, up from 15% in 2015.

Meanwhile, Fadhil Hasan, board member of the Indonesian Palm Oil Association, said palm oil production will increase to 38.5 million tonnes in 2018, up from an expected 36.5 million tonnes in 2017.

Indonesia’s palm oil exports are expected to rise to 29 million tonnes in 2018, from an expected 28 million tonnes in 2017. Crude palm oil prices are likely to average between US$700 and $710 per tonne in 2017 on a CIF Rotterdam basis.

Source: www.indonesia-investments.com, Nov 3, 2017

US anti-subsidy duties hit biodiesel imports

In a final ruling released on Nov 9, the US Commerce Department set anti-subsidy rates in the range of 34.45-64.73% for palm biodiesel imports originating from Indonesia. This was slightly lighter than the preliminary 41.06-68.28% range set in August 2017.

The final duties for soybean-based biodiesel from Argentina were set in the range of 71.45-72.28%, higher than the preliminary countervailing rates set in August 2017. The government of Argentina said it may take the dispute to the World Trade Organisation (WTO).

The issue arose when US biodiesel producers complained about the ‘dumping’ of biodiesel in the domestic market by Indonesian and Argentine exporters. They were alleged to even sell their products below the market value.

Indonesian exporters are able to sell cheap palm biodiesel in the US because the government subsidises production through its B10, B15 and B20 programmes. Under these programmes, diesel is blended with a mandatory amount of fatty acid methyl ester (derived from palm oil). The programmes aim at limiting imports of fuel into Indonesia.

The Trade Ministry of Indonesia had earlier emphasised that the subsidy programme is only meant for biodiesel sold in the domestic market.

Also on Nov 9, Indonesia lost an appeal ruling at the WTO in a dispute with the US and New Zealand over restrictions on imports of food and animal products, such as meat and poultry. Indonesia had been setting import barriers due to health concerns, halal food standards, and to deal with a temporary surplus in the domestic market.

New Zealand and the US took the case to the WTO panel, claiming Indonesia’s move was a violation of their trade agreements. In December 2016, a panel of adjudicators faulted Indonesia, leading to the appeal and the ruling.

Source: www.indonesia-investments.com, Nov 10, 2017

India hikes import tax on edible oils to 10-year high

India, the world’s biggest edible oils importer, has raised the import tax on these products to the highest level in more than a decade, to try and support its farmers. The duty increase will lift oilseed prices and their availability for crushing in the domestic market, helping the country in capping edible oil imports in the 2017/18 marketing year, which started on Nov 1.

India doubled the import tax on crude palm oil to 30%, while the duty on refined palm oil has been raised to 40% from 25% earlier, the government said in an order. The import tax on crude soybean oil was increased to 30% from 17.5%, while on refined soybean oil it was raised to 35% from 20%.

Indian oilseed crushers have been struggling to compete with cheap imports from Indonesia, Malaysia, Brazil and Argentina that have reduced demand for local rapeseed and soybean, even after a steep fall in oilseed prices.

The second increase in import tax in less than three months will push up domestic edible oil prices and support prices of local oilseeds like soybean and rapeseed, said BV Mehta, executive director of the Mumbai-based Solvent Extractors’ Association.

Soybean and rapeseed prices have been trading below the government-set price level in the physical market, angering farmers. India relies on imports for 70% of its edible oils consumption, up from 44% in 2001/02.

Even after the duty increase, India will need to import about 15.5 million tonnes in 2017/18, down from earlier estimate of 15.9 million tonnes, but higher than last year’s 15 million tonnes, said Sandeep Bajoria, chief executive of the Sunvin Group, a vegetable oil importer.

“The duty hike will have marginal impact on imports. India has to import due to huge demand,” Bajoria said.

The government also raised the import duty on soybean, canola oil and sunflower oil.

Source: Reuters, Nov 17, 2017

By gofb-adm on Friday, September 1st, 2017 in Issue 3 - 2017, Market Briefs No Comments

Summary

Indonesia expects substantial yield increases with new oil palm materials

PT SMART Tbk, a subsidiary of Singaporean palm oil company Golden-Agri Resources Ltd, announced on May 22 that it had cultivated high-yielding oil palm planting materials that could “substantially” increase the yield from its plantations without increasing land use.

The two materials – Eka 1 and Eka 2 – were developed at the SMART Research Institute and SMART’s Biotechnology Centre, through a conventional selection programme and tissue culture from “elite palms”.

“Tissue culture helps us propagate planting materials through a non-GMO process that produces more CPO; and, in the near future, it will help to produce planting materials that make better use of nutrients and are more resistant to both disease and drought,” said SMART’s head of plant production and biotechnology division Tony Liwang.

The materials could increase SMART’s CPO yield to more than 10 tonnes/ha/year at the prime palm production age of 8-10 years, from its current yield of 7.5-8 tonnes/ha/year under optimal soil conditions, according to the company. Indonesia’s industry average yield is still under 4 tonnes/ha/year, SMART said.

“With the success to date of our tissue culture programme, we can expect to see substantially higher yields with Eka 1 and Eka 2, and greater oil extraction levels from the fruit itself,” Liwang said.

SMART expects the Eka 1 seedling to produce 10.8 tonnes/ha of CPO at prime maturity, with oil extraction levels of 32% due to increased oil ratio in the fruit, while the Eka 2 seedlings are projected to yield 13 tonnes/ha and 36% oil extraction.

Furthermore, the company expects the seedlings to reach the first harvest in 24 months, in contrast to the current industry average of 30 months.

It intends to multiply the seedling clones through tissue culture over the next five years to cultivate a sufficient quantity to plant over a larger commercial area by 2022.

SMART started developing the materials in 2007, when its research team studied more than 4,000 oil palm trees for differing varieties. Field technicians selected and bred the optimal specimens over the next 10 years.

The first clonal seedlings were planted in 2011. Following several trials and commercial pilots, Golden-Agri Resources had by 2016 planted the materials in Sumatra and West Kalimantan in Indonesia.

Source: Oils & Fats International, June 2, 2017

Reserved dairy names barred for plant-based products in the EU

On June 14, the European Court of Justice (ECJ) ruled that plant-based products cannot be labelled with dairy names such as ‘milk’, ‘cheese’ or ‘butter’ even if the plant origin is clearly marked on the label.

