Uzbekistan is Central Asia’s biggest economy and a trade hub for the region. The country has a land border stretching over 6,893km, which is shared with Afghanistan, Kazakhstan, Kyrgyzstan, Tajikistan and Turkmenistan.

Uzbekistan is home to more than 32 million people, with about 40% of them based in urban areas in Tashkent, Navoi and Samarkand. Population growth has been steady at an annual average of 1.5%. At this rate, the population could exceed 35 million in 2025 and 41 million in 2050.

From Independence in 1991, the government led by President Islam Karimov had controlled the economy, especially sectors like banking services and the production of oil and gas, minerals and food products. Despite entry and operational barriers, the economy grew respectably. However, it failed to inspire the confidence of foreign investors and big corporations.

Many feared that, after the death of President Karimov in September 2016, the country would descend into chaos. But the new president, Shavkat Mirziyaev, who had been the Prime Minister for 13 years, adopted a balanced policy on both the foreign and domestic fronts. He has introduced a wide range of economic reforms since 2017:

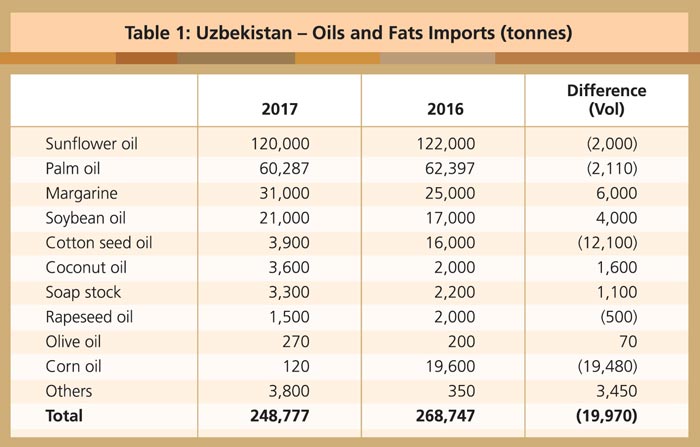

Source: The State Committee of the Republic of Uzbekistan on Statistics

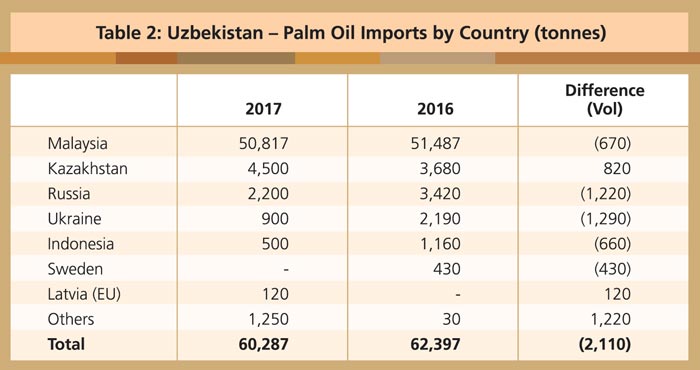

Source: The State Committee of the Republic of Uzbekistan on Statistics

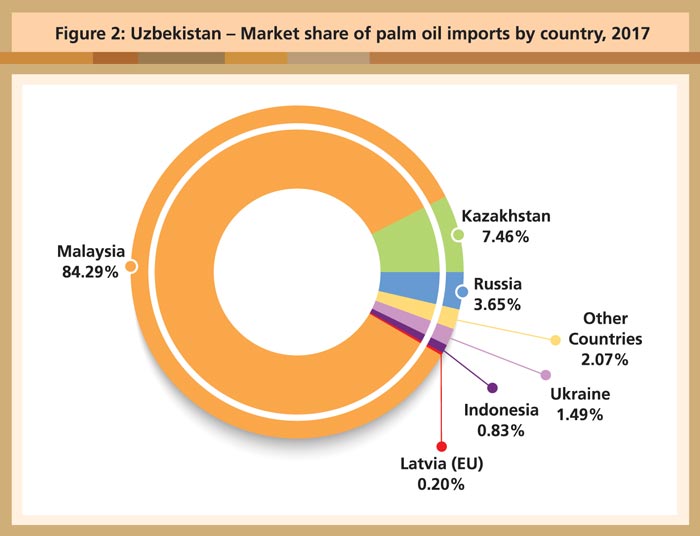

Source: The State Committee of the Republic of Uzbekistan on Statistics

Overall, the improvements have had a positive effect on the economy and restored investor confidence. Since January 2017, more than 32,000 new small and medium business entities have been registered; of these, about 27% are engaged in industrial production and manufacturing. Uzbekistan’s overall trade showed an increase of 7.7% in 2017, compared to 2016.

Oils and fats market

Uzbekistan is emerging as the leading consumer of oils and fats in the Central Asian Region. Total consumption currently stands at about 556,000 tonnes, of which 52% is met by locally produced oils and fats.

The edible oils industry is dominated by domestic cotton seed oil and imported sunflower oil from Russia and neighbouring countries. Cotton seed is the largest oilseed crop in Uzbekistan, with a share of about 50% of total consumption of oils and fats. However, production is declining due to a government policy to shift the focus away from the textile industry. The reduction in the supply of cotton seed oil and increase in overall consumption will widen the gap between supply and demand – this will have to be bridged by imports.

