London to the Labuk

By gofb-adm on Thursday, August 2nd, 2018 in Issue 2 -2018, Publication No Comments

By gofb-adm on Thursday, August 2nd, 2018 in Issue 2 -2018, Publication No Comments

From 1965 to 1967, in addition to bringing to completion our programmes for planting, roads and buildings, we were also very preoccupied with the erection of our factory. At that time, the only company which could build a standard turn-key palm oil mill on contract, was Messrs Stork of Amsterdam.

Read more »By gofb-adm on Thursday, August 2nd, 2018 in Issue 2 -2018, Publication No Comments

Two recipe books featuring Malaysian palm oil gained recogntion at the Gourmand World Cookbook Awards held in Yantai, China, from May 26-27. Malaysian Palm Oil: The Essential Ingredient in Delicious Food took the first prize for Best Corporate Book in the World, while Palm to Plate garnered the second prize for Best French Cuisine Book in the World.

The Gourmand World Cookbook Awards were founded in 1995 by Edouard Cointreau. The annual awards honour the best food and wine books in print or digital mode. The Gourmand Awards have been compared to the Oscars in the film industry.

The cookbooks, produced by the Malaysian Palm Oil Council, had previously won awards at the national level. Malaysian Palm Oil: The Essential Ingredient in Delicious Food took top honours in three categories: Best International Cuisine Book (Malaysia), Best Corporate Book (Malaysia) and Best Single Subject Book (Malaysia). Palm to Plate won in the categories for Best Health & Nutrition and Best French Cuisine Book.

Malaysian Palm Oil: The Essential Ingredient in Delicious Food features tantalising recipes by six international chefs. These include slow-roasted shaved beef, berliner, Moroccan-style lamb soup, soft red palm oil bread, chicken teriyaki steak and satay. Quick facts on what makes palm oil a healthy, versatile and essential ingredient are incorporated, making this book a must-have for cooking enthusiasts.

Palm to Plate represents a gastronomic celebration of the 100 years of the Malaysian palm oil industry. This culinary collaboration with The Star presents delightful local and international dishes. Chef Rodolphe Onno, the Technical Director of Le Cordon Bleu Malaysia, contributed several recipes and wrote the foreword. In it, he says: “I had no hesitation when I was first asked to use palm oil to create a couple of recipes for this book and I discovered amazing results […] I hope you will have similar experience[s] whilst going through them.”

The recipes in both books use Malaysian palm oil and Malaysian red palm oil as main ingredients to enable professional and home cooks to understand their suitability, and to learn how to creatively apply these in cooking.

MPOC

By gofb-adm on Thursday, August 2nd, 2018 in Issue 2 -2018, Plantation No Comments

The Pareto Law, also known as the 80/20 principle, is useful in the planning of marketing strategies. Essentially, it states that 80% of the results will be derived from 20% of the input. For example, 80% of company profits will be generated by 20% of the products, or 80% of sales will come from 20% of the premium customers.

The Pareto Law was developed by Vilfredo Pareto of the University of Lausanne in 1896. In his first paper, he stated that 80% of the land in Italy belongs to 20% of the population. He then carried out a survey in other countries and observed a similar distribution.

Business managers are increasingly making use of the Pareto Law to analyse the impact of their marketing budget, sales distribution, customer complaints, feedback and service plans.

The Pareto Law also has a place in daily plantation operations, with everyone from the general manager to the agronomist being able to apply it to their area of work. These are some rules of thumb:

Reasons to apply the principle

Senior planters may be dubious about such measures. They may have many questions – particularly about the recommendation to target 20% of any area of plantation management in order to improve overall results. To view the situation holistically, we have to understand the evolution of plantation management.

During the mechanical era, new machinery and equipment were developed. The chemical revolution resulted in improved fertilisers and crop protection products. The biogenetic revolution saw the promotion of biogenetic annual crop seeds with better yield.

We are now experiencing the fourth agricultural revolution, involving the Internet of Things. Agricultural start-ups are looking at new concepts such as using sensors to capture basic raw data (moisture, rainfall and sunshine duration) to predict the yield, with complex logarithm programming for annual crops. Unmanned robotic tractors to Unmanned Aerial Vehicles are used to carry out spraying, manuring, census and mapping using hyper-spectral cameras.

In order to act quickly and correctly within a limited time-frame – while coping with acute labour constraints – we have to rely on emerging technology tools like intelligent software, logarithm studies, distribution patterns or big data management.

The 80/20 principle is a simple mathematical distribution model that is capable of capturing data for many years to come. Applying the Pareto Law in daily operations will also enable productive use of time toward efficient and effective management of plantations.

Devarajen Rajagopal

Developer, Oil Palm Pesticides Calculator

By gofb-adm on Thursday, August 2nd, 2018 in Issue 2 -2018, Branding No Comments

Over the past few decades, the palm oil sector has been confronted by multiple false claims about its environmental footprint. Some campaigns have resulted in a boycott of palm oil, as seen in the example of the Iceland supermarket chain in the UK. This case is worth analysing because it highlights underlying issues for stakeholders.

An article dated Nov 3, 2016 by the US Department of Agriculture states that risk is an important aspect of the farming business in any country. The uncertainties inherent in weather, yields, prices, government policies, global markets and other factors can cause large swings in farm income. Five types of risk are described: production risk, price or market risk, financial risk, institutional risk, and human or personal risk. I would add one more – the risk of not instituting a competent protocol to manage negative issues that arise.

Issues management is a process that helps organisations to respond appropriately when under fire. Applying the process has become even more critical in a world driven by social media. A negative story can impact stakeholder perception and have real-world consequences within hours of being posted. The consequences are often felt long after the story is shown up to be false or inaccurate.

The 18th century writer Jonathan Swift noted that ‘a lie can travel halfway around the world, before the truth has even pulled its boots on’. The challenge for the palm oil sector is: how quickly can we pull on our boots?

Elizabeth Dougal of the Institute of Public Relations has said that issues tend to have a lifecycle comprising five stages – early, emerging, current, crisis and dormant. As the issue moves through the first four stages, it attracts attention and becomes less manageable from the organisation’s point of view.

If the issues-management process detects an issue at the earliest stage, more options are available to decision makers in determining their response. The strategic choices shrink as the issue matures. When the number of stakeholders and other influencers expand, positions on the issue become more entrenched. At the crisis stage, the only available responses are reactive and are sometimes imposed by external parties, such as government agencies.

There are two paths toward issues management. In the short term, the ability to respond to an issue, challenge or attack in the quickest possible time and in the most effective manner can make or break reputations. Over the long term, the ability to manage public policy issues is crucial. This is not always about outright victory but also about stability.