The ECJ ruling gives a very strict interpretation of the EU’s rules on the use of designations reserved for milk and milk products. This was in a case brought against a German company for marketing vegetarian and vegan products labelled with dairy names such as ‘tofu butter’ and ‘veggie cheese’.

The ECJ concluded that for marketing and advertising purposes, in principle, the designations ‘milk’, ‘cream’, ‘butter’, ‘cheese’ and ‘yogurt’ are reserved under EU law for products of animal origin only.

Its ruling prohibits the use of dairy names in association with purely plant-based products unless the names are included in the EU list of exceptions. The ECJ also clarified that this prohibition applies even when the plant origin of the product is stated, because the addition of descriptive and explanatory terms cannot completely rule out consumer confusion.

The ECJ ruling is an interpretation of the EU’s Single Common Market Organisation (CMO) 1308/2013 which repealed Regulation 1234/2007. The Single CMO establishes marketing standards for milk and milk products and sets out definitions, designations or sales descriptions that may only be used for the marketing of dairy products.

By way of exception, the Single CMO allows the marketing of plant-based products under the reserved designations when the exact nature of the product is clear from traditional usage (e.g. coconut milk) and/or when the designations are clearly used to describe a characteristic quality of the product (e.g. creamy).

The EU’s first Single CMO Regulation 1234/2007 required member-states to provide to the European Commission (EC) an indicative list of non-dairy products meeting the criteria. Based on the lists submitted, Commission Decision 2010/791 – in force since December 2010 – has established a list of non-dairy products that may be labelled with reserved dairy names.

The list of exceptions is a collection of product names grouped per language (not product). Product names included in the list are not translated in all EU languages. The English-language term ‘almond milk’ for example is not included in the list, but the French, Spanish and Italian terms ‘lait d’amandes’, ‘leche de almendras’ and ‘latte di mandorla’ are.

The ECJ does not accept translations of product names included in the list as falling within the scope of authorised exceptions. The EC has clarified that, in the event of a dispute, it is ultimately for the ECJ to provide a definitive interpretation of the applicable EU law.

Source: USDA, July 11, 2017

Nutella maker wins court battle against ‘No palm oil’ claim

A Belgian court has ruled that advertising claims about the health and environmental benefits of the palm oil-free Choco spread are illegal, in a case brought against the supermarket chain Delhaize.

Ferrero, which manufactures Nutella, took the case to court. Delhaize has been ordered not to repeat any claims about its Choco spread being better for the planet or human health, on pain of a €25,000 (£22,000) fine for each repetition.

Source: www.theguardian.com, June 19, 2017

European chemicals agency refutes accusations linked to glyphosate

The European Chemicals Agency (ECHA) has fired back at NGO accusations that it carried out a malicious attempt to undermine the authority of the EU’s food safety agencies and their assessment of the ubiquitous herbicide glyphosate.

The ECHA also refuted claims it breached EU regulations and colluded with the pesticide industry when assessing the carcinogenicity of the herbicide.

In March, Global 2000 – a consortium of NGOs including Friends of the Earth and the Pesticide Action Network in Europe – released a stinging report. This argued that industry-funded studies showing that glyphosate is safe contained “fundamental scientific flaws” due to the omission of key data and inclusion of irrelevant data.

These studies were then used by both the European Food Safety Authority and the ECHA in their positive opinion of glyphosate.

“[The] ECHA is concerned [about] an attempt to publicly malign the integrity of EU institutions mandated to ensure safe use of chemical substances in the EU,” the Helsinki-based institution responded.

“This is of particular concern, when the process actually provides the opportunity to submit any further data and to make any science-based observations during the process.”

In making its assessment on glyphosate, it said “there was no collective preconception of whether or not the substance was hazardous for any of the end-points, let alone any collusion with industry, as alleged in the Global 2000 report”.

The ECHA’s opinion will be taken into consideration by member-countries who must vote on whether to renew the licence for glyphosate by the end of the year.

Source: www.politico.eu, Aug 8, 2017

By gofb-adm on Thursday, June 29th, 2017 in Issue 2 - 2017, Market Briefs No Comments

Summary

Brazil in push for GM-free soybean

A movement to replace genetically modified (GM) soybean with conventional seeds is gaining traction in Brazil’s largest soybean-producing state of Mato Grosso, as farmers anticipate growing demand from Asia and Europe.

Brazil was an early adopter of transgenic crops and more than 96% of its soybean harvest is of GM varieties, which helped to transform the country into the world’s largest soybean exporter.

Biotech crops, such as corn, soybean and cotton, are genetically modified to resist pests or disease, tolerate drought or withstand sprayings of weed killers like glyphosate, the active ingredient in Monsanto Co’s herbicide.

Wininton Mendes, coordinator of a programme to promote the use of conventional seeds – run by Mato Grosso growers and the government agricultural research agency Embrapa – said doubts about the impact of GM food on human health are a driver behind demand for conventional raw materials.

Proponents of biotech crops say that the technology lowers the cost of food and helps farmers to manage pests and diseases more safely. But some consumers and environmental groups argue that GM crops boost pesticide use and pose threats to the environment and human health.

Mendes said Mato Grosso’s drive to plant more conventional soybean is backed by three trading firms – Amaggi SA, Imcopa International SA and Caramuru Alimentos SA – which pay a premium. The average premium stood at 12 Reais per 60kg bag of GM-free soybean this season.

Reintroduction of conventional soybean creates a niche market for farmers with deep pockets, since non-GM crops require strict controls to avoid contamination during production and shipping, which may raise costs.

Encouraged by the premium paid this season, farmers may plant more non-GM soybean in the next cycle, said Daniel Ferreira, the superintendent of agricultural research agency Imea. However, for many farmers, the difficulty remains the availability of seeds.

An estimated 13.6% of the 2016/17 soybean harvest in Mato Grosso was of the conventional variety. This was down slightly from 15% previously as Brazil’s conventional seeds supply remains low, said Mendes.

Soybean demand from China, a major factor in Brazil’s agricultural expansion, remains strong. However, a consumer backlash there against GM crops is beginning to dent demand for soybean oil, its main cooking oil; this could spell trouble for the crushing industry, which relies on GM soybean from Brazil and the US.

China, which does not grow GM soybean, needs 11 million tonnes of conventional soybean for food production per year, said Lin Tan, an executive at Hopefull Grain & Oil Group. Local farmers cannot supply at least 3 million tonnes of demand from crushers, and the “additional grains must come from somewhere”.

