Market Updates – Issue 1, 2017

By gofb-adm on Friday, March 3rd, 2017 in Issue 1 - 2017, Market Briefs No Comments

By gofb-adm on Friday, March 3rd, 2017 in Issue 1 - 2017, Market Briefs No Comments

Summary

Malaysia targets higher revenue from export commodities

The Plantation Industries and Commodities Ministry is aiming to grow Malaysia’s exports of commodities by 5-8% this year through the implementation of strategic measures.

“This will be done by expanding our market share while penetrating new markets, including [negotiating] a free trade agreement with Iran and exploration of new markets in south Asia and southern Europe,” said the Minister, Datuk Seri Mah Siew Keong.

These initiatives are expected to maintain the momentum of the country’s commodities segment, which consists of palm oil, rubber, wood, cocoa, pepper and kenaf products.

“[From] January to October 2016, [exports of] commodities grew 2% to RM99.2 billion from the year before. The commodities sector also accounted for 15.6% of national exports,” the Minister said.

The Ministry will continue to invest in research and development in order to develop higher value-added downstream products, as well as to improve current export products.

“The R&D work will increase the marketability and competitiveness of our exports in the global arena,” Datuk Seri Mah said.

Source: Malaysia Reserve, Jan 6, 2017

Change at the helm of Malaysia’s FELDA

Tan Sri Shahrir Abdul Samad has been named the new Chairman of the Federal Land Development Authority (FELDA) in line with the Malaysian government’s aspiration to strengthen the agency’s leadership.

He has wide experience in government administration, having previously held three Cabinet portfolios at different times. He was once the Chairman of the Malaysian Palm Oil Board and of the parliamentary Public Accounts Committee.

Tan Sri Shahrir replaces Tan Sri Mohd Isa Abdul Samad whose term ended, although he remains Chairman of Felda Global Ventures Holdings Bhd. During his tenure, FELDA had implemented many community activities and programmes to enhance the quality of life of settlers and their families.

In a statement, Prime Minister Datuk Seri Najib Abdul Razak said that with the restructuring, there is a division of responsibilities in regard to the settlers’ welfare and socio-economic status, and FELDA’s business activities.

Source: Bernama, Jan 7, 2017

Malaysia, Indonesia to discuss common CPO tax structure

Malaysia is open to negotiations with Indonesia over the possibility of harmonising the CPO export duty structure of both countries.

Malaysian Plantation Industries and Commodities Minister Datuk Seri Mah Siew Keong said a meeting will be held in the coming months.

“When I say harmonise the CPO tax structure, it doesn’t mean Malaysia will compromise to our disadvantage. We want to discuss […] the possibility of a common tax structure which does not conflict the trading of our palm oil in the world market,” he explained.

Currently, the wide gap in Indonesia’s export duty differential between CPO and refined palm oil encourages more production of refined palm oil; this has resulted in increased competition with Malaysia, particularly in the downstream sector.

“When you add a new system, there will be some losses and benefits to the respective players, but we will try to combine it to strike a balance for our overall exports,” the Minister said.

On export performance, he noted that the Malaysian palm oil market share in China had fallen to 45.7% in 2015 from 52% in 2014, while Indonesia’s market share rose to 53.9% from 47% over the same period. However, efforts are being made to woo back buyers.

Datuk Seri Mah also stressed the significance of diversification to new products and securing new markets.

“We want to go to the Middle East, as well as ASEAN countries such as the Philippines and Vietnam. I am going to Iran [this month] to negotiate higher imports for our palm oil. These are the new markets,” he added.

Source: The Star, Jan 16, 2017

RM30mil fund set up to mechanise oil palm fruit harvesting in Malaysia

Malaysia is establishing a RM30 million fund to improve the mechanisation of oil palm fruit harvesting,

Plantation Industries and Commodities Minister Datuk Seri Mah Siew Keong said: “We have to be more committed in finding more efficient ways to harvest oil palm fruit. We cannot go on being so reliant on manual labour.”

Some 70% of Malaysia’s oil palm estate workers are foreigners.

“This year, we are celebrating 100 years of commercial oil palm planting, but we have yet to improve on mechanisation of fruit harvesting. Of the RM30 million mechanisation fund, RM5 million will be privately-funded,” the Minister said.

It has been reported that Malaysia’s oil palm industry is facing a shortage of workers, resulting in many planters not being able to fully harvest the fruit.

