Market Updates – Issue 1, 2018

By gofb-adm on Thursday, April 26th, 2018 in Issue 1 - 2018, Market Briefs No Comments

By gofb-adm on Thursday, April 26th, 2018 in Issue 1 - 2018, Market Briefs No Comments

Summary

Envoy: China will not ban Malaysian palm oil

China will not impose a ban on Malaysian palm oil and palm-based products, said H.E. Bai Tian, who is China’s Ambassador to Malaysia.

Instead, China will import more primary products such as palm oil and rubber-based products from Malaysia in the future.

“We will not set any limit on the import of Malaysian palm oil and related products. There will be no glass ceiling for the imports,” he said after paying a courtesy call on Plantation Industries and Commodities Minister Datuk Seri Mah Siew Keong in Putrajaya.

Malaysia exported palm oil and palm-based products worth RM8.5 billion to China from January to November 2017, compared to RM7.8 billion over the same period in 2016 – this reflects an increase of 9.8%.

Bai said China would encourage more of its business community to invest in primary industries, especially biomass, in Malaysia.

On China’s biodiesel market, he said diesel and biodiesel B5 consumption in 2016 stood at about 165 million tonnes and 8.3 million tonnes, respectively, while its biodiesel production in 2015 was 300,000 tonnes.

“This means, we need to import 8 million tonnes of biodiesel. I think this is good news for palm biodiesel producers. We hope Malaysia will take up this golden opportunity,” he said.

Meanwhile, Mah said China is the second-biggest buyer of Malaysian palm oil and palm-based products after the EU for its biofuel needs.

“China has overtaken India to become the Number Two export destination for Malaysian palm oil and palm-based products. We expect China to become the biggest importer of our commodity in two years’ time,” he said.

Mah further said the Ministry, through the Malaysian Palm Oil Board, is conducting a study with China’s Tsinghua University on biodiesel B5.

To counter the EU’s intended palm oil ban in biofuels, Mah said Malaysia is pursuing the growth potential in markets like Iran, Vietnam, the Philippines, Japan and the Middle East.

On rubber and rubber products, Mah said China has overtaken the US and the EU to become Malaysia’s top export destination.

He said Malaysia exported rubber and rubber products worth RM7.5 billion to China from January to November 2017, an increase of 76% compared to RM4.2 billion over the same period in 2016.

Source: Bernama, Feb 3, 2018

Another stiff hike in India’s import duty on palm oil

India has raised import tax on crude and refined palm oil to the highest level in more than a decade, the government said in a statement, as the world’s biggest edible oil importer tried to support local farmers.

The duty increase would lift oilseed prices and encourage domestic supply for crushing, helping to cap edible oil imports in the 2017/18 marketing year that started on Nov 1, dealers said.

India raised import tax on crude palm oil to 44% from 30% and on refined palm oil to 54% from 40%, a government order said.

India relies on imports for 70% of its edible oil consumption, up from 44% in 2001/02.

The fourth increase in import tax in less than six months would push up domestic edible oil prices and support prices of local oilseeds like soybean and rapeseed, said BV Mehta, executive director of the Solvent Extractors’ Association, a Mumbai-based trade body.

“Supplies from the new season rapeseed crop have just started. Now farmers will get remunerative prices due to the duty hike,” Mehta said.

India primarily imports palm oil from Indonesia and Malaysia and soybean oil from Argentina and Brazil. It also buys small volumes of sunflower oil from Ukraine and canola oil from Canada.

The duty hike will narrow the difference between palm oil and soft oils like soybean oil and sunflower oil, making it lucrative for refiners to increase purchases of soybean oil and sunflower oil in the coming months, said a Mumbai-based dealer with a global trading firm.

“Palm oil’s share is likely to fall substantially unless India raises import tax on soybean oil and sunflower oil,” the dealer said.

Source: Reuters, March 2, 2018

Traceability required for sale of CPO futures in Malaysia

Sellers of crude palm oil futures who want to be involved in physical deliveries must now provide traceability details up to the palm oil mill’s location, according to a document posted on the Bursa Malaysia Derivatives website.

Crude palm oil sellers should submit traceability documents to port tank installations approved by Bursa Malaysia Derivatives.

The traceability document requires the name of the parent company, mill address and coordinates, and quantity of crude palm oil received. The requirement took effect from Feb 26.

Source: Reuters, Feb 26, 2018

Leading analyst predicts higher Malaysian palm oil prices

Malaysian palm oil prices are expected to trade at RM2,500 to RM2,700 per tonne as production falls from March and stock levels decline between January and July.

Leading vegetable oils analyst Dorab Mistry said this would mean a recovery for benchmark palm oil prices that have slumped more than 10% since early November 2017 on rising Malaysian stockpiles. Inventory levels in Malaysia rose to their highest in more than two years in December 2017, hitting 2.7 million tonnes.