A group of 14 EU countries imported about 2.7 million tonnes of non-GM soybean meal equivalent, according to a 2015 report, and there is potential demand from India, Mendes said.

Brazil’s Agriculture Minister Blairo Maggi said the country needs to step up research to develop conventional seeds for mass production. He cautioned that the government has no funds to promote GM-free soybean production, adding there is space for both kinds in the marketplace.

Source: Reuters, May 11, 2017

Russian soybean oil exports keep up record pace

Russia exported 53.8 kilo metric tonnes (KMT) of soybean oil in March – almost 53% more than in the previous month (35.2 KMT) – and up 86% from March 2016. This was the second-biggest shipment after the 63.2 KMT exported last October.

The top importers in the 2016/17 season include Algeria (152.9 KMT or 51% of total exports), Tunisia (32.5 KMT or 11%) and Cuba (29.7 KMT or 10%). China remains a major importer, although it decreased purchases to 28.4 KMT, against 35.5 KMT a year earlier.

In addition, the current season features an expansion of the range of export destinations to countries like Saudi Arabia, Venezuela, Rwanda, Haiti and Yemen.

Source: UkrAgroConsult, May 8, 2017

Malaysia to defend palm oil in Europe

Malaysia remains ready to defend its palm oil industry, following the European Parliament’s support for the ‘Resolution on Palm Oil and Deforestation of Rainforests’.

Plantation Industries and Commodities Minister Datuk Seri Mah Siew Keong said in a statement that the Ministry is ready with credible facts and figures “to face those unfair, biased and distorted allegations about the palm oil industry”.

The Resolution, adopted on April 4, calls on the EU to phase out by 2020 the use of vegetable oils – including palm oil – in biodiesel, if produced in an unsustainable way that leads to deforestation. It also wants a single EU-led certification scheme to be drawn up for palm oil.

At the 30th ASEAN Summit in Manila in late April, leaders issued a statement urging the EU to recognise the palm oil sustainability certification schemes of the region’s producer countries. They noted that these government-led schemes also demonstrate ASEAN’s commitment to the UN’s Sustainable Development Goals.

Mah said the region’s palm oil industry supports the livelihood of 3.5 million smallholders, mainly in Malaysia, Indonesia and Thailand.

The EU imports between 7 million tonnes and 7.5 million tonnes of palm oil annually. Last year, Malaysia accounted for 29.4% of the imports, while Indonesia supplied 48.6%. Malaysian palm oil exports to the EU were valued at RM9.9 billion.

On April 5, Datuk Seri Mah had said that Malaysia and Indonesia would team up to convince European Parliament lawmakers that the two countries are already taking steps to ensure that oil palm production activities do not harm the environment.

“We know that the global community is concerned about the environment and deforestation, but it is unfair just to target palm oil […] . We want to be given a chance to address the lawmakers […] as to why we feel the resolution is unfair to palm oil,” he said.

The minister said he would also fight for the EU to recognise the Malaysian Sustainable Palm Oil certification scheme. All plantations must be certified by December 2018. Estates and smallholdings have until June and December 2019 respectively, to achieve certification.

Sources: Bernama, May 4, 2017; The Star Online, April 6, 2017

Labour shortage in Malaysian oil palm plantations

Malaysian oil palm planters are bracing for a severe labour shortage, with Indonesian workers staying away due to the weaker Ringgit and increased opportunities at home. This could delay harvests and curb output, as extraction rates fall when fruit is picked late.

About 70% of the workforce in the Malaysian oil palm industry comes from Indonesia. But the Ringgit has plunged in value, falling 15% against the Indonesian Rupiah since the start of 2015.

That, along with increased demand for labour in Indonesia as new plantations open there, is cutting the number of workers prepared to head for Malaysia, planters said. Some also cited tighter employment regulations in Malaysia, with stricter Immigration procedures for foreign workers.

“This year, output will be impacted by [the shortage of] workers,” said Datuk Zakaria Arshad, chief executive of Felda Global Ventures Bhd, one of Malaysia’s largest oil palm plantation operators. “Workers are more difficult to get now, especially from Indonesia.”

Plantation workers usually make little more than the minimum wage, which is about RM1,000 in Peninsular Malaysia and 3.35 million Rupiah in Indonesia.

Indonesia is the world’s top producer of palm oil, churning out 31.8 million tonnes last year. Malaysia produced 17.3 million tonnes.

Source: Reuters, April 8, 2017

Pacts to promote Malaysian palm oil in India

The Malaysian Palm Oil Council has signed pacts with two bodies in India – the Solvent Extractors Association and the Mumbai Dabbawala Association – to extend acceptance of palm oil among food manufacturers and consumers.

The memorandum of understanding (MoU) with each was exchanged in the presence of Malaysian Prime Minister Datuk Seri Najib Abdul Razak, a statement said. It aims at educating consumers on the nutritional and health properties of Malaysian palm oil, as well as its uses.

With their outreach to consumers by way of distribution of daily meal-boxes, the Dabbawalas are in a unique position to assist the MPOC in enhancing the image of Malaysian palm oil, the statement said.

Source: Press Trust of India, April 3, 2017

India set to boost oil palm cultivation

India’s government has relaxed the land ceiling for oil palm cultivation under the National Mission on Oilseeds and Oil Palm (NMOOP). The aim is to attract farmers and corporate bodies to boost output and cut imports.

Domestic production of edible oils stands at about 9 million tonnes, while demand is around 25 million tonnes. The gap is met through imports, valued at Rs 68,000 crore in 2015-16. Palm oil contributes 70% of the vegetable oil imports.

The Cabinet also revised norms for assistance under Mini Mission-II of the NMOOP. It approved revisions in assistance for planting materials, maintenance costs, inter-cropping costs and bore-wells. All this is intended to make investment in oil palm plantations more attractive and to help utilise waste land.

This programme is being implemented in 12 states – Andhra Pradesh, Karnataka, Tamil Nadu, Mizoram, Odisha, Kerala, Assam, Telangana, Chhattisgarh, Gujarat, Arunachal Pradesh and Nagaland. Nearly 133 districts are under oil palm cultivation in these states.

There will be some financial implications in relaxing restrictions on the acreage and upscaling the norms of subsidies, but this will be accommodated within the NMOOP fund, a statement said.

The government has promoted oil palm planting since 1986-87. From 2014-15, this was done via the NMOOP. The planted area has expanded from 8,585 ha in 1991-92 to about 3 lakh ha in 2015-16. An additional 1.3 lakh ha is planned to be cultivated in 2016-17.

