But it remains the world's top market

April, 2018 in Issue 1 - 2018, Markets

Improved transport infrastructure

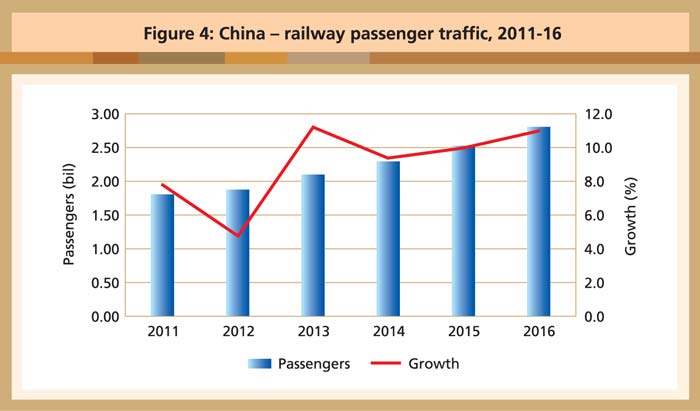

Train stations were once an important venue for the sale of instant noodles. However, sales have fallen despite the consistently higher turnover of passenger traffic, which rose to 2.8 billion in 2016 (Figure 4).

Source: National Railway Administrator, China

This is attributed to improvements to the railway system over the past 10 years, in particular the introduction of high-speed trains. About 20 years ago, passengers chose to eat instant noodles during long journeys that lasted three or more days on trains that had a maximum speed of 130km/h.

But better train services and station amenities have had a knock-on effect on the sale of instant noodles. Journeys are quicker, while the range of food options is far more varied and include international cuisines.

Another point to consider is the boom in aviation travel, with middle-class Chinese flying to domestic destinations instead of taking the train. Almost 500 million domestic and international passengers were recorded in 2016, according to the Civil Aviation Administration of China.

Food delivery services

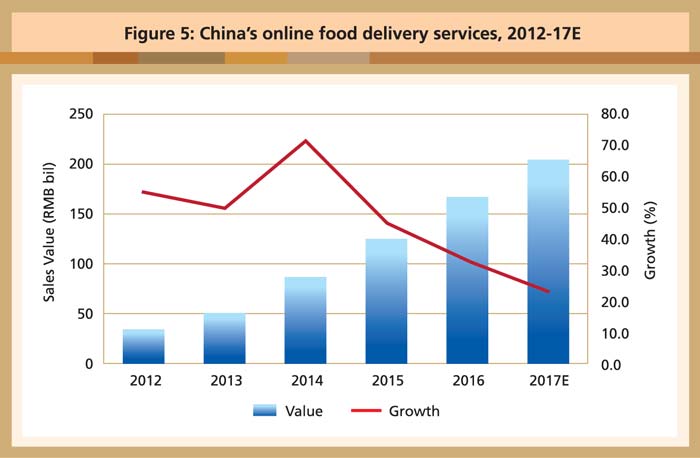

The rise of food delivery services and the smartphone industry have contributed as well to the declining fortunes of the instant noodles industry. About 730 million people in China now have access to the Internet, with about 95% of them using smartphones to connect to the food delivery sector via apps like Eleme, Meituan and Baidu.

Food ordered online is delivered to homes, offices or wherever one happens to be. Although most of the items are more expensive than a bowl of instant noodles, some of the food is affordable and tasty.

Users of food delivery services reached 295 million by the end of June 2017, a 41.6% increase from the end of 2016. This is the new booming industry, according to the China Internet Network Information Centre. The China Cuisine Association has estimated that the food delivery market exceeded RMB200 billion in 2017 (Figure 5).

Source: Meiluan-Dianping Research Team

Move towards better nutrition

As consumers in the world’s second-largest economy became wealthier, they also became more health-conscious and developed an interest in improved nutrition. The fall in the sale of instant noodles has reflected this trend. Manufacturers are responding by intensifying R&D efforts to upgrade the nutritional value of instant noodles.

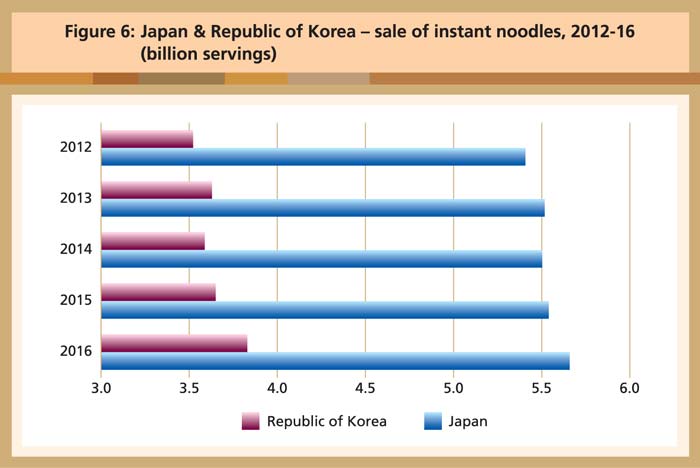

Despite the drop in domestic sales, China remains the world’s biggest market for instant noodles. At the same time, demand for instant noodles has been growing steadily in neighbouring Japan and South Korea since 2012 (Figure 6).

Source: World Instant Noodles Association

Japan’s Nissin Foods remains bullish about its business prospects in China, where it is the fifth-biggest brand in the market for instant noodles. It plans a stock market flotation in Hong Kong to raise about US$145 million. Chief Executive Kiyotaka Ando noted that most consumers want to improve their diet. Innovation is therefore the way forward for food giants like Nissin to sustain their business.

MPOC China

Pages : 1 2