“Palm oil looks oversold and demand is at record levels,” Mistry said at an edible oils conference in Karachi, Pakistan.

“We must expect measures from the Malaysian government to assist small growers and to support prices. Stocks have peaked and will gradually decline from now until July.”

Mistry said his price outlook is based on an assumption of Brent crude oil prices at US$60-75 a barrel.

Palm oil production typically rises during the fourth quarter of each year before declining through the middle of the following year. Analysts, however, expect to see slower seasonal tapering this year, as output trends have been affected by the El Nino event of 2015.

Mistry, the director of Indian consumer goods company Godrej International, pegged Malaysia’s 2018 palm oil output at 21 million tonnes, while Indonesia’s was forecast at 38 million tonnes. Together, these countries account for nearly 90% of global palm oil production.

The Malaysian Palm Oil Board reported an output of 19.9 million tonnes last year, while the Indonesia Palm Oil Association estimated its production at 36.5 million tonnes.

“Overall in oil year 2017-2018 [ending September 2018], palm oil production will be up at least 4.5 million tonnes [globally],” said Mistry.

Based on rainfall patterns and weather forecasts, production is expected to surge from September, he said.

The crude palm oil price would rise to US$750 per tonne CIF Rotterdam by mid-year, while the RBD palm olein price would touch US$720 a tonne on a free-on-board basis, he added.

Source: Reuters, Jan 22, 2018

India’s branded edible oils sales cross Rs 1.3 trillion mark

Health-conscious Indians are driving the sale of branded edible oils, ditching ‘loose oil’ sold by neighbourhood grocery stores.

According to market research firm Euromonitor International, the edible oils category in India grew 25.6% to cross the Rs 1.3 trillion mark last year – the first time any packaged food category has done so. Dairy products were second, achieving Rs 1.2 trillion or 16.5% more than in 2016.

Edible oils formed over 30% of the Rs 4.3 trillion packaged foods market in India, compared to the 8.8% share held by rice, pasta and noodles.

“Growth is primarily coming from new consumers who are shifting from loose to packaged oils,” said Atul Chaturvedi, chief executive officer of Adani Wilmar Ltd, which refines and produces edible oils.

Deoki Muchhal, managing director of Cargill’s food business in India, said: “Packaged oil sales are growing at 2.5 times the rate of overall edible oils consumption in India.

“Increasing awareness of safe products, the food law administration restricting loose product sales and the crackdown by the government on unfair trade practices have aided this growth.”

According to Euromonitor, the rice, pasta and noodles category will grow faster than others until 2022 with a 12% cumulative average growth rate, followed by breakfast cereals (10.6%). Edible oils are expected to maintain a healthy rate of 9%.

Source: Business Standard, Feb 7, 2018

India’s cooking oil imports on the rise

In the wake of unsatisfactory oilseed production in the harvesting year 2017-18, India is expected to import 15 million tonnes of cooking oil. This is likely to push up the annual bill for edible oils imports to about Rs 650 billion.

The latest survey by the Soybean Processors Association estimates that Indian soybean production will register 8.4 million tonnes, or 24% less compared to 10.9 million tonnes previously. Soybean contributes nearly a third of domestic oilseeds output.

India is the world’s largest importer of edible oils, buying nearly 70% of the volume required to keep pace with consumer demand for cooking oil.

Local farmers having been planting less soybean each year to avoid losses arising from low prices. Last year, industry players and farmers requested the government to impose higher import duty on edible oils in order to safeguard their interests. As a result, the import duty was raised to the highest level in more than 10 years.

Source: Financial Express, Feb 13, 2018

Turning oil palm waste into biogas in Thailand

Thai palm oil producer Agriculture of Basin Co Ltd (ABC) and Japan’s Osaka Gas Co Ltd are engaged in a joint project to refine biogas – generated from agriculture process residues – for use as fuel in vehicles that run on natural gas.

ABC has installed a facility to refine biogas, as well as a natural gas station, at its palm oil factory in southern Thailand. Organic matter in the factory’s wastewater first goes through the process of digestion to generate biogas. This is then refined into biomethane – a renewable natural gas – after removing carbon dioxide (CO2) and other impurities.

The hybrid biogas refining system, developed by Osaka Gas, is based on an original combination – CO2 separation membrane with Pressure Swing Adsorption, a technology that selectively adsorbs and removes CO2. The system, which can extract 99% of the methane contained in biogas, is among the most efficient of its kind, according to Osaka Gas.

A year-long pilot project was launched last November to focus on verification of a long-term stable operation, as well as methods to minimise the cost of producing methane gas and determine the effectiveness of the output as a vehicle fuel.