Source: Press Trust of India, April 12, 2017

Benefits from Brexit for Malaysian palm oil?

Malaysia’s food-based exports, especially palm oil, could reap trade opportunities through the changes created by the UK’s departure from the EU.

Glenreagh Sdn Bhd Managing Director Nordin Abdullah expects better opportunities for Malaysian companies with the capacity to operate in highly-regulated and competitive environments.

“It is no secret that certain countries in the EU are less receptive to imports of palm oil for protectionist reasons. Malaysia can now [re-examine how it deals] with the issue, as regulations and attitudes can change post the UK’s departure,” he said in a statement today.

Nordin said that, in the short-term, both the UK and EU economies will be competing for trade and investments with external parties.

In February, Malaysia’s exports of palm oil to the EU and the UK stood at 153,165 tonnes and 1,759 tonnes respectively.

Source: Bernama, March 30, 2017

MSPO-certified palm oil for Europe by year-end

Malaysia will send its first consignment of domestically-certified palm oil to Europe by the end of the year, said Minister of Plantation Industries and Commodities Datuk Seri Mah Siew Keong.

Malaysia’s target is to send 5 million tonnes of certified oil to Europe by 2019. The industry will also continue to engage with European buyers, he told a press conference.

He said that mandatory implementation of the Malaysian Sustainable Palm Oil (MSPO) standard by December 2019 is a move towards branding the output as being sustainably-produced and safe.

The government plans to organise more than 100 nationwide briefings on the MSPO up to next year, to enhance awareness among the 550,000 smallholders.

Source: Bernama, Feb 28 & March 30, 2017

Drop expected in India’s vegetable oil imports

India’s booming edible oils imports are expected to decline or hold flat in the year to October 2017, failing to grow for the first time in six years as near-record domestic oilseeds output boosts supplies, industry executives said in Kuala Lumpur.

India, the world’s biggest edible oils importer, is expected to purchase about 14-14.5 million tonnes of vegetable oils this year, compared to 14.5 million tonnes in 2015/16.

“We are going to have an additional [1.2] million tonnes of edible oils this year because of higher soybean production last year, and expectations of a bumper rapeseed crop which will be harvested in the coming months,” said Sandeep Bajoria, chief executive of Mumbai-based brokerage Sun Win Group.

India’s edible oils purchases – mainly palm oil from Malaysia and Indonesia and soybean oil from Argentina – have risen each year since 2010/11, according to US Department of Agriculture data. The imports have grown at an average of 11% a year.

India’s soybean crop, harvested in October, rose to 11.5 million tonnes, up from 7 million tonnes a year ago. This was the biggest annual output jump in more than a decade, boosting supplies and dragging down prices.

Rapeseed production is forecast to rise to 7 million tonnes, from 5.8 million tonnes a year ago, Bajoria said.

India’s soybean oil imports are expected to decline to 3.4 million tonnes from 4.3 million tonnes a year ago. However, palm oil imports are forecast to rise to 8.8 million tonnes this year from 8.4 million tonnes last year.

Source: Reuters, March 6, 2017

Indonesia seeks better productivity in oil palm planting

The Indonesian Palm Oil Board (DMSI) – an umbrella organisation of the country’s main palm oil associations – says higher productivity will be the key to boosting CPO production.

Amidst international pressure, particularly after the devastating forest fires in Sumatra and Kalimantan in the second half of 2015, President Joko Widodo had announced a five-year moratorium on new concessions in order to limit the expansion of oil palm plantations.

Although the authorities want higher CPO output to safeguard foreign exchange earnings and create employment opportunities, further growth should come on the back of rising productivity, not by adding new plantations.

DMSI Chairman Derom Bangun said higher productivity should be achieved by replanting. Currently, the average production is close to 3.7 tonnes/ha/year. This should be raised to at least 5 tonnes/ha/year. The estimated maximum (perfect) productivity is 9 tonnes per ha, but this is considered too difficult to achieve.

Without higher productivity, the moratorium will curtail growth of the palm oil industry, both in terms of production and plantation size. Bangun said the sector had expanded by 13-15% per year in the 1990s, in production and plantation size. However, over the past couple of years, growth had fallen to 5-8% per year.

The palm oil sector is one of the key foreign exchange earners for Indonesia and provides employment to millions, especially in Sumatra and Kalimantan.

Indonesia’s oil palm plantation size is currently estimated at 11 million ha. Bangun said that, if productivity can be raised to 6 tonnes/ha/year, then CPO production would nearly double to 66 million tonnes per year.

The Indonesian Palm Oil Association said CPO production recorded 34.5 million tonnes in full-year 2016, down 3% from 35.5 million tonnes the previous year. The drop was due to the impact of the El Nino phenomenon, which brought dry weather to Southeast Asia in 2015.

Source: www.indonesia-investments.com, Feb 18, 2017

RM50mil R&D boost for Malaysia’s palm oil sector

Malaysia has allocated RM50 million to develop the quality of its palm oil, said Plantation Industries and Commodities Minister Datuk Seri Mah Siew Keong.

The money will be disbursed as matching grants for research and development to improve the safety and quality of Malaysian palm oil and derived products.

“R&D will be done on a joint-venture basis with the private sector,” he said, noting that the scientific research will focus on eliminating contaminants in palm oil.

He said palm oil is already safe in terms of nutritional value, and that research would make it even better.

Malaysian-owned palm oil mills and refineries based in the country will be eligible to apply for funds via the allocation.

Source: The Star Online, March 8, 2017

These are edited versions of the articles.

By gofb-adm on Friday, March 3rd, 2017 in Issue 1 - 2017, Market Briefs No Comments

Summary

Malaysia targets higher revenue from export commodities

The Plantation Industries and Commodities Ministry is aiming to grow Malaysia’s exports of commodities by 5-8% this year through the implementation of strategic measures.

“This will be done by expanding our market share while penetrating new markets, including [negotiating] a free trade agreement with Iran and exploration of new markets in south Asia and southern Europe,” said the Minister, Datuk Seri Mah Siew Keong.

These initiatives are expected to maintain the momentum of the country’s commodities segment, which consists of palm oil, rubber, wood, cocoa, pepper and kenaf products.

“[From] January to October 2016, [exports of] commodities grew 2% to RM99.2 billion from the year before. The commodities sector also accounted for 15.6% of national exports,” the Minister said.

