Net importer

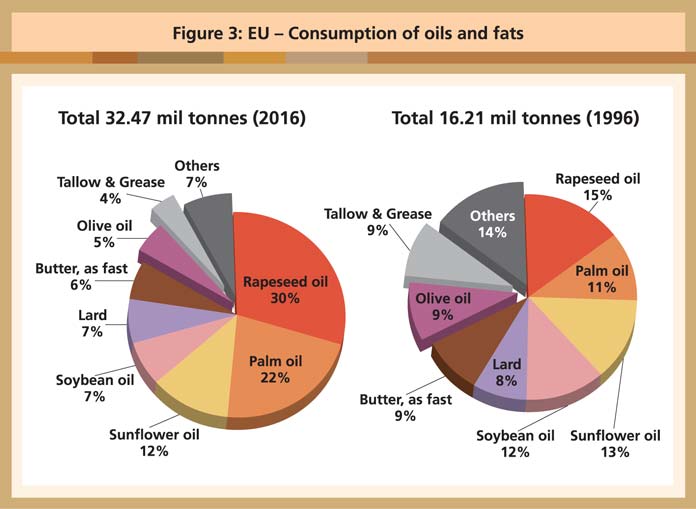

The region’s oils and fats consumption has doubled over a 20-year period from 1996 (Figure 3). For example, palm oil, which was the fourth most-consumed edible oil in 1996, is now ranked second.

Source: Oil World

Last year, EU imports of four major vegetable oils went up by 3.3% or 293,000 tonnes on account of a larger volume of sunflower oil, mainly from Ukraine. Under a Free Trade Agreement that took effect from Jan 1, 2016, the country gained preferential access to the European market. In addition, sunflower oil prices in Europe enjoyed a better and wider discount vis-a-vis rapeseed oil, thereby extending its use in the food sector.

Palm oil imports from Indonesia and other countries remained stable, but the volume of Malaysian palm oil imports fell. The EU has also imported palm oil from countries such as Ivory Coast, because of declining imports from Southeast Asia due to foreign exchange shortages and the weakness of local currencies.

Palm oil has maintained its market share as the preferred feedstock for biodiesel production at the expense of rapeseed and other oils. However, competition from waste and used cooking oil (UCO) cannot be ignored.

Rapeseed oil imports have dropped by 10.9%. This is partly attributed to demand shifts to palm oil and other feedstock (for biofuels) and to sunflower oil (in the food industry).

The main palm oil importers in the EU are the Netherlands, Italy, Spain, Germany and Belgium. Eastern European countries like Poland, Romania and Bulgaria have absorbed some amounts as well.

Indonesia and Malaysia are the major suppliers of palm oil to the EU. South and Central American countries, in particular Colombia, Honduras and Guatemala, are becoming significant exporters. Their combined market share rose from 2% in 2012 to 12% last year. Thailand and Ivory Coast have also emerged as suppliers.

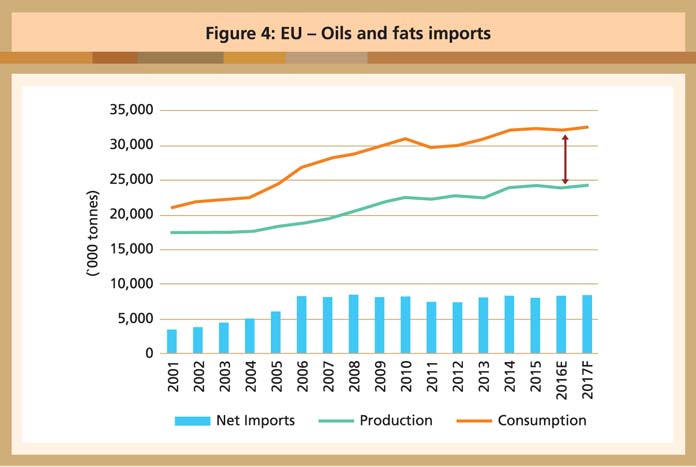

The EU’s import demand for oils and fats has been going up due to the domestic supply deficit, as well as the expansion of the biofuels sector (Figure 4). Total oils and fats output is projected to increase slightly to 24.2 million tonnes this year. This is reflective of the reduced production outlook for main crops, primarily rapeseed, hence driving down the demand for crushing.

Source: Oil World, MPOC projection

Consumption of oils and fats is expected to be stagnant at around 32.7 million tonnes, despite the slight recovery in biodiesel production. The EU is expected to import 11.7 million tonnes of oils and fats, with palm oil imports estimated at about 7.8 million tonnes this year. The region will remain a net importer of oils and fats.