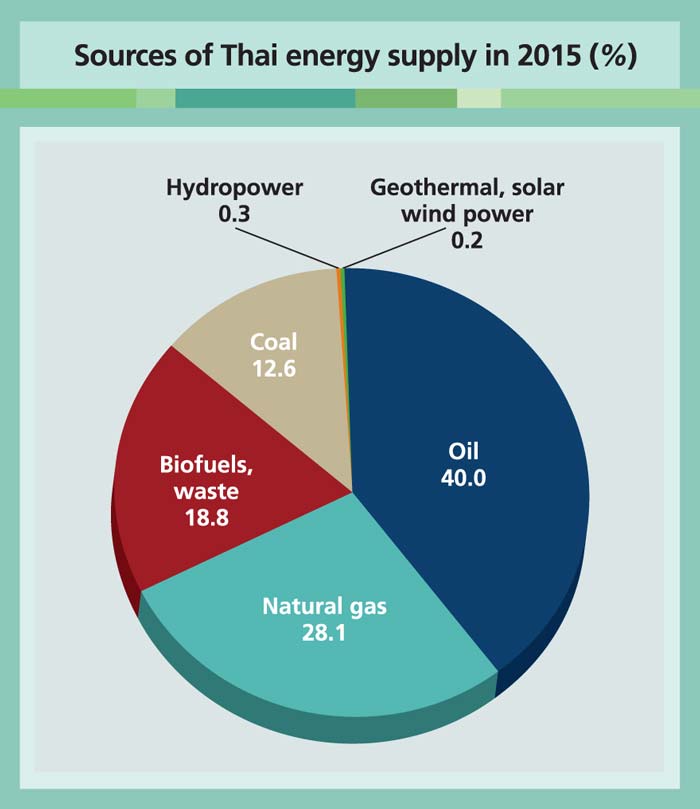

Source: International Energy Agency

Note: Electricity trade not included

Once approved as meeting Thailand’s quality standards for vehicle fuel, ABC will use the refined methane gas to run its own natural gas-powered vehicles. Based on the outcome of pilot testing, ABC will develop further transportation initiatives to effectively utilise the renewable natural gas.

The project is supported by the Thai government, which has provided over 40% of the 35 million baht (US$1.1 million) that ABC has spent building the natural gas station.

With concerns growing about the depletion of domestic natural gas reserves – the principal source of electricity in Thailand – the government is keen to develop new sources of energy.

It is therefore looking to biogas to help raise the share of renewable energy sources in the country’s overall final energy consumption to 30% by 2036.

The clean energy campaign is also driven by growing concerns about the heavy dependence on imported energy. Thailand uses imports for over 40% of its energy needs, according to the International Energy Agency.

The government views biomethane as an important energy source that can help the country wean itself off its reliance on imports, a top official at the Ministry of Energy said.

Since agriculture is one of Thailand’s most prominent industries, there is an abundance of biomass resources. These include oil palm residue; the remnants of sugarcane crushed to extract juice; and food factory wastewater. The use of natural gas vehicles is also becoming more prevalent in Thailand.

Sources: Business Wire, Nov 26, 2017; NVG Global News, Dec 3, 2017; Nikkei Asian Review, Jan 5, 2018

Malaysia enhances use of oil palm trunks, rubber trees

Malaysia is making better use of wood from oil palm trunks and rubber trees, given the versatility and durability of this raw material.

The move away from hardwood timber is also in line with efforts to conserve the country’s natural forests, said Malaysian Timber Industry Board (MTIB) director-general Datuk Dr Jalaluddin Harun.

Timber industry players are looking at using raw materials from rubber trees and oil palm trunks to produce veneer, plywood and panels, he said.

“We have relatively huge rubber and oil palm plantations. Currently, 80% of our furniture exports [are made of] rubber wood. The future of the plantation sector is secure,” he said.

Malaysia has close to 1.1 million ha of rubber estates to sustain demand for timber downstream businesses.

“We also have 5.7 million ha of oil palm plantations. These estates undergo replanting after 25 years. We have about 80,000 ha to 100,000 ha of oil palm plantations available for harvesting and replanting annually,” he said.

Currently, five factories produce veneer plywood and soft-timber made from oil palm trunks.

Jalaluddin said the National Forestry Department is also active in replanting trees: “In that sense, we are managing the situation sustainably for the future. For example, we plant Acacia mangium. We have more than 300,000 ha in Sabah, Sarawak and Peninsular Malaysia.”

Malaysia is the world’s eighth-largest exporter of wooden furniture. Japan is its biggest market for timber exports, followed by the US, European Union, India and Australia.

The MTIB also encourages the import of raw materials from North America, Europe, Africa and Latin America to add value to the furniture-making chain. Finished products are then exported at a premium price.