The Ministry will continue to invest in research and development in order to develop higher value-added downstream products, as well as to improve current export products.

“The R&D work will increase the marketability and competitiveness of our exports in the global arena,” Datuk Seri Mah said.

Source: Malaysia Reserve, Jan 6, 2017

Change at the helm of Malaysia’s FELDA

Tan Sri Shahrir Abdul Samad has been named the new Chairman of the Federal Land Development Authority (FELDA) in line with the Malaysian government’s aspiration to strengthen the agency’s leadership.

He has wide experience in government administration, having previously held three Cabinet portfolios at different times. He was once the Chairman of the Malaysian Palm Oil Board and of the parliamentary Public Accounts Committee.

Tan Sri Shahrir replaces Tan Sri Mohd Isa Abdul Samad whose term ended, although he remains Chairman of Felda Global Ventures Holdings Bhd. During his tenure, FELDA had implemented many community activities and programmes to enhance the quality of life of settlers and their families.

In a statement, Prime Minister Datuk Seri Najib Abdul Razak said that with the restructuring, there is a division of responsibilities in regard to the settlers’ welfare and socio-economic status, and FELDA’s business activities.

Source: Bernama, Jan 7, 2017

Malaysia, Indonesia to discuss common CPO tax structure

Malaysia is open to negotiations with Indonesia over the possibility of harmonising the CPO export duty structure of both countries.

Malaysian Plantation Industries and Commodities Minister Datuk Seri Mah Siew Keong said a meeting will be held in the coming months.

“When I say harmonise the CPO tax structure, it doesn’t mean Malaysia will compromise to our disadvantage. We want to discuss […] the possibility of a common tax structure which does not conflict the trading of our palm oil in the world market,” he explained.

Currently, the wide gap in Indonesia’s export duty differential between CPO and refined palm oil encourages more production of refined palm oil; this has resulted in increased competition with Malaysia, particularly in the downstream sector.

“When you add a new system, there will be some losses and benefits to the respective players, but we will try to combine it to strike a balance for our overall exports,” the Minister said.

On export performance, he noted that the Malaysian palm oil market share in China had fallen to 45.7% in 2015 from 52% in 2014, while Indonesia’s market share rose to 53.9% from 47% over the same period. However, efforts are being made to woo back buyers.

Datuk Seri Mah also stressed the significance of diversification to new products and securing new markets.

“We want to go to the Middle East, as well as ASEAN countries such as the Philippines and Vietnam. I am going to Iran [this month] to negotiate higher imports for our palm oil. These are the new markets,” he added.

Source: The Star, Jan 16, 2017

RM30mil fund set up to mechanise oil palm fruit harvesting in Malaysia

Malaysia is establishing a RM30 million fund to improve the mechanisation of oil palm fruit harvesting,

Plantation Industries and Commodities Minister Datuk Seri Mah Siew Keong said: “We have to be more committed in finding more efficient ways to harvest oil palm fruit. We cannot go on being so reliant on manual labour.”

Some 70% of Malaysia’s oil palm estate workers are foreigners.

“This year, we are celebrating 100 years of commercial oil palm planting, but we have yet to improve on mechanisation of fruit harvesting. Of the RM30 million mechanisation fund, RM5 million will be privately-funded,” the Minister said.

It has been reported that Malaysia’s oil palm industry is facing a shortage of workers, resulting in many planters not being able to fully harvest the fruit.

Source: New Straits Times, Jan 17, 2017

Malaysian CPO output has doubled every 10 years over centennial

Malaysia, one of the world’s largest producers of CPO, enters the milestone centennial celebration of the sector in 2017 amidst tremendous growth.

Output has doubled every 10 years and the country’s track-record of providing quality vegetable oil to consumers worldwide, at reasonable prices, has helped alleviate poverty in many Third World countries.

Dorab Mistry, a leading industry analyst at Godrej International Ltd, endorses the country’s palm oil as its “Jewel in the Crown”. He said Malaysia has done wonders in terms of boosting export revenue.

“For 90 years, you [Malaysia] have been on your own. You are the Number One producer as you are doing all the propagation. You are being challenged by Indonesia on all fronts,” he said.

“So, while Malaysia celebrates 100 years, it has to re-dedicate itself to really take its competitor head on. At the same time, Malaysia must ensure that the markets it has, and the new markets that [it is] developing, go according to plan.”

Although Malaysia’s palm oil industry is expanding rapidly, labour shortage has been an issue – and it is becoming more difficult to source additional workers.

“Malaysia has got to do something about its labour regulations because the labour shortage is really strangling your plantations. It has been the biggest challenge facing the country’s CPO sector,” he said.

“However, against this backdrop, congratulations to Malaysia. I think if there is an example of a country which has nursed and nurtured an industry into great prosperity, I would hold Malaysia as a fine example.”

James Fry, Chairman of commodities consultancy LMC International, agreed that the Malaysian government needs to address the labour shortage issue, following its policy to reduce the number of foreign workers by 110,000.

“It is all right if you tell the industry how they will manage with fewer workers, but you have seen the impact, you have longer harvesting periods, lower quality and it hits your yield,” he said.

ISTA Mielke GmbH Executive Director Thomas Mielke said Malaysia has been the forerunner in palm oil and food research. He said palm oil has made major inroads not only into Asia, but also the African continent and central and South America.

“There has been tremendous increase in palm oil imports and consumption in Europe, as well as in the Commonwealth of Independent States countries,” he noted.

Source: Bernama, Nov 20, 2016

More palm oil for Indonesia’s biodiesel sector by 2020

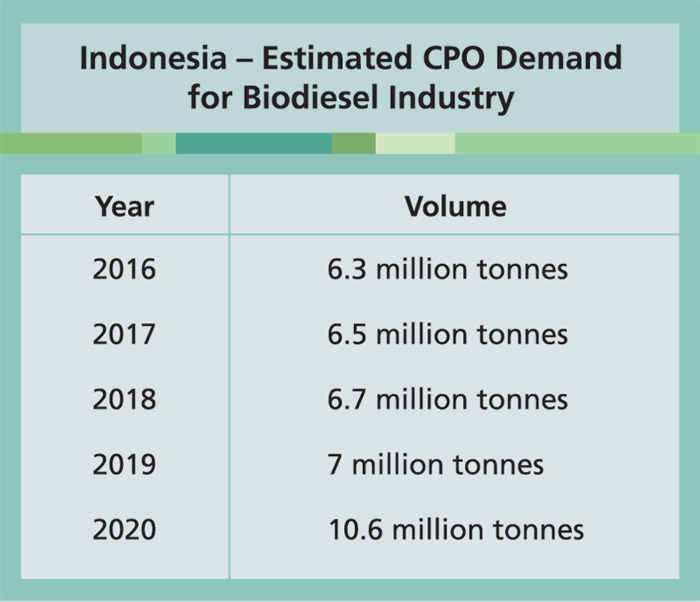

Indonesian demand for CPO for biodiesel use will grow nearly 70% by 2020 as the price gap with conventional diesel narrows and more subsidies for blending become available.

