Alongside growth of food industry

April, 2018 in Issue 1 - 2018, Markets

Egypt is among the world’s fastest growing markets for imported food and agricultural products. It is, however, a price-sensitive market that also struggles with government austerity measures, soaring youth unemployment and double-digit inflation.

Demand for oils and fats, including palm oil, is supported by growth of the food industry. The sector grew with a compound annual growth rate of almost 15% from 2011-16. Driving growth is the shift to increased production for domestic consumption and export. Consumption of oils and fats will continue to rise, due in part to population growth which is expected to surpass 100 million by 2021 and to record 117 million by 2030.

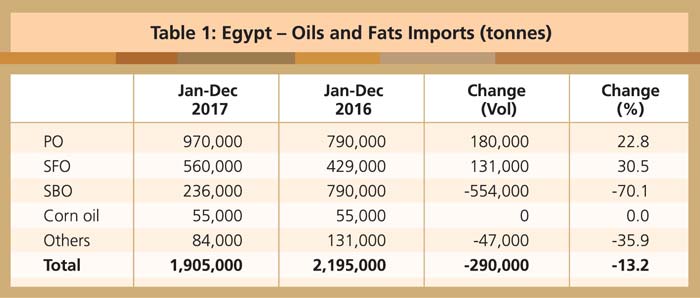

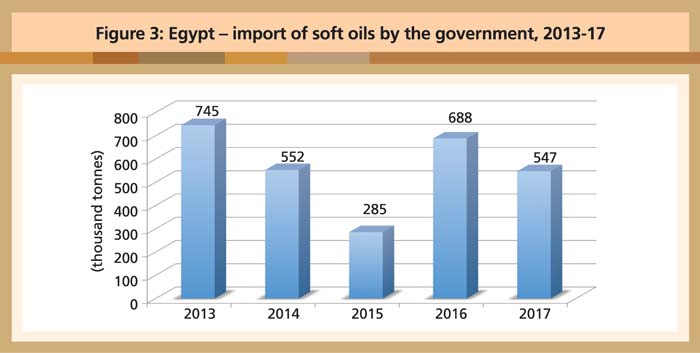

Oils and fats imports were recorded at 1.9 million tonnes in 2017, a drop of 13.2% compared to the previous year. This was mainly due to reduction of the government’s procurement under the cooking oil subsidy scheme, due to budget constraints. In 2017, the government imported 547,235 tonnes of soft oils for the subsidy programme, compared to 688,174 tonnes in 2016.

Palm oil imports rose by 23% or 180,000 tonnes to record 970,000 tonnes in 2017, compared to 790,000 tonnes in 2016 (Table 1).

Source: Oil World

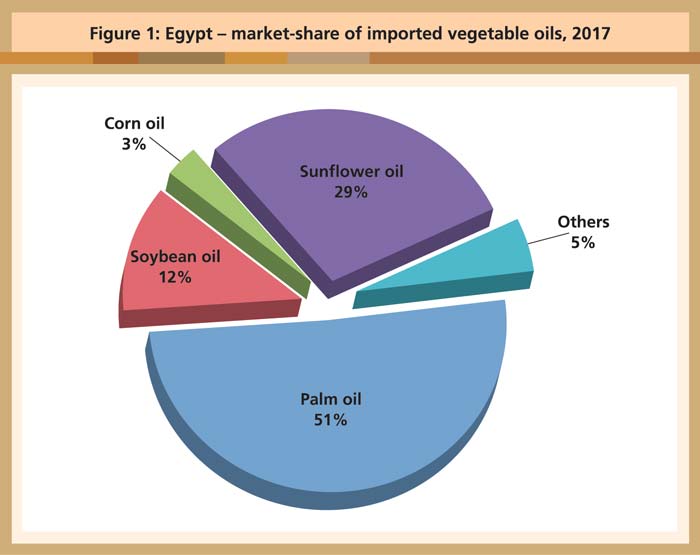

The volume accounted for 51% of the total oils and fats imports (Figure 1).

Source: MPOC

Food processing sector

Consumer behaviour in Egypt has been changing in recent years because the retail prices of nearly all goods and services have increased. This has restricted the level of disposable income, which was already low. Food prices soared 40% in June 2017 compared to the same period in 2016, while food inflation reportedly reached 44% in April 2017.

The floating of the Egyptian pound, which has stoked inflation, has also pressured importers to raise the prices of goods. The government is imposing stricter rules on importers with the aim of reducing imports by 25% to save foreign currency reserves and protect local industries. A statement from the Central Agency for Public Mobilisation and Statistics revealed that the price of imported oils and fats increased by 18.5% in 2017.

The value of domestic consumption of processed foods grew from US$32 billion in 2008 to nearly US$45 billion in 2017. The food processing sector is forecast to grow from 2017-21, albeit at a slower rate of 5% in terms of the local currency.

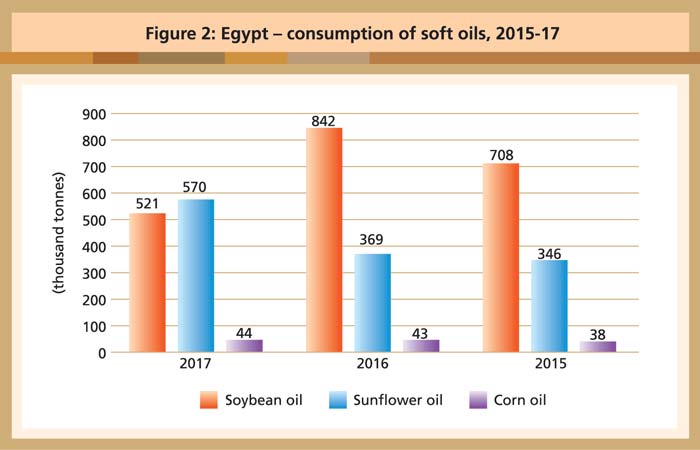

Source: Oil Word

Food processors are also taking advantage of Egypt’s central location in the Middle East and North Africa to increase exports to regional markets. Its processed food products are exempted from import duty in nearly all of the Arab and African export destinations.

Source: Trade calculations

Egypt’s exports of processed foods earned nearly US$2.6 billion up to November 2017. Of this, some US$1.1 billion worth of goods went Saudi Arabia ($289 million), Libya ($144 million), and Jordan ($123 million). Top exports were edible oils ($397 million), processed cheese ($152 million), and sugar and confectionery ($143 million).

MPOC Egypt