Logs are processing into furniture parts and building components like flooring, wall panels and mouldings, said an industry player.

Affin Hwang Capital plantation analyst Nadia Aquidah said timber is in scarce supply globally due to reduced availability of natural forest logs.

“There is no problem in selling our logs [while] the demand for plywood remains stable,” she added.

Within this scenario, oil palm smallholders have been urged to make better use of oil palm trunks whenever they carry out replanting.

Plantation Industries and Commodities Minister Datuk Seri Mah Siew Keong said the sale of oil palm trunks would generate additional income for the small farmers.

About 18 million mature oil palm trunks are produced every year during replanting exercises in Malaysia, with 136 oil palm trunks being extracted from every hectare planted, he noted.

Sources: New Straits Times, Dec 9, 2017; Bernama, Dec 19, 2017

Record volume of soybean imports by India

High domestic soybean prices coupled with a smaller crop in 2017 are causing processors in India to import a record volume of soybean this year. Reports indicate that they have contracted to import up to 100,000 tonnes since December 2017, with the 2017/18 total likely reaching 200,000 tonnes.

The shipments are said to be primarily sourced from Ethiopia and Benin – likely re-exports – because those countries have preferential access to the Indian market. India’s most-favoured nation tariff rate is 30%, and it does not allow the importation of genetically-modified (GM) soybean.

Over the last five crop years, the average soybean yield in India has been about 0.8 tonnes/ha. The crop is almost exclusively grown under dryland conditions and subject to the vagaries of rainfall during the monsoon season.

Many farmers do not want to grow soybean because of the low yield and despite the government’s guaranteed high minimum price. With some forecasters now predicting below-average rainfall during the upcoming monsoon season, it appears that 2018 may not be a good year for Indian soybean production.

Indian soybean meal demand is rising at about 10% annually due to its rapidly growing poultry and aquaculture sectors, and there is no foreseeable way that domestic soybean production is going to keep up.

Source: Ag Perspective, March 13, 2018

China to import 100 million tonnes of soybean in 2017/18?

JY Chow, a food and agriculture analyst with Japan’s Mizuho Bank, has predicted that China will import 100 million tonnes of soybean in 2017/18. He based this forecast on a rapidly growing swine sector that is requiring more soybean meal.

Muyuan Foods Co Ltd, China’s second-largest swine producer, recently indicated that the company plans to boost the number of hogs it will produce and slaughter to 12 million, up from 7 million in 2017.

An increase in China’s soybean imports may also be partly driven by expectations that it will export more meal in 2017/18. One trader has told Reuters that he estimates the country will export 2 million tonnes, almost double the volume in 2016/17.

The increases are anticipated because the drought in Argentina will likely reduce the amount of soybean meal that it exports. Another trader told Reuters he expects China will export more meal this year to Japan, Vietnam, Thailand and Indonesia, among other countries.

China imported 93.5 million tonnes in MY 2016/17, and the USDA is forecasting 97 million tonnes in 2017/18. The total increased by an average 6.9 million tonnes over the previous five years; therefore, achieving 100 million tonnes is certainly a possibility.

China’s growing demand for soybean makes it very unlikely that the country will retaliate against US soybean exports, as some have suggested. Even if it took all the soybean exported by Brazil, Argentina, Paraguay and Uruguay, China would still need to import about 25 million tonnes from the US.

In addition, the US would simply export to the other nations that could no longer source from those origins. Retaliation against US soybean would also be disproportionate since the volume exported to China in 2016/17 was valued at over $14.5 billion versus US imports of Chinese steel and aluminum worth slightly less than $1.7 billion.

Source: Ag Perspective, March 13, 2018

By gofb-adm on Wednesday, April 25th, 2018 in Issue 1 - 2018, Publication No Comments

From 1965 to 1967, in addition to bringing to completion our programmes for planting, roads and buildings, we were also very preoccupied with the erection of our factory. At that time, the only company which could build a standard turn-key palm oil mill on contract, was Messrs Stork of Amsterdam.

Read more »By gofb-adm on Wednesday, April 25th, 2018 in Issue 1 - 2018, Health No Comments

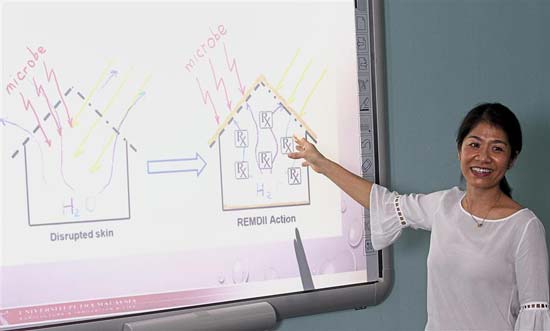

Professor Dr Lai Oi Ming of Universiti Putra Malaysia’s (UPM) Department of Bioprocess Technology had her first child in 2013. However, her initial joy was marred because he had an unexpected skin condition.