Indonesia, the world’s top producer of palm oil, is pushing to increase usage of biodiesel to cut its oil import bill and curb greenhouse gas emissions. Its so-called B20 programme required a minimum 20% blend of bio-content in diesel fuel in 2016, up from 15% in 2015.

The biodiesel sector’s appetite for palm oil will increase to 10.6 million tonnes by the start of the next decade, from 6.3 million tonnes forecast for 2016, said Bayu Krisnamurthi, Chief Executive of the Indonesia Estate Crop Fund.

“Looking forward, we’ve calculated that by 2020, 26% of palm oil will go to biodiesel, so biodiesel becomes the new demand for the palm oil industry,” he said at a conference on Nov 23, 2016.

The fund is a government agency in charge of collecting palm oil levies to finance biodiesel subsidies in the country.

“The gap is getting thinner,” he said, referring to the spread between prices for biodiesel and conventional diesel coming down by around 30% in 2016 as oil prices strengthened.

The palm oil industry hopes the drive towards biodiesel will provide underlying support for prices of the edible oil.

Source: Indonesia Estate Crop Fund

The country is also targeting a 90% increase in unblended biodiesel consumption in 2017 to 5.5 million kilolitres, from an estimated 2.9 million kilolitres in 2016.

The 2017 target is “with the assumption that there is an expansion of subsidies”, said Dadan Kusdiana, Secretary of the Renewable Energy Directorate.

Indonesia started collecting a levy on its palm oil exports in July 2015 – US$50 per tonne for CPO and US$30 for processed palm oil products – and uses part of this to help fund biodiesel subsidies.

Levies collected by the Indonesia Estate Crop Fund would also need to be increased to pay for additional biodiesel subsidies, Kusdiana said, adding that his office had proposed an incremental increase. The fund is targeting a 14% increase in levies collected in 2017.

Source: Reuters, Nov 25, 2016

Phase 1 of new smallholder traceability system in place

GeoTraceability, Wilmar International Ltd and Wild Asia have announced that the first phase in the development of a new smallholder traceability system has been successfully completed.

The system enables mills to map their smallholder supply base and trace smallholder fresh fruit bunch (FFB) deliveries from the mills back to their farms. A key innovation in this project is the ability to provide smallholders with agronomic recommendations from mills and supporting organisations for increasing productivity, as part of their participation in the traceability system.

This project, supported by the Sustainable Trade Initiative (IDH), is currently underway in Wilmar’s Sapi Plantation in Sabah, Malaysia. The ability to trace smallholder FFB supply is critical to Wilmar in ensuring compliance by its third-party mill suppliers and independent smallholder suppliers, under its ‘No Deforestation, No Peat and No Exploitation’ policy.

Since July 2016, more than 90% of the smallholder supply base of the mill has been surveyed and mapped, with 1,400 traceable deliveries of smallholder FFB recorded. The next steps in the project are to roll out the system to an additional Wilmar-owned mill, as well as a third-party supplier mill, both in Sabah.

Jeremy Goon, Wilmar’s Chief Sustainability Officer, said: “Smallholders are a key stakeholder group in our pursuit of a sustainable and transparent supply chain. We have committed substantial resources to empowering smallholders to improve their livelihoods and to ensure they share in the benefits of oil palm development.

“Our collaboration with GeoTraceability and Wild Asia to develop this smallholder-specific traceability tool is a win-win for the industry and smallholders. Benefiting from agronomic expertise is an important incentive that will further strengthen sustainability take-up among smallholder producers. We hope this tool can help facilitate the traceability agenda of our external mill suppliers and the wider industry.”

Dr Reza Azmi, Executive Director and Founder at Wild Asia said: “Our Wild Asia Group Scheme is a programme to promote traceability and better production among groups of small independent oil palm producers.

“Systematic electronic data on the small producers means that we can accelerate our work, and that our agronomists can deliver individualised support to our group members. More importantly, we want to be able to empower local producers with tools that can provide meaningful insights to their own production data.”

Pierre Courtemanche, Chief Executive Officer at GeoTraceability, said: “Our software and training is designed to support mills, NGOs, development agencies and governments in better delivery of support to smallholders. This combination of tools supports a ‘New Deal’ for farmers: allow us to use your data to improve transparency and you’ll receive improved support services.”

GeoTraceability’s Digital Agronomist is a new software technology which allows the delivery of agronomists’ expertise to each individual smallholder farmer, and his or her fields.

The agronomic recommendations for increasing smallholder productivity are compiled in individual ‘Farm Business Plans’, which can be further supported with field-input credit, training and ultimately Roundtable for Sustainable Palm Oil group certification. This package of opportunities to improve productivity and profitability for smallholder farmers presents a compelling alternative path to the farm expansion model.

IDH has been working with industry actors to coordinate and accelerate progress on traceability since 2014 and is supporting platforms such as GeoTraceability as critical innovations on the path to sustainability. IDH is supporting the project financially and has informed project design with the objective of maximising lessons learnt, that may be of value to the wider industry.

Source: foodingredientsfirst.com, Nov 8, 2016

Global edible oils market valued at US$130bil in 2024

The global edible oils market is segmented into palm, soybean, sunflower, olive, corn and canola oils, as well as specialty blended oils and others. The palm oil segment is projected to register the fastest growth rate through the forecast period, with the segment accounting for over 32% share in the global market in terms of volume in 2015.

Soybean oil is projected to register a slight negative growth owing to the surplus availability of raw materials and shifting consumer preferences towards healthier edible oil options such as olive and canola oils. This shifting market trend is a result of increasing disposable income levels in households worldwide and growing awareness with regard to healthy eating.