Iceland’s ‘intellectually lazy’ position

Iceland supermarket’s recent decision to stop using palm oil in own brand products provides a case in point for issues management. The announcement was accompanied by a video in which oil palm farmers stood accused of a wide range of environmental and social ills. The UK media picked up the story, which quickly captured attention in palm oil producing countries including Malaysia.

Malaysia saw the video as representing a personal attack against 650,000 small farmers who cultivate oil palm for their livelihood and do so sustainably. Many naturally voiced their frustration – pointing out that those who live far away from countries cultivating oil palm do not appreciate the importance of a commodity and an industry that has lifted landless farmers out of poverty and provided them with a source of income.

Oil palm farmers in Malaysia work hard under exacting conditions to put food on the table and send their children to school, so that they can aspire to a better life. It can be daunting for them, as single-income earners, to provide for their family and to raise their quality of life.

The video content was also inaccurate on multiple counts. Malaysia instantly set out the facts and challenged Iceland’s claims. If this had not been done, it would have been an acute mistake.

Dato’ Aliasak Ambia, President of the National Association of Smallholders in Malaysia, said in a statement: “Iceland through this action longs for the dark days of Britain’s colonial past where they tell us what to do from Britain, while […] taking away our incomes and our ability to feed our families. This announcement is disrespectful and without any basis in fact. Malaysian palm oil is sustainable, unlike the rapeseed and sunflower oil they will now be using. Iceland should be ashamed that their new policy will take food off the plates of our communities.”

In his April 27 blog-post, environmentalist and writer Sir Jonathon Porritt, rebutted comments by Iceland’s Managing Director Richard Walker who had claimed that there is no such thing as ‘sustainable’ palm oil available to retailers.

Porritt commented: “What an ignorant, intellectually lazy position that is, belittling more than a decade’s worth of efforts by governments, academics, NGOs and the companies themselves to determine appropriate criteria for managing [oil] palm plantations in genuinely sustainable ways.”

The Faces of Palm Oil advocacy group, with the support of Malaysian small famers, released a video pointing out Iceland’s factual errors. In particular, it refuted the claim that palm oil is a cause of deforestation.

According to NASA, rarely is there a single cause of deforestation. Most often, multiple processes work simultaneously or sequentially to cause deforestation. People have been deforesting the earth for thousands of years, primarily to clear land for crops or livestock. Europe, for example, has been deforesting for centuries; so much so that its forest cover is almost gone… only 11% remains in Walker’s country, the UK.

Is oil palm cultivation the main cause of deforestation? A 2012 study on the impact of EU consumption on deforestation reveals that the livestock industry is the single biggest contributor (24%) to global deforestation. This is about 10 times higher than oil palm (2.5%). Soybean cultivation accounts for 5.4% and maize cultivation for 3.3%. A larger percentage (48%) is attributed to other causes.

The authors of the study further confirmed that, due to the oil palm’s high yield, the crop occupies the smallest area of the four major oil crops worldwide. Replacing the oil palm with other oilseed crops would mean a much bigger impact on land resources.

Malaysia currently maintains 54.9% of its land area under forest cover, which exceeds its pledge of 50% at the UN Earth Summit in 1992. Oil palm occupies 5.8 million ha in Malaysia, or 17% of the land area. This is equal to just 0.1% of the global area under agriculture.

So, the facts are indisputable – the oil palm produces more oil on less land; the industry is responsible for less deforestation; and Malaysia (a major palm oil producer) protects its forests at world-leading levels. That is not all.

The government has committed to making the Malaysian Sustainable Palm Oil standard mandatory by end 2019. This adds to the certification scheme of the Roundtable for Sustainable Palm Oil and the Indonesian Sustainable Palm Oil standard. Buyers therefore have a choice of schemes on which to base their purchases. It won’t be long before schemes are customised to the requirements of buyers.

Unlike Walker, Malaysia is not stuck in the past. Rather, the industry is looking to the future by using technology and innovation to guarantee Malaysia’s place as the world leader in sustainable palm oil production, both from the environmental and socio-economic standpoint. Rather than boycott palm oil, companies or governments should encourage sustainable practices by supporting the certification scheme of their choice.

The Iceland supermarket chain could have applauded countries like Malaysia, which have achieved the double benefit of social gains (through small farmer communities) and environmental gains (by ensuring the production of certified sustainable palm oil).

The Malaysian palm oil sector must remain vigilant. Issues management is central to combating threats and in mitigating risks that lie in wait. Producers must not be too distracted by the noise, but should take control of safeguarding palm oil’s international reputation.

They should realise that decisions are often driven by domestic politics when palm oil becomes a serious competitor to locally produced oils. But a strong issues-management process, quick communication of facts and robust counter-arguments would counteract threats and boycotts.

Belvinder Sron

Deputy CEO, MPOC

By gofb-adm on Thursday, August 2nd, 2018 in Issue 2 -2018, Markets No Comments

Ireland´s economy, which is export-oriented and open to foreign investors, has benefitted greatly from globalisation. An extended boom since the 1990s – marked by high growth rates, steeply increasing per capita income and sharp falls in unemployment – was followed from 2008 by a bust that lasted several years.

But Ireland is again living up to its reputation of being the ‘Celtic Tiger’. Impressive growth rates, such as 8% in 2014 and over 5% in 2017, make it the leader among EU member-states.

Ireland also remains an attractive location for foreign direct investors using the island as an export base for the rest of Europe. The main sectors are financial services, the communications industry, software and pharmaceutical products, as well as medical industries.

The US is by far the largest investor. American companies in Ireland employ around 140,000 people. American FDI amounted to US$311 billion in 2013. To put this into perspective, Germany and France together invested about US$196 billion, according to the American Chamber of Commerce Ireland.

Interestingly, soybean oil is the only vegetable oil produced in Ireland albeit on a limited scale of several thousand tonnes per year. It seems that Irish agriculture is trying to reduce its dependency on imported protein for animal feed.

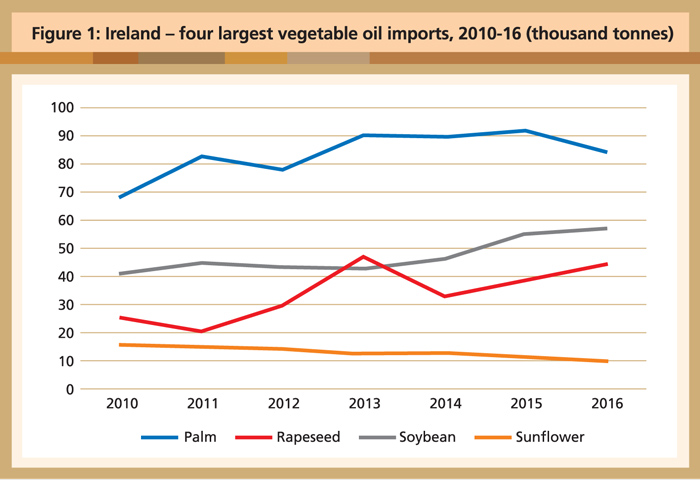

Palm oil dominates the imported vegetable oils sector. The 85,000 tonnes in 2016 represented over 40% of oils and fats imports. While the level of palm oil remains relatively high, soybean and rapeseed have gained ground in the last few years (Figure 1).