“My son had very severe eczema when he was born. I come from a family that does not have asthma, eczema or other allergic conditions, so I didn’t know how to deal with him,” she said.

At the time, the lipid and enzyme technology expert was working on a tocotrienols clinical trial with one of her Masters students.

Tocotrienols are one of the two forms of Vitamin E, with the other being tocopherols. They are differentiated by the type of chemical bonds they have in their side chain; tocotrienols have three double bonds, while tocopherols have single bonds. Both forms have four members, or isomers, each – namely, alpha, beta, gamma and delta.

Said Prof Lai: “From that trial, I knew that tocotrienols have very good anti-inflammatory properties; they have always been used for cardiovascular diseases, cancer, etc, but there wasn’t any study for eczema or atopic dermatitis [the most common form of eczema].

“So I decided to have a look at all the [eczema] creams that were out there; it was very frustrating to find out that most do not have anti-inflammatory properties – I just couldn’t wrap my head around that.

“Whenever I saw doctors, they would tell me there is no cure for eczema. That was even harder to accept because, in the 21st century, you would think that a skin condition would have a treatment. So, I decided to work on it.”

Studies have shown that in many cases, eczema patients do not have a protein known as filaggrin in the skin, said Prof Lai.

“This particular protein is supposed to protect the skin barrier so that the moisture below the skin doesn’t evaporate. At the same time, allergens and microbes from the outside are unable to penetrate the skin.”

Using the analogy of a house, Prof Lai explained the problems that eczema causes to the skin, and how the cream that she and her students developed has helped to solve those problems.

Without a properly-functioning barrier, the skin is unable to maintain its moisture, leading to the dry and scaly skin of eczema. Foreign substances are able to penetrate the skin, causing the inflammation that results in red and itchy rashes and, in severe cases, infection.

Eczema can occur at any age, although it more commonly begins in childhood or even infanthood. While some children outgrow this condition by the age of two, around half will continue to suffer from the chronic condition for life. Based on the latest available data from 2005, about a quarter of the Malaysian population has eczema.

Doctors take a two-prong approach for a flare-up – they prescribe a steroid to reduce the inflammation and tell patients to continuously moisturise. However, Prof Lai’s team discovered a problem with this.

“When we did a survey of all the creams in the market, we found that 90% don’t even have an active ingredient. Considering that eczema is an inflammatory skin condition, you would think that there should be some bioactive ingredient to reduce inflammation – an anti-inflammatory bioactive – but most of the creams do not have any.

“Of the 10% that do have it, some are synthetic ones. Most of the time, they only act on the surface [of the skin]. But inflammation happens in the dermal layer. That’s when we realised that something doesn’t match.”

By gofb-adm on Wednesday, April 25th, 2018 in Issue 1 - 2018, Sustainability No Comments

Reports indicate that, by November, the Roundtable for Sustainable Palm Oil (RSPO) is set to release revised Principles and Criteria (P&C) for the production of sustainable palm oil. This will bring new standards into force.

At the same time, the European Parliament is pushing for the creation of a ‘Eurocentric sustainable palm oil standard’. This is beginning to encroach on the standardisation work of the RSPO and of the two biggest palm oil producing countries.

In addition to its P&C on the production of sustainable palm oil, the RSPO develops and maintains a number of documents and standards. They include those relating to the supply chain, internal and external certification systems and processes, and other relevant guidance for its members. On June 14, 2017, the RSPO Board of Governors (BoG) approved revised versions of such documents. These in part help set the foundation for the upcoming P&C.

On July 4, 2017, the RSPO Secretariat published the revised Certification Systems for P&C. The document entered into effect on July 1, 2017, but all members and certification bodies have been given 12 months to bring their systems into compliance.

The document sets out the requirements for the systems that must be followed in the implementation of certification against the requirements of the P&C and/or its National Interpretations. Although most of the document will apply from July 1, 2018, Clauses 4.10 and 4.11 entered into force on Sept 1, 2017.

Clause 4.10 addresses reporting and communications. The certification body must prepare a peer-reviewed certification audit report, including a public summary report, and submit it to the RSPO by the deadlines set. Clause 4.11 pertains to the certificates that the certification body must complete and send to the RSPO Secretariat within the stipulated time-period.

The RSPO Secretariat has also published a revised Standard Operating Procedure (SOP) for Standard Setting and Review. This document, also approved at the June meeting, took effect from July 1, 2017. It sets out the procedures and describes the processes by which the RSPO standards are to be set and reviewed.

In general, two standing committees are charged with the oversight of the standards: the RSPO Standards & Certifications Standing Committee (S&C SC); and the Trade & Traceability Standing Committee (T&T SC).