According to a new report published by Persistence Market Research, ‘Global Market Study on Edible Oils: Industry Analysis and Forecast 2016-2024’, the global edible oils market is expected to register a CAGR of 5.1% through the forecast period to reach the value of US$130.3 billion at the end of 2024. The projected market trend can be attributed to rising health concerns across the globe and growing demand for healthy edible oils, such as canola and olive oils.

Manufacturers are adopting new techniques – such as cold pressing – to increase production of edible oils. This, combined with growing disposable incomes and the growing demand for snacks and fried food globally, are major drivers in the global market. The rising retail sector is a major boon, as the wide network organised market has helped bolster growth of edible oils.

In terms of end-users, the global market is segmented into the food service, food processor, and retail sectors. Established chains and a strong supply chain of edible oil products are expected to drive the retail segment, which is expected to register a CAGR of 5.3% through the forecast period. The food service segment is projected to register a CAGR of 5.1%, due to the lower prices and easy availability of palm oil.

The global edible oils market is segmented on the basis of region, into North America, Europe, Asia Pacific, Latin America, and Middle East and Africa (MEA).

Asia Pacific is projected to dominate the global market, accounting for 41.2% share in 2015, and is expected to account for 42.4% at the end of 2024. The projected market trend can be ascribed to growing demand for edible oils in India and China, especially in the food and beverage industries.

Europe and MEA are anticipated to register negative growth in terms of market share, owing to shifting consumer preferences towards high-quality edible oils in the regions.

Source: http://satprnews.com, Dec 7, 2016

Brazil’s grain export lull sets stage for record shipments

If there is a silver lining to Brazil’s recent shortcomings in grain exports, the country is now more prepared than ever to pump out big volumes in 2017, perhaps to the dismay of its competitors.

Brazil is the No. 1 and 2 shipper of soybean and corn respectively, but early in 2016, the drought-stricken country found itself with much less exportable supply than expected at the wrap-up of harvest.

Brazil should be at the height of the corn shipping season from October through December, but saying that corn exports have been dismal over the last two months might be far too generous.

Shipments of corn and its by-product, ethanol, were down by nearly 80% in October and November 2016 versus a year earlier. Soybean fared slightly better with exports down two-thirds over the same timeframe, although exports of the oilseed do not usually get going until February or March.

But with the drought of 2016 mostly in the rear-view mirror, record corn and soybean crops are a real possibility heading into 2017, particularly if favourable weather holds. And although Brazil has notoriously faced transportation and logistical issues at ports in the past, that is much less the case today.

The upcoming 2016/17 export season could be one of the smoothest Brazil has seen in recent years. And if domestic soybean and corn prices are internationally competitive once the products arrive to market, the US, one of the country’s main trade rivals, will start feeling the pressure.

In 2015/16, the Brazilian soybean and corn harvests were originally projected to top 100 million and 80 million tonnes respectively, but late-season drought cut the volumes to 95.4 million and 66.6 million tonnes. The second crop corn, also called safrinha, was hit especially hard.

But the 2016/17 season is already showing promise as both soybean planting and development is ahead of normal, and 94% of the first corn crop is in good condition. Analysts polled by Reuters expect both crops to set new records this year – 102.64 million tonnes for soybean and 86.58 million tonnes for corn.

Good weather and an early harvest would place the oilseed a little sooner than usual in the market place, potentially cutting into the US business. It would also mean an earlier start to the sowing period for safrinha, which accounts for roughly two-thirds of Brazil’s total corn output.

Corn does not typically start being shipped out en masse until August, as the safrinha crop is more heavily exported than the full-season corn, which is mostly dedicated to domestic use, since the ports are full of soybean when it is harvested.

Brazil is expected to ship a record volume of soybean in its 2016/17 marketing year, which begins in February 2017 and runs through January 2018. Current industry estimates range from 57.5-60 million tonnes, well above figures for the 2015/16 year which stand at or just above 50 million tonnes.

Relatively speaking, the drought has impacted corn exports much more than soybean, as shipments in the current marketing year will fall up to 50% from the record 2014/15 campaign. Industry estimates for Brazilian corn exports range from 16-19 million tonnes for the 2015/16 season, which will conclude at the end of February 2017.

Analysts peg Brazil corn exports to be the second-largest volume on record in the 2016/17 marketing year, beginning in March 2017. Shipments are likely to range between 25 million and 30 million tonnes. If the weather remains supportive and export prices are attractive to buyers, trade competitors have good reason to start getting nervous.

Source: Reuters, Dec 8, 2016

Sabah to gazette forest as orang utan protected area

The Sabah Forestry Department is to gazette a forest rich in orang utan, as a fully protected area.

This comes with a sudden change in the ownership of the 101,000ha Forest Management Unit 5 (FMU 5), which also contains 13,000ha of flora and fauna.

State Forests Chief Conservator Datuk Sam Mannan said the area in central Sabah is being classified as a first-class reserve and will become part of the Trusmadi Forest Reserve.

FMU 5, owned by logging and reforestation company Anika Desiran, was purchased by wood products maker Priceworth International for RM260 million in October 2016.

Anika Desiran had been working with conservationists, including WWF Malaysia, over the past three years to create a model example of a conservation economy. The sudden sale of the property took the conservationists by surprise.

Mannan said the forest region had been logged a few times since the 1980s and that the Forestry Department had allowed it to be parceled out under the FMU programme in 1997 because it did not expect orang utan to inhabit such highland areas.

He said a WWF study had since found orang utan in FMU 5, so the high-conservation area within it will now be turned into a first-class reserve.

Once done, the new owner will have to provide a development master plan which must be approved before any kind of work can take place on the land.

Source: The Star, Jan 5, 2017

By GOFB on Monday, December 5th, 2016 in Issue 4 - 2016, Market Briefs No Comments

Summary

Record global palm oil output expected in 2017

Palm oil output in top two producers Indonesia and Malaysia will rise next year and likely surpass the 2015 record, as trees recover from a crop-damaging El Nino weather pattern, said leading industry analyst Dorab Mistry.

The recovery in palm oil output will lead to a “massive rebuilding of stocks” in the oil year ending Sept. 30, 2017, he said at an industry conference in Kuala Lumpur.

“It is too early to forecast Malaysian and Indonesia production for calendar year 2017 but it is more than likely to exceed the record production of 2015.”

The expectations of rising stockpiles could weigh on benchmark palm oil prices, which are up nearly 7% this year on tight supplies after yields were impacted by the lingering effects of last year’s El Nino.

