More imports from Malaysia

August, 2018 in Issue 2 -2018, Markets

Measured by gross domestic product (GDP), Italy is ranked tenth among the world’s largest economies. The main driver is the manufacture of high-quality consumer goods produced by small- and medium-size enterprises, many of them family-owned.

The third-largest economy in the Eurozone, Italy has suffered many problems. After strong GDP growth of 5-6% per year from the 1950s to the early 1970s, there was a slowdown over the 1980s and 1990s. In the last decade, the annual growth rate was poor, averaging 1.2% and comparing unfavourably with the EU average of 2.3%.

Stagnation in economic growth, coupled with political efforts to revive it with massive government spending from the 1980s, resulted in a sharp rise in public debt. In 2016, this reached a staggering 132% of GDP. Within the EU, only Greece is in worse shape.

After a drastic decline in economic output of about minus 9% in 2008 compared to the pre-crisis level, Italy recorded growth of 0.8% in 2015. Still, unemployment at 12% was a problem, with youth unemployment at over 40%. But the inflation rate was 0.1% in 2015, lower than the 0.2% of 2014 and 1.2% of 2013.

Energy supply in Italy is characterised by high dependence of about 79% on imports. The demand for energy is covered to 36% by petrol, 35% by gas, 15% by renewable energy, 9% by solid fuels and 5% by imported electricity.

In the renewable energy sector, the biomass and biogas industry is gradually gaining importance, albeit at a low level. Legislation introduced in June 2014 has restricted the subsidies available for renewables.

Reliance on palm oil

Italy produces 1.3 million tonnes of oils and fats per year. More than one-third of this is olive oil, a staple in its cuisine.

It is the second-largest importer of palm oil in Europe after the Netherlands. This is all the more impressive considering that much of the Dutch imports are for oil processing and re-export as refined products. In Italy, though, the high demand is attributed to a vibrant food processing industry and strong consumer demand among the population of 60 million.

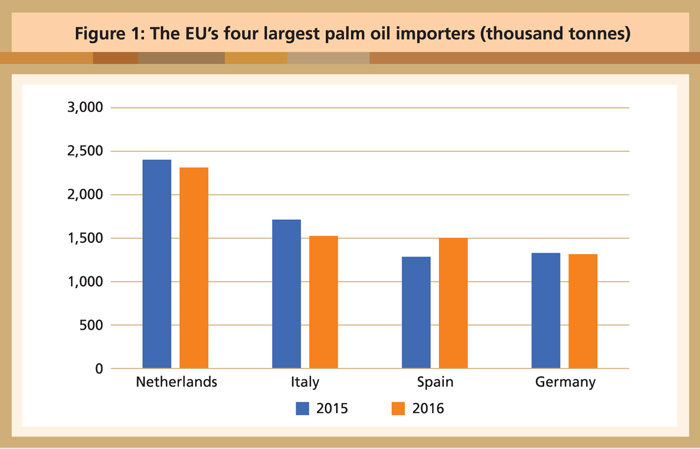

It is interesting that the combined purchases of only four of the EU-28 member-states in 2014, namely the Netherlands, Italy, Spain and Germany, accounted for well over two-thirds of the EU´s palm oil imports (Figure 1).

Source: Oil World Annual 2017

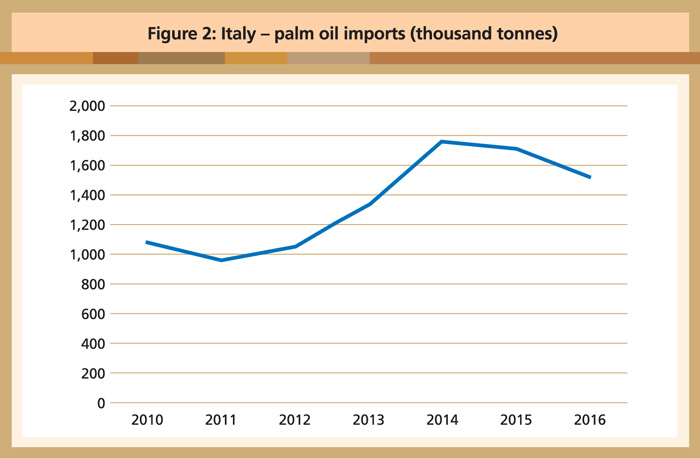

While Italy’s intake of palm oil more than tripled over the decade preceding 2014, it has since declined. Between 2014 and 2016, the volume dropped by more than 13% (Figure 2).