Edible oil imports in 2017 registered 248,777 tonnes (Table 1), or 7.5% lower compared to 2016. The decline was mainly due to the currency rate adjustment in September 2017, which resulted in devaluation of more than 90%. This increased the cost of imports out of proportion and many contracts were cancelled. After the initial shock, the import market settled in the following months and picked up from January 2018.

Imports are dominated by sunflower oil which accounts for 48% of the total volume. Primarily used as a premium cooking oil, it is imported from Russia, Kazakhstan and other CIS countries. Palm oil is the second-largest import and is fast becoming a key ingredient in the confectionery and food industries.

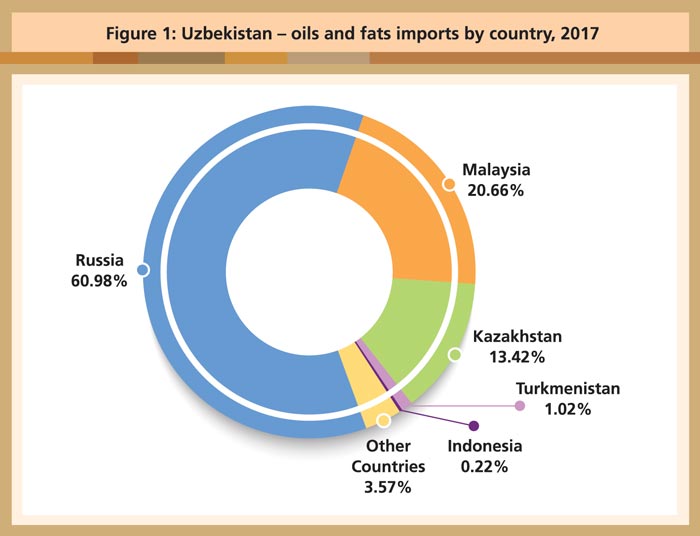

Uzbekistan imports most of its oils and fats from the neighbouring CIS countries as they have open borders and a preferred duty structure. Malaysia is the only country which has managed to secure a sizeable market share in this double landlocked country. In 2017, Malaysia held a market share of 84.3% in palm oil imports (Figure 2), and 21% of total oils and fats imports.

Source: The State Committee of the Republic of Uzbekistan on Statistics

Prospects for palm oil

Palm oil has become an important ingredient in Uzbekistan’s food industry, with its use and consumption having risen consistently. The food industry has registered double-digit growth over the past three years and this is expected to continue. Margarine, confectionery and ice cream are the main industries that use palm oil and its various fractions.

Palm oil distribution has been controlled by several importers who obtain supply from Malaysia, Ukraine and Russia, and then distribute it locally. Most industries have not bought palm oil directly, mainly due to foreign currency restrictions up to 2017. However, there is now keen interest in buying direct from suppliers in order to obtain a better price, consistent quality and after-sales support.

Until recently, the import duty on palm oil had been higher if supply was obtained from Malaysia and Indonesia, compared to the CIS countries. A significant volume of imports had therefore shifted to suppliers from Ukraine and Russia.

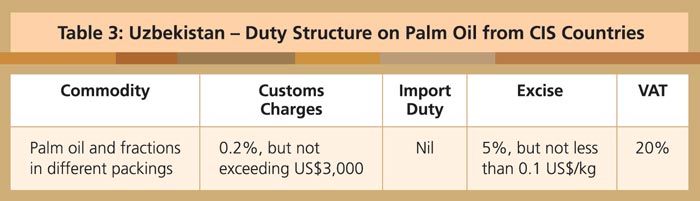

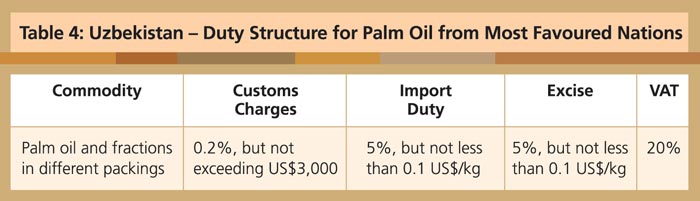

Oils and fats have been subjected to very high import duty and taxes. The total tariff on oils and fats imported from CIS countries came up to 26%, compared to 31% from Malaysia and Indonesia and other countries with Most Favoured Nations status. Under the reforms, however, the government pledged to reduce the import duty and VAT on imports including palm oil, and to provide a level playing field for all countries.

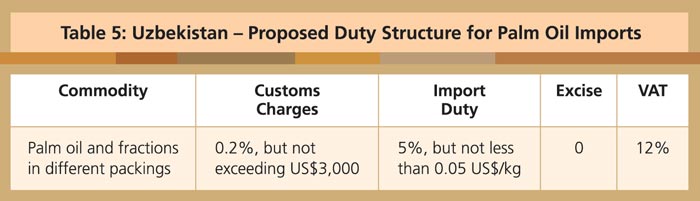

The government’s decision to reduce the duty and tariffs from 31% to 18% has been applauded, as this will not only bring down retail prices but will also enable industries to step up their production capacity.

This duty structure is due to take effect from January 2019, and is expected to boost palm oil supply from Malaysia, while encouraging industry members to import directly. The potential for growth in the import of palm oil has never been better.

Faisal Iqbal

MPOC Pakistan