Source: New Straits Times, Jan 17, 2017

Malaysian CPO output has doubled every 10 years over centennial

Malaysia, one of the world’s largest producers of CPO, enters the milestone centennial celebration of the sector in 2017 amidst tremendous growth.

Output has doubled every 10 years and the country’s track-record of providing quality vegetable oil to consumers worldwide, at reasonable prices, has helped alleviate poverty in many Third World countries.

Dorab Mistry, a leading industry analyst at Godrej International Ltd, endorses the country’s palm oil as its “Jewel in the Crown”. He said Malaysia has done wonders in terms of boosting export revenue.

“For 90 years, you [Malaysia] have been on your own. You are the Number One producer as you are doing all the propagation. You are being challenged by Indonesia on all fronts,” he said.

“So, while Malaysia celebrates 100 years, it has to re-dedicate itself to really take its competitor head on. At the same time, Malaysia must ensure that the markets it has, and the new markets that [it is] developing, go according to plan.”

Although Malaysia’s palm oil industry is expanding rapidly, labour shortage has been an issue – and it is becoming more difficult to source additional workers.

“Malaysia has got to do something about its labour regulations because the labour shortage is really strangling your plantations. It has been the biggest challenge facing the country’s CPO sector,” he said.

“However, against this backdrop, congratulations to Malaysia. I think if there is an example of a country which has nursed and nurtured an industry into great prosperity, I would hold Malaysia as a fine example.”

James Fry, Chairman of commodities consultancy LMC International, agreed that the Malaysian government needs to address the labour shortage issue, following its policy to reduce the number of foreign workers by 110,000.

“It is all right if you tell the industry how they will manage with fewer workers, but you have seen the impact, you have longer harvesting periods, lower quality and it hits your yield,” he said.

ISTA Mielke GmbH Executive Director Thomas Mielke said Malaysia has been the forerunner in palm oil and food research. He said palm oil has made major inroads not only into Asia, but also the African continent and central and South America.

“There has been tremendous increase in palm oil imports and consumption in Europe, as well as in the Commonwealth of Independent States countries,” he noted.

Source: Bernama, Nov 20, 2016

More palm oil for Indonesia’s biodiesel sector by 2020

Indonesian demand for CPO for biodiesel use will grow nearly 70% by 2020 as the price gap with conventional diesel narrows and more subsidies for blending become available.

Indonesia, the world’s top producer of palm oil, is pushing to increase usage of biodiesel to cut its oil import bill and curb greenhouse gas emissions. Its so-called B20 programme required a minimum 20% blend of bio-content in diesel fuel in 2016, up from 15% in 2015.

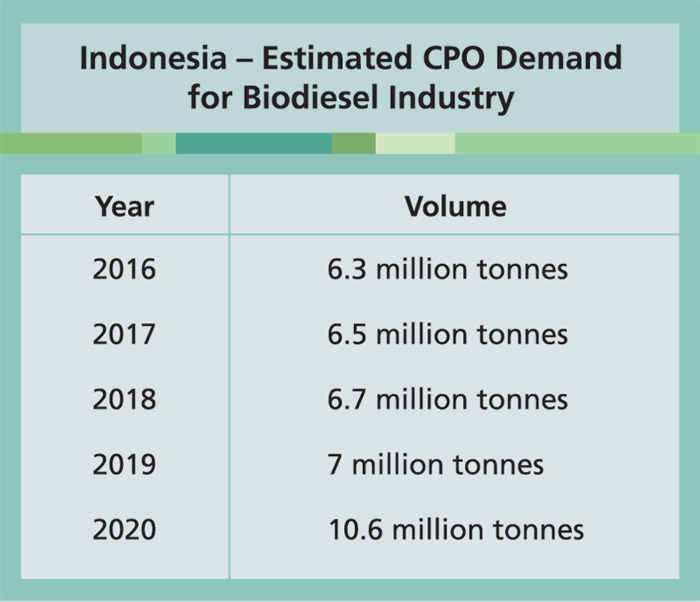

The biodiesel sector’s appetite for palm oil will increase to 10.6 million tonnes by the start of the next decade, from 6.3 million tonnes forecast for 2016, said Bayu Krisnamurthi, Chief Executive of the Indonesia Estate Crop Fund.

“Looking forward, we’ve calculated that by 2020, 26% of palm oil will go to biodiesel, so biodiesel becomes the new demand for the palm oil industry,” he said at a conference on Nov 23, 2016.

The fund is a government agency in charge of collecting palm oil levies to finance biodiesel subsidies in the country.