The S&C SC is responsible for documents describing and relating to the RSPO P&C, while the T&T SC is responsible for documents describing the RSPO supply chain certification standard.

The SOP is particularly relevant as the S&C SC finalises the new P&C. The RSPO standards are reviewed at least once every five years. The existing standard from 2013 is being reviewed for continued relevance and effectiveness, including through the assessment of results of ongoing monitoring and evaluation by the RSPO.

The S&C also decides to what extent it is necessary to conduct stakeholder engagement during the revision process; whether a task force is required; and the extent of public consultation. The Terms of Reference of the S&C SC include:

Once developed, revised standards are to be field-tested so as to assess their feasibility and the extent to which the requirements can be audited. Pilot tests can take place in multiple locations to assess differences in geographical regions. Once endorsed by the BoG, the revised standards are voted upon by the RSPO General Assembly, where a single majority of a fixed quorum of ordinary members is required for adoption.

There are as yet few details of the new RSPO P&C. In terms of the three main roles of the S&C SC – stakeholder engagement; task force creation; and public consultation – reports indicate that the stakeholder engagement process was launched in May 2017.

In addition, on May 26, 2017, the RSPO announced the formation of a Labour Rights Task Force. It is expected that addressing labour rights will be an important part of the revised P&C.

It is also expected that the revised P&C will take steps to improve the ability of smallholders to meet the sustainability criteria, in the hopes of recruiting more of them into the RSPO membership.

By gofb-adm on Wednesday, April 25th, 2018 in Issue 1 - 2018, Markets No Comments

China’s appetite for instant noodles flourished from the 1990s to 2013, with the market dominated by brands such as Master Kang (produced by Ting Hsin), Uni-President and Nissin at the national level, and by Baixiang, Jinmailang and Hua Long at the regional level.

Read more »By gofb-adm on Wednesday, April 25th, 2018 in Issue 1 - 2018, Markets No Comments

A guidance note on food labelling in Turkey expressly states that the ‘palm oil-free’ claim is illegal. The guidance for the food industry, prepared by the government, is of great interest regarding the notorious ‘palm oil-free’ claim commonly used in many EU member-states.

Turkey’s interpretation should be seen as an important hint in the direction of EU authorities that continue to ignore the illegal, anti-competitive and misleading labelling of food products carrying the ‘palm oil-free’ claim.

The government of Turkey had published the updated Food Codex Regulation on Labelling in the Official Journal on Jan 26, 2017. Last July, after collaborating with different food industry associations and food business operators for more than three years, the Ministry of Food, Agriculture and Livestock of Turkey published a guidance note entitled ‘Turkish Food Codex: Guidance on Food Labelling and Consumer Information Regulation’, which interprets the updated labelling rules.

The updated Food Codex Regulation on Labelling and the related guidance are part of Turkey’s efforts to bring its food law in line with EU law. Turkey has been a candidate-country since 1999. Accession negotiations started on Oct 3, 2005.

A revised Accession Partnership was adopted in 2008 and established the principles, priorities and conditions for accession negotiations. Under Chapter 12 on ‘Food safety, veterinary and phytosanitary policy’, Turkey committed to adopt a framework on food, feed and veterinary matters compliant with EU requirements and allowing for a complete transposition of the so-called ‘acquis’, the body of EU law.

In this context, the Turkish Food Codex Regulation on Labelling is particularly relevant. Article 50(1) states: ‘This Regulation has been prepared in accordance with the legislation of the European Parliament, taking into consideration the Regulation (EC) No. 1169/2011 of the European Parliament and of the Council of [Oct] 25, 2011 on the provision of food information to consumers’ (also known as the Food Information Regulation, FIR).

Ahead of the EU

Ahead of the EU

In an innovative and forward-thinking manner, the Turkish Food Codex Regulation on Labelling and the guidance note address matters that have not yet been agreed at the EU level. This concerns, in particular, specific rules on declarations on the absence of food ingredients and rules on the establishment of so-called nutrient profiles.

Particularly relevant to the infamous ‘palm oil-free’ claim is Article 7(1)(c) of the Turkish Food Codex Regulation on Labelling. It states: ‘Informing about food cannot be misleading, in particular by claiming that a particular food has special qualities, in particular, by highlighting the presence or absence of certain ingredients and/or nutrients, when all similar foods have the same qualities.’

This provision implements Article 7(1)(c) of the FIR on fair information practices, which provides that food information must not be misleading, particularly ‘by suggesting that the food possesses special characteristics when in fact all similar foods possess such characteristics, in particular by specifically emphasising the presence or absence of certain ingredients and/or nutrients’.

