Five reasons for optimism

February, 2017 in Biofuels, Issue 1 - 2017

Ethanol margins

Ethanol has, in some respects, become a forgotten industry. Production and consumption have been assumed to stay flat, and there is little talk of new ethanol plants being built or of updates or expansions to existing ones. The US is, by most accounts, up against the blend wall unless the percentage of ethanol blended in gasoline is pushed above the 10% level. Gasoline consumption in the US has been declining as the automobile fleet becomes more efficient.

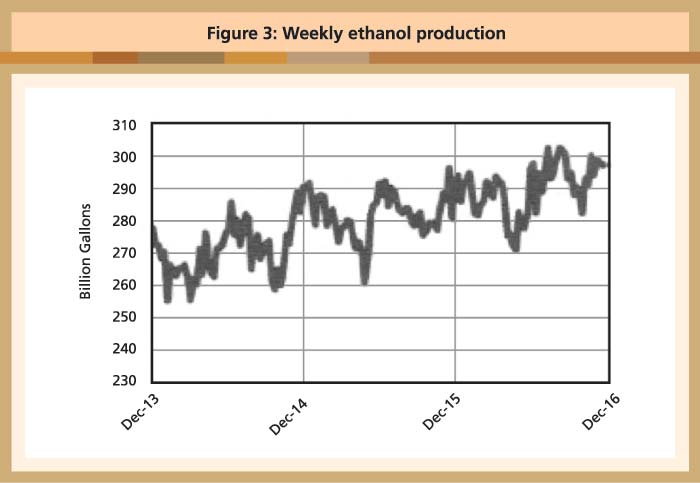

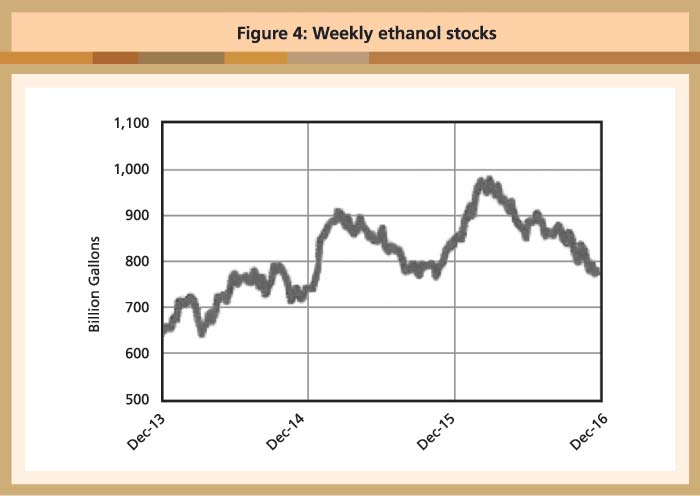

In contrast to a stagnant domestic industry, ethanol production has been better than expected over the past several months, primarily on the strength of ethanol exports. Figures 3-5 show that weekly ethanol stocks have been rapidly declining even while weekly ethanol production has been growing.

Source: EIA, WPI

Source: EIA and WPI

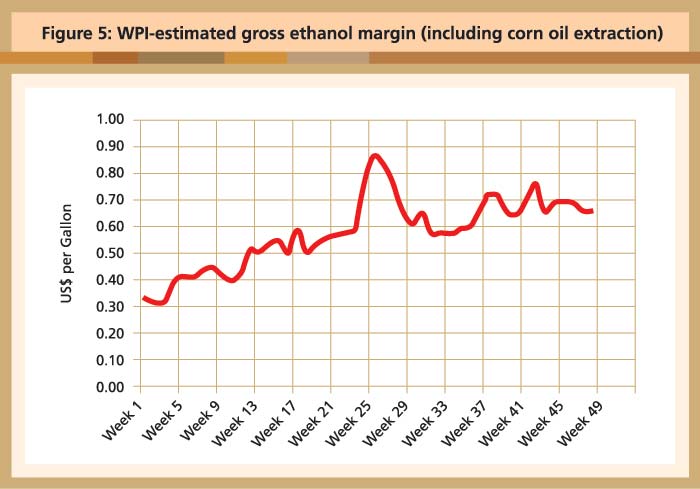

Source: USDA, EIA, WPI

The combination of declining stocks amidst higher production has led to a boom in ethanol margins that started in late April 2016 and has continued since, largely based on cheaper corn prices and strong RIN values.

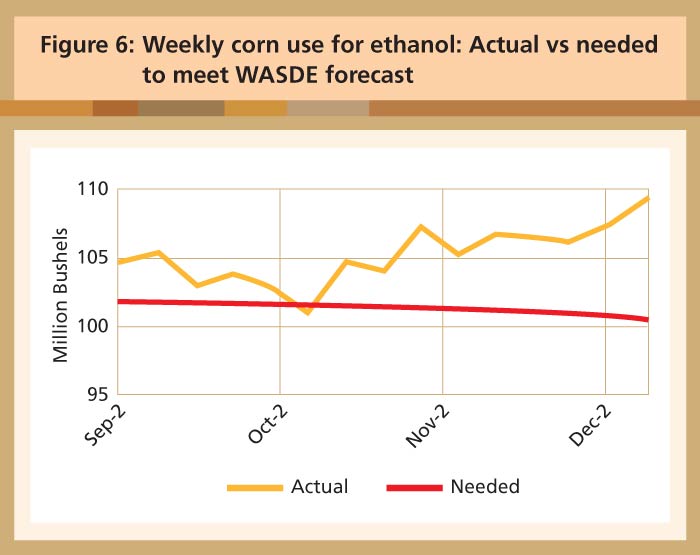

The profitability of ethanol production is sending more corn into the plants than was previously expected. Figure 6 compares weekly corn use in ethanol production against the weekly amount needed to meet the USDA’s goal of 5.3 billion bushels for the 2016/17 corn marketing year. Note the target in the previous two marketing years was 5.2 billion bushels and that 5.3 billion bushels represent 35% of the record 2016 US corn crop.

Source: EIA, USDA WASDE, WPI