“The gap is getting thinner,” he said, referring to the spread between prices for biodiesel and conventional diesel coming down by around 30% in 2016 as oil prices strengthened.

The palm oil industry hopes the drive towards biodiesel will provide underlying support for prices of the edible oil.

Source: Indonesia Estate Crop Fund

The country is also targeting a 90% increase in unblended biodiesel consumption in 2017 to 5.5 million kilolitres, from an estimated 2.9 million kilolitres in 2016.

The 2017 target is “with the assumption that there is an expansion of subsidies”, said Dadan Kusdiana, Secretary of the Renewable Energy Directorate.

Indonesia started collecting a levy on its palm oil exports in July 2015 – US$50 per tonne for CPO and US$30 for processed palm oil products – and uses part of this to help fund biodiesel subsidies.

Levies collected by the Indonesia Estate Crop Fund would also need to be increased to pay for additional biodiesel subsidies, Kusdiana said, adding that his office had proposed an incremental increase. The fund is targeting a 14% increase in levies collected in 2017.

Source: Reuters, Nov 25, 2016

Phase 1 of new smallholder traceability system in place

GeoTraceability, Wilmar International Ltd and Wild Asia have announced that the first phase in the development of a new smallholder traceability system has been successfully completed.

The system enables mills to map their smallholder supply base and trace smallholder fresh fruit bunch (FFB) deliveries from the mills back to their farms. A key innovation in this project is the ability to provide smallholders with agronomic recommendations from mills and supporting organisations for increasing productivity, as part of their participation in the traceability system.

This project, supported by the Sustainable Trade Initiative (IDH), is currently underway in Wilmar’s Sapi Plantation in Sabah, Malaysia. The ability to trace smallholder FFB supply is critical to Wilmar in ensuring compliance by its third-party mill suppliers and independent smallholder suppliers, under its ‘No Deforestation, No Peat and No Exploitation’ policy.

Since July 2016, more than 90% of the smallholder supply base of the mill has been surveyed and mapped, with 1,400 traceable deliveries of smallholder FFB recorded. The next steps in the project are to roll out the system to an additional Wilmar-owned mill, as well as a third-party supplier mill, both in Sabah.

Jeremy Goon, Wilmar’s Chief Sustainability Officer, said: “Smallholders are a key stakeholder group in our pursuit of a sustainable and transparent supply chain. We have committed substantial resources to empowering smallholders to improve their livelihoods and to ensure they share in the benefits of oil palm development.

“Our collaboration with GeoTraceability and Wild Asia to develop this smallholder-specific traceability tool is a win-win for the industry and smallholders. Benefiting from agronomic expertise is an important incentive that will further strengthen sustainability take-up among smallholder producers. We hope this tool can help facilitate the traceability agenda of our external mill suppliers and the wider industry.”

Dr Reza Azmi, Executive Director and Founder at Wild Asia said: “Our Wild Asia Group Scheme is a programme to promote traceability and better production among groups of small independent oil palm producers.

“Systematic electronic data on the small producers means that we can accelerate our work, and that our agronomists can deliver individualised support to our group members. More importantly, we want to be able to empower local producers with tools that can provide meaningful insights to their own production data.”

Pierre Courtemanche, Chief Executive Officer at GeoTraceability, said: “Our software and training is designed to support mills, NGOs, development agencies and governments in better delivery of support to smallholders. This combination of tools supports a ‘New Deal’ for farmers: allow us to use your data to improve transparency and you’ll receive improved support services.”

GeoTraceability’s Digital Agronomist is a new software technology which allows the delivery of agronomists’ expertise to each individual smallholder farmer, and his or her fields.

The agronomic recommendations for increasing smallholder productivity are compiled in individual ‘Farm Business Plans’, which can be further supported with field-input credit, training and ultimately Roundtable for Sustainable Palm Oil group certification. This package of opportunities to improve productivity and profitability for smallholder farmers presents a compelling alternative path to the farm expansion model.

IDH has been working with industry actors to coordinate and accelerate progress on traceability since 2014 and is supporting platforms such as GeoTraceability as critical innovations on the path to sustainability. IDH is supporting the project financially and has informed project design with the objective of maximising lessons learnt, that may be of value to the wider industry.

Source: foodingredientsfirst.com, Nov 8, 2016

Global edible oils market valued at US$130bil in 2024

The global edible oils market is segmented into palm, soybean, sunflower, olive, corn and canola oils, as well as specialty blended oils and others. The palm oil segment is projected to register the fastest growth rate through the forecast period, with the segment accounting for over 32% share in the global market in terms of volume in 2015.

