Biodiesel market

The EU is the world’s largest producer of biodiesel, which currently represents 80% of the transport biofuels market on an energy basis. Biodiesel was the first biofuel developed and used in the EU’s transport sector in the 1990s. Factors that led to rapid expansion of its use were the rise in crude oil prices; the Blair House Agreement; provisions on the production of oilseeds under CAP programmes; and generous tax incentives mainly in Germany and France. The biofuels goals in the Renewable Energy Directive strengthened the market for biodiesel.

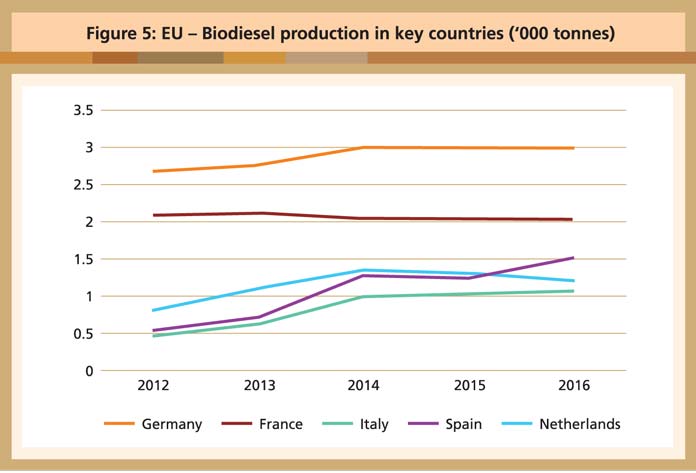

EU biodiesel production is driven almost exclusively by member-states’ mandates and, to a lesser extent, by tax incentives in the respective countries. In 2014, regional production benefitted from substantially lower imports and higher domestic consumption. As a result, production increased in Germany, Spain, Italy and the Netherlands. In the Netherlands, this was largely attributed to higher production of hydrogenated vegetable oils (HVOs). In 2015 and 2016, production remained stable in most of the countries.

The ranking of the top five EU biodiesel producers – Germany, France, Netherlands, Spain and Italy – remains unchanged. Spain and Italy have invested significantly in renewable energy in recent years, most notably in electricity and power generation. Both countries have been driven by their commitment to EU directives and legislation, which explains the increase in their biodiesel output (Figure 5).

Source: Oil World

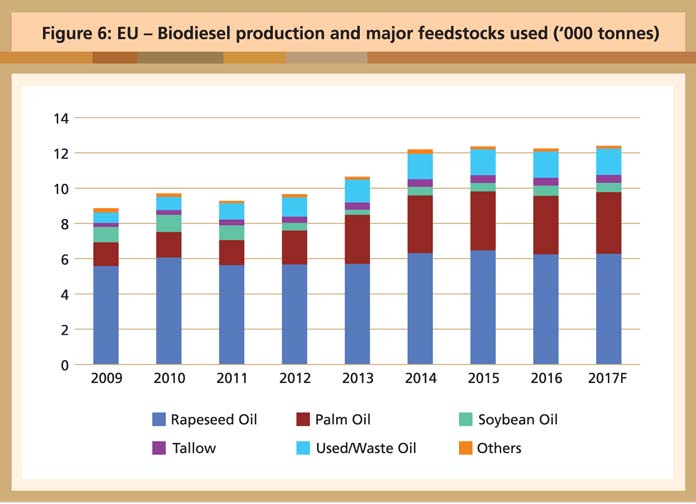

In terms of feedstock, rapeseed oil is the dominant vegetable oil, accounting for 51% of total production last year. Even then, its share of the feedstock mix has shrunk considerably, compared to a commanding 63% in 2009. This is due to wider use of recycled vegetable oil/ UCO and palm oil. The palm oil share has further expanded because of its use in HVO production. Currently, palm oil is used in Spain, the Netherlands, Finland, Italy and France; and, to a much lesser extent, in Germany, Portugal, Romania and Poland.

UCO has become an important feedstock in the EU (Figure 6). Its use received a boost after Austria, Belgium, Croatia, France, Hungary, Ireland, the Netherlands, Poland, Portugal, Slovenia and the UK introduced double-counting. The largest EU producers of UCOME (biodiesel produced from UCO) are the Netherlands, the UK and Germany.

Source: Oil World

The outlook for EU biodiesel production is estimated at 12.4 million tonnes this year, a slight increase from 12.3 million tonnes last year. This is due to higher biofuel mandates in countries like Germany, Italy, the Netherlands, Portugal and Spain. Additionally, several plants producing HVOs are reportedly scheduled to start operations this year in France, Italy and Portugal. This will boost demand for vegetable oils for energy purposes.

Azriyah Azian

Executive,

Marketing & Market Development Division, MPOC