Source: Oil World Annual 2017

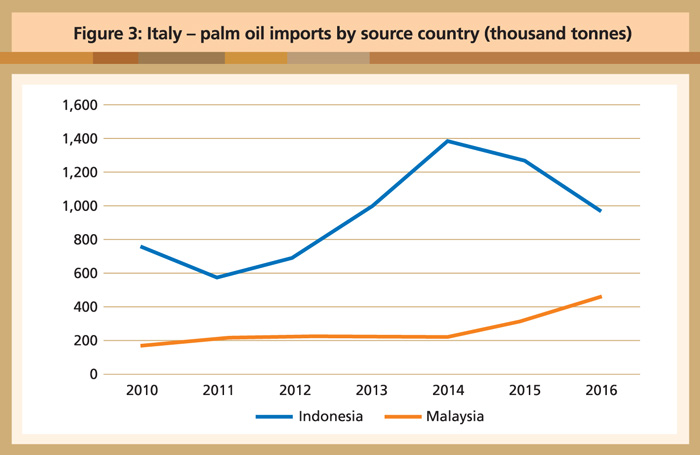

However, this drop appeared to be almost entirely attributable to Indonesian palm oil. Malaysian export volumes more than doubled from 2015-16 (Figure 3).

Source: Oil World Annual 2017

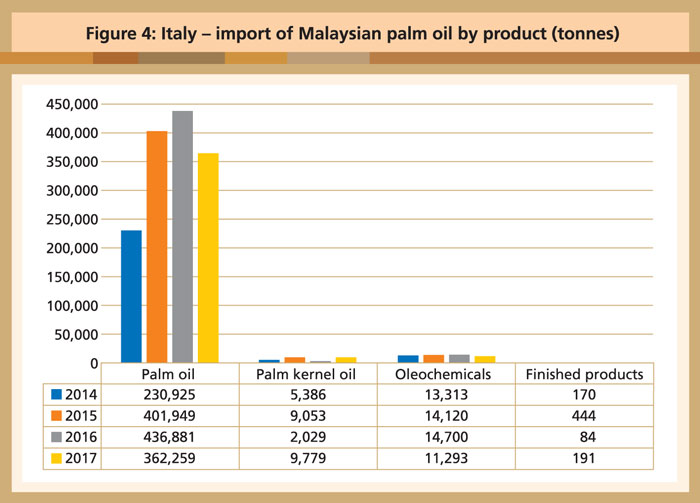

Italy has also been a significant importer of palm kernel oil and oleochemicals (Figure 4), compared to other European countries.

Source: MPOB

This relatively healthy picture for the palm oil industry has been somewhat dampened by negative campaigns. In May 2016, Italy´s largest food retail chain, Cooperativa di Consumatori, banned food products containing palm oil from its supermarkets and hypermarkets.

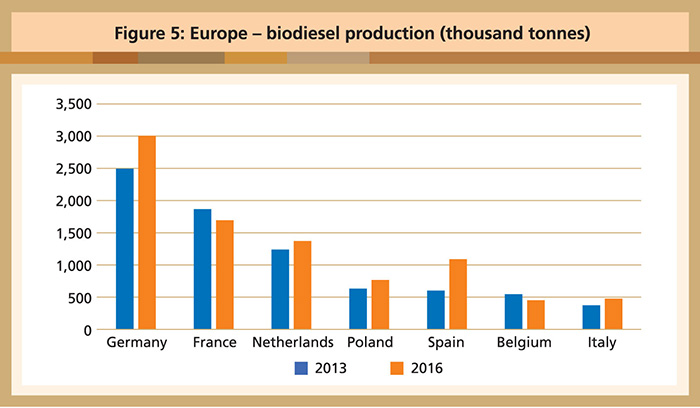

But what about biodiesel? A few years ago, Italy seemed poised to jump on the renewable fuels bandwagon with determination. And the country does produce biofuels in reasonable quantities.

However, based on data from the European Biodiesel Board, Italy has fallen to seventh in the ranking of the largest biofuels producers in Europe (Figure 5).

Source: http://www.ebb-eu.org/stats.php#

All this notwithstanding, Italian demand for palm oil is projected to be robust. Much of its food processing industry depends on palm oil as an ingredient, such as in the world-famous hazelnut spread Nutella. Italy will therefore remain a formidable European market for the palm oil industry.

MPOC Brussels