Soybean oil is projected to register a slight negative growth owing to the surplus availability of raw materials and shifting consumer preferences towards healthier edible oil options such as olive and canola oils. This shifting market trend is a result of increasing disposable income levels in households worldwide and growing awareness with regard to healthy eating.

According to a new report published by Persistence Market Research, ‘Global Market Study on Edible Oils: Industry Analysis and Forecast 2016-2024’, the global edible oils market is expected to register a CAGR of 5.1% through the forecast period to reach the value of US$130.3 billion at the end of 2024. The projected market trend can be attributed to rising health concerns across the globe and growing demand for healthy edible oils, such as canola and olive oils.

Manufacturers are adopting new techniques – such as cold pressing – to increase production of edible oils. This, combined with growing disposable incomes and the growing demand for snacks and fried food globally, are major drivers in the global market. The rising retail sector is a major boon, as the wide network organised market has helped bolster growth of edible oils.

In terms of end-users, the global market is segmented into the food service, food processor, and retail sectors. Established chains and a strong supply chain of edible oil products are expected to drive the retail segment, which is expected to register a CAGR of 5.3% through the forecast period. The food service segment is projected to register a CAGR of 5.1%, due to the lower prices and easy availability of palm oil.

The global edible oils market is segmented on the basis of region, into North America, Europe, Asia Pacific, Latin America, and Middle East and Africa (MEA).

Asia Pacific is projected to dominate the global market, accounting for 41.2% share in 2015, and is expected to account for 42.4% at the end of 2024. The projected market trend can be ascribed to growing demand for edible oils in India and China, especially in the food and beverage industries.

Europe and MEA are anticipated to register negative growth in terms of market share, owing to shifting consumer preferences towards high-quality edible oils in the regions.

Source: http://satprnews.com, Dec 7, 2016

Brazil’s grain export lull sets stage for record shipments

If there is a silver lining to Brazil’s recent shortcomings in grain exports, the country is now more prepared than ever to pump out big volumes in 2017, perhaps to the dismay of its competitors.

Brazil is the No. 1 and 2 shipper of soybean and corn respectively, but early in 2016, the drought-stricken country found itself with much less exportable supply than expected at the wrap-up of harvest.

Brazil should be at the height of the corn shipping season from October through December, but saying that corn exports have been dismal over the last two months might be far too generous.

Shipments of corn and its by-product, ethanol, were down by nearly 80% in October and November 2016 versus a year earlier. Soybean fared slightly better with exports down two-thirds over the same timeframe, although exports of the oilseed do not usually get going until February or March.

But with the drought of 2016 mostly in the rear-view mirror, record corn and soybean crops are a real possibility heading into 2017, particularly if favourable weather holds. And although Brazil has notoriously faced transportation and logistical issues at ports in the past, that is much less the case today.

The upcoming 2016/17 export season could be one of the smoothest Brazil has seen in recent years. And if domestic soybean and corn prices are internationally competitive once the products arrive to market, the US, one of the country’s main trade rivals, will start feeling the pressure.

In 2015/16, the Brazilian soybean and corn harvests were originally projected to top 100 million and 80 million tonnes respectively, but late-season drought cut the volumes to 95.4 million and 66.6 million tonnes. The second crop corn, also called safrinha, was hit especially hard.

But the 2016/17 season is already showing promise as both soybean planting and development is ahead of normal, and 94% of the first corn crop is in good condition. Analysts polled by Reuters expect both crops to set new records this year – 102.64 million tonnes for soybean and 86.58 million tonnes for corn.

Good weather and an early harvest would place the oilseed a little sooner than usual in the market place, potentially cutting into the US business. It would also mean an earlier start to the sowing period for safrinha, which accounts for roughly two-thirds of Brazil’s total corn output.

Corn does not typically start being shipped out en masse until August, as the safrinha crop is more heavily exported than the full-season corn, which is mostly dedicated to domestic use, since the ports are full of soybean when it is harvested.

Brazil is expected to ship a record volume of soybean in its 2016/17 marketing year, which begins in February 2017 and runs through January 2018. Current industry estimates range from 57.5-60 million tonnes, well above figures for the 2015/16 year which stand at or just above 50 million tonnes.

Relatively speaking, the drought has impacted corn exports much more than soybean, as shipments in the current marketing year will fall up to 50% from the record 2014/15 campaign. Industry estimates for Brazilian corn exports range from 16-19 million tonnes for the 2015/16 season, which will conclude at the end of February 2017.