Source: Oil World Annual 2017

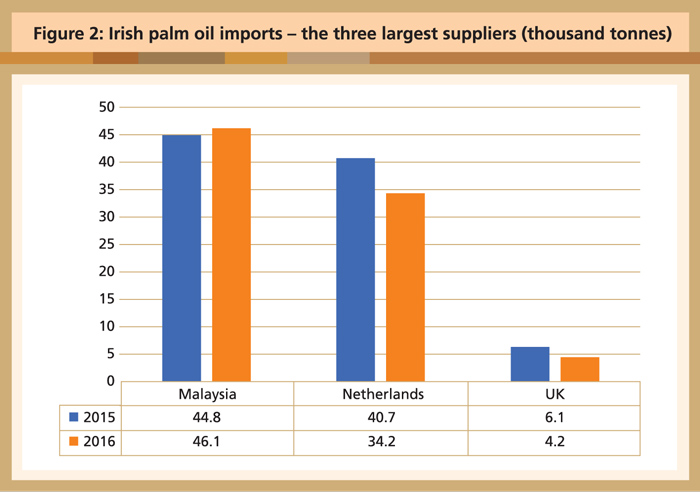

While Malaysia and the Netherlands together supply nearly 90% of the palm oil sold to Ireland, Malaysia has been able to widen the lead since 2014 (Figure 2).

Source: Oil World Annual 2017

Experience suggests that, as societies become wealthier and more urbanised, and as general education levels rise, the taste for all things sustainable also grows.

This is the case in Ireland, which has progressed from being Europe´s poorhouse to Celtic Tiger. About one-third of the population of 4.6 million lives in the metropolitan area of Dublin, the capital.

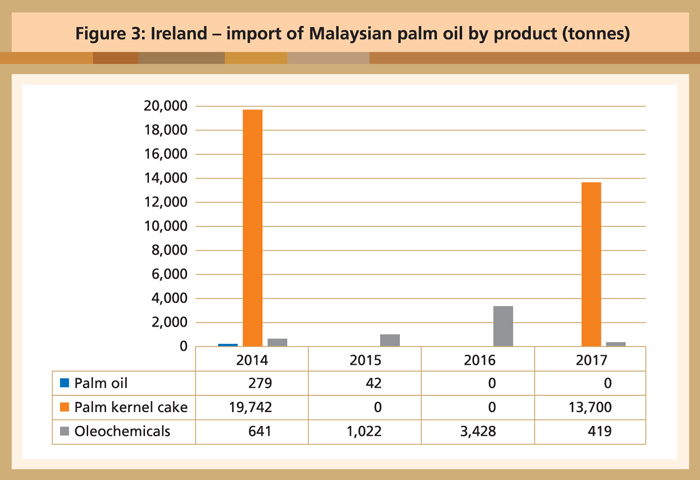

Source: MPOB

In particular, concerns over the environment and issues like global warming have become more evident. For example, the Irish subsidiary of German discount chain Aldi states on its website: ‘As of January 2016 we achieved our goal for 100% of the palm oil used in our own label food products in the UK and Ireland to be from RSPO certified, sustainable sources. This includes all palm oil, palm kernel oil and palm derivatives and fractions. Having achieved 100% sustainable palm oil in food, we aim to have 100% sustainable palm oil in non-food products by the end of 2018.’

The lesson here, as in most European countries, is that the future belongs to certified sustainably produced palm oil. Industry players should take this into account when thinking about the market potential that Ireland presents. Palm oil is already the primary vegetable oil consumed in the country, and there is potential for biofuels as well.

MPOC Brussels

By gofb-adm on Thursday, August 2nd, 2018 in Issue 2 -2018, Markets No Comments

Measured by gross domestic product (GDP), Italy is ranked tenth among the world’s largest economies. The main driver is the manufacture of high-quality consumer goods produced by small- and medium-size enterprises, many of them family-owned.

The third-largest economy in the Eurozone, Italy has suffered many problems. After strong GDP growth of 5-6% per year from the 1950s to the early 1970s, there was a slowdown over the 1980s and 1990s. In the last decade, the annual growth rate was poor, averaging 1.2% and comparing unfavourably with the EU average of 2.3%.

Stagnation in economic growth, coupled with political efforts to revive it with massive government spending from the 1980s, resulted in a sharp rise in public debt. In 2016, this reached a staggering 132% of GDP. Within the EU, only Greece is in worse shape.

After a drastic decline in economic output of about minus 9% in 2008 compared to the pre-crisis level, Italy recorded growth of 0.8% in 2015. Still, unemployment at 12% was a problem, with youth unemployment at over 40%. But the inflation rate was 0.1% in 2015, lower than the 0.2% of 2014 and 1.2% of 2013.

Energy supply in Italy is characterised by high dependence of about 79% on imports. The demand for energy is covered to 36% by petrol, 35% by gas, 15% by renewable energy, 9% by solid fuels and 5% by imported electricity.

In the renewable energy sector, the biomass and biogas industry is gradually gaining importance, albeit at a low level. Legislation introduced in June 2014 has restricted the subsidies available for renewables.

Reliance on palm oil

Italy produces 1.3 million tonnes of oils and fats per year. More than one-third of this is olive oil, a staple in its cuisine.

It is the second-largest importer of palm oil in Europe after the Netherlands. This is all the more impressive considering that much of the Dutch imports are for oil processing and re-export as refined products. In Italy, though, the high demand is attributed to a vibrant food processing industry and strong consumer demand among the population of 60 million.

