The European Union (EU) is among major players in the global oils and fats market. The upward trend in the region’s consumption of oils and fats has been significant in recent years, due to expansion of its biofuels sector, as well as demand from the food and non-food sectors.

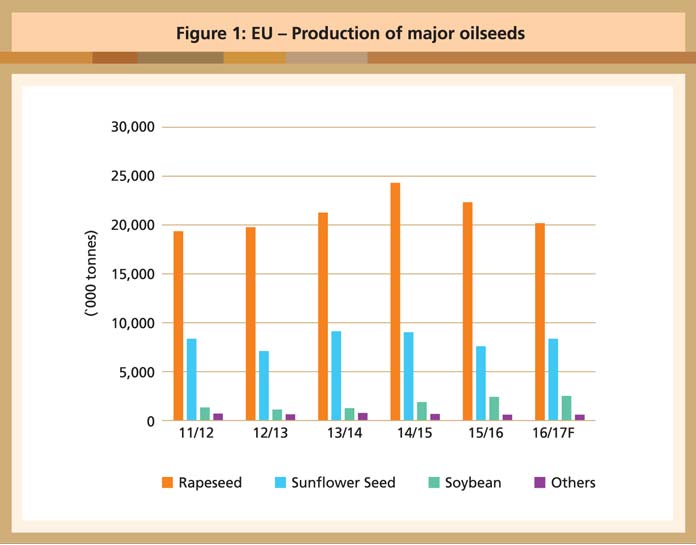

The region is the world’s largest producer of rapeseed and derived products. However, rapeseed output was lower in 2015/16 at 22.3 million tonnes; this is expected to further decline in 2016/17 to 20.2 million tonnes. Unfavourable growing conditions will affect yields in France, Germany, Estonia, Latvia and Lithuania. Even the expansion of acreage and favourable growing conditions in countries like Hungary and Romania may not offset the reductions.

A higher average yield is expected for sunflower seed and soybean in 2016/17. Sunflower seed production is forecast to go up by more than 9% to 8.3 million tonnes. Major producing countries have expanded their planted area, with the highest growth rates in Spain, Hungary, Romania and Bulgaria. They have benefitted from favourable spring weather, which promises an excellent crop. However, the planted area in France will decline substantially due to unfavourable weather.

Soybean production, which is at a minor level but is constantly rising, is anticipated at 2.5 million tonnes in 2016/17, compared to 2.4 million tonnes in 2015/16. Apart from higher yields, the increase is also attributed to incentives under the Common Agricultural Policy (CAP).

For 2016/17, the production of major EU oilseeds – rapeseed, sunflower seed and soybean – is projected at 31.6 million tonnes. This is lower than the 32.9 million tonnes recorded in 2015/16 (Figure 1).

Source: Oil World

** Others: Cottonseed, linseed, groundnuts

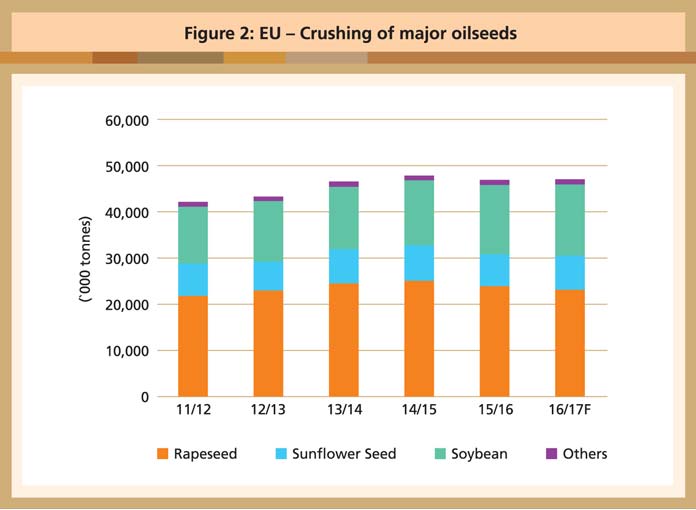

Soybean crushing has reached a high level in the EU because of the smaller rapeseed crop and lower demand for rapeseed oil. Imports of soybean for crushing have also increased, reflecting the growing demand for soybean oil in food use.

The abundant supply of sunflower seed has also encouraged crushing. This is supported by price-competitive imports, rapeseed deficits and strong demand for sunflower meal and oil for feed and food uses. Overall, crushing of oilseeds is estimated to remain stable in 2016/17 at 47.1 million tonnes (Figure 2).

Source: Oil World

** Others: Cottonseed, linseed, groundnuts, sesame seed