Analysts peg Brazil corn exports to be the second-largest volume on record in the 2016/17 marketing year, beginning in March 2017. Shipments are likely to range between 25 million and 30 million tonnes. If the weather remains supportive and export prices are attractive to buyers, trade competitors have good reason to start getting nervous.

Source: Reuters, Dec 8, 2016

Sabah to gazette forest as orang utan protected area

The Sabah Forestry Department is to gazette a forest rich in orang utan, as a fully protected area.

This comes with a sudden change in the ownership of the 101,000ha Forest Management Unit 5 (FMU 5), which also contains 13,000ha of flora and fauna.

State Forests Chief Conservator Datuk Sam Mannan said the area in central Sabah is being classified as a first-class reserve and will become part of the Trusmadi Forest Reserve.

FMU 5, owned by logging and reforestation company Anika Desiran, was purchased by wood products maker Priceworth International for RM260 million in October 2016.

Anika Desiran had been working with conservationists, including WWF Malaysia, over the past three years to create a model example of a conservation economy. The sudden sale of the property took the conservationists by surprise.

Mannan said the forest region had been logged a few times since the 1980s and that the Forestry Department had allowed it to be parceled out under the FMU programme in 1997 because it did not expect orang utan to inhabit such highland areas.

He said a WWF study had since found orang utan in FMU 5, so the high-conservation area within it will now be turned into a first-class reserve.

Once done, the new owner will have to provide a development master plan which must be approved before any kind of work can take place on the land.

Source: The Star, Jan 5, 2017

By gofb-adm on Sunday, February 26th, 2017 in Issue 1 - 2017, Special Focus No Comments

The oil palm has been the bedrock of Malaysia’s economy, socio-development, political stability and ability to innovate. As we mark the centenary of its cultivation this year, we look back at the first five of 10 milestones to understand the challenges and efforts that have gone into producing palm oil. As a sustainable crop, the oil palm plays a critical role in helping to feed more than three billion people in over 150 countries. Feeding an additional two billion people by 2050 with limited arable land will be no small task.

The oil palm is eight to ten times more productive than other major oilseed crops; highly efficient with a high output-to-input energy ratio; and extremely versatile in its uses, including the biomass waste generated. In 2015, Malaysia produced 32% of the global palm oil output on a mere 0.1% of global agricultural land.

Malaysian palm oil is renowned for its high quality and usability. With improvements in processing technologies, it can be easily tailored to meet specifications of end-users. It is highly sought after for various applications in food and non-food industries, making it a true global product. We record the first five milestones in the history of Malaysian cultivation of the oil palm.

The oil palm (Elaeis Guineensis) is native to West Africa. It was introduced to Malaya by the British in the 1870s.

Small farmers have been important players from the early years of the Malaysian palm oil industry. They now own about 40% of the planted area.

By gofb-adm on Saturday, February 18th, 2017 in Issue 1 - 2017, Publication No Comments

Although I thought I had done as much as I could to make everything ready for the family’s arrival, things were still fairly primitive. There was the persistent rat, or rather family of rats, which kept swimming up through the pipes into the bowl of the toilet.

Read more »By gofb-adm on Saturday, February 18th, 2017 in Biofuels, Issue 1 - 2017 No Comments

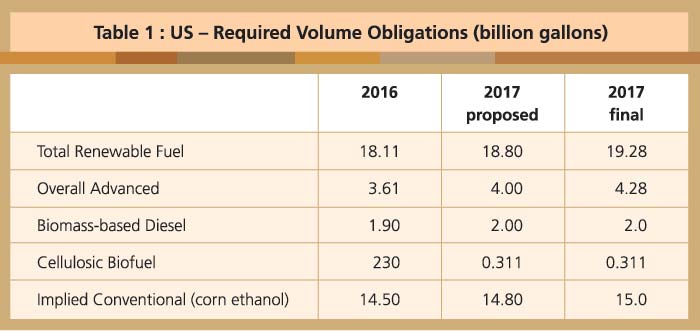

On Nov 23, 2016, the US Environmental Protection Agency (EPA) finalised the 2017 Required Volume Obligations (RVOs) for biofuels under the Renewable Fuel Standard (RFS). The overall volume was increased to 19.28 billion gallons versus the 18.8 billion gallons proposed by the agency on May 18.

This was the fourth consecutive year the EPA has boosted final volumes from the initial proposal and only the third time they have been finalised by the Nov 30 statutory deadline. The announcement was welcome news for the renewable fuels sector and will mean growth in both ethanol and biodiesel production, as well as consumption, in 2017.