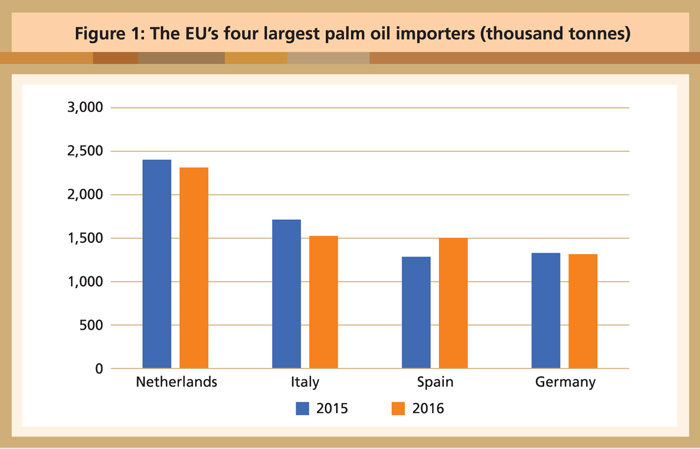

It is interesting that the combined purchases of only four of the EU-28 member-states in 2014, namely the Netherlands, Italy, Spain and Germany, accounted for well over two-thirds of the EU´s palm oil imports (Figure 1).

Source: Oil World Annual 2017

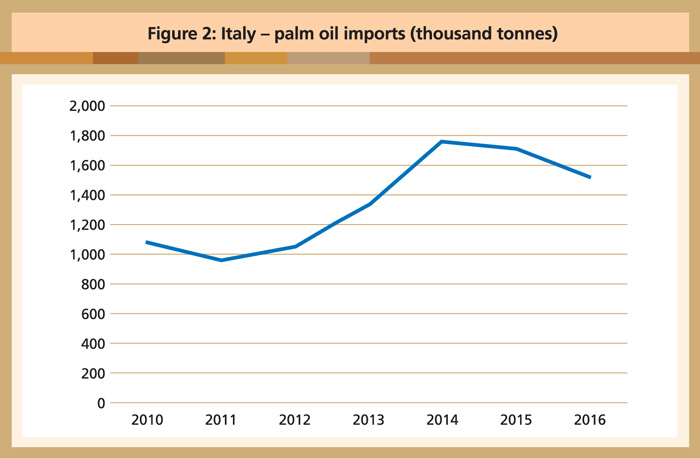

While Italy’s intake of palm oil more than tripled over the decade preceding 2014, it has since declined. Between 2014 and 2016, the volume dropped by more than 13% (Figure 2).

Source: Oil World Annual 2017

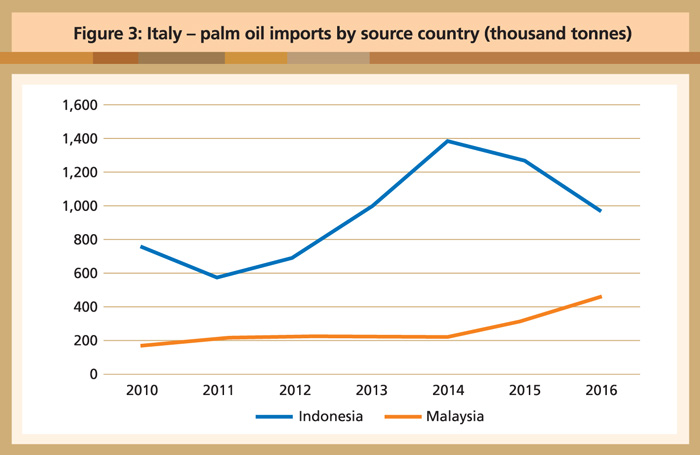

However, this drop appeared to be almost entirely attributable to Indonesian palm oil. Malaysian export volumes more than doubled from 2015-16 (Figure 3).

Source: Oil World Annual 2017

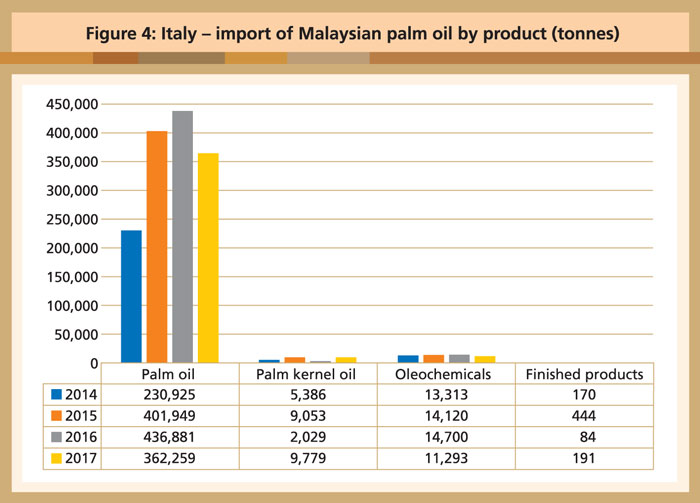

Italy has also been a significant importer of palm kernel oil and oleochemicals (Figure 4), compared to other European countries.

Source: MPOB

This relatively healthy picture for the palm oil industry has been somewhat dampened by negative campaigns. In May 2016, Italy´s largest food retail chain, Cooperativa di Consumatori, banned food products containing palm oil from its supermarkets and hypermarkets.

But what about biodiesel? A few years ago, Italy seemed poised to jump on the renewable fuels bandwagon with determination. And the country does produce biofuels in reasonable quantities.

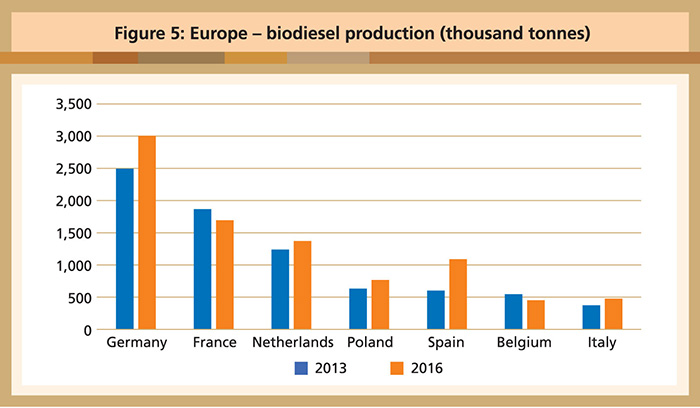

However, based on data from the European Biodiesel Board, Italy has fallen to seventh in the ranking of the largest biofuels producers in Europe (Figure 5).

Source: http://www.ebb-eu.org/stats.php#

All this notwithstanding, Italian demand for palm oil is projected to be robust. Much of its food processing industry depends on palm oil as an ingredient, such as in the world-famous hazelnut spread Nutella. Italy will therefore remain a formidable European market for the palm oil industry.

MPOC Brussels

By gofb-adm on Thursday, August 2nd, 2018 in Issue 2 -2018, Markets No Comments

The global oils and fats trade proved very demanding throughout 2017. This was attributed partially to political, social and economic uncertainties. Free trade as understood and practised over the decades was twisted by new political demands in the China-US trade negotiations, as well as the European Parliament’s vote proposing an earlier exit date for palm biofuels in the RED II mandates.

