By gofb-adm on Thursday, May 6th, 2021 in Advertorial No Comments

By gofb-adm on Thursday, May 6th, 2021 in Advertorial No Comments

Global oilseeds production for 2020/21 is forecast at 596 million tonnes, 750,000 tonnes above February. Higher Brazil soybean production, coupled with greater Australia and European Union (EU) rapeseed production, have more than offset lower palm kernel, cottonseed and sunflower seed production forecasts.

Read more »By gofb-adm on Saturday, October 6th, 2018 in Advertorial, Issue 3 - 2018 No Comments

Bursa Malaysia Derivatives (BMD) Berhad has successfully launched the RBD Palm Olein Futures Contract on 24th May 2018.

Read more »By gofb-adm on Monday, January 15th, 2018 in Issue 4 - 2017, Advertorial No Comments

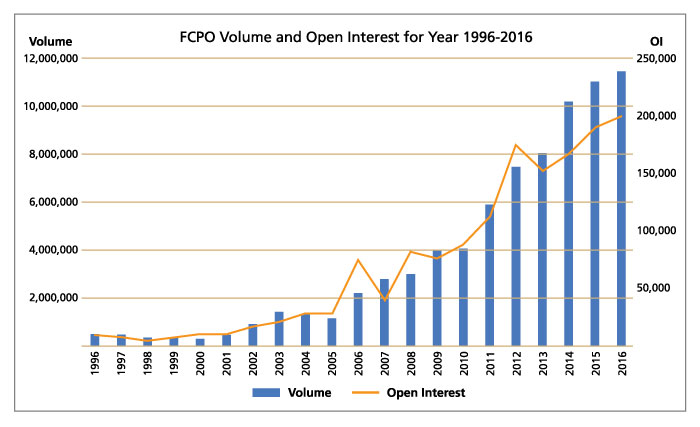

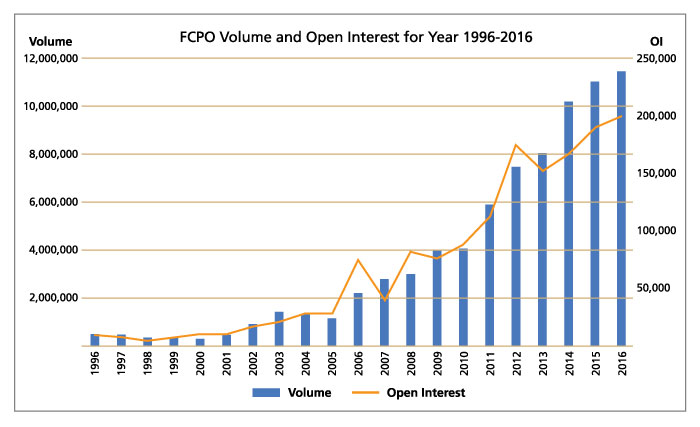

Bursa Malaysia Derivatives (BMD) Malaysia Ringgit (MYR) denominated Crude Palm Oil Futures (FCPO) contract is a global benchmark pricing of Crude Palm Oil market. Since its launch in October 1980, it has become the reference point for major global vegetable oils and fats market players.

The trading volume had increased more than 4 times in 10 years from 2.8mil contracts / 70mil MT in 2007 to 11.4mil contracts / 285 mil MT in 2016. In January – September 2017, we have seen a 4% increase in contracts traded compared to January-September 2016. The market segment trading FCPO consist of 56% institutions, 28% Professional Traders, and 16% retailers.

To compliment FCPO contract, Bursa Malaysia Derivatives had launched the Options on Crude Palm Oil Futures (FCPO) on 16 July 2012. Options are highly versatile instruments that allow a myriad of trading strategies which satisfy different risks appetites and hedging requirements.

In Year 2016, OCPO trading volume was at the historical high. A total of 40,120 lots / 1mil MT was traded. Majority of the trades are done by Institutional Clients through our Negotiable Large Trade (NLT) Facility. The Exchange is actively sourcing for market makers to provide on screen liquidity. With market makers on board, we do foresee that most of the trades will eventually translate into on screen trading and these will then attract the professional traders and retailers to trade OCPO.

By gofb-adm on Sunday, January 14th, 2018 in Issue 4 - 2017, Advertorial No Comments

Bursa Malaysia Derivatives (BMD) Malaysia Ringgit (MYR) denominated Crude Palm Oil Futures (FCPO) contract is a global benchmark pricing of Crude Palm Oil market. Since its launch in October 1980, it has become the reference point for major global vegetable oils and fats market players.

The trading volume had increased more than 4 times in 10 years from 2.8mil contracts / 70mil MT in 2007 to 11.4mil contracts / 285 mil MT in 2016. In January – September 2017, we have seen a 4% increase in contracts traded compared to January-September 2016. The market segment trading FCPO consist of 56% institutions, 28% Professional Traders, and 16% retailers.

To compliment FCPO contract, Bursa Malaysia Derivatives had launched the Options on Crude Palm Oil Futures (FCPO) on 16 July 2012. Options are highly versatile instruments that allow a myriad of trading strategies which satisfy different risks appetites and hedging requirements.

In Year 2016, OCPO trading volume was at the historical high. A total of 40,120 lots / 1mil MT was traded. Majority of the trades are done by Institutional Clients through our Negotiable Large Trade (NLT) Facility. The Exchange is actively sourcing for market makers to provide on screen liquidity. With market makers on board, we do foresee that most of the trades will eventually translate into on screen trading and these will then attract the professional traders and retailers to trade OCPO.