Why WPI is bullish

• Increased RFS volumes will boost demand for biodiesel and ethanol

• Higher RINs prices will support blending of ethanol and biodiesel

• Exports will help add value to ethanol producers

• Fulfilling the advanced biofuels mandate will require more biodiesel

• Loss of the biodiesel blenders’ credit will lower biodiesel profitability

The 428 million gallon boost in the renewable fuel volume (Table 1) was based on the increases of 200 million gallons for the implied conventional biofuel (i.e. corn ethanol) category and 228 million gallons for the advanced category.

Source: EPA, WPI

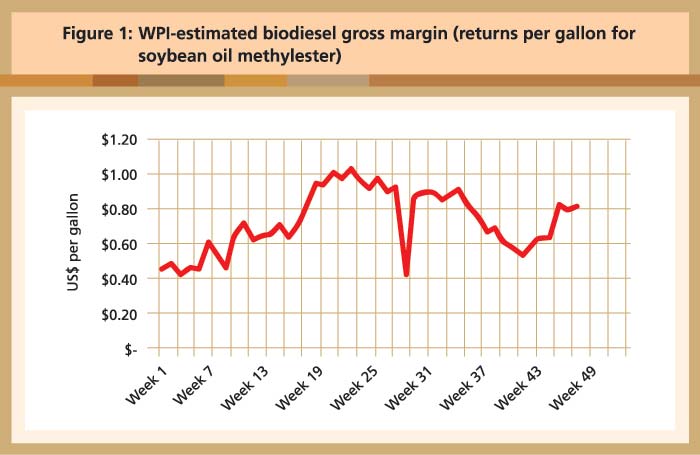

Biodiesel producers generally maintained profitable margins last year and will see slightly higher supply and demand in 2017 as a result of the RVOs (Figure 1).

Source: USDA, EIA, WPI

While the 2017 and 2018 RVOs for biodiesel remained the same as the proposed rule, the increase in the overall advanced category will likely rely on that particular fuel to meet the target. This is because there is neither enough cellulosic nor other advanced biofuels supply to meet the overall volume requirements. Indeed, on the day of the EPA’s announcement, the January soybean oil futures contract rose from $0.34 to $0.37 based on the assumption that more biodiesel production would draw down end-of-the-year stocks.

By gofb-adm on Saturday, February 18th, 2017 in Issue 1 - 2017, Branding No Comments

A recurring theme with branding, especially for an industry as removed from mainstream branding as edible oils and fats, is to learn from other areas and then apply the lessons to your own.

Mostly this means looking at product- or industry-branding, but the US presidential election is no exception. The most recent one involved such a strange mixture of surprises that we can only think that there must be useful lessons to be learnt.

Branding and marketing have something in common with events in history in general: after they have happened, events take on an air of inevitability. It is as if, as human beings, we have a strong leaning to look at an event, after it has happened, to say: ‘Well, I guess it just had to be that way.’

Read more »By gofb-adm on Saturday, February 18th, 2017 in Issue 1 - 2017, Sustainability No Comments

Recent media reports have praised yet another sustainable palm oil standard and label, called ‘Palm Done Right’. The standard was started by Natural Habitats, a business organisation formed by various operating companies and which has offices in Ecuador, Sierra Leone and the Netherlands. Natural Habitats produces, collects, processes and trades organic, fair trade and sustainable palm oil.

Currently, only two companies supply palm oil under the standard developed by Natural Habitats and Dr Bronner’s, a US-based personal care company with operations in Ghana. But it appears that any company that sources palm oil within the ‘Palm Done Right’ supply chain may use the logo on its products and marketing materials.

The presence of yet another palm oil sustainability standard complicates the market for businesses and operators in general. Natural Habitats prefers to refer to ‘Palm Done Right’ as an education programme, but has developed its own sustainability standard and has trademark rights to a logo to be placed on products.

In particular, the standard is for ‘conflict-free palm oil’, which it believes means that such palm oil is produced organically – using natural pest management, multi-cropping and composting – in a vertically integrated supply chain. Moreover, the oil palm must only be cultivated on existing crop land or on degraded land, be handpicked, and preferably be transported using animal labour.

Natural Habitats is of the view that its standard goes beyond other certification schemes, such as that of the Roundtable on Sustainable Palm Oil (RSPO), which is the most widely-used internationally.