Such sparring between trading nations does not augur well for the global economy and more specifically for palm oil producing nations. The tremors in the case of the latter are often felt in the very heart of smallholders. Their livelihood is impacted by decisions taken by the high and mighty, who never come face to face with the very communities compromised by their lopsided decisions.

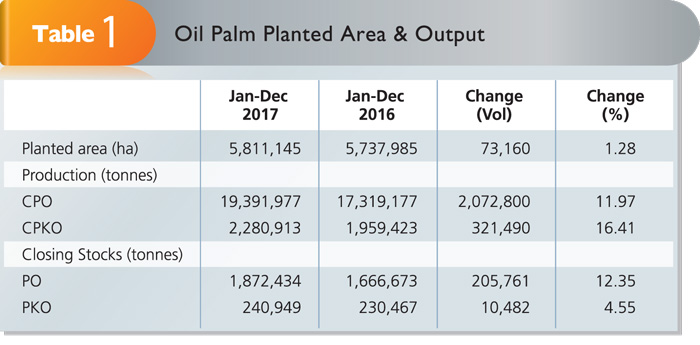

In spite of these increasingly challenging scenarios, Malaysian palm oil mostly tracked positive results in 2017, thanks to the discipline, commitment and teamwork of all stakeholders. This was assisted by fair weather conditions. The overall Malaysian oil palm planted acreage was recorded at 5.8 million ha in 2017, a 1.3% growth of 73,160 ha compared to 5.7 million ha in 2016 (Table 1).

Source: MPOB – data as at Feb 28, 2018; subject to revision

Crude palm oil production jumped by 2.1 million tonnes (11.9%) compared to 2016. Weather conditions improved throughout the year, especially in the second half, and this more than made up for the production shortfalls of 2016. Production of crude palm kernel oil (2.3 million tonnes) increased by 321,490 tonnes (by 16.4%) compared to almost 2 million tonnes in 2016.

Compared to 2016, palm oil production recovered in 2017, resulting in higher monthly ending stocks. December 2017 recorded a higher year-ending stock of 1.9 million tonnes compared to 1.7 million tonnes the previous year.

For palm kernel oil, the stock levels were recorded lower in the first quarter of 2017, but gradually rose in the following months. The year-ending stock was recorded marginally higher at 240,949 tonnes against 230,467 tonnes a year earlier.

In 2017, prices were higher, influenced by the slower recovery of palm oil production, the weaker Ringgit and stronger demand by major consuming countries. The annual average FOB CPO price increased by US$16.67 (2.5%) to US$678.67 per tonne against US$662 in 2016. This was also reflected in the higher export earnings of palm-based products at RM74.75 billion.

Market performance

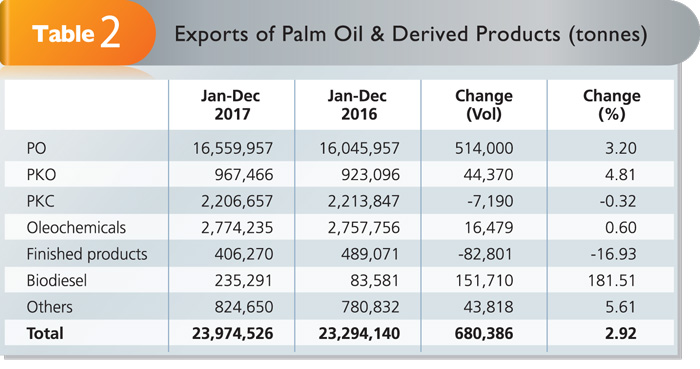

2017 saw higher exports of palm oil and its derived products. Total exports were at 23.9 million tonnes (Table 2), an increase of 680,386 tonnes (2.9%). With the exception of palm kernel cake and finished products, all other palm products registered increases in export volume. Palm biodiesel exports increased by an impressive 151,710 tonnes (181.5%), facilitated by an anti-dumping litigation against palm biodiesel ex-Indonesia.

Source: MPOB – data as at Feb 28, 2018; subject to revision

Exports of finished products in 2017 fell by 82,801 tonnes, mainly due to the drop in soap chips imported by the Philippines, followed by the drop in shortenings, vegetable fats and vegetable ghee demand from several consuming regions.

Soap chip imports by the Philippines dropped due to higher availability of coconut oil in the domestic market that grew 7% in 2017; this narrowed the price gap between locally-produced soap noodles and imported soap noodles made from palm oil.

Increased exports of other palm products were led by palm kernel shell and palm fibre to Japan, going up from 431,154 tonnes to 478,422 tonnes; and to China, from 213,216 tonnes to 217,777 tonnes, for use in their energy sector.

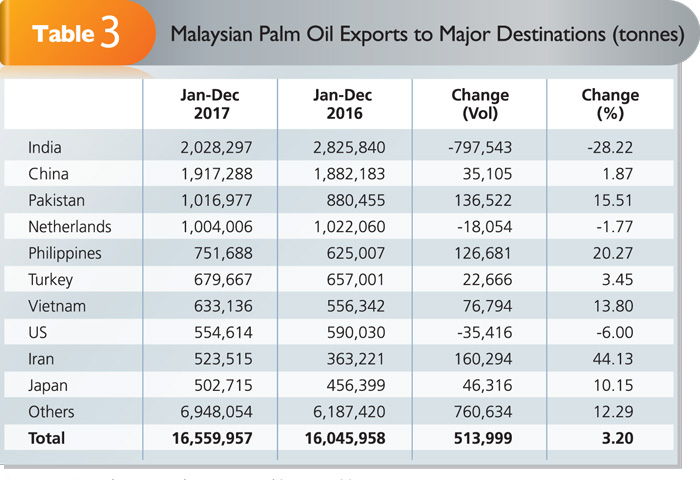

Overall, Malaysia exported 16.6 million tonnes of palm oil, an increase of 513,999 tonnes (3.2%) compared to 2016 (Table 3). The top 10 importing countries purchased 9.6 million tonnes or 58% of Malaysian palm oil. Demand for Malaysian palm oil continued to be driven by strong consumption especially in countries like India, China, Pakistan, the Netherlands and the Philippines.

Source: MPOB – data as at Feb 28, 2018; subject to revision

India retained its position for the second year running as the biggest importer of Malaysian palm oil, even though it imported 797,543 tonnes (28.2%) less compared to 2016. The uptake of more than 2 million tonnes represented 12.3% of Malaysian palm oil exports. Competitive prices of crude palm oil and processed palm oil from Indonesia impeded further inroads by Malaysian palm oil in India.

