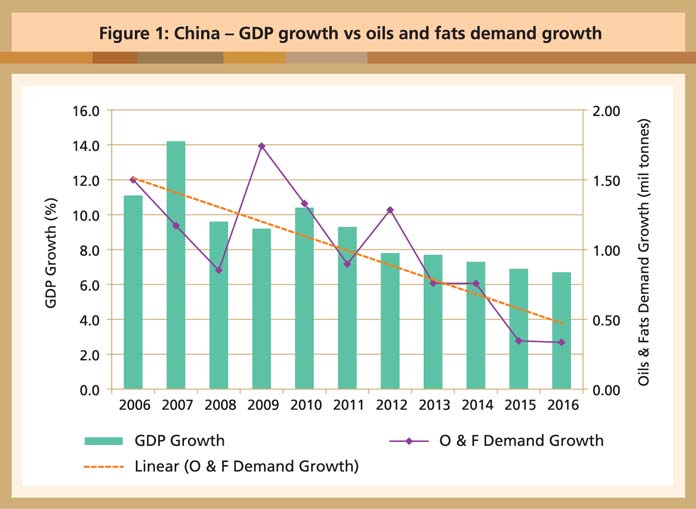

Oils and fats consumption in China has kept pace with the country’s economic development, which was robust until recent years. However, the GDP growth rate fell last year to 6.7%, the lowest since the country initiated its open-door policy in the 1980s (Figure 1).

Source: Oil World

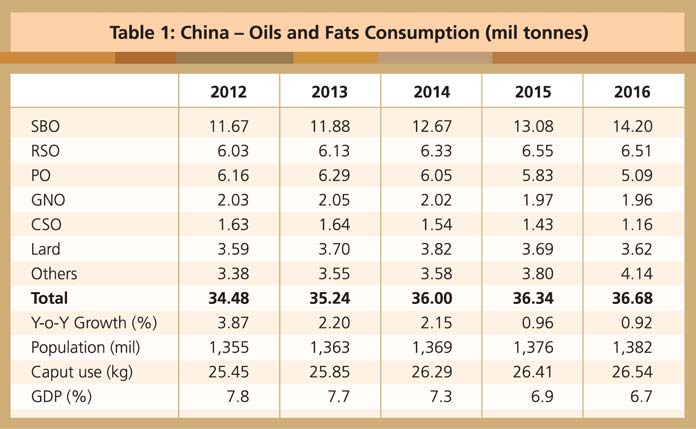

Industrial production slowed in the food and non-food sectors. In tandem with this, demand growth for oils and fats declined by 340,000 tonnes compared to 2015 (Table 1), to the lowest level since 1993.

Source: Oil World

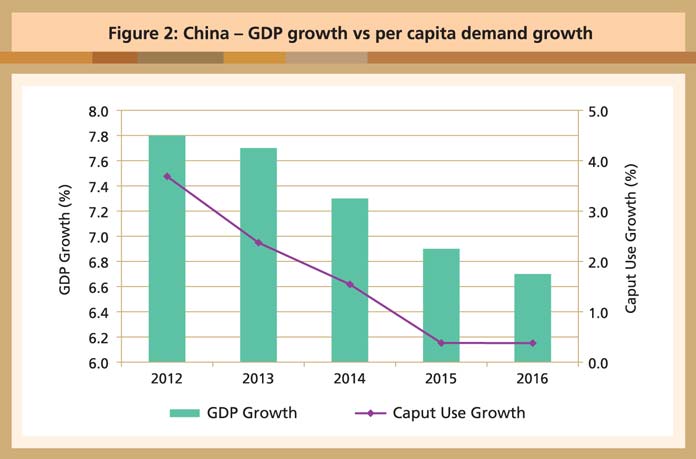

China’s GDP growth also has a strong correlation with per capita consumption of oils and fats (Figure 2). Population growth is projected at 0.6% from 2016-20, but there will be an increase in the number of people who are ageing. For the current year, the GDP is forecast at 6.5-6.7%. This may be translated to growth of less than 0.5% in terms of per capita oils and fats consumption.

The per capita consumption growth rate was 0.4% over the past two years. Using this as a benchmark, an additional 0.1kg can be expected this year, to stand at 26.7kg. Multiplied by the projected population increase of 0.6%, overall demand for oils and fats is therefore likely to go up by 300,000 tonnes in the current year.

With declining or stagnating domestic production of oilseeds and oils, China has increasingly relied on imports to meet the shortfall. Self-sufficiency in oils and fats has decreased from 50.3% to 33.1% over the past decade. The share of oils from imported oilseeds has more than doubled – from 19.6% to 43.6% (Figure 2). The share of imported oils has decreased from 30.1% to 23.3% because greater demand for oil meal for animal feed has driven local crushing activities.

Source: Oil World

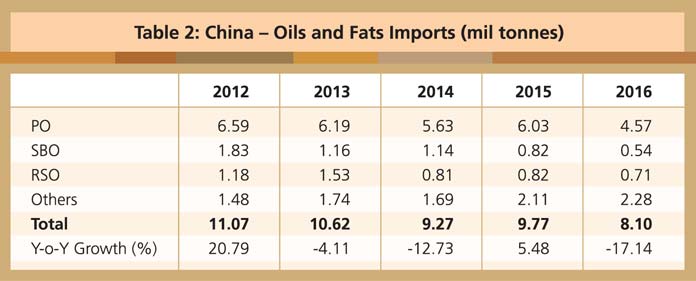

Over the last five years, China’s imports of oils and fats have fallen from 11.1 million tonnes to 8.1 million tonnes, due mainly to smaller imports of soybean oil and, to some extent, rapeseed oil (Table 2).

Source: Oil World

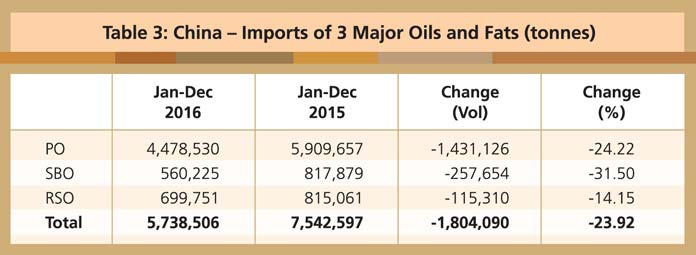

Lower volumes of all three major vegetable oils were recorded last year (Table 3).The steep decline in palm oil imports was attributed to a drastic drop in global output.

Source: General Administration of Customs, China