Another popular certification standard is by the Palm Oil Innovation Group. Its Charter is intended to build upon the RSPO’s ‘Principles & Criteria’ with regard to deforestation, carbon stocks, biodiversity, greenhouse gas emissions, pesticide use and social relations.

At the national level, the best-known and well-structured sustainability standards and related certifications naturally come from the two countries that produce the most palm oil: Indonesia and Malaysia.

Even more sustainability schemes relevant to palm oil exist, including the International Sustainability and Carbon Certification (ISCC); the certification by the Rainforest Alliance/Sustainable Agriculture Network; the Roundtable on Sustainable Biomaterials; the Sustainable Palm Oil Manifesto guidelines; and the High Carbon Stock Approach, which itself is built into other schemes.

By gofb-adm on Saturday, February 18th, 2017 in Issue 1 - 2017, Comment No Comments

During the 2016 US presidential election, the term ‘fake news’ gained popularity. In essence, the discourse centred on news articles, especially those frequently shared on popular social media websites, that arguably provided biased or even false information regarding the candidates, and may have even contributed to determining voters’ choices.

However, the concept of ‘fake news’ is not new to the palm oil industry which is regularly confronted by articles that use incomplete or manipulated data; which are regularly supported by competitors to distort trade; and which create fear among consumers against consuming palm oil.

Read more »By gofb-adm on Saturday, February 18th, 2017 in Issue 1 - 2017, Comment No Comments

Campaigns against palm oil have evolved over the years. In the 1980s and 1990s, the US soybean lobby campaigned against it on purported health grounds. Since 2000, the campaign has shifted to alleged environmental concerns, largely supported by the rapeseed and sunflower industries in Europe and led by radical Green NGOs. In recent years, this has taken on a new and more comprehensive approach. Its clear objective is to make palm oil ‘socially unacceptable’. This new approach has been aggressive.

Read more »By gofb-adm on Saturday, February 18th, 2017 in Issue 1 - 2017, Comment No Comments

NGOs and campaign groups almost never admit that the oil palm industry is in the right as far as deforestation claims are concerned. However, the Union of Concerned Scientists (UCS) – a US-based campaign group – has bucked the trend.

In a blog-post on Dec 14, 2016, (see Ending Tropical Deforestation) it pointed out that oil palm cultivation is not the environmental bogeyman that NGOs have made it out to be. Why? Because it is not a major contributor to global deforestation.

What changed the UCS stance is a 2016 report by Climate Focus, written for signatories to the New York Declaration on Forests. In particular, it looked at the Declaration’s ‘Goal 2’ – to support and help meet the private-sector goal of eliminating deforestation from the production of agricultural commodities such as palm oil, soybean, paper and beef products by no later than 2020, recognising that many companies have even more ambitious targets.

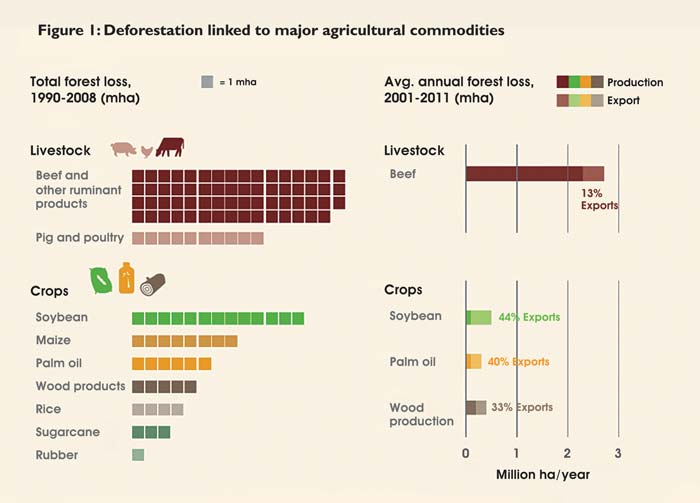

The study found that agricultural commodities such as beef, soybean and maize have a significantly higher deforestation footprint than the oil palm. In the case of beef, it is about 10 times more. The analysis also examined data from the European Commission (EC), which has previously looked at the deforestation footprints of the commodities.

The study pointed out that oil palm companies have made significantly bigger commitments to zero deforestation than any other commodity group, despite being a much lower contributor.

The UCS mea culpa has larger implications for environmental campaigning. As the blog-post states in part:

‘In working to change the world, there’s always a need to keep asking ourselves whether we’re focusing on what’s most important. This certainly applies to the effort to end tropical deforestation, which is why I [scientific adviser Doug Boucher] and my UCS colleagues have put a lot of emphasis on figuring out what causes – and in particular, which businesses – are the main drivers of deforestation.