Article 7(1)(c) of the FIR further addresses the legal concept of misleading advertisements with certainties (i.e. ‘obvious’, ‘self-evident’ and ‘flagrantly misleading’ advertising), which has been so far mostly applied in cases of the so-called ‘clean’ labelling. Clean label claims, such as ‘additives-free’ or ‘free from preservatives’, may only be made as long as they are true and the use of additives in such foods is legal.

Since Dec 13, 2014, the FIR has required the specific vegetable oils to be indicated in the list of ingredients. Listing the generic indication ‘vegetable oils’ is no longer sufficient. Now that the specific origin of the vegetable oil must be declared, the ‘palm-oil free’ claim has become irrelevant and illegal. It is also misleading because it gives consumers the impression that food products carrying the claim have special properties that other similar foods do not.

The Turkish guidance note expressly spells out that claims such as ‘palm oil-free’ and ‘no glucose syrup’ are prohibited. The aim of the guidance is to protect consumers from being misled and to help food business operators to comply with the updated rules on food labelling that ban terms such as ‘real’ or ‘genuine’ and prevent firms from making certain claims like ‘no palm oil’. The same restrictions apply to claims used in English that are generally recognisable by consumers, such as ‘original’ or ‘natural’.

The most relevant part of the guidance on certain terms and expressions used on food labels in private practice reads as (unofficially translated):

(3) Other Negative and Positive Statements

1. Declarations on the absence of food ingredients (‘… contains no …’) other than those specified in this guideline cannot be used. Examples: ‘Sunflower oil-free’; ‘Does not contain glucose syrup’; Palm oil-free’, etc. These expressions cannot be used.

Since the guidance note implements the FIR, it should arguably not be a challenge for European food exporters to comply when supplying the Turkish market. However, EU member-states and the European Commission (EC), in their guidance to the FIR, have unfortunately not gone as far as Turkey in explicitly noting that ‘palm oil-free’ or ‘no palm oil’ claims cannot be made. Some EU food business operators might have to change their labelling to bring it into compliance with the Turkish rules and their interpretation provided in the guidance.

By gofb-adm on Wednesday, April 25th, 2018 in Issue 1 - 2018, Markets No Comments

Egypt is among the world’s fastest growing markets for imported food and agricultural products. It is, however, a price-sensitive market that also struggles with government austerity measures, soaring youth unemployment and double-digit inflation.

Demand for oils and fats, including palm oil, is supported by growth of the food industry. The sector grew with a compound annual growth rate of almost 15% from 2011-16. Driving growth is the shift to increased production for domestic consumption and export. Consumption of oils and fats will continue to rise, due in part to population growth which is expected to surpass 100 million by 2021 and to record 117 million by 2030.