Mistry maintained his global outlook for a strong output recovery of nearly 6.5 million tonnes for the oil year 2016-17 and calendar year 2017.

However, he adjusted his crude palm oil price target, saying it would drop to RM2,200 by end December – Instead of in November as earlier expected – because of recovering production and rising stocks.

“Most of the additional supply will simply replenish stocks,” said Mistry, the director of Indian consumer goods company Godrej International. “Currently I do not expect stocks to become burdensome.”

Crude palm kernel oil prices are also expected to decline from current levels around US$700 per tonne higher than crude palm oil values, to premiums of US$200-250 on slower demand, he said.

Palm kernel oil prices reached a five-year top of RM6,200 per tonne in late August, highest since March 2011, on tight supplies, according to assessment prices by Thomson Reuters.

Price recovery seen

At the same conference, another leading analyst, Thomas Mielke, said global palm oil output will grow by 5.5 million tonnes in the new oil year beginning October,

Global supplies of palm oil will still be tight until March, but production will rebound by 5.7-6.3 million tonnes in calendar year 2017, said Mielke, editor of Hamburg-based newsletter Oil World.

Global output in calendar year 2016 is expected to drop by 3.3 million tonnes to 59.2 million tonnes, he said.

He lowered his 2016 output forecast for top producer Indonesia by 100,000 tonnes to 32.2 million tonnes, and for second-largest producer Malaysia by 300,000 tonnes to 17.8 million tonnes.

He cut his Malaysian output forecast for 2017 by 100,000 tonnes to 20.5 million tonnes, and maintained expectations for Indonesian production next year at 35 million tonnes.

Mielke also said benchmark Malaysian crude palm oil prices are expected to climb to RM2,900-3,000 per tonne in the fourth quarter or in early 2017.

“Palm oil prices are undervalued at the moment,” Mielke said, adding that prices will recover as importing countries start to make more purchases.

Palm oil output, though, will continue to be under pressure due to the lingering effects of El Nino.

“I don’t expect that yields will come back next year … The real increase in yields is going to be in 2018,” Mielke said.

Lauric oils are set to decline in the next 12 months on account of weak demand and recovering production, he noted.

“Once production starts increasing next year, for palm kernel oil in particular and also coconut oil, stocks will increase because demand is poor. Premiums of lauric oil prices versus palm oil is set to narrow in 2017,” he added.

Source: Reuters, Oct 13, 2016

Indonesia imposes mandatory biodiesel blend for non-subsidised diesel

According to The Jakarta Post, a new regulation issued last week by Indonesia’s Energy and Mineral Resources Ministry makes it mandatory for non-subsidised diesel fuel to also contain a 20% mix of biodiesel. A penalty of Rp 6,000 per litre will be imposed on those who violate the regulation.

According to The Jakarta Post, a new regulation issued last week by Indonesia’s Energy and Mineral Resources Ministry makes it mandatory for non-subsidised diesel fuel to also contain a 20% mix of biodiesel. A penalty of Rp 6,000 per litre will be imposed on those who violate the regulation.

The Biofuels Producers Association said the government still needs to clear up some details in the policy to ensure business certainty.

If implemented and enforced, the move is positive for palm oil prices as the biodiesel demand is then expected to more than double year-on-year from the 2016 demand of 2.6-2.7 million kilolitres to 5.6-6 million kilolitres in 2017 (this is after doubling in 2016 from 2015).

However, execution is key; and Indonesia’s track record, especially on the biodiesel front, has been patchy.

Are the subsidies enough? Yes, says the Indonesia Estate Crop Fund which manages the collection of the US$50 per tonne export levy on palm oil (imposed since July 2015) to subsidise biodiesel.

It forecasts that the levy fund will increase 14% year-on-year in 2017 to US$830 million, as exports should recover in 2017 alongside production.

So far 85% of the subsidy fund has been used to subsidise biodiesel and the surplus is enough to maintain the biodiesel programme until the first quarter of 2017.

Source: Credit Suisse, Oct 26, 2016

India cuts import taxes on CPO, refined vegetable oils

India has cut import taxes on crude palm oil, refined vegetable oils and wheat, as part of efforts to curb food inflation.

Import duty on crude palm oil and refined edible oils has been reduced by five percentage points to 7.5% and 15% respectively, according to the order on a government website. The wheat import tax has been cut to 10% from 25%.

The cut in taxes is expected to increase demand for palm oil from Malaysia and Indonesia, major suppliers that are already enjoying strong demand from China.

India is the world’s biggest edible oil importer. However, domestic crushers believe the cut to the import duty is mistimed.

“We’re a bit disappointed as we’re on the verge of harvesting a new oilseed crop. The reduction in the duty will put pressure on local oilseed prices,” said Atul Chaturvedi, president of industry body Solvent Extractors Association of India.

“The government should have rather raised the differential between the duties of crude and refined oils to support the domestic refining industry.”

Local vegetable oil prices have surged by 20% since July.

Malaysia allocates RM80 mil to oil palm sector in Budget 2017

Malaysia has proposed a RM50 million allocation for scientific research to raise the quality of palm oil products. Another RM30 million is proposed for replanting, reflecting the position of palm oil as a major export commodity.

The allocations were included in the 2017 Budget Speech delivered on Oct 21, but awaits approval by the two chambers of Parliament.

A day earlier, Plantation Industries and Commodities Minister, the Hon. Datuk Seri Mah Siew Keong, said replanting is crucial in order to boost yields. Much of the area under cultivation has mature oil palm trees that are more than 30 years old.

These are too tall for harvesting, and this has caused a fall in productivity, he noted. A replanting grant would encourage growers, especially smallholders, to replace old trees.

He said this year’s palm oil production is expected to be less than 20 million tonnes due to the impact of El Nino.

Last year, the oil palm industry contributed 5.1% to agriculture in terms of gross domestic product. Export earnings stood at RM63.2 billion and accounted for 8.1% of total exports.

Source: Compiled from media reports, Oct 20 & 21, 2016

Argentina postpones soybean export tax cut to 2018

Argentina will not reduce soybean export taxes this year or in 2017 as previously announced, and will instead reduce the tax by 0.5 percentage points per month from January 2018 to December 2019, President Mauricio Macri said on Oct 3.

Shortly after taking office in December, Macri eliminated corn and wheat export taxes as part of his plan to revitalise the country’s massive farm sector.

He also cut the export tax on soybean, the country’s main cash crop, from 35% to 30%. The government had planned further cuts beginning this year.