Unfortunately, a recent study indicates that that global corporations that have committed to ending the deforestation they cause, have got their priorities backwards. And it suggests that the NGO community – and that definitely includes me – may have had our priorities wrong too.’

The issue for the broader campaigning community is whether they will now cease their absurd attacks on the oil palm industry and if they will apologise for erroneous claims.

Damage done

A bigger question, though, involves the funding that continues to be associated with such NGO campaigns.

The Climate and Land Use Alliance, a coalition of US-based foundations, has funded myriad activities against palm oil. A look at its Global Grants list indicates that it has spent more than US$13 million across 38 such projects – including US$3 million to Greenpeace.

Compare this with its spending on five activities involving soybean (US$2.5 million) and several on beef (US$759,000). The beef projects were not even exclusive activities; these also looked at different commodities.

Greenpeace is in the middle of utilising a US$1 million grant directed at palm oil, as is the Rainforest Action Network. Friends of the Earth is working through a US$400,000 grant. It’s no wonder the campaigning against palm oil and the subsequent commitments have been skewed: there was simply more money thrown at it.

Another factor is that there is no substitute for beef. And since the world’s largest beef producers are the US and the EU, negative campaigns are simply not politically tenable.

In the EU, palm oil can be substituted with competing domestic products such as sunflower and rapeseed oils. As such, generating an environmental case against the oil palm – which is really only grown in two countries that are not major trading partners – is a no-brainer.

This is not the first time that environmentalists have declared war on a particular industry and got the underlying facts wrong.

During the 1990s and most of the 2000s, campaigners concentrated heavily on the timber industry. There was an assumption that demand for wood was leading to global forest loss. This resulted in campaigns against paper products and raised an entire industry of consultants working on illegal logging policy. But it was not timber demand that was the problem: it was the need to grow food.

But there is little disadvantage for NGOs if they are proved wrong. Greenpeace claimed for a long time that tropical deforestation was responsible for about 25% of global carbon emissions. The estimate is now much closer to 10%. Greenpeace would no doubt justify this by saying it had brought attention to the issue.

In the case of palm oil, though, erroneous information has harmed the commodity’s reputation and affected the livelihood of some three million small farmers who grow oil palm. While they are surely the ones who could do with an apology, will this be enough to repair the damage done?

MPOC

By gofb-adm on Saturday, February 18th, 2017 in Issue 1 - 2017, Comment No Comments

In working to change the world, there’s always a need to keep asking ourselves whether we’re focusing on what’s most important. This certainly applies to the effort to end tropical deforestation, which is why I and my UCS colleagues have put a lot of emphasis on figuring out what causes – and in particular, which businesses are the main drivers of – deforestation.

Unfortunately, a recent study indicates that the global corporations that have committed to ending the deforestation they cause, have got their priorities backwards. And it suggests that the NGO community – and that definitely includes me – may have had our priorities wrong too.

The study, by Climate Focus and many collaborators, is part of an assessment of the impact of the New York Declaration on Forests two years ago. That Declaration, launched at the September 2014 Climate Summit that also featured a march of 400,000 people through the streets of New York, highlighted commitments by hundreds of companies, governments, NGOs, Indigenous Peoples’ groups and others to work towards a rapid end to deforestation.

The September 2014 Climate March through the streets of New York, with yours truly on the left, helping to carry the UCS banner. The New York Declaration on Forests was launch a few days later.

The Climate Focus report looked in particular at the Declaration’s ‘Goal 2’: ‘Support and help meet the private-sector goal of eliminating deforestation from the production of agricultural commodities such as palm oil, soybean, paper and beef products by no later than 2020, recognising that many companies have even more ambitious targets.’

In evaluating progress toward achieving Goal 2 by 2020, Climate Focus looked at the most recent data showing the main drivers of deforestation. Figure 1 gives these results, from two different data analyses (on the left, from Henders et al, 2015; on the right, from the European Commission 2013).

The main commodities driving deforestation, from the analysis of Climate Focus based on two different data sources.

Source: Climate Focus 2016. http://climatefocus.com/publications/progress-new-york-declaration-forests-goal-2-assessment-report-update-goals-1-10

The data is pretty clear: by far the biggest driver of deforestation is beef. Soybean is second, but far behind in terms of importance. And palm oil and wood products are even smaller drivers, causing only about a tenth as much deforestation as beef.