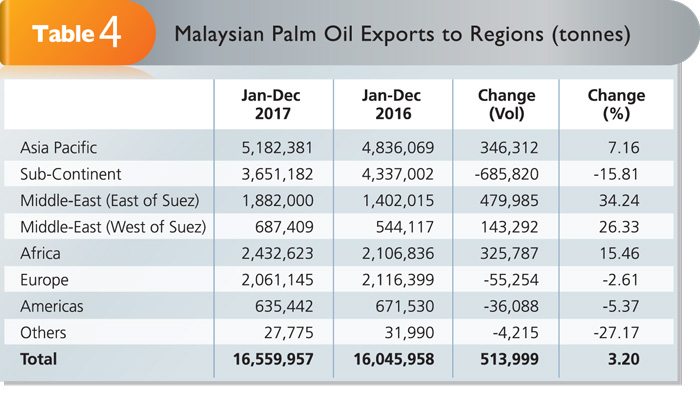

Some regions registered consistent growth for Malaysian palm oil and derived products. Overall, uptake of Malaysian palm oil showed an increase of 3.2% (513,999 tonnes), highlighted by a 7.2% increase in the Asia Pacific, 34.2% in the East of Suez, 26.3% in the West of Suez and 15.5% in Africa (Table 4).

Source: MPOB – data as at Feb 28, 2018; subject to revision

MPOC continues to ensure that Malaysian palm oil retains a favourable global market position through its various programmes and activities that have also contributed to the improved export performance.

Our key Palm Oil Trade Fair and Seminar was instrumental in again creating much needed awareness among the trade; this was successfully completed in Iran and Ghana. In the US, another MPOC-branded programme held was the Global Oils and Fats Forum. These events were supplemented through a targeted outreach programme called Techno-Economic and Marketing of Palm Oil in Uzbekistan, Pakistan, the Philippines, Egypt, South Korea and China.

A number of official delegations led by the Minister of Plantation Industries and Commodities to key importing nations or regions (Vietnam, the Philippines, EU-28, Japan, Iran and India) assisted in enhancing exports of Malaysian palm oil.

Global scenario

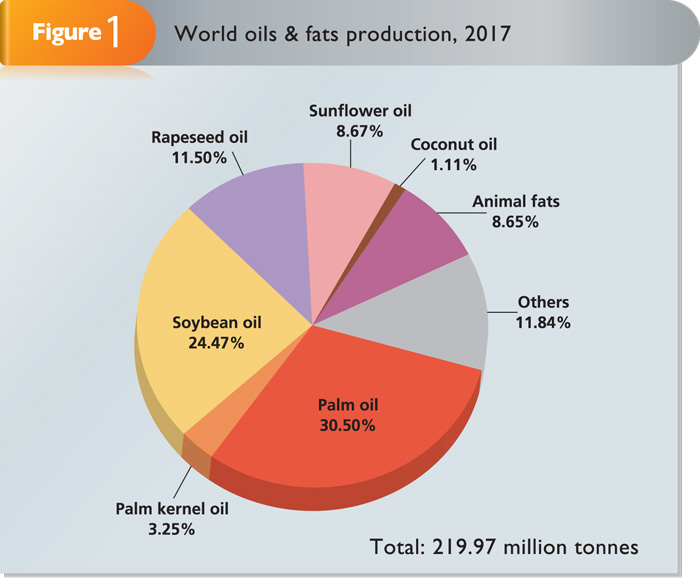

The 2017 world production of oils and fats stood at about 219.9 million tonnes, an impressive increase of 14.3 million tonnes from 2016 (Figure 1). Palm oil and palm kernel oil jointly accounted for 74.3 million tonnes, which made up 33.8% of total oils and fats production. Soybean oil output contributed 51.5 million tonnes (24.5%) and rapeseed oil registered 24.9 million tonnes (11.5%).

Source: Oil World & MPOC estimates

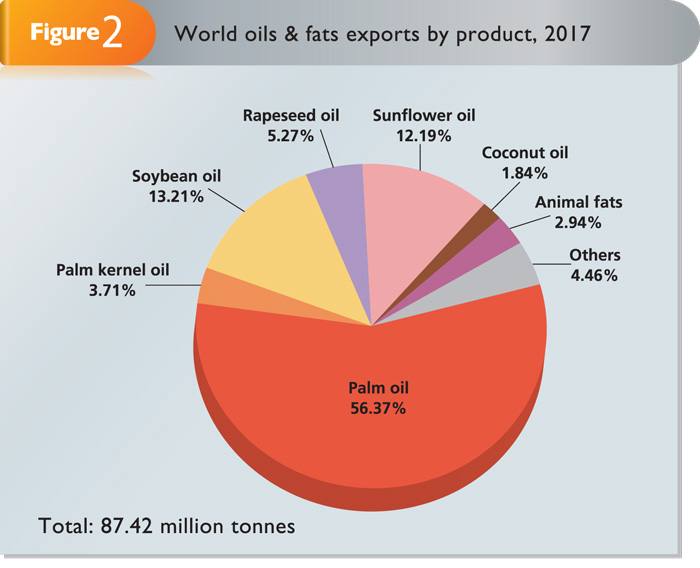

Of the 87.4 million tonnes of oils and fats traded worldwide in 2017, palm oil and palm kernel oil together accounted for 60.1% (Figure 2). Malaysia retained its position as a major player in the oils and fats export market. Its palm oil exports of 16.6 million tonnes represented 33.6% of the global palm oil trade.

Source: Oil World & MPOC estimates

The IMF forecasts that China’s GDP will continue to grow this year at 6.5%, while its population will grow by 0.5% or 6.3 million to 1.4 billion. In line with this, MPOC’s supply and demand model predicts that China’s domestic oils and fats disappearance will increase to approximately 37.6 million tonnes. Palm oil import demand is projected at about 5.1 million tonnes on account of high palm oil stocks at the end of the year and projected improved soybean crushing.

In India, population growth will continue to drive oils and fats consumption. Its 2018 oils and fats production is forecast to increase to 9.9 million tonnes, which is only 4.1% more than in 2017. The country will continue to be dependent upon imports to fill the supply and demand gap. MPOC anticipates India’s palm oil imports to stand at 10 million tonnes this year.

For EU-28, MPOC estimates that oils and fats imports will increase slightly to 12.3 million tonnes. Overall, palm oil imports are projected at 7.6 million tonnes and Malaysia’s share is estimated at over 2 million tonnes.

The Middle East region should feature as a net importer of oils and fats as domestic production caters to less than 40% of projected consumption. Countries such as Saudi Arabia, Egypt, Turkey and Iran will continue to spur demand. MPOC estimates imports of Malaysian palm oil by Turkey and Iran at 1 million tonnes on account of the favourable FTA with Turkey and removal of the palm oil import quota in Iran.