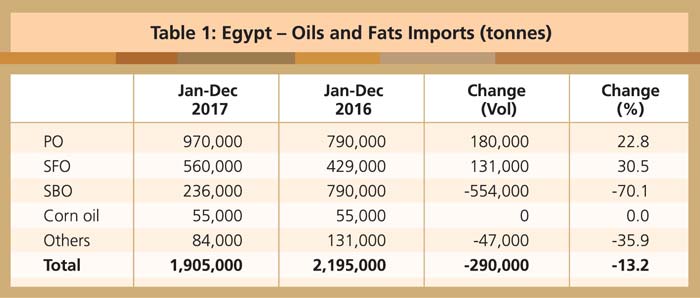

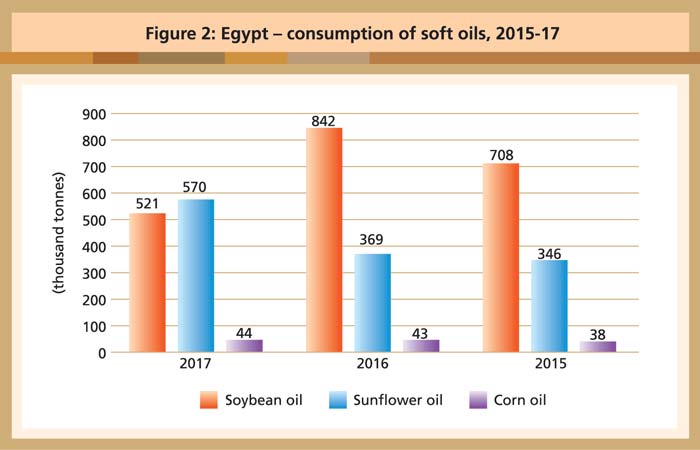

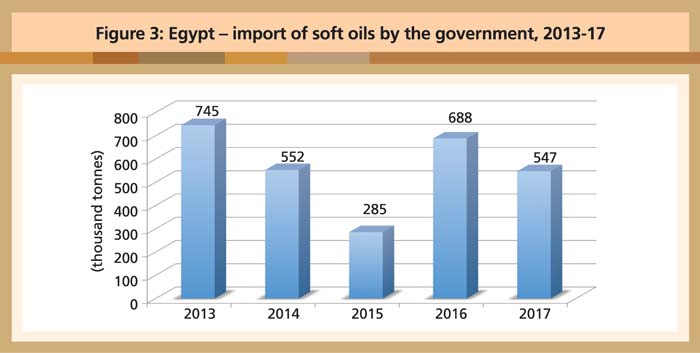

Oils and fats imports were recorded at 1.9 million tonnes in 2017, a drop of 13.2% compared to the previous year. This was mainly due to reduction of the government’s procurement under the cooking oil subsidy scheme, due to budget constraints. In 2017, the government imported 547,235 tonnes of soft oils for the subsidy programme, compared to 688,174 tonnes in 2016.

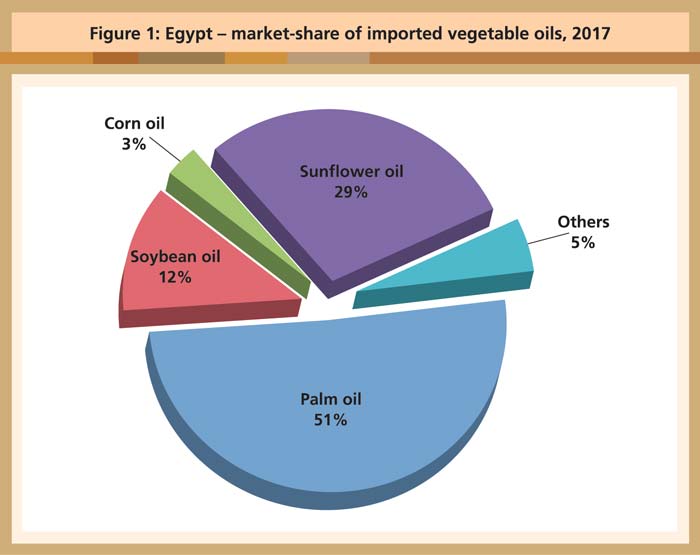

Palm oil imports rose by 23% or 180,000 tonnes to record 970,000 tonnes in 2017, compared to 790,000 tonnes in 2016 (Table 1).

Source: Oil World

The volume accounted for 51% of the total oils and fats imports (Figure 1).

Source: MPOC

Food processing sector

Consumer behaviour in Egypt has been changing in recent years because the retail prices of nearly all goods and services have increased. This has restricted the level of disposable income, which was already low. Food prices soared 40% in June 2017 compared to the same period in 2016, while food inflation reportedly reached 44% in April 2017.

The floating of the Egyptian pound, which has stoked inflation, has also pressured importers to raise the prices of goods. The government is imposing stricter rules on importers with the aim of reducing imports by 25% to save foreign currency reserves and protect local industries. A statement from the Central Agency for Public Mobilisation and Statistics revealed that the price of imported oils and fats increased by 18.5% in 2017.

The value of domestic consumption of processed foods grew from US$32 billion in 2008 to nearly US$45 billion in 2017. The food processing sector is forecast to grow from 2017-21, albeit at a slower rate of 5% in terms of the local currency.

Source: Oil Word

Food processors are also taking advantage of Egypt’s central location in the Middle East and North Africa to increase exports to regional markets. Its processed food products are exempted from import duty in nearly all of the Arab and African export destinations.

Source: Trade calculations

Egypt’s exports of processed foods earned nearly US$2.6 billion up to November 2017. Of this, some US$1.1 billion worth of goods went Saudi Arabia ($289 million), Libya ($144 million), and Jordan ($123 million). Top exports were edible oils ($397 million), processed cheese ($152 million), and sugar and confectionery ($143 million).

MPOC Egypt

By gofb-adm on Wednesday, April 25th, 2018 in Issue 1 - 2018, Comment No Comments

A draft of the revised EU Renewable Energy Directive (RED II) is making its way through the legislative process in Brussels. The proposals present a huge issue for Malaysia, specifically for its palm oil exports. This is because the European Parliament intends to ban palm oil biofuels from 2021 – last year, its Environment Committee and the Industry, Research and Energy Committee had respectively voted for the ban.

Read more »By gofb-adm on Wednesday, April 25th, 2018 in Issue 1 - 2018, Cover Story No Comments

A lot has been written about the anti-palm oil campaigns that are currently underway in Europe.

Read more »By gofb-adm on Wednesday, April 25th, 2018 in Issue 1 - 2018, Editorial No Comments

The European Parliament continues its discriminatory campaign against palm oil. On Jan 17, it adopted its position on the European Commission’s (EC’s) proposal for a Directive of the European Parliament and of the Council of the EU (Council) on the promotion of the use of energy from renewable resources (proposed RES Directive).

Read more »