Africa, with its population of more than 900 million, will present significant opportunities for palm oil. The region is deficient in its production of domestic oils and fats and will continue to depend upon palm oil imports to satisfy its consumption needs.

MPOC estimates total oils and fats imports by the Sub-Saharan region this year to record 5.7 million tonnes, of which palm oil will account for nearly 5.1 million tonnes.

The Asia Pacific region is expected to record healthy growth demand for Malaysian palm oil, to potentially reach 3.4 million tonnes. The Philippines, Vietnam and Japan are anticipated to feature as strong markets for Malaysian palm oil and its products.

MPOC

By gofb-adm on Thursday, August 2nd, 2018 in Issue 2 -2018, Markets No Comments

Malaysia’s oil palm small farmers have condemned a plan by British supermarket chain Iceland Foods Ltd to remove palm oil from its own brand products by the end of this year.

In a statement, National Association of Smallholders (NASH) president Dato’ Aliasak Ambia decried the move, saying it was “disrespectful and lacking factual basis”.

Iceland through this action longs for the days of colonialism where they tell us what to do from Britain, while taking away our income and our ability to feed our families, he said.

“There is a name for this – colonialism. Rapeseed and sunflower are grown largely in rich countries in Europe. Oil palm is grown in developing countries. Its major producers are all in Asia, sub-Saharan Africa and Latin America,” he pointed out.

Aliasak said Iceland – a company he described as clearly living in the wrong century – should be ashamed of its “colonial-era” policy that would take food off the plates of small farmers.

He said that, unlike rapeseed oil and sunflower oil, Malaysian palm oil is sustainably produced.

“Iceland’s flimsy environmental claims are easily disproved. The latest European Union research proves that palm oil is not a major factor in global deforestation. In fact, livestock (beef) accounts for 10 times more deforestation than palm oil,” he said, with soybean accounting for more than double.

Rapeseed cultivation uses five times the amount of pesticides compared to oil palm, while growing sunflowers utilises four times more land to produce the same amount of oil.

However, he said there was no sign of Iceland attacking these commodities, which are grown in in the west.

“Double standards. One rule favouring rich countries, another rule discriminating against poorer nations,” Aliasak noted.

He also commented on a video- recording in Borneo by Iceland’s Managing Director Richard Walker, in which the moral high ground was taken while facts on the ground were ignored.

“This is not surprising. His actions literally take money out of the pocket of poor communities,” he said.

NASH, the Federal Land Development Authority, the Dayak Oil Palm Planters Association, the Sarawak Land Consolidation and Rehabilitation Authority and the MPOC have set up the Faces of Palm Oil grouping in support of Malaysian smallholders.

Source: The Star, April 14, 2018

This is an edited version of the article.

By gofb-adm on Thursday, August 2nd, 2018 in Issue 2 -2018, Comment No Comments

A recently-published study on European consumer healthiness evaluation of ‘free from’ labelled food products has concluded that such foods appeal more to consumers. It aimed at determining how ‘free from’ labelling shapes consumers’ perception and whether the absence of an ingredient is considered an indicator of improved nutritional value of food products.

The study was conducted by researchers from the renowned Swiss Federal Institute of Technology in Zurich and the Brussels-based European Food Information Council, a non-profit organisation that ‘stands up for science-based information on food and health’.

They came to the conclusion that products with a ‘free from’ label are considered healthier than products without the label; and that the strongest effects occurred for ‘GMO-free’ and ‘palm oil-free’ labelling.

Under the study, an online survey was conducted with 500 respondents in France, Poland and Sweden and 450 in the UK. Four labels – lactose-free, gluten-free, GMO-free and palm oil-free – were tested using different product categories.

Each label was shown on three different food products that are common in all four countries: bread/pasta/cookies products with a ‘free from gluten’ claim; cheese/milk/yoghurt with a ‘free from lactose’ claim; oil/maize/chocolate with a ‘free from GMOs’ claim; and margarine/chocolate spread/chocolate with a ‘free from palm oil’ claim. The sample mock-up products were designed based on images of real products available on the European market.

The healthiness perception was evaluated by comparing products with the ‘free from’ label to identical products without the label, and asking specific questions. Potential factors for the healthiness evaluation and the intention to pay a price premium were nutrition knowledge, information-seeking on food packages, preference for food naturalness, general health interest, trust in actors in the food domain, and ‘affect’ regarding the absent ingredients. The concept of ‘affect’ was measured for each label separately by asking participants to indicate their feeling(s) when they think about the different ingredients.

With respect to palm oil, the study stated that there is currently no official (i.e. legally permitted) label for products in the European market to indicate that the product is free from palm oil. However, individual retailers or manufacturers use their own labels to highlight that their products are ‘palm oil-free’. The study also noted that there is one label used for food packaging, which indicates the use of palm oil certified by the Roundtable on Sustainable Palm Oil.

Results of the study

The findings indicated that products with a ‘free from’ label were considered healthier than products without such a label. The largest deviations from the average response were observed for the ‘GMO-free’ and ‘palm oil-free’ labels.

Country effects were observed as well. The largest differences in the evaluations were observed for ‘GMO-free’ and ‘palm oil-free’, with less significant differences for ‘lactose-free’ and ‘gluten-free’ labels. Participants from France evaluated chocolate, chocolate spread and margarine labelled as ‘palm oil-free’ and maize, oil and chocolate labelled ‘GMO-free’ as being healthier compared with respondents from Sweden and the UK.

A majority of the participants, independently of the country of origin, evaluated food products with the ‘GMO-free’ and the ‘palm oil-free’ labels as being healthier than identical products without such labels. The effects appear to be less significant for the ‘gluten-free’ and the ‘lactose-free’ labels.

The researchers suggested that these sentiments may be due to French policy: ‘Public debate and negative media coverage [in France] as well as the contemplated tax ban on palm oil and restrictive regulation of GMOs in food and crops could be drivers of the negative image these ingredients have in the French consumer sample.’

Moreover, the results appeared to indicate that the removal of something (e.g. lactose) or the absence of an ingredient (e.g. palm oil) that holds negative connotations in consumers’ perception can lead to a more positive evaluation of the product displaying such labels.

Indeed, the most consistent and strongest country-specific effects for both healthiness evaluation and intention to pay a price premium were observed among French participants in the context of ‘GMO-free’ and ‘palm oil-free’ labelling.

French respondents also reported the strongest negative connotation for these two ingredients. Consumers considered policy to be based on the judgments of experts; and policy concerning the regulation of GMOs and palm oil might have significantly influenced individuals to intrinsically assume that products containing these ingredients are less safe or less healthy.

The researchers argued that certain labelling contains important information for consumers with food allergies (e.g. to gluten) or intolerances (e.g. for lactose). The question is whether these labels may also be a purchase incentive for consumers who are not required to check their diet for these ingredients, but rather attribute false characteristics, such as healthiness, to products due to the labelling.

Past research has shown that consumers do not always interpret labels as intended by food business operators. In the case of ‘free from’ labels, consumers might interpret the label as a sign of unpalatability; as being only useful for certain consumer groups; or as an indicator for a healthier food option.

Currently, the number of ‘palm oil-free’ labelled products in France is larger than in any other country. Extensive market research, last conducted in 2016, has shown that an increasing number of food business operators use ‘no palm oil’ or ‘palm oil-free’ claims/labels on a large number of food products.

The number of products bearing such claims in France increased from 312 in 2013, to 666 in 2014 and to 692 by the end of 2015. The number of brands using such claims also increased from 39 in 2013 to 60 in 2014 and to 66 in 2015. It can be assumed that French consumers have been confronted with ‘palm oil-free’ labels over a long period of time and through increasingly virulent commercial campaigns.

Noteworthy is that the study confirmed an increased consumer willingness to pay a price-premium for ‘free-from’ labelled products. The study showed that, in particular, French respondents were the most receptive to ‘palm-oil free’, and attributed this to public debate and negative media coverage.

Food labels influence and shape consumers’ food shopping behaviour. This change of behaviour must clearly be factored in when assessing the relevance and legality of certain ‘free from’ claims. The French respondents expressed the strongest intentions to pay more for ‘palm oil-free’ products.

However, an author of the study reportedly stated: “In my view the industry should be cautious with using ‘free from’ labels, however. It could create mistrust if consumers realise that ‘free from’ products may not be healthier than comparable products with [the ingredient].”

The study appeared to confirm that the negative campaigns and discriminatory policies in France reach the consumers and influence their purchasing decisions. Obviously, this is deceptive, anti-competitive and negative for the palm oil industry.

The outcome of this study could also be interpreted as proof of the damage caused by ‘palm oil-free’ labels and campaigns. French consumers really believe that products with this infamous label are healthier. This perception must change. The industry needs to step up its educational campaigns vis-à-vis consumers and, where necessary, take legal action against denigratory, deceptive and anti-competitive practices.

FratiniVergano

European Lawyers

By gofb-adm on Thursday, August 2nd, 2018 in Issue 2 -2018, Comment No Comments

Much of the media debate surrounding palm oil in recent months has focused on the European Parliament’s proposed ban on palm oil biofuels, as part of the revised Renewable Energy Directive (RED II).

This focus is understandable – the RED II represents an imminent threat that must be opposed forcefully. Malaysia is leading the opposition to the proposed ban.

This article, however, is not about the RED II. Even in the midst of such a critical period, Malaysia has a responsibility to keep its focus on the wider picture of the palm oil debate not just in Europe, but globally. Our approach must be strategic and a long-term one.

We cannot only focus on what is today’s threat, in order to wear the mantle of thought-leadership, but need to look ahead to what may be the challenges in future. Why? The better we can think and understand the challenges, the better the chance to mitigate and defeat them.

This does not only mean thought-leadership in relation to challenges. There are many of those coming over the horizon – from the EU’s new approach to addressing deforestation to the debate over mutual recognition of certification schemes, and many more.

We must also be brave and set forth a positive, pro-active strategic direction for the future, based on positive messages about Malaysia and its overall conduct of the palm oil industry. A starting point should be an ambition to position Malaysia as a global leader in agriculture – in technology, innovation and development throughout the palm oil supply chain.

Highlight achievements

Several examples spring to mind. Mapping the oil palm genome is a giant leap – it is beneficial in and of itself, in that it enhances scientific understanding. More importantly, it will have practical consequences benefitting the environment, rural development and economic growth.

We must think of this achievement not in academic terms, but how we position Malaysia as a global leader in agriculture, particularly in oil palm cultivation.

The use of methane capture technology is another major step forward. Ninety-two methane-capture facilities have been completed; over 150 more are in the planning or construction stage. The Malaysian government and industry are working on this together.

This approach will at once reduce carbon emissions, improve profitability through the alternative use of biogas and help ensure future market access for Malaysian palm oil, as greenhouse gas emission standards around the world become stricter.

If this sounds too good to be true, it isn’t. It is simply the fruit of technological innovation, government support and industry pro-activeness.

The focus on yield enhancement through advanced breeding and tissue culture propagation (as opposed to land-bank expansion) is a world-leading effort from Malaysia to prove that sustainability and economic development do not have to be in opposition; rather, they are bedfellows.

The seeds for this success have already been sown. At every opportunity we must remind the world, and especially our critics in Europe, of this far-sighted approach.

Similarly, the development of the Malaysian Sustainable Palm Oil (MSPO) certification scheme is far more significant at a global level than perhaps many in the industry or even in Malaysia appreciate.

The MSPO is not merely a new, or locally-driven, standard. It is at the forefront of driving an approach to palm oil sustainability based not on whimsical or arbitrary criteria conceived in the backroom of an NGO headquarters, but on internationally-recognised standard-setting methods such as those used by the International Standards Organisation and United Nations Development Programme.

Send simple, clear messages

Send simple, clear messages

Now we must accelerate communicating our vision to the world. We must understand that communicating in Europe and other western markets is different – they do not have the same intimate knowledge of palm oil as Malaysians.

There is already some ingrained prejudice or misguided idealism in the minds of western world consumers. So, we must be more direct by using simpler, clearer messages that frame Malaysia in a positive way. Academic messages don’t resonate – they are not sharp or simple enough for the public and media discourse.

We are talking about the sweet spot for a successful palm oil strategy internationally; long-term thinking, positive messages and simple communication.

An additional factor can be to re-assess our audience. We have been very successful with the trade audience, moving conversations away from negative Green NGO talking points to issues of trade and economics.

France, Spain and other EU member-states support Malaysia in the European RED II debate, precisely because of this strategy. A critical part of our strategic thinking is how to expand this success to reach other sympathetic audiences in European capital cities – the pro-development and community advancement groups, for example.

Another opportunity lies in the pro-innovation and investment audiences in Europe who are interested in agricultural progress and innovation.

We must be realistic that some – if not most – of the environmental or sustainability community will not defend palm oil. Therefore, let us spend our time and money more wisely.

That means working with our current friends, and finding new friends to outnumber our critics. We must raise our eyes to the horizon and aspire to lead the agenda of debate globally.

Datuk Lee Yeow Chor

Chairman, MPOC

This is an edited version of an opinion piece published